The commodities market today is experiencing significant fluctuations, drawing the attention of investors and analysts worldwide. From energy resources to precious metals and agricultural products, the global commodity landscape is in a constant state of flux, influenced by various economic, geopolitical, and environmental factors. This dynamic market has a profound impact on industries, economies, and everyday life, making it crucial to stay informed about the latest trends and insights.

In this FintechZoom.com article, we’ll explore the current state of the commodities market, focusing on key sectors that shape the global economy. We’ll examine the movements in the energy sector, including WTI oil, Brent oil, and natural gas. We’ll also delve into the precious metals market, analyzing the performance of gold, silver, platinum, and palladium. Finally, we’ll take a look at agricultural commodities, including grains like wheat and corn, to provide a comprehensive overview of the commodity trading scene and its impact on commodity prices and futures.

Energy Sector: Oil and Natural Gas Movements

The energy sector, particularly oil and natural gas, plays a crucial role in shaping the commodities market today. Recent trends have shown significant fluctuations in prices and market dynamics, influenced by various factors including geopolitical events, supply and demand imbalances, and global economic conditions.

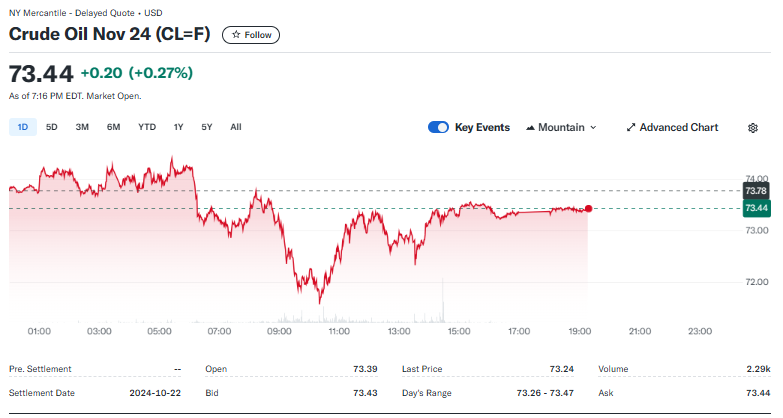

Crude Oil Price Trends

In the commodities market today, crude oil prices have experienced notable volatility. The West Texas Intermediate (WTI) and Brent oil benchmarks have seen fluctuations, with prices recently hovering around USD 73.50 per barrel for WTI crude. This represents a slight increase from previous months, reflecting the complex interplay of supply and demand factors in the global oil market.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have had a significant impact on oil prices through their production decisions. Recent output cuts of 2.5 million barrels per day have pushed Brent oil prices past USD 90.00 per barrel, demonstrating the influence of supply management on commodity prices.

Natural Gas Market Dynamics

Natural gas, another key player in the commodities market, has also experienced notable price movements. The U.S. Henry Hub natural gas prices have recently rebounded to USD 3.50 per million British thermal units (MMBtu), indicating a shift in market dynamics. This increase has been attributed to factors such as weather conditions, storage levels, and changing demand patterns.

The natural gas market has seen increased volatility, with prices rising at most locations in recent weeks. Factors contributing to this trend include changes in consumption patterns, particularly in the electric power sector, and fluctuations in liquefied natural gas (LNG) exports.

Impact of Geopolitical Events

Geopolitical events have had a significant influence on the commodities market today, particularly in the energy sector. Recent tensions in the Middle East have raised concerns about potential supply disruptions, leading to increased price volatility in both oil and natural gas markets.

Precious Metals: Gold and Silver Insights

Gold Price Analysis

In the commodities market today, gold continues to be a significant player, with its price influenced by various factors. The price of gold is determined by supply and demand as it is traded through large global markets of physical metals and futures contracts. Recently, gold has shown resilience in the face of economic uncertainties, with prices hovering around USD 2,604.66 per ounce. This performance underscores gold’s role as a safe-haven asset during times of market volatility.

Investors closely monitor gold prices as they often move inversely to the stock market. When investors become wary of stocks or fear potential market downturns, they tend to buy gold, pushing its price higher. This inverse correlation makes gold an attractive option for portfolio diversification and risk management in the commodities market today.

Silver Market Performance

Silver, another key player in the precious metals market, has experienced its own set of dynamics. Unlike gold, silver has always had a market-determined price, leading to sharper fluctuations. In the commodities market today, silver closed at USD 23.85 per ounce at the end of the previous year, showing remarkable stability compared to its closing price a year earlier.

The silver market has seen increased industrial demand, reaching a record high of 632 million ounces in recent times. This surge is attributed to silver’s unique properties, making it invaluable in various applications such as electric vehicles, solar panels, and 5G technology. The growing emphasis on green infrastructure and environmental concerns has been a significant factor propelling silver’s industrial demand upward.

Factors Influencing Precious Metals

Several factors have a substantial impact on precious metals prices in the commodities market today. Central bank policies, particularly interest rate decisions, play a crucial role. Low interest rates generally make precious metals more attractive compared to bonds, leading to increased demand and higher prices. Conversely, rising interest rates can dampen enthusiasm for gold and silver.

Geopolitical tensions and global economic uncertainties also significantly influence precious metals prices. During times of political instability or economic downturns, investors often turn to gold and silver as safe-haven assets, driving up their values. Additionally, inflation trends across major economies can be strong indicators of future precious metal price movements, as these metals are often seen as hedges against inflation.

Agricultural Commodities: Grains and Softs

Corn and Wheat Market Updates

In the commodities market today, corn and wheat have experienced significant fluctuations. The U.S. Department of Agriculture (USDA) projects the 2024 U.S. corn crop at 385.7 million tons, the second largest on record, with a record yield of 11.5 tons per hectare. This bumper crop follows another record harvest in 2023, leading to excess corn availability in the market. Consequently, U.S. corn exports for the 2024/25 marketing year are forecast at 58.4 million metric tons, potentially the fourth highest on record.

Wheat prices have shown resilience, supported by issues in the Black Sea region. The USDA estimates wheat production for 2024 at 1.971 billion bushels, the largest in eight years. However, weather conditions in the Midwest U.S. remain a key factor to monitor as the crop enters a crucial emergence period.

Coffee and Cocoa Price Movements

Coffee and cocoa prices have surged to record highs due to severe weather events impacting production in key regions. Cocoa prices have more than tripled year-on-year, rising 49% in the last month alone to USD 10,050 per ton. This spike is attributed to catastrophic harvests in West Africa, where about 70% of global cocoa is produced.

Coffee prices have also seen significant increases. Robusta coffee futures have risen by 15% month-on-month to USD 3,825 per ton, while Arabica coffee prices have surged 17% over the last month to USD 2.16 per pound. These price movements are largely due to extreme droughts in Southeast Asia, particularly in Vietnam and Indonesia, resulting in lower coffee bean harvests.

Weather Impact on Crop Yields

Climate change has had a substantial impact on crop yields in the commodities market today. Extreme weather events, including heat waves, heavy rainfall, and droughts, have damaged harvests and disrupted supplies. For instance, in West Africa, El Niño has led to unseasonal heavy rainfall followed by strong heat waves, severely affecting cocoa production. Similarly, droughts in Southeast Asia have significantly impacted coffee bean harvests.

Conclusion

The commodities market today showcases a complex interplay of factors shaping global trade and economic landscapes. From the energy sector’s volatility to the precious metals’ role as safe havens, and the agricultural commodities’ susceptibility to weather patterns, each segment has its unique dynamics. These markets have a significant impact on industries, economies, and daily life, highlighting the need to stay informed about the latest trends and insights.

Looking ahead, the commodities market is likely to remain dynamic, influenced by geopolitical events, economic policies, and environmental concerns. The energy transition, technological advancements, and changing consumer preferences will continue to shape demand for various commodities. To navigate this ever-changing landscape, investors and industry players need to keep a close eye on market indicators, global events, and emerging trends that could affect commodity prices and trading patterns.