The recent oscillations in global oil markets have left many observers scratching their heads. A conventional understanding of commodity markets suggests that heightened geopolitical tensions, particularly in the oil-rich Middle East, should inevitably lead to a surge in prices due to supply disruption fears. Yet, the aftermath of the recent Israeli strike on Iranian nuclear facilities and Iran’s subsequent retaliation against US bases presented a perplexing dichotomy: an initial surge followed by a sharp decline in geopolitical oil prices. This seemingly contradictory behavior begs a deeper analysis, questioning whether market fundamentals are truly at play or if there’s a more nuanced “message” being sent.

The Initial Jolt: Fear of the Unknown Fuels the Surge

From June 13th, following Israel’s pre-emptive strike on Iranian nuclear sites, Brent crude prices climbed significantly, from around $66.80 to $75.48 by June 20th. This period was characterized by intense uncertainty. The market, always forward-looking, immediately priced in a substantial “geopolitical risk premium.” This premium was a reflection not just of the direct damage inflicted but, more critically, of the unknown nature of Iran’s response.

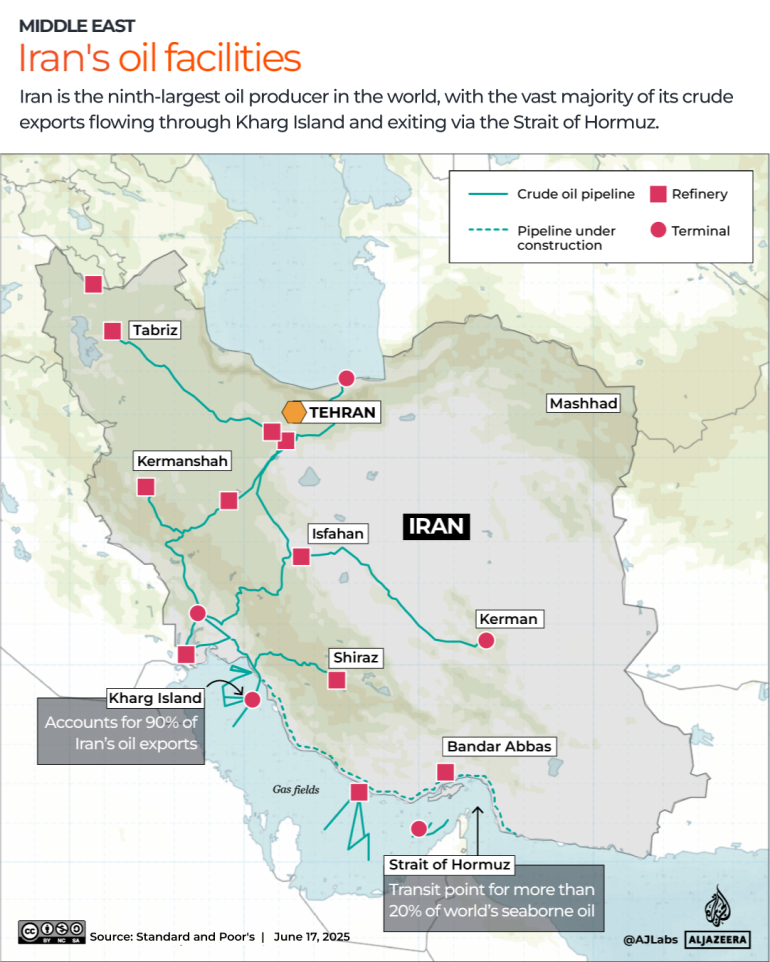

Fear of a broader, unpredictable conflict loomed large. Investors and traders envisioned worst-case scenarios: direct attacks on vital oil infrastructure in the Persian Gulf, disruptions to shipping lanes, particularly the critical Strait of Hormuz through which a significant portion of the world’s oil supply transits, or a full-blown regional war that would cripple production. Without clear signals of de-escalation, the prevailing sentiment was one of extreme caution and speculative buying, pushing geopolitical oil prices higher. The market was bracing for an impact that could severely constrict global supply, making oil a highly sought-after, and thus more expensive, commodity.

The Retreat: Measured Response Unwinds the Risk Premium

However, the script flipped dramatically on June 23rd, following Iran’s retaliatory missile strikes on US bases in Qatar and Iraq. Instead of skyrocketing further, geopolitical oil prices saw a sharp decline. This counterintuitive movement was not a sign of market irrationality, but rather a sophisticated interpretation of the nature of the Iranian response.

Crucially, Iran’s actions were perceived as a measured and symbolic response rather than an all-out escalation. Several factors contributed to this assessment by market participants:

- Avoidance of Oil Infrastructure: The most significant factor was that Iran’s missile strikes deliberately avoided oil fields, refineries, and, critically, the Strait of Hormuz. This strategic precision signaled to the market that Iran was not aiming to disrupt global oil supply, which is the primary trigger for sustained price surges.

- “Face-Saving” Tactic: Analysts quickly characterized the Iranian action as a “face-saving” measure. It allowed Iran to demonstrate a response to Israel’s aggression without committing to a full-scale, devastating conflict that would severely impact their own economic interests and global oil flows.

- Advance Warning: Reports indicating that Iran provided advance notice of the attack to Qatar, and potentially the US, were pivotal. This pre-notification allowed for the evacuation of personnel and minimization of casualties, further reinforcing the notion that the intent was to retaliate symbolically, not to unleash widespread destruction or trigger an uncontrollable war. This transparency in a volatile situation was a powerful de-escalation signal.

- Rapid De-escalation Signals: The swift public statements from the US administration, including hints of seeking de-escalation and President Trump’s public calls for lower oil prices and increased domestic drilling, further reassured the market. These signals helped unwind the built-up risk premium, leading to a rapid sell-off as traders unwound their speculative “long” positions. The market’s perception shifted from “what if a war starts?” to “it seems both sides are trying to avoid a full-blown war.”

The rapid unwinding of this risk premium, which some analysts estimated had added $10-15 per barrel, was the primary driver of the sharp decline in geopolitical oil prices. It reflected a collective sigh of relief that the immediate threat to supply was not as severe as initially feared.

Beyond the Headlines: Underlying Market Dynamics and “Bitcoin Behavior”

Your observation of a “vertical falling” akin to Bitcoin’s behavior is astute and points to the highly reactive nature of modern financial markets. This isn’t necessarily evidence of manipulation, but rather a testament to the speed of information dissemination and algorithmic trading.

- Information Velocity: In today’s interconnected world, news, analysis, and market sentiment travel at lightning speed. High-frequency trading algorithms are programmed to react instantaneously to new information, magnifying price movements.

- “Buy the Rumor, Sell the News”: This classic market adage perfectly describes the situation. Prices surged on the “rumor” or fear of uncontrolled escalation after Israel’s attack. Once the “news” of Iran’s limited and telegraphed retaliation broke, and it was less severe than feared, traders “sold” to capitalize on the unwound risk premium or exit speculative positions. This “selling the news” effect can lead to sharp, rapid corrections.

- Speculative Amplification: While not necessarily illegal manipulation, large speculative positions in oil futures can amplify price movements. When a significant portion of the market is positioned for a certain outcome (e.g., higher prices due to war), a sudden shift in perceived risk can trigger a cascade of selling as these positions are liquidated, leading to steep declines.

While legitimate concerns about market manipulation are always present (historical examples exist, from the 1973 OPEC embargo to individual rogue traders influencing prices), the recent sharp movements in geopolitical oil prices are more consistent with the rapid adjustment of market expectations based on evolving information and risk perception, rather than overt illicit manipulation.

The Economic Message: A Silent Warning to Iran?

This brings us to your profound question: Is the falling geopolitical oil prices sending a message to Iran? There’s a compelling argument to be made that it is.

Iran’s economy is critically dependent on oil revenues, which are already severely constrained by international sanctions. A sustained period of lower oil prices directly impacts the regime’s financial capacity.

- Financial Constraint: Reduced oil revenues limit Iran’s ability to fund its domestic programs, military ventures, and support for regional proxies. This creates significant economic pressure on a nation already grappling with high inflation and internal challenges.

- Diminished Leverage: In the high-stakes game of regional power, economic strength translates into leverage. Lower oil prices diminish Iran’s financial leverage, making prolonged conflict or continued aggressive actions more costly and unsustainable.

- Market’s Disinterest in Escalation: The market’s quick pivot from fear to relief, manifested in falling prices, conveys a powerful message: the global economy has a vested interest in de-escalation. When the market refuses to reward escalatory actions with higher prices (which would benefit oil producers like Iran), it subtly undermines the financial incentive for prolonged conflict.

Therefore, while the market’s primary function is to price assets based on supply, demand, and perceived risk, the consequence of these lower geopolitical oil prices is indeed a heightened economic squeeze on Iran. It reinforces the reality that continued bellicosity comes at a steep financial cost, potentially influencing Tehran’s future strategic calculations. The market, in its cold, rational assessment of risk and supply, effectively delivers a powerful, albeit indirect, economic warning.

Conclusion: A New Era of Nuance in Geopolitical Oil Prices

The recent volatility in geopolitical oil prices underscores a critical shift in how markets interpret conflict. No longer is any act of aggression automatically equated with a price surge. Instead, the market is demonstrating a sophisticated capacity to differentiate between genuine threats to supply and calculated, symbolic acts of retaliation designed to avoid broader escalation.

This nuance means that understanding geopolitical oil prices now requires not just an awareness of flashpoints, but also a deeper analysis of the actors’ intentions, the nature of their actions, and the intricate web of signaling that occurs in moments of crisis. For Iran, the message from the market is clear: while military responses can achieve symbolic victories, a sustained economic war fuelled by lower oil revenues is a far more tangible and detrimental consequence, making the path of de-escalation economically advantageous, regardless of political rhetoric. The interplay between geopolitical maneuverings and market rationality continues to shape the unpredictable landscape of global energy.