The latest consumer survey conducted by the University of Michigan reveals that Americans are feeling more positive about inflation and the overall state of the economy. The preliminary reading for June indicates an 8% increase in consumer sentiment compared to the previous month. This surge in optimism can be attributed to the easing of inflationary pressures and the resolution of the debt ceiling crisis. In this article, we will delve into the key findings of the survey, explore the factors contributing to the improved sentiment, and analyze the implications for the Federal Reserve and the broader economy.

Also read: Dow Jones Today: Stocks Rise as Debt Ceiling Bill Passes House, Focus Shifts to Jobs Report.

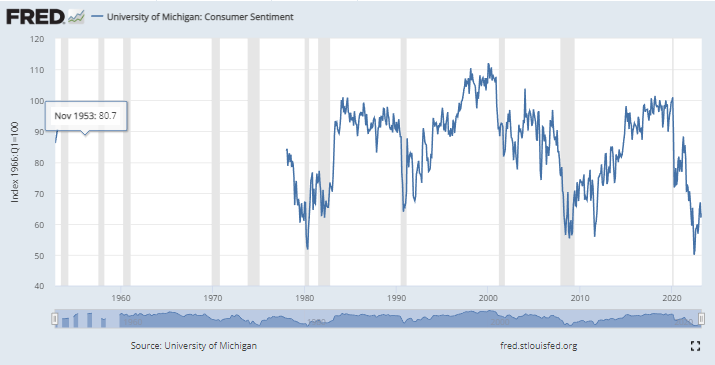

Consumer Sentiment Reaches a Four-Month High

According to the University of Michigan’s survey, consumer sentiment in June rose to its highest level in four months. The index climbed from 59.2 in May to 63.9 in June, surpassing economists’ expectations of a more modest increase to 60.0. Joanne Hsu, the Director of Surveys of Consumers, attributes this significant rise in sentiment to the resolution of the debt ceiling crisis and the easing of inflationary pressures. However, it is worth noting that sentiment remains relatively low when compared to historical standards, as income expectations have softened.

Factors Driving Improved Sentiment

The increase in consumer sentiment can be primarily attributed to two key factors: the easing of inflation and the resolution of the debt ceiling crisis. Consumers’ inflation expectations for the year ahead have declined for the second consecutive month, dropping from 4.2% in May to 3.3% in June. This decline indicates that consumers are becoming more optimistic about price stability, which is a positive sign for the overall economy.

Moreover, the resolution of the debt ceiling crisis has provided reassurance to consumers, alleviating concerns about potential economic disruptions. The swift action taken by policymakers to address this issue has instilled confidence and contributed to the overall improvement in sentiment.

Implications for the Federal Reserve

The Federal Reserve closely monitors consumer sentiment surveys to gauge expectations regarding price hikes and overall economic conditions. Despite elevated inflation, Fed Chair Jerome Powell has stated that longer-term inflation expectations remain well anchored. This sentiment is reflected in various surveys of households, businesses, and forecasters, as well as measures from financial markets.

The positive consumer sentiment revealed in the University of Michigan survey aligns with Powell’s assessment and suggests that inflation expectations are in check. This could provide the Federal Reserve with greater confidence in their monetary policy decisions, as they aim to strike a balance between price stability and economic growth.

Current Economic Conditions and Consumer Expectations

In addition to the overall increase in consumer sentiment, the University of Michigan survey also highlights improvements in current economic conditions and consumer expectations.

The index of current economic conditions rose from 64.9 in May to 68.0 in June, indicating a positive perception of the current state of the economy among consumers. This rise further supports the notion that Americans are feeling more optimistic about their immediate economic circumstances.

Consumer expectations, which reflect sentiments about future economic conditions, saw a significant jump from 55.4 in May to 61.3 in June. This increase suggests that consumers are increasingly hopeful about the trajectory of the economy in the coming months.

Decrease in Inflation Expectations

One of the key findings of the University of Michigan survey is the notable decrease in inflation expectations among consumers. In June, year-ahead inflation expectations dropped to 3.3% from 4.2% in May, marking the lowest level since March 2021. This decline indicates that consumers are becoming more confident in the stability of prices, despite recent inflationary pressures.

Furthermore, the survey reveals that five-year inflation expectations also edged down slightly, from 3.1% in May to 3.0% in June. These figures demonstrate that consumers’ long-term expectations regarding inflation remain relatively stable within a narrow range.

Joanne Hsu highlights that while long-run inflation expectations remain elevated compared to pre-pandemic levels, they are consistent with the current economic environment. This suggests that consumers have adjusted their expectations to align with the unique circumstances brought about by the pandemic and its aftermath.

Conclusion

The University of Michigan’s consumer sentiment survey for June paints a picture of increasing optimism among Americans regarding inflation and the overall state of the economy. The significant rise in sentiment, driven by the easing of inflationary pressures and the resolution of the debt ceiling crisis, bodes well for economic recovery. The Federal Reserve can take comfort in the fact that longer-term inflation expectations appear to remain well anchored, as reflected in various surveys and market indicators. As the economy continues to rebound, it will be crucial to monitor consumer sentiment and its impact on future economic trends.

Read also these FintechZoom articles: