The withdrawal of Joe Biden from the 2024 presidential race could herald significant ramifications for both the national and global markets. The mere speculation about such a major shift in the political landscape of the United States has traditionally been enough to stir volatility in the stock market, hinting at the intricate interplay between politics and economic performance. The US presidential election, serving as a pivotal event that shapes policies and regulatory outlooks, undeniably holds the power to sway the sentiments of investors, corporations, and foreign governments alike. Given the heightened sensitivity of markets to political developments, the prospect of such an unexpected turn in the Joe Biden presidential race demands a thorough analysis of its potential impacts.

This article will explore the immediate consequences of a Biden withdrawal on market volatility, delve into the sector-specific effects that could reshape the economic landscape, and examine how the crypto market might respond to such a political upheaval. Further, it will assess the long-term economic projections tied to changes in leadership and policy directions, focusing on elements such as inflation and legislative dynamics within the Senate. By providing a comprehensive overview of these dimensions, we aim to uncover the broader implications of this hypothetical scenario in the presidential election context, offering insights into how shifts in political circles could reverberate through the realms of finance and governance.

Immediate Market Volatility

Immediate market volatility often arises when significant events, such as political changes, impact financial markets. This volatility can cause rapid and unpredictable fluctuations in stock prices, presenting both challenges and opportunities for investors .

Reaction of Investors

Investors typically respond to sudden market volatility with a mix of fear, uncertainty, and a protective instinct towards their investments. This emotional response can lead to impulsive decisions, such as panic selling or rushed buying, which may exacerbate market instability . For example, if President Biden were to announce his withdrawal from the reelection race, the initial market response would likely be characterized by volatility and uncertainty, as investors generally prefer stability and predictability .

Impact on Stock Prices

The impact of immediate market volatility on stock prices can be substantial. Stock prices may suffer sharp declines or experience sudden spikes, complicating the task of predicting market directions . Following a significant political announcement like Biden’s withdrawal, the initial reaction could include a sharp drop in stock prices as investors scramble to hedge against the ensuing risks .

Possible Hedging Strategies

In light of such volatility, investors might consider various hedging strategies to mitigate risk. These strategies could include the use of options, futures, or other derivative instruments to offset losses. Implementing these measures can help stabilize portfolios during periods of significant market upheaval . Additionally, financial experts like those at UBS recommend diversifying investments into assets such as long-term Treasurys and gold, which are traditionally seen as hedges against election-related risks .

Sector-Specific Effects

U.S. Equities

The possibility of President Biden withdrawing from the presidential race introduces a unique dynamic in the U.S. equities market. Historically, the health of the U.S. economy has been a significant factor in influencing whether the incumbent party retains the presidency . This relationship suggests that the market’s anticipation of political changes can lead to increased volatility. For instance, if the incumbent party changes, this could initially increase market volatility due to uncertainty about future policies and regulatory environments . Moreover, the response of the stock market to past presidential elections indicates that average and median total returns for the S&P 500 Index were modestly lower in election years compared to non-election years .

Gold and Silver

Gold and silver markets typically react to political uncertainty as investors seek safe-haven assets. If President Biden were to announce his exit from the race, it would likely heighten political uncertainty, prompting investors to increase their holdings in gold and silver . This move is often motivated by the desire to hedge against potential volatility in the stock market and currency fluctuations . Additionally, changes in leadership could lead to shifts in economic policies, particularly fiscal and monetary policies, influencing gold and silver prices. The Federal Reserve might respond to increased political uncertainty by adopting a more accommodative monetary policy, potentially weakening the dollar and supporting higher prices for these metals .

Bonds

The bond market could also experience significant shifts in response to a Biden withdrawal. Bond yields and prices might react to changes in the fiscal policy outlook, especially if investors anticipate a shift towards policies that are perceived as inflationary . For example, a scenario where the next potential leader is likely to extend tax cuts or increase government spending could lead to higher bond yields and lower bond prices . This dynamic was observed in past election cycles, where bond market reactions varied based on the perceived economic policies of the incoming administration .

