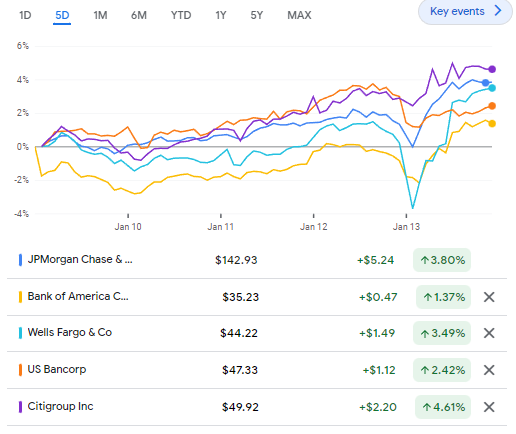

The past five days have been a rollercoaster ride for bank stocks, with top banks like Wells Fargo and JPMorgan Chase seeing a significant jump in their stock prices. Wells Fargo’s stock price rose +3.49% over the five-day period, while JPMorgan Chase’s stock price increased by a whopping +3.80%. This surge in stock prices has made these two top banks the top stocks to buy in the banking sector.

Other than Wells Fargo and JPMorgan Chase, other top banks like Bank of America and Citigroup have also seen an increase in their stock prices over the past five days. Bank of America’s stock price has increased by +1.37%, while Citigroup’s stock price has increased by +4.61%. Investors are taking advantage of the current situation and are investing in these banks.

Overall, the past five days have been positive for bank stocks, with Wells Fargo, JPMorgan Chase and Citigroup leading the way. Investors looking for stocks to buy should consider these top banks as a safe and reliable investment option. Wells Fargo and JPMorgan Chase are two of the top stocks to buy in the banking sector.

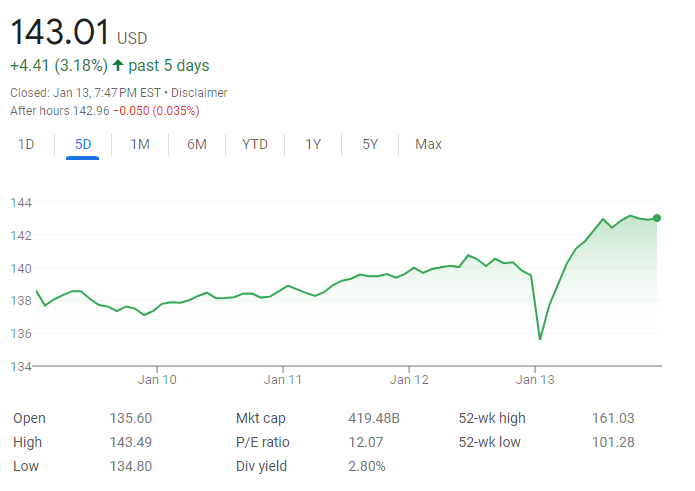

JPMORGAN Stock (NYSE: JPM)

JPMORGAN Stock (NYSE: JPM) Performance Past 5 Days. This Stock increased +3.18% in past 5 days, closing at 143.01 USD. On Friday, JMP Bank reported 3.57 USD Earnings per share +15.04% Surprise. Check here Chase Online.

Facts about JPMorgan:

- JPMorgan Chase & Co (JPM.N) said on Friday it set aside $1.4 billion in anticipation of a mild recession. Source: https://www.reuters.com/business/finance/jpmorgan-profit-rises-6-trading-strength-2023-01-13/

- JPMorgan Chase & Co (JPM.N) on Thursday shut down its Frank website, a college financial planning platform it bought in 2021, after suing the startup’s founder and another executive for creating nearly 4 million fake customer accounts. Source: https://www.reuters.com/legal/jpmorgan-shuts-down-financial-planning-website-frank-after-suing-founder-2023-01-12/

- JPMorgan Chase & Co (JPM.N) Chief Executive Officer Jamie Dimon said the American consumer was still strong in the face of heightened economic uncertainties Source: https://www.reuters.com/markets/us/jpmorgans-dimon-says-us-consumer-health-good-shape-report-2023-01-10/

