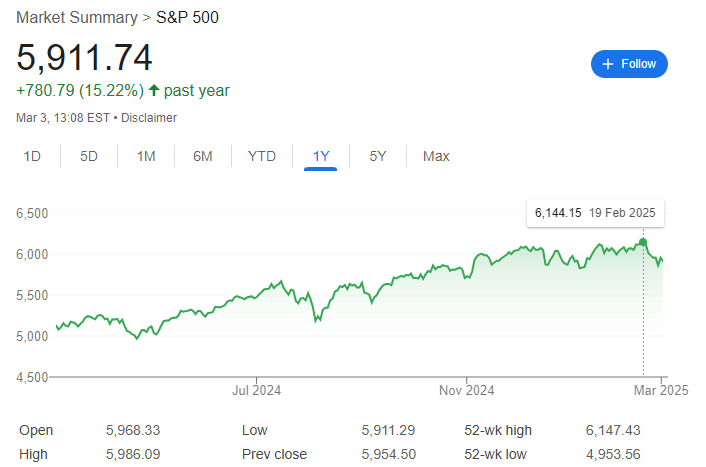

The S&P 500 just hit a record high. This is huge news because the total value of the 500 most prominent companies in the United States has never been higher.

To describe why this happened in the simplest terms, many investors bought stocks late in the trading day, pushing prices up.

Businesses and investors will be celebrating because they will be more prosperous than ever, and the benefits don’t stop at an individual level. Higher stock prices mean more confidence in business, creating more jobs, leading to company growth, and lowering inflation.

In 2024, 62% of adult Americans invested in the stock market, a number likely to rise due to the strength of the market following the recent US election. Therefore, it’s helpful to consider how stocks change if you are considering investing.

This article explores the market drivers behind the rally, sector performance and key stocks, the role of IT management, and the future market outlook.

Market Drivers Behind the Rally

When you understand some of the reasons behind the last-minute stock-buying rally, you can understand when and how this might happen again. You can use this data to inform future stock purchasing decisions.

Many different attitude shifts, data, and company outcomes lead to the S&P 500 reaching a new high. Some of the biggest reasons include:

- Companies Made More Money—Many big companies reported substantial profits, which made investors confident that businesses were doing well.

- Good Economic Data – Reports showed that more people have jobs, and businesses are growing. When the economy is strong, people spend more money, which helps companies grow.

- Lower Interest Rates—The Federal Reserve lowered interest rates, which helped control money in the U.S. This point means businesses and people can borrow money more efficiently, which allows companies to expand.

These factors combined create positive attitudes toward stock purchases, leading to this record high for S&P 500 shares.

Sector Performance and Key Stocks

Now, let’s examine the sector performance and the key stocks that showed the most significant increases in value. Not all companies grew at the same speed, and some industries performed better than others.

Here are a few of the biggest winners:

- Technology Companies—The biggest gains were in Companies that make software, phones, and online services. As more businesses and people use technology daily, investors invest more money into these companies.

- Financial Companies – Banks and investment companies also did well. Since people were buying more stocks, these companies made more money.

- Energy Companies – Some oil and gas companies saw their stock prices rise because of high energy demand.

Some of the biggest companies in the world, like Apple, Microsoft, and Amazon, saw their stock prices rise. These companies are significant because they make products and services that millions use daily.

The Role of IT Management in a Booming Market

When businesses grow, they need to make sure their technology works well. IT (Information Technology) management is crucial because it helps companies stay safe, work faster, and avoid technical problems.

One of the primary roles of IT management is keeping systems running. Businesses rely on computers, websites, and software. If these systems stop working, companies can lose money. IT teams make sure everything stays online and working properly.

Successful businesses also use the best RMM software (Remote Monitoring and Management) to help IT teams monitor systems. This software allows IT teams to check computers, servers, and networks from anywhere. If a problem occurs, they can fix it quickly before it affects business operations.

Future Market Outlook

Many experts believe the stock market will keep growing, but there are risks when it grows beyond a specific size or too quickly. Some things that could affect the market in the future include geopolitical tensions, inflation concerns, and policy changes.

Geopolitical tensions, such as conflicts between countries, can make investors nervous. If they believe a situation could harm businesses, they may sell their stocks, leading to a price drop.

Concerns about increasing inflation will likely play a huge role in stock buyer confidence. If prices for everyday items go up too much, people may spend less money. The impact can be slower economic growth and lower business earnings.

Conclusion

The S&P 500’s record-high performance is exciting for businesses and investors. Substantial company profits, good economic conditions, and lower interest rates helped push the stock market up.

Technology, finance, and energy companies performed the best, and businesses now have more growth opportunities. However, they also need to be careful because stock prices can change quickly.

Good IT management, including RMM software, helps businesses stay efficient and safe during a strong market.

The future of the stock market depends on various diverse factors, but businesses and investors who plan carefully can take advantage of new opportunities while preparing for risks.

For the financial industry, the S&P 500 reaching a record high amid a late trading rally is a momentous occasion. To commemorate this significant milestone, entrepreneurs and finance enthusiasts can go to Custom Enamel Pins.

When customizing the pins, in addition to choosing financial-themed designs, you can also add elements related to the S&P 500 index. These custom pins can serve as souvenirs to commemorate this important financial historical event, and can also be worn during investing or trading to inspire confidence and bring good luck.