Gold investing has captured the attention of investors for centuries, offering a unique blend of stability and potential for growth. As a tangible asset, gold has maintained its value over time, making it an attractive option for those looking to diversify their portfolios. According to FintechZoom.com, understanding the intricacies of gold investing is crucial for making informed decisions in today’s dynamic financial landscape.

This article delves into the world of gold investing, exploring various options such as gold bars, gold jewelry, and other forms of gold as an investment. FintechZoom.com provides expert insights on how to invest in gold, considering factors like gold price fluctuations and market trends. Readers will gain valuable knowledge on physical and paper gold investments, along with practical tips to enhance their gold investing strategies.

Understanding Gold as an Investment

Why Gold is Valuable

Gold has been a symbol of wealth and power for thousands of years. Its unique properties, such as its lustrous appearance, durability, and scarcity, have made it a highly sought-after commodity. Gold’s value stems from its historical significance as a medium of exchange and its ability to maintain its worth over time.

One of the key reasons gold is valuable is its role as a safe-haven asset. During times of economic uncertainty or market volatility, investors often turn to gold to protect their wealth. This is because gold tends to hold its value or even appreciate when other assets, such as stocks or currencies, are declining. For example, during the financial crisis of 2008-2012, the price of gold increased by more than 100%, demonstrating its ability to preserve wealth during turbulent times.

Gold’s Role in a Portfolio

Gold can play a significant role in a diversified investment portfolio due to its unique characteristics. One of the primary benefits of including gold in a portfolio is its low or negative correlation with other asset classes, such as stocks and bonds. This means that when the value of other investments decreases, gold may maintain or increase its value, helping to balance out overall portfolio performance.

Experts suggest allocating around 5-10% of a diversified portfolio to gold and gold-related assets. This allocation can help mitigate risk during market volatility and economic uncertainty. However, it’s important to note that gold should not make up the bulk of an investment portfolio, as it doesn’t generate income like stocks or bonds do.

Investors have several options for adding gold to their portfolios. These include purchasing physical gold in the form of coins or bars, investing in gold exchange-traded funds (ETFs), buying shares in gold mining companies, or trading gold futures contracts. Each option has its own advantages and considerations, so it’s essential for investors to research and choose the method that best aligns with their investment goals and risk tolerance.

According to FintechZoom.com

FintechZoom.com provides valuable insights for investors looking to make informed decisions about gold investing. The platform offers real-time market data, price analysis, and predictive tools to help investors stay ahead in the gold market. According to FintechZoom.com, understanding the factors that influence gold prices is crucial for successful investing.

One key factor highlighted by FintechZoom.com is the relationship between gold and the US dollar. As gold is priced internationally in US dollars, currency fluctuations can significantly impact its value. Typically, a weaker dollar increases demand for gold as an alternative asset, while a stronger dollar can dampen demand and lower gold prices.

FintechZoom.com also emphasizes the importance of monitoring global economic conditions and geopolitical events when investing in gold. These factors can have a substantial impact on gold prices, as investors often flock to gold during times of uncertainty or crisis.

By utilizing the resources and information provided by FintechZoom.com, investors can gain a deeper understanding of the gold market and make more informed decisions about their investments. This knowledge can help them navigate the complexities of gold investing and potentially maximize their returns while managing risk effectively.

