Disney stock (DIS) is scheduled to report earnings on November 8, 2023, after the stock market closes. This is the most anticipated earnings report of the week, as Disney is a major player in the entertainment industry and its results can have a significant impact on the market.

Other notable earnings reports scheduled for the week of November 6-10, 2023 for US Stock Market, include:

- Uber (UBER) on November 7, after the market closes

- Rivian (RIVN) on November 8, after the market closes

- Occidental Petroleum (OXY) on November 9, after the market closes

- Warner Brothers Discovery (WBD) on November 10, after the market closes

Investors will be closely watching these earnings reports for signs of economic strength or weakness. Strong earnings results from major companies could boost the stock market, while weak earnings results could lead to a sell-off.

Here is a summary of the key factors that investors will be watching in each company’s earnings report:

- Disney (DIS): Investors will be watching for signs of strength in Disney’s parks and resorts business, as well as its streaming business, Disney+. Disney has been facing some challenges in its theme parks division, due to rising costs and labor shortages. However, the company is hoping to see a rebound in the coming months.

- Uber (UBER): Investors will be watching for Uber’s growth metrics, as well as its profitability. Uber has been growing rapidly in recent years, but it has yet to turn a profit. Investors will be looking for signs that the company is on track to profitability.

- Rivian (RIVN): Investors will be watching for Rivian’s production and delivery numbers, as well as its financial performance. Rivian is a young company that is still ramping up production of its electric vehicles. Investors will be looking for signs that the company is on track to meet its production goals and generate positive cash flow.

- Occidental Petroleum (OXY): Investors will be watching for Occidental’s oil and gas production numbers, as well as its financial performance. Occidental is a major oil and gas producer, and its results are sensitive to oil and gas prices. Investors will be looking for signs that the company is benefiting from the current high oil and gas price environment.

- Warner Brothers Discovery (WBD): Investors will be watching for Warner Brothers Discovery’s streaming subscriber numbers, as well as its financial performance. Warner Brothers Discovery is a new company that was formed from the merger of WarnerMedia and Discovery. The company is hoping to compete with Netflix and Disney+ in the streaming market. Investors will be looking for signs that the company is gaining traction in the streaming market.

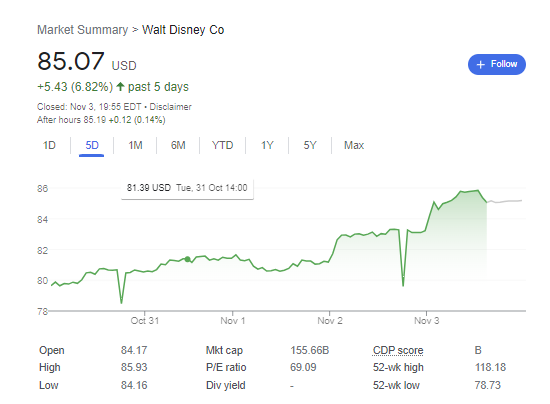

Disney’s stock has been on a tear in recent days, rising +6.82% in the past 5 days

This is likely due to a combination of factors, including:

- Positive earnings expectations: Analysts are expecting Disney to report strong earnings when it reports on November 8th. This is due to the fact that the company is benefiting from strong demand for its streaming service, Disney+.

- A rebound in the travel industry: Disney’s theme parks are also seeing a rebound in demand as the travel industry recovers from the COVID-19 pandemic.

- Overall bullish sentiment in the stock market: The stock market has been on a tear in recent months, and Disney’s stock is benefiting from this overall bullish sentiment.

It is important to note that past performance is not indicative of future results. Disney’s stock could continue to rise in the near term, but it could also experience a pullback. Investors should carefully consider their own investment goals and risk tolerance before investing in Disney stock.

Here are some additional factors that investors may want to consider when evaluating Disney stock:

- Competition: Disney faces increasing competition from other streaming services, such as Netflix and Amazon Prime Video. It is important to see how Disney can maintain its competitive advantage in the streaming market.

- Economic conditions: Disney’s business is sensitive to economic conditions. If the economy weakens, it could impact demand for Disney’s products and services.

- Regulatory environment: Disney is subject to a variety of regulations, both domestically and internationally. Changes in the regulatory environment could impact Disney’s business.

Overall, Disney is a well-established company with a strong brand. However, investors should carefully consider the risks involved before investing in Disney stock.

Also read: