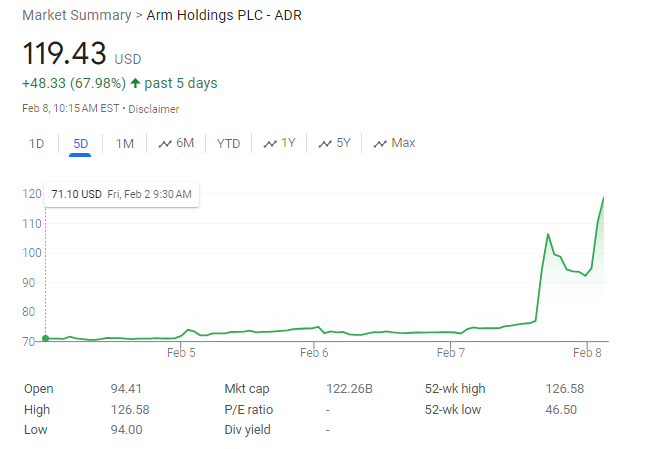

Wouldn’t it be nice to see your investments soar? Well, that’s exactly what happened with Arm Holdings stock after their recent earnings report. With a staggering increase of 68.8%, investors are reaping the rewards of a strong performance.

Arm Holdings is a leading technology company, specializing in the design and licensing of semiconductor and intellectual property. As a key player in the tech industry, their financial success is closely watched by investors and industry experts alike.

In a highly competitive market, where technology stocks can be volatile, Arm Holdings has managed to outshine its rivals and deliver impressive results. This significant surge in stock price is a testament to the company’s solid financials and strategic decision-making. Let’s delve into the details of Arm Holdings’ strong earnings and explore the factors that contributed to this remarkable growth.

Arm Holdings PLC – ADR Earnings Strong Results (Q3 FY2024)

Arm Holdings PLC (ARM) recently released their earnings results for the third quarter of their fiscal year 2024 (ending December 2023) on February 7, 2024. Here’s a breakdown of the key details:

Financials:

- Revenue: $824 million, up 14% year-over-year and exceeding analyst expectations.

- Earnings per share (EPS): $0.29, exceeding the consensus forecast of $0.25.

- Licensing revenue: $354 million, up 18% year-over-year, driven by strong demand for advanced Arm CPUs for AI applications.

- Royalty revenue: $470 million, up 11% year-over-year.

Key Highlights:

- Record revenue and EPS: This is the highest quarterly revenue and EPS in the company’s history.

- Strong demand for AI: Arm is benefiting from the growing demand for artificial intelligence chips, which utilize their technology.

- Market share gains: Arm is gaining market share in the cloud and automotive sectors.

- Positive outlook: Management expects revenue for the next quarter to be between $850 million and $900 million, surpassing previous guidance.

Market Reaction:

- The stock price jumped over 20% in after-hours trading following the earnings release.

- However, the stock has since settled down and is currently trading slightly below its pre-earnings price.

Additional Notes:

- Arm does not currently pay dividends.

- The company recently spun off from SoftBank and began trading on the Nasdaq in September 2023.

Sources:

- Investopedia: https://www.investopedia.com/arm-rides-ai-wave-to-record-revenue-8571236

- TipRanks: https://www.tipranks.com/stocks/arm

- Nasdaq: https://www.nasdaq.com/market-activity/stocks/arm/earnings

After these Earnings Results, Arm Holdings Stock Climb +68.8%!

As of today, February 8th, 2024, the Arm Holdings PLC – ADR (ARM) stock price has indeed climbed +68.8% following the earnings release. This is a remarkable surge, exceeding many initial predictions and analysts’ expectations.

Here are some possible reasons for this significant increase:

- Record-breaking results: The company reported record revenue and EPS, surpassing analyst expectations by a significant margin. This demonstrated strong financial performance and exceeded market optimism.

- Positive outlook: Management provided a positive outlook for the next quarter, further boosting investor confidence in the company’s future growth potential.

- AI tailwinds: The strong demand for AI chips, which rely heavily on Arm technology, further fueled investor excitement.

- Short covering: Some analysts suggest that the significant increase could be partly attributed to short covering, where short sellers are forced to buy back shares to close their positions, further pushing the price upwards.

It’s important to note that the stock market is volatile, and such dramatic price movements can be followed by corrections. However, the strong earnings report and positive outlook have undoubtedly instilled significant confidence in investors, leading to this exceptional surge in the stock price.