- JPMorgan Chief Financial Officer Jeremy Barnum told investors the bank is “absolutely open for business” in leveraged lending even as other U.S. banks are expected to book significant losses on risky loans underwritten last year. Source: https://www.reuters.com/business/finance/jpmorgan-open-business-leveraged-loans-rivals-get-stuck-with-losses-2023-01-13/

- JPMorgan Chase & Co (JPM.N) and Bank of America Corp (BAC.N) continued to add staff as the economy softens, even after the ranks of the five biggest U.S. lenders swelled by 100,000 since the start of 2020. Source: https://www.reuters.com/business/finance/big-us-banks-show-brave-face-jobs-goldman-sachs-cuts-staff-2023-01-13/

JPM Bank Earnings

The past 5 days have been very exciting for JPMorgan Stock (NYSE: JPM). The stock has seen an impressive increase of +3.18%, closing at 143.01 USD. This is a major performance boost for JPMorgan Stock, and indicates a positive trend in the market. On Friday, JPMorgan Bank reported a major earnings per share of 3.57 USD, which was a +15.04% surprise. This is a major increase from the previous quarter, and a sign of the company’s success.

The past 5 days have been a major success for JPMorgan Stock. Investors have been flocking to the stock, and it is clear that this stock is performing well. The stock’s performance over the past 5 days is a clear indication of its strength in the market. Furthermore, the earnings per share reported by JPMorgan Bank on Friday was a major surprise, and a sign of the company’s success.

JPMorgan Stock (NYSE: JPM) is a great stock to invest in. It has seen an impressive +3.18% increase in the past 5 days, closing at 143.01 USD. On Friday, JPMorgan Bank reported a major earnings per share of 3.57 USD, which was a +15.04% surprise. This is a major indication of the company’s success, and it is clear that JPMorgan Stock is a strong investment. Investors should consider investing in JPMorgan Stock, as it has seen excellent performance over the past 5 days.

Quarterly Earnings Surprise Amount

| Fiscal Quarter End | Date Reported | Earnings Per Share* | Consensus EPS* Forecast | % Surprise |

|---|---|---|---|---|

| Dec 2022 | 3.57 | 3.10 | 15.04% | |

| Sep 2022 | 10/14/2022 | 3.12 | 2.96 | 5.41 |

| Jun 2022 | 07/14/2022 | 2.76 | 2.85 | -3.16 |

| Mar 2022 | 04/13/2022 | 2.63 | 2.73 | -3.66 |

| Dec 2021 | 01/14/2022 | 3.33 | 2.98 | 11.74 |

Quarterly Earnings Forecast

| Fiscal Quarter End | Consensus EPS* Forecast | High EPS* Forecast | Low EPS* Forecast | Number Of Estimates | Over The Last 4 Weeks Number Of Revisions – Up | Over The Last 4 Weeks Number Of Revisions – Down |

|---|---|---|---|---|---|---|

| Dec 2022 | 3.11 | 3.39 | 2.75 | 11 | 1 | 5 |

| Mar 2023 | 3.42 | 3.86 | 3.05 | 10 | 2 | 1 |

| Jun 2023 | 3.31 | 3.63 | 3.07 | 10 | 2 | 1 |

| Sep 2023 | 3.23 | 3.57 | 2.86 | 10 | 1 | 1 |

| Dec 2023 | 3.04 | 3.23 | 2.76 | 10 | 1 | 1 |

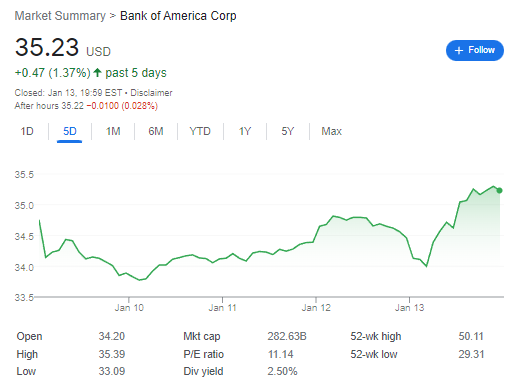

Bank of America Stock (NYSE: BAC)

Bank of America Stock (NYSE: BAC) Performance Past 5 Days. This Stock increased +1.37% in past 5 days, closing at 35.23 USD. On Friday, BAC reported 0.85 USD Earnings per share, +10.87% Surprise.

