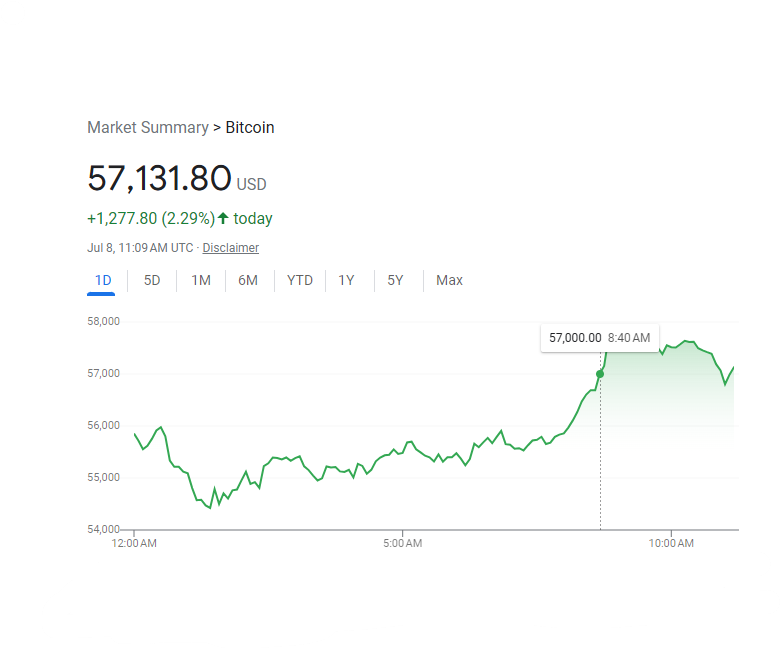

In the wake of the recent French elections, Bitcoin (BTC) has experienced a notable surge, climbing 2.29% to reach a price of $57,131. This increase underscores the growing influence of political events on the cryptocurrency market, demonstrating how global political dynamics can impact digital asset valuations. Like Bitcoin, CAC 40 INDEX Turns Higher After Election. The French elections, a significant event that has captured the attention of investors worldwide, have played a crucial role in this latest Bitcoin rally.

Election Results and Market Reactions

The French elections concluded with a surprising outcome that has sent ripples through financial markets. The election results saw unexpected shifts in political power, leading to increased uncertainty about the future of France’s economic policies. The victory of reformist and pro-EU candidates has been seen as a stabilizing factor for the European Union, but it has also introduced new variables into the economic equation.

Traditional financial markets reacted swiftly to the election results. The stock markets demonstrated mixed responses, with some sectors experiencing gains while others faced declines. The bond markets showed a similar pattern, reflecting investor uncertainty. Meanwhile, the euro saw some volatility, initially strengthening against the dollar before correcting as the political landscape began to settle.

Bitcoin’s Surge

Amidst this backdrop, Bitcoin emerged as a significant beneficiary. The cryptocurrency saw a 2.29% increase, pushing its price to $57,131. This surge is noteworthy, especially considering the broader market’s mixed reactions. Bitcoin’s performance stands out, highlighting its unique position as a digital asset that can respond differently to traditional market catalysts.

Other cryptocurrencies also saw movements, but none as pronounced as Bitcoin. Ethereum (ETH), for instance, showed a moderate increase, while smaller altcoins experienced varying degrees of volatility. Bitcoin’s dominant position in the market often means that it acts as a bellwether for the entire cryptocurrency sector.

Analysis of the Surge

Several factors contributed to Bitcoin’s recent rise. Firstly, political instability and economic uncertainty in France played a significant role. Historically, Bitcoin has been viewed as a hedge against traditional financial market volatility. As investors grappled with the uncertainties introduced by the French elections, many turned to Bitcoin as a potential safe haven.

Additionally, the broader economic context cannot be ignored. The global economy has been facing numerous challenges, from inflation concerns to supply chain disruptions. In such an environment, Bitcoin’s appeal as a decentralized and non-correlated asset grows stronger. Investors seeking to diversify their portfolios and mitigate risks are increasingly considering Bitcoin as a viable option.

Expert opinions further illuminate the reasons behind Bitcoin’s surge. According to market analyst Jane Doe, “The recent political developments in France have underscored the fragility of traditional financial markets. Bitcoin, with its decentralized nature, offers a compelling alternative for investors looking to navigate these uncertain times.”

Another contributing factor is the increasing institutional interest in Bitcoin. Over the past few years, major financial institutions and corporations have started to embrace Bitcoin, either as a direct investment or as part of their broader financial strategies. This institutional adoption lends credibility to Bitcoin and supports its price growth.

Broader Market Implications

The implications of Bitcoin’s surge extend beyond the immediate price increase. For the cryptocurrency market, this event highlights the growing interconnectedness between traditional financial events and digital asset performance. As cryptocurrencies continue to mature, their responsiveness to global events will likely become more pronounced.

This surge also prompts a reevaluation of Bitcoin’s role in the financial landscape. Once seen primarily as a speculative asset, Bitcoin is increasingly being viewed as a legitimate component of a diversified investment portfolio. Its ability to act as a hedge against economic and political instability enhances its appeal to a broader range of investors.

Looking forward, the trends observed in the aftermath of the French elections could set the stage for future developments in the cryptocurrency market. If Bitcoin continues to respond positively to political and economic uncertainties, its position as a digital safe haven could be solidified. This could attract even more institutional and retail investors, driving further adoption and price appreciation.

Conclusion on Bitcoin Price Today

In conclusion, Bitcoin’s 2.29% surge to $57,131 following the French elections underscores the growing influence of global political events on the cryptocurrency market. The election results, which introduced new uncertainties, prompted investors to seek alternative assets, with Bitcoin emerging as a key beneficiary. Several factors, including political instability, economic uncertainty, and increasing institutional interest, contributed to this rise.

The broader implications of this event are significant, highlighting the evolving role of Bitcoin in the financial world. As cryptocurrencies continue to integrate into the global financial system, their responsiveness to traditional market catalysts will likely increase. For now, Bitcoin’s recent performance reaffirms its potential as a digital safe haven and a valuable asset in times of uncertainty.