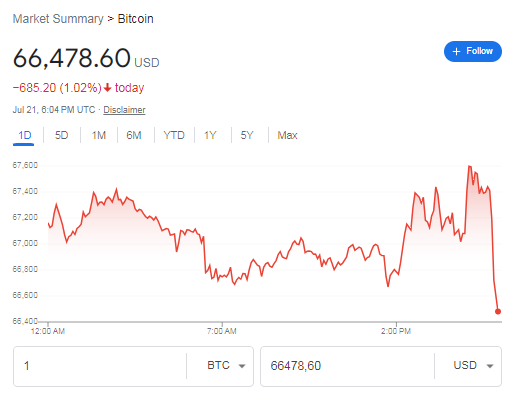

Crypto Market Response

Potential Rally

With the Joe Biden withdrawing from the 2024 presidential election, there could be a significant rally in the crypto markets, particularly if Donald Trump, known for his crypto-friendly stance, were to secure the presidency. Analysts have noted that such a political shift could propel Bitcoin to new heights, with projections suggesting a possible surge to $150,000 by year-end . This expectation stems from the belief that a Trump administration would foster a more favorable regulatory environment for cryptocurrencies .

Factors Influencing Crypto Prices

Several factors are poised to influence crypto prices in the wake of political changes. First, the perceived regulatory stance of the incoming administration plays a crucial role. For instance, a Trump victory is viewed as likely to lead to deregulation and supportive policies for the crypto industry, which historically has boosted investor confidence and market prices .

Moreover, macroeconomic policies such as deficit spending and the potential weakening of the US Dollar could also play a significant role. Analysts suggest that ongoing deficit spending and a weaker dollar under a Trump administration could introduce downside risks for the US Dollar, indirectly supporting higher cryptocurrency prices as investors might seek alternative stores of value .

Additionally, market sentiment and volatility related to electoral outcomes can cause significant fluctuations in crypto markets. For example, Bitcoin saw a notable increase in value, rising by about 9% over a weekend, influenced by the betting odds favoring a Trump victory, which was seen as beneficial for the crypto sector . This kind of volatility underscores the sensitivity of cryptocurrency prices to political developments, which can swiftly alter investor sentiment and market dynamics .

Long-Term Economic Projections

Fiscal Policies Under Trump

Should Trump return to office, his administration may prioritize extending the Tax Cut and Jobs Act (TCJA), potentially lowering the corporate tax rate further to as low as 15% . This move is expected to stimulate capital spending and economic growth, although the benefits may be tempered by full employment and labor shortages . However, the broader economic impact includes a projected increase in the national debt by $5.2 trillion through 2035, which could elevate long-term interest rates and counteract some benefits of the tax cuts .

Inflation Concerns

Inflation remains a pivotal concern, influenced significantly by fiscal and monetary policies. Under Trump’s potential policies, inflation could initially rise due to reduced taxes and increased consumer spending but might stabilize or decrease as investments begin to boost productivity . The Federal Reserve’s actions will be crucial in managing this inflation, especially in response to fiscal changes that may increase the money supply and consumer spending .

Federal Reserve’s Potential Actions

The Federal Reserve’s role in shaping economic conditions through interest rate adjustments is well-documented. During election years, the Fed’s decisions can significantly influence the economy and voter sentiment . For instance, lowering interest rates can boost consumer spending and improve perceptions of incumbents, while maintaining high rates might be seen as detrimental to incumbent politicians . The Fed’s historical actions, such as the aggressive rate hikes in 1980 and the strategic rate adjustments in 1992, have shown their profound impact on election outcomes and overall economic stability .

Conclusion

Throughout this analysis, we’ve navigated the potential market ramifications of a Biden withdrawal from the 2024 presidential race, highlighting its implications on market volatility, sector-specific dynamics, and the broader economic landscape, including the crypto market. The interconnection between political events and economic performance has been scrutinized, underlining the critical nature of presidential elections in shaping investor sentiment, regulatory outlooks, and fiscal policies.

Reflecting on these findings, it’s evident that political shifts carry significant weight in financial markets and economic forecasts. As we anticipate future developments, it becomes crucial for investors, policymakers, and market analysts to stay informed and agile. The potential outcomes discussed herein underscore the importance of strategic planning and the need for a keen eye on political and economic indicators that drive market dynamics and influence global economic health.