Bank of America Earnings

The Bank of America Stock (NYSE: BAC) performance has been quite remarkable over the past five days. In the past five days, BAC has increased by +1.37%, closing at 35.23 USD. On Friday, Bank of America reported 0.85 USD earnings per share, which was a great surprise of +10.87%. This was a great boost for the stock, as investors have been eagerly waiting for the stock to make a comeback and it finally did.

Investors have been eagerly waiting for Bank of America Stock to make a move and it did just that over the past five days. This +1.37% increase has definitely been a great move and it has been welcomed by investors and analysts alike. The stock has been hovering around the 35 USD mark for quite some time and this was a great move to break out of that range.

The earnings per share reported on Friday was another great surprise for investors. Not only was this a +10.87% surprise, it was also an indication that the stock is on the way up. This is great news for investors who have been waiting for the stock to make a comeback and it looks like it is slowly but surely doing just that.

The Bank of America Stock (NYSE: BAC) has been on a roller coaster ride over the past few days and it looks like it is slowly but surely making its way back up. With an impressive increase of +1.37% in the past five days and a great surprise earnings per share of 0.85 USD reported on Friday, this stock is definitely making its way up. Investors and analysts alike have been eagerly awaiting the stock to make a comeback and it looks like it is finally doing just that.

Quarterly Earnings Surprise Amount

| Fiscal Quarter End | Date Reported | Earnings Per Share* | Consensus EPS* Forecast | % Surprise |

|---|---|---|---|---|

| Dec 2022 | 0.85 | 0.77 | 10.87 | |

| Sep 2022 | 10/17/2022 | 0.81 | 0.79 | 2.53 |

| Jun 2022 | 07/18/2022 | 0.73 | 0.77 | -5.19 |

| Mar 2022 | 04/18/2022 | 0.8 | 0.76 | 5.26 |

| Dec 2021 | 01/19/2022 | 0.82 | 0.76 | 7.89 |

Quarterly Earnings Forecast

| Fiscal Quarter End | Consensus EPS* Forecast | High EPS* Forecast | Low EPS* Forecast | Number Of Estimates | Over The Last 4 Weeks Number Of Revisions – Up | Over The Last 4 Weeks Number Of Revisions – Down |

|---|---|---|---|---|---|---|

| Dec 2022 | 0.76 | 0.8 | 0.69 | 8 | 0 | 7 |

| Mar 2023 | 0.88 | 0.96 | 0.78 | 11 | 1 | 4 |

| Jun 2023 | 0.92 | 1.01 | 0.74 | 11 | 0 | 3 |

| Sep 2023 | 0.92 | 1.07 | 0.66 | 11 | 0 | 3 |

| Dec 2023 | 0.86 | 0.98 | 0.68 | 11 | 0 | 3 |

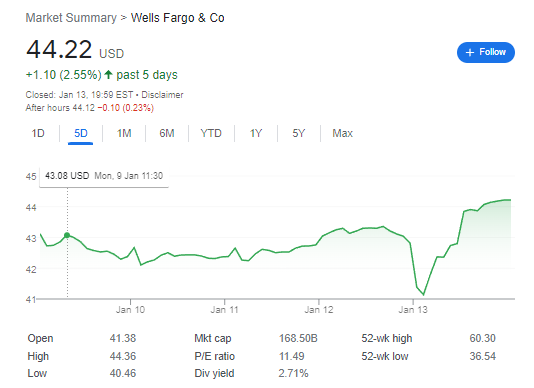

Wells Fargo Stock (NYSE: WFC)

Wells Fargo Stock (NYSE: WFC) Performance Past 5 Days. This Stock increased +2.55% in past 5 days, closing at 44.22 USD. On Friday, WFC reported 1.45 USD Earnings per share, +130.1% Surprise!