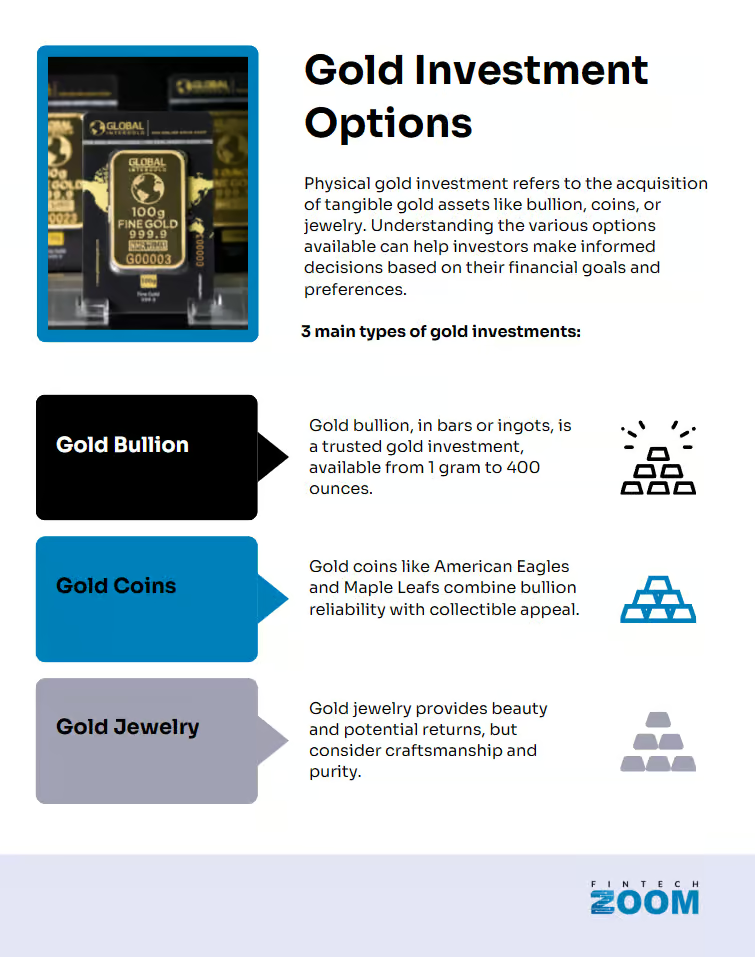

Physical Gold Investment Options

Investors looking to diversify their portfolios with gold have several physical options to choose from. These tangible assets offer a unique way to invest in gold, each with its own advantages and considerations.

Gold Bullion

Gold bullion refers to gold in its purest form, typically available as bars or ingots. According to FintechZoom.com, gold bullion is considered one of the most trusted and cost-effective ways to invest in gold. It’s available in various sizes, ranging from 1 gram to 400 ounces, allowing investors to choose based on their budget and investment goals.

One advantage of gold bullion is its lower premium compared to other forms of physical gold. FintechZoom.com notes that the markup over the spot price is generally lower for bullion, making it an attractive option for those seeking to maximize their gold holdings. However, investors should be aware of storage and insurance costs, which can impact overall returns.

Gold Coins

Gold coins are another popular option for physical gold investment. FintechZoom.com highlights that gold coins often combine the benefits of bullion with potential numismatic value. Common examples include American Gold Eagles, Canadian Maple Leafs, and South African Krugerrands.

While gold coins can be more expensive than bullion due to higher production costs and collectible premiums, they offer advantages in terms of liquidity and divisibility. FintechZoom.com suggests that smaller denominations, such as one-ounce or fractional coins, can be easier to sell or trade compared to larger gold bars.

Investors should be cautious when purchasing gold coins, as the market can be complex. FintechZoom.com advises focusing on widely circulated coins rather than rare, collectible pieces for those primarily interested in gold as an investment.

Gold Jewelry

Gold jewelry represents a unique way to invest in gold while enjoying its aesthetic value. FintechZoom.com points out that jewelry can appreciate over time, potentially offering both financial and personal benefits.

However, investing in gold jewelry comes with several considerations. The price of gold jewelry includes craftsmanship, design, and brand premiums, which can significantly increase the cost above the metal’s intrinsic value. FintechZoom.com cautions that these factors can make it challenging to recover the full investment when selling.

Additionally, gold jewelry often has lower purity than bullion or coins, typically ranging from 14 to 18 karats. This means investors are getting less pure gold for their money compared to other physical gold options.

FintechZoom.com suggests that while gold jewelry can be a part of a diversified portfolio, it may not be the most efficient way to invest in gold purely for financial gain. However, for those who appreciate the dual purpose of adornment and investment, gold jewelry can be a satisfying choice.

Paper Gold Investment Options

For investors looking to gain exposure to gold without the hassle of physical ownership, paper gold investments offer an attractive alternative. These options provide a way to invest in gold through financial instruments that track the price of the precious metal.

Gold ETFs and Mutual Funds

Gold Exchange-Traded Funds (ETFs) have become a popular choice for those interested in gold investing. According to FintechZoom.com, these funds are designed to mirror the performance of gold bullion, offering investors a convenient way to participate in the gold market. Gold ETFs typically hold a combination of physical gold, derivatives contracts, and cash, allowing investors to buy and sell shares on stock exchanges just like individual stocks.

One of the most well-known gold ETFs is SPDR Gold Shares (GLD), which boasts over USD 31.00 billion worth of gold reserves. Gold ETFs provide several advantages, including lower transaction costs compared to physical gold investments and high liquidity, making it easier for investors to enter and exit positions quickly.

