More than half of all traffic to cryptocurrency platforms now comes from mobile devices, with smartphones making up about 60% of visits. This shift has reshaped the $2.3 trillion global crypto market—and it’s clear that mobile design is no longer an afterthought, but the foundation.

If you’re new to buying crypto, you’ll quickly notice just how much things have changed. Today, the top platforms aren’t just websites—they’re powerful apps, built with mobile users in mind. Major exchanges have doubled down on delivering smooth, intuitive mobile-first experiences that leave clunky desktop setups behind.

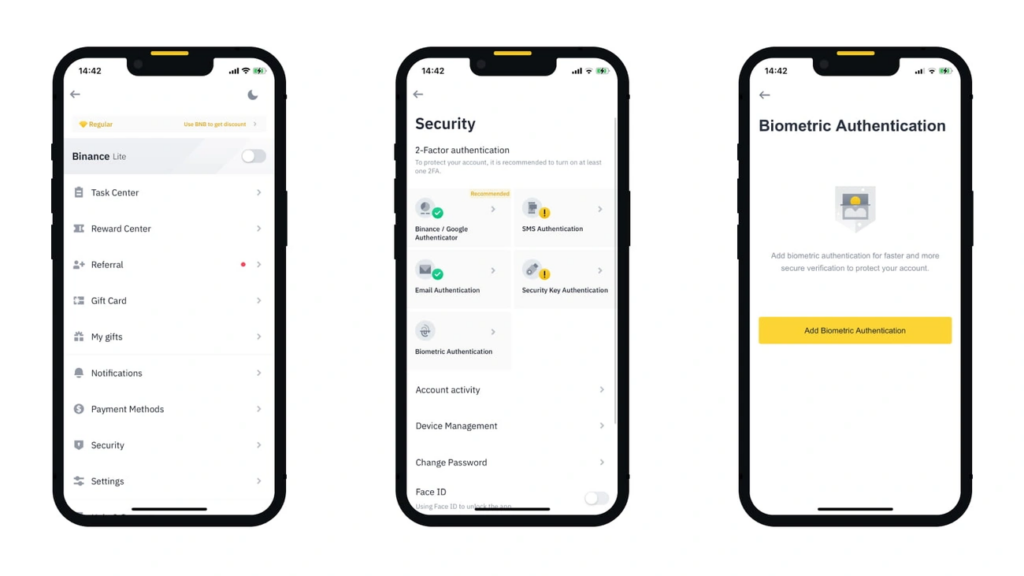

These mobile-first platforms offer advantages that desktops simply can’t compete with. Features like biometric logins boost security, while tap-to-trade interfaces let users react instantly to market shifts.

Bitcoin Solaris takes things even further by allowing users to mine cryptocurrency directly from their phones. In testing, some users have reportedly earned up to $27 a day, all while using just 1–5 GB of storage.

The shift to mobile-first crypto platforms

Your pocket’s mobile device has become the main gateway to cryptocurrency for millions of users worldwide. The UN’s International Telecommunication Union reports that 3 out of 4 people globally own mobile phones. These phones now serve as the most common way to access the internet. This widespread use of mobile devices has created the perfect foundation for new crypto platforms to grow.

Why mobile is now the default for new users

Mobile phones give new cryptocurrency users a natural starting point, especially for younger generations. Most Gen Z users see their smartphones as their go-to device. This makes mobile-first crypto platforms perfect to reach this tech-savvy audience. The way people buy crypto has changed because platforms need to focus on mobile experiences to stay relevant.

Mobile technology has opened doors for many users. People can skip expensive desktop devices and jump straight into cryptocurrency markets. Anyone wondering how to buy crypto will find the best way is often the easiest, right from their smartphone.

Simplicity drives adoption. Crypto’s biggest roadblock has always been how complex it is. Mobile-first crypto platforms fix this with phone number-based systems and accessible interfaces that make transactions feel natural. New users find it much easier to learn, and the best platform to buy crypto becomes one that doesn’t need much tech knowledge.

How mobile usage is shaping crypto adoption

The mobile-first approach has changed how people use cryptocurrency. The best crypto buying apps offer several key benefits:

- Always available: Users can watch markets and react to price changes 24/7

- Quick setup: Only two in five people find crypto services easy to use on phones, but those who get started tend to stick around

- Better security: Face and fingerprint scanning keep things safe without complications

- Clear visuals: Mobile screens do a great job of making complex ideas simple through charts and graphics

The numbers show a gap, though. While 75% of millennials would switch banks for better mobile features, only 13% of people found crypto setup “very easy” compared to 47% for mobile banking. This creates both a challenge and a chance for crypto platforms to improve.

Platforms like Garanti BBVA Crypto have launched new mobile apps to address these needs. They’ve added advanced features like accessible interfaces, built-in custody, trading services, and custom alerts. Exodus now lets users buy crypto directly in their mobile wallet without using other exchanges.