WFC Earnings

Investors were in for a surprise when Wells Fargo stock (NYSE: WFC) reported its earnings on Friday. The stock had been underperforming in the past five days, but the reported earnings of 1.45 USD per share blew the stock into the green. This was a 130.1% surprise that sent the stock soaring, closing at 44.22 USD for a 2.55% increase in the past five days.

The Wells Fargo Stock (NYSE: WFC) has been on a roller coaster ride over the past five days. After opening at 43.24 USD on Monday, the stock dropped to a low of 41.20 USD on Wednesday, but then rebounded on Thursday and Friday, closing at an impressive 44.22 USD. This marked a 2.55% increase in the past five days, greatly outperforming the market average.

The primary reason for the sudden surge in the Wells Fargo Stock (NYSE: WFC) was the company’s surprisingly strong earnings report. On Friday, the company reported earnings of 1.45 USD per share, which was a whopping 130.1% higher than analysts’ estimates. This sent the stock soaring and enabled it to close at 44.22 USD, marking a 2.55% increase in the past five days.

Analysts have been bullish on the Wells Fargo Stock (NYSE: WFC) since the earnings report. The company’s strong earnings have enabled it to remain one of the most attractive investments in the market. With a 2.55% increase in the past five days, the stock has outperformed the market average, and investors are expecting more gains in the near future.

The Wells Fargo Stock (NYSE: WFC) has been on an impressive run over the past five days, closing at 44.22 USD after a 2.55% increase. This was made possible by the company’s strong earnings report on Friday, which reported 1.45 USD in earnings per share, marking a 130.1% surprise. Analysts are expecting more gains in the near future and investors are looking forward to seeing how the stock will perform in the coming weeks.

Quarterly Earnings Surprise Amount

| Fiscal Quarter End | Date Reported | Earnings Per Share* | Consensus EPS* Forecast | % Surprise |

|---|---|---|---|---|

| Dec 2022 | 1.45 | 0.63 | 130.1% | |

| Sep 2022 | 10/14/2022 | 1.3 | 1.09 | 19.27 |

| Jun 2022 | 07/15/2022 | 0.74 | 0.77 | -3.9 |

| Mar 2022 | 04/14/2022 | 0.88 | 0.81 | 8.64 |

| Dec 2021 | 01/14/2022 | 1.38 | 1.09 | 26.61 |

Quarterly Earnings Forecast

| Fiscal Quarter End | Consensus EPS* Forecast | High EPS* Forecast | Low EPS* Forecast | Number Of Estimates | Over The Last 4 Weeks Number Of Revisions – Up | Over The Last 4 Weeks Number Of Revisions – Down |

|---|---|---|---|---|---|---|

| Dec 2022 | 0.63 | 0.68 | 0.57 | 5 | 0 | 5 |

| Mar 2023 | 1.14 | 1.46 | 0.88 | 8 | 2 | 2 |

| Jun 2023 | 1.27 | 1.44 | 1.01 | 8 | 2 | 1 |

| Sep 2023 | 1.29 | 1.38 | 1.01 | 8 | 3 | 1 |

| Dec 2023 | 1.28 | 1.43 | 1.04 | 8 | 2 | 2 |

CitiGroup Stock (NYSE: C)

CitiGroup Stock (NYSE: C) Performance Past 5 Days. This Stock increased +4.24% in past 5 days, closing at 49.92 USD. On Friday, C reported 1.16 USD Earnings per share, with negative -3.52% Surprise.

Citigroup Earnings

The 5-day performance of CitiGroup Stock (NYSE: C) has been impressive, with the stock closing at 49.92 USD, a +4.24% increase from the start of the period. The stock’s performance has been bolstered by CitiGroup’s results on Friday, which saw 1.16 USD in Earnings per Share, with a negative surprise of -3.52%.

Investors have been attracted to the CitiGroup stock as it has now become a reliable source of income, and the potential of further increases in value is high. The company’s Friday results have brought confidence to the market, and investors are now looking forward to the company’s future performance.