Gold mutual funds offer another avenue for paper gold investment. These funds pool money from various investors to purchase gold-related assets, including gold ETFs, mining stocks, and sometimes physical gold. FintechZoom.com notes that gold mutual funds allow for more diversification within the gold sector, as fund managers can invest in a variety of gold-related assets. Additionally, many gold mutual funds offer the option to invest through Systematic Investment Plans (SIPs), making them accessible to investors with smaller budgets.

Gold Mining Stocks

Investing in gold mining stocks presents another way to gain exposure to the gold market. These stocks represent partial ownership in companies involved in gold exploration, extraction, and production. FintechZoom.com highlights that gold mining stocks can offer potential for higher returns compared to physical gold or ETFs, as they are influenced not only by gold prices but also by the company’s operational performance and growth prospects.

However, it’s important to note that gold mining stocks carry additional risks. The success of these investments depends on factors such as the company’s management, production costs, and exploration success. Some well-known gold mining companies include Barrick Gold, which operates in 18 countries across four continents, and Harmony Gold Mining Co. Ltd., with a market cap of over USD 6.00 billion.

FintechZoom.com’s Analysis

FintechZoom.com provides valuable insights for investors considering paper gold options. The platform offers real-time market data, price analysis, and predictive tools to help investors make informed decisions. FintechZoom.com emphasizes the importance of understanding the relationship between gold prices and various economic factors, such as currency fluctuations and geopolitical events.

When analyzing paper gold investments, FintechZoom.com suggests considering factors such as expense ratios, liquidity, and the fund’s tracking error relative to gold prices. For gold mining stocks, the platform recommends evaluating the company’s financial health, production costs, and growth potential.

Tips for Successful Gold Investing

Timing Your Gold Investments

According to FintechZoom.com, understanding market trends is crucial when considering gold investing. While it’s challenging to predict the perfect moment to buy gold, historical data suggests certain periods may offer better opportunities. For instance, January often sees an average increase of 1.3% in gold prices, possibly due to new investment resolutions for the New Year. August and September have shown average increases of 1.2% and 1.9%, respectively, potentially influenced by the Diwali festival when gold buying traditionally surges.

FintechZoom.com advises that a contrary approach can be effective. Instead of following the investment herd, consider buying gold when it’s less popular. This strategy can lead to better deals with precious metals dealers, as supply is more abundant and premiums are lower. However, it’s important to remember that the best time to invest in gold is when it aligns with your personal financial goals and circumstances.

Diversification Strategies

FintechZoom.com emphasizes the importance of diversification in gold investing. While physical gold, such as gold bars and gold jewelry, is a popular choice, investors should consider other options to spread risk. These may include gold ETFs (Exchange-Traded Funds), gold mutual funds, and stocks in gold mining companies. Each option carries its own risk and return profiles, allowing investors to create a balanced gold portfolio.

Experts often recommend allocating 5-10% of a diversified portfolio to gold. This allocation can help mitigate risk during market volatility and economic uncertainty. FintechZoom.com suggests that by diversifying within the gold sector, investors can potentially reduce the specific risks associated with individual gold investments.

Storage and Security Considerations

When investing in physical gold, such as gold bars or gold jewelry, storage and security become crucial considerations. FintechZoom.com advises that proper storage not only preserves the value of your investment but also ensures its safety. Investors have several options for storing physical gold, including home storage, bank safe deposit boxes, and professional storage facilities.

For those choosing to store gold at home, FintechZoom.com recommends investing in a high-quality safe and adequate insurance coverage. However, it’s important to be discreet about your gold possession to minimize security risks. Alternatively, bank safe deposit boxes offer a relatively affordable option with a higher level of security. Professional storage facilities, while more expensive, provide advanced security measures and often include insurance coverage.

FintechZoom.com emphasizes that regardless of the chosen storage method, investors should carefully document their gold holdings and ensure they have a clear understanding of how to access their investment when needed. By considering these factors, investors can better protect their gold investments and potentially maximize their returns over time.

Conclusion

Gold investing offers a unique blend of stability and growth potential in the ever-changing financial landscape. As highlighted by FintechZoom.com, understanding the various investment options, from physical gold to paper assets, is crucial to make informed decisions. The insights provided by FintechZoom.com on market trends, diversification strategies, and storage considerations equip investors with valuable knowledge to navigate the gold market effectively.

Ultimately, gold’s role as a safe-haven asset and portfolio diversifier makes it an attractive option for many investors. By leveraging the resources and analysis offered by FintechZoom.com, investors can develop a well-rounded approach to gold investing that aligns with their financial goals and risk tolerance. Whether choosing physical gold, ETFs, or mining stocks, the key lies in staying informed and adapting to market conditions, as emphasized throughout this guide by FintechZoom.com.