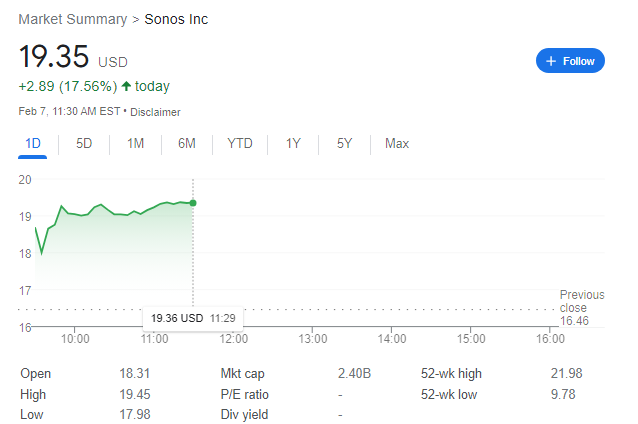

Sonos stock is up significantly after their earnings report. Here’s a summary of the key points:

- Stock price: Up 17.56% to $19.35 (as of February 6, 2024)

- Earnings: $0.84 per share, beating analyst expectations

- Revenue: Declined year-over-year, but profit margins increased

- Analyst recommendation: The average recommendation is “Buy,” and this may be revised upwards based on the strong earnings report

Overall, this is positive news for Sonos, and the stock price reflects that. It’s important to note that past performance is not necessarily indicative of future results, so be sure to do your own research before making any investment decisions.

Main factors in Sonos Earnings Report to Justify this Climb

Several key factors in Sonos’ Q1 2024 earnings report contributed to the 13.76% climb in its stock price:

1. Beating Earnings Expectations: This is a classic driver of stock price increases. Sonos reported earnings per share of $0.84, exceeding analyst expectations of $0.74, demonstrating stronger-than-anticipated profitability.

2. Improved Profitability Metrics: Despite a slight revenue decline, gross margin jumped significantly from 29.4% to 46.1%, indicating better cost management and product mix. Additionally, both GAAP and non-GAAP net income saw positive growth, further boosting investor confidence.

3. Market Share Gains: Sonos reported successful holiday promotions and market share growth, suggesting they are capturing a larger portion of the home audio market. This signifies potential for future revenue expansion.

4. Strong Cash Flow: The company generated robust free cash flow of $269.3 million, demonstrating financial health and the ability to reinvest in growth initiatives.

5. Management Optimism: CEO Patrick Spence’s positive outlook and mention of an upcoming product launch in a new category fueled investor excitement about the company’s future potential.

6. Analyst Recommendation Shift: With the strong earnings report, the average analyst recommendation might shift upwards from “Buy,” adding further momentum to the stock price.

It’s important to remember that the stock market is complex and influenced by various factors beyond just earnings reports. While these points provide a strong explanation for the initial climb, future performance depends on various market forces and company developments.

Sonos Reports First Quarter Fiscal 2024 Results

Here’s a summary:

Financials

- Revenue: $612.9 million, down 8.9% year-over-year

- GAAP net income: $80.9 million, up 7.6% year-over-year

- Non-GAAP net income: $106.1 million, up 2.6% year-over-year

- Adjusted EBITDA: $115.2 million, down 7% year-over-year

- Gross margin: 46.1%, up significantly from 29.4% year-over-year

- Free cash flow: $269.3 million

Key takeaways

- Revenue declined, but key profitability metrics like gross margin and net income improved.

- The company outperformed analyst expectations.

- Sonos attributed the results to strong holiday promotions and market share gains.

- They reiterated their fiscal 2024 revenue guidance of $1.6 billion to $1.7 billion.

- CEO Patrick Spence expressed optimism about the future, mentioning an upcoming product launch in a new category.

Overall

Despite a revenue decline, Sonos delivered a solid Q1 with improved profitability and market share growth. The upcoming product launch and confident outlook from management are fueling investor optimism, reflected in the stock price jump.

Additional resources

- Sonos Investor Relations: https://investors.sonos.com/

- Sonos Q1 2024 Earnings Release: https://investors.sonos.com/news-and-events/investor-news/latest-news/2024/Sonos-Reports-First-Quarter-Fiscal-2024-Results/default.aspx