The American stock market experienced a boost on Tuesday, as major stocks rebounded and encouraging data on capital goods orders helped assuage concerns over a slowing U.S. economy, despite the Federal Reserve’s aggressive interest rate hikes.

Rebound in the Market

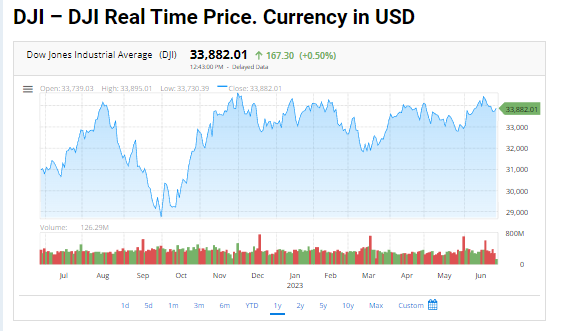

U.S. stock indexes, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, all registered increases. High-capacity stocks like Amazon, Tesla, and Nvidia all experienced approximately a 1% rise each. Additionally, Meta Platforms saw a 2% increase after Citigroup hiked its price target on the stock to the highest on Wall Street.

Economic Data Paints Positive Picture

The Commerce Department revealed in a report that orders for non-defense capital goods excluding aircraft—a key indicator of business spending plans—rose 0.7% in May, defying economists’ prediction that orders would remain flat. This surprising increase in capital goods orders paints a positive picture of the U.S. economy, hinting at its resilience despite fears of a recession.

Market Sentiment and Predictions

“The market sentiment is building that the Federal Reserve is nearing the end of its rate hike regime,” noted Peter Andersen, founder of Andersen Capital Management. This sentiment, coupled with the surprisingly positive economic data, has helped boost the stock market.

Investors are also keyed into the European Central Bank Forum in Sintra, Portugal, where Jerome Powell, the Federal Reserve Chair, is expected to deliver a speech. Last week, Powell hinted at more rate hikes on the horizon, a move that temporarily halted Wall Street’s winning streak. However, traders are now optimistic, with a 76.9% chance that the Federal Reserve will raise interest rates by 25 basis points to a range of 5.25%-5.50% at its July meeting.

Impact on Big Tech Stocks

Despite recent market weaknesses, the main U.S. stock indexes are on track to record second-quarter gains, bolstered by a rally in growth stocks, positive earnings reports, and hopes that the Federal Reserve will soon end its monetary tightening campaign.

Among the big tech companies, Google’s parent company Alphabet saw a 0.8% slip after Bernstein downgraded the stock to “market perform.” Conversely, Snowflake, the cloud data analytics company, climbed 2.6% following the announcement of a partnership with Nvidia, which will allow customers to build AI models using their own data.

Chinese Firms See Growth

U.S.-listed shares of Chinese firms such as Alibaba Group and JD.com also rose approximately 2% after Chinese Premier Li Qiang announced plans for economic stimulus and predicted that economic growth in the second quarter will surpass the first.

Walgreens Boots Alliance Faces Challenges

On the other hand, Walgreens Boots Alliance saw a significant 8.5% drop as the pharmacy chain cut its fiscal year profit forecast, citing reduced demand for COVID-19 tests and vaccines.

Bankruptcy for Lordstown Motors

Lordstown Motors also experienced a dramatic plunge, with shares falling 45.4% as the U.S. electric truck manufacturer filed for bankruptcy protection and put itself up for sale after failing to resolve a dispute over a promised investment from Foxconn.

A Look at the Broader Market

In the broader market, advancing issues outnumbered decliners by a 1.65-to-1 ratio on the NYSE and a 1.15-to-1 ratio on the Nasdaq. The S&P index recorded eight new 52-week highs and one new low, while the Nasdaq added 18 new highs and 48 new lows.

As the second quarter and first half of 2023 draw to a close, the Nasdaq is on pace for a nearly 10% gain in the period and its best first half in 40 years as investors dive back into technology stocks after 2022’s slump. The S&P 500 and Dow are on track to wrap up the quarter with nearly 6% and 2% gains, respectively.

Conclusion about US Stock Market

In conclusion, despite the challenges and uncertainties, the U.S. stock market remains resilient. The encouraging economic data, the positive sentiment surrounding the Federal Reserve’s rate hike regime, and the performance of major stocks all point to a promising outlook for the U.S. economy. As we move into the second half of 2023, investors and market participants will continue to monitor these factors closely.

Please note: This article was created based on the information available at the time of writing and should not be used as financial advice.