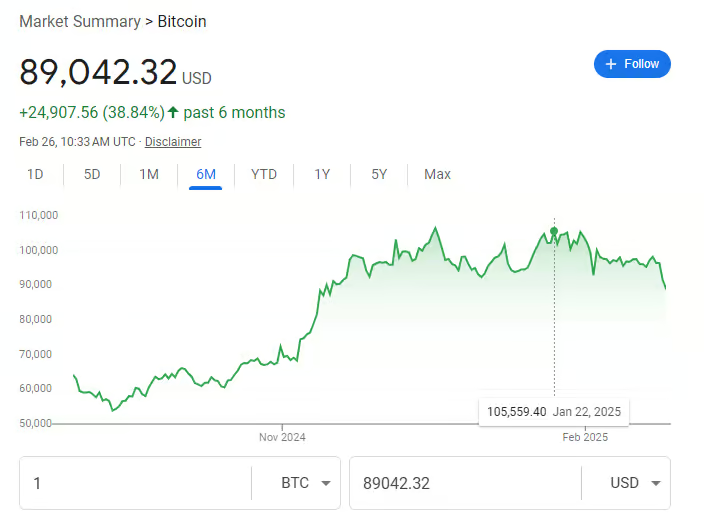

The cryptocurrency market is witnessing renewed vigor as Bitcoin (BTC) surpasses the $100,000 mark, driven by cooling inflation data and mounting anticipation surrounding Donald Trump’s presidential inauguration on January 20th. The leading cryptocurrency has demonstrated remarkable resilience, posting an 11% recovery from Monday’s sub-$90,000 levels, with analysts suggesting this could be the beginning of a more substantial rally. Market sentiment has shifted dramatically since the November elections, with institutional investors increasingly viewing digital assets as a strategic component of their portfolios.

Market Momentum Builds Amid Early Sales and Strategic Initiatives

The digital asset sector’s robustness extends beyond Bitcoin’s price action, with crypto presales and emerging projects gaining significant traction as investors position themselves ahead of potential policy shifts. Market analysts note that Trump’s previous pledge to establish a national strategic bitcoin stockpile has already catalyzed substantial institutional interest, contributing to BTC’s impressive surge from $70,000 to over $108,000 following his election victory.

The recent market dynamics have been particularly influenced by Wednesday’s softer-than-expected core CPI report, which has significantly altered the investment landscape. According to Matt Mena, crypto research strategist at 21 Shares, the latest economic data has created favorable conditions for Bitcoin to challenge its previous resistance levels. “The removal of inflation fears clears the way for bitcoin to break through the strong $100,000 resistance level before Trump’s inauguration,” Mena explained, highlighting the potential for new all-time highs as market optimism builds.

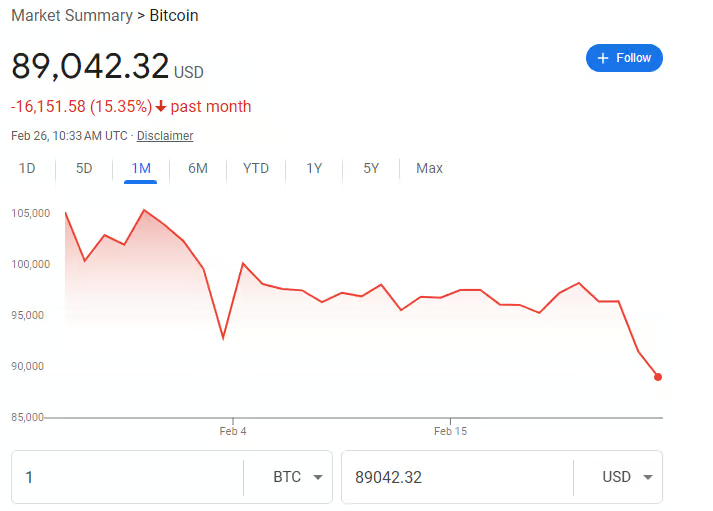

However, in last month the BTC price drops from approximately $105,000 to $89,042.32, showing a -15.35% decrease.

Technical Analysis Points to Volatile Trading Ahead

Paul Howard, senior director at crypto market-making firm Wincent, anticipates significant price movements across major cryptocurrencies in the coming week. The firm’s analysis suggests potential swings of ±10% for leading assets including BTC, SOL, ETH, and XRP, as markets react to policy announcements from the incoming administration. This volatility expectation is supported by historical patterns observed during major political transitions and policy shifts.

Market analysts have identified several key technical indicators that suggest increased volatility ahead. Trading volumes across major exchanges have surged by 40% in the past 48 hours, while options market data indicates a significant uptick in both calls and put options extending into late January.

Adding to the market dynamics, Binance altcoin dominance has reached 78%, suggesting a strong rotation into alternative cryptocurrencies as traders position themselves for potential policy-driven movements. Derivatives markets have shown particular sensitivity to political developments, with open interest in Bitcoin futures reaching an all-time high of $24.5 billion.

The cryptocurrency market’s correlation with traditional financial markets has also strengthened, with Bitcoin’s positive correlation with the Nasdaq 100 reaching a two-year high. The tech-heavy index’s recent 2% surge, coupled with the dollar index’s stalled momentum, has provided additional support for digital assets. Market technicians point to the S&P 500’s approach toward the crucial 6,000 level as another potential catalyst for broader market gains.

Traditional financial institutions have begun adjusting their positions in response to these developments, with several major banks reportedly expanding their digital asset trading desks in anticipation of increased institutional demand. Goldman Sachs and Morgan Stanley have both announced plans to enhance their cryptocurrency trading capabilities, while BlackRock’s spot Bitcoin ETF has seen record inflows since its recent approval. The convergence of traditional finance with cryptocurrency markets has created a unique environment where policy decisions could have amplified effects across both sectors.

Strategic Bitcoin Reserve Plans Draw Global Attention

Nathan Cox, chief investment officer at Two Prime, emphasizes the transformative potential of Trump’s proposed Strategic Bitcoin Reserve. “If Trump indicates on day one that he will be creating the Strategic Bitcoin Reserve, even if he doesn’t sign it on day one, expect price discovery to be asymmetric,” Cox stated, suggesting that such an initiative could trigger unprecedented global demand for Bitcoin.

The proposal represents a significant shift in U.S. cryptocurrency policy, particularly noteworthy given Trump’s evolution from digital asset skeptic to advocate. Industry observers anticipate that formal announcements regarding cryptocurrency regulation and banking rules could further catalyze market movements, with potential implications for global monetary policy and international reserve currency dynamics.

Financial experts suggest that the creation of a Strategic Bitcoin Reserve could fundamentally alter the landscape of international finance, potentially inspiring other nations to follow suit. Several European and Asian central banks have reportedly begun internal discussions about similar initiatives, although no formal announcements have been made. The implications for global trade, monetary policy, and financial sovereignty have become central topics of discussion among policymakers and market participants alike.

Conclusion

As the cryptocurrency market braces for a potentially transformative week, Bitcoin’s trajectory appears increasingly tied to political developments and broader economic indicators. Investors seeking to capitalize on these market movements are carefully evaluating the top crypto to buy right now before making strategic decisions.

With the confluence of cooling inflation data, Trump’s inauguration, and the prospect of groundbreaking policy initiatives, market participants remain alert to the possibility of new price records and increased volatility across the digital asset landscape.