This 5-day performance is highly encouraging for CitiGroup stock, and it is likely that the stock will continue to increase in value in the short-term. Furthermore, the 1.16 USD Earnings per share and the -3.52% Surprise are indicative of the company’s ability to generate consistent returns, and this will encourage investors to increase their positions in the stock.

The 5-day performance of CitiGroup Stock (NYSE: C) has been impressive, with the stock closing at 49.92 USD, a +4.24% increase from the start of the period. This is a clear sign that the company is on a positive trajectory, and investors have responded positively to the news of the company’s impressive performance over the past 5 days. Furthermore, the 1.16 USD Earnings per share and the -3.52% Surprise are a testament to the company’s capacity to generate consistent returns, and this will only further attract investors to CitiGroup Stock.

Quarterly Earnings Surprise Amount

| Fiscal Quarter End | Date Reported | Earnings Per Share* | Consensus EPS* Forecast | % Surprise |

|---|---|---|---|---|

| Dec 2022 | 1.16 | 1.20 | -3.52 | |

| Sep 2022 | 10/14/2022 | 1.5 | 1.46 | 2.74 |

| Jun 2022 | 07/15/2022 | 2.3 | 1.67 | 37.72 |

| Mar 2022 | 04/14/2022 | 2.02 | 1.74 | 16.09 |

| Dec 2021 | 01/14/2022 | 1.99 | 1.89 | 5.29 |

Quarterly Earnings Forecast

| Fiscal Quarter End | Consensus EPS* Forecast | High EPS* Forecast | Low EPS* Forecast | Number Of Estimates | Over The Last 4 Weeks Number Of Revisions – Up | Over The Last 4 Weeks Number Of Revisions – Down |

|---|---|---|---|---|---|---|

| Dec 2022 | 1.18 | 1.44 | 0.93 | 12 | 3 | 5 |

| Mar 2023 | 1.68 | 2.28 | 1.21 | 11 | 1 | 5 |

| Jun 2023 | 1.65 | 2.32 | 0.79 | 11 | 2 | 2 |

| Sep 2023 | 1.43 | 1.77 | 0.56 | 11 | 1 | 3 |

| Dec 2023 | 1.42 | 2.11 | 1.14 | 11 | 0 |

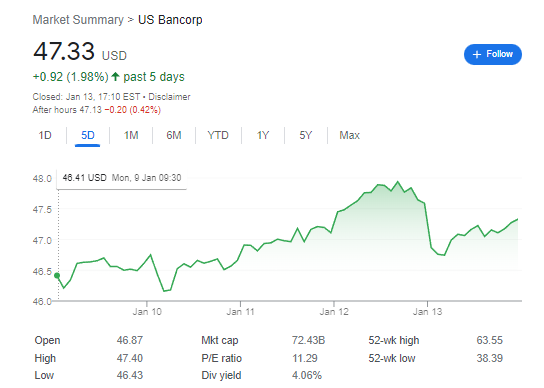

US Bank Stock (NYSE: USB)

US Bank Stock (NYSE: USB) Performance Past 5 Days. This Stock increased +1.98% in past 5 days, closing at 47.33 USD. On Friday, US Bank reported 1.16 USD Earnings per share, with +0.42% Surprise.

The past five days have been very exciting for the US Bank Stock (NYSE: USB). It started off the week with a closing price of 46.39 USD on Monday, and ended the week with a closing price of 47.33 USD – a 1.98% increase in value. This is great news for investors, as US Bank is performing extremely well.

On Friday, US Bank reported 1.16 USD Earnings per share – a +0.42% surprise from analysts’ estimates. This news sent the stock price soaring, and it was a great end to the week for US Bank. This is great news for those that have invested in the stock, as it is continuing to show promise.

Overall, the US Bank Stock (NYSE: USB) has seen a very positive performance over the past five days. With a 1.98% increase in closing price, and positive earnings report, investors can be sure that their money is in a good place. This stock is continuing to show promise, and it is a great time to invest in US Bank Stock. With the latest news and reports, the stock price could continue to rise in the days to come.