The decline of desktop-first exchanges

Desktop crypto platforms are losing ground as users move to mobile. Desktop designs show their limits in user retention – last year, more than a quarter of people gave up on new online accounts because setup took too long.

Mobile-first design takes a different approach. It puts simplicity first and focuses on core features. This leads to exactly what crypto apps need – quick, efficient processes that take minutes instead of hours.

Getting a mobile app feels less daunting than installing desktop software. People are more likely to try crypto platforms when they don’t feel they’re taking a big risk. The best way to buy crypto turns out to be the one that feels easiest to start with.

This shift to mobile in cryptocurrency isn’t just about making things easier – it’s changing how digital assets fit into our everyday lives.

Key features driving mobile-only adoption

Mobile apps now offer countless innovative features that make cryptocurrency available to more people. These specialized tools are changing how users interact with digital assets through their smartphones.

Tap-to-trade and swipe navigation

OANDA Crypto app shows how an accessible interface can transform trading. Users can “let your fingers do the talking” with simple taps and swipes that make trading nearly effortless. This approach lets users respond to market opportunities without complex menus. The app developers note that users can “make trades as the market moves” and “manage orders and risk exposure with a single tap.”

The Pulse app has introduced swipe navigation that makes exploring crypto content feel seamless and intuitive. Users can effortlessly scroll through a rich mix of articles, community discussions, and polls—all designed to keep them informed and engaged. Compared to traditional platforms, this interactive approach makes the process of buying crypto feel more natural and user-friendly.

Some crypto platforms are taking inspiration from dating apps to make investing more engaging. Coinswipe puts a playful spin on crypto discovery with its Tinder-style swiping feature, letting users quickly browse and rate different cryptocurrencies. It’s a fun, approachable way for beginners to explore the market and spot potential investments, without getting lost in the complexity.

Real-time alerts and price tracking

Instant access to market data gives mobile crypto users a serious edge, allowing them to react quickly to price swings and make smarter moves wherever they are.

Platforms like Cryptocurrency Alerting keep an eye on thousands of crypto assets across multiple exchanges. Users can set up custom alerts to monitor everything from price changes and trading volume to new exchange listings and large whale wallet movements.

The Coin Push app takes this a step further. It pulls live data from major exchanges and runs it through advanced algorithms in real time to detect early signs of market trends, price surges, sudden dumps, and volume spikes. Users get timely notifications the moment something big starts brewing, giving them a valuable head start.

These alerts aren’t just helpful—they can directly impact results. One user reported that real-time notifications helped them “execute trades at optimal moments,” boosting profits by as much as 15%.

Integrated staking and rewards

Modern crypto apps are making it easier than ever to earn passive income, thanks to seamless, built-in staking features.

Trust Wallet is a strong example of how easy earning passive income through crypto can be. It offers over 24 staking options directly within the app, with competitive annual returns—3.24% for Ethereum, 4.50% for Solana, and a standout 24.93% for Stargaze.

Coinbase also simplifies the process by removing the usual complexity. With just a few taps in its clean, beginner-friendly mobile app, anyone can start staking—even if they’re completely new to crypto. That kind of simplicity makes staking feel approachable and accessible for everyone.

For those who value security above all, ELLIPAL’s hardware wallets offer a secure way to manage staking directly through the ELLIPAL app, keeping funds safe while still generating passive rewards.

These rewards can add up. One platform estimates annual earnings of over 3.2 ETH based on current rates. With mobile staking, your smartphone becomes more than a trading tool—it’s a gateway to passive income.

All-in-one dashboards

Modern crypto apps shine with their complete approach to asset management. CoinStats lets users “connect your entire portfolio to track, buy, swap, and stake your assets” from one interface. The app supports “all major crypto platforms and DeFi protocols.”

TabTrader shows what an all-in-one solution can do. Users get “quick access to all leading crypto exchanges from a single dashboard” plus “advanced charting tools and indicators” for technical analysis. This unified experience removes the need for multiple apps when managing various crypto investments.

New users benefit from these merged dashboards. Tap app developers highlight how their platform helps users “instantly access a large range of cryptocurrencies.” The experience feels “simple again” for both beginners and experts looking for the best crypto buying platform.

Security innovations in mobile crypto apps

Security is the lifeblood of crypto adoption. Mobile platforms now offer protection mechanisms that were once desktop-only features. Smartphone security’s progress has changed how users protect their digital assets. The best app to buy crypto often proves to be the most secure one.

Biometric authentication and device encryption

Passwords alone no longer suffice. Modern crypto apps use advanced biometric features that verify identity through unique biological traits. Fingerprint scanners deliver reliable authentication with false acceptance rates as low as 0.001%. Facial recognition technology—like Apple’s Face ID—reduces unauthorized access chances to less than one in a million.

Premium security environments now include voice recognition and iris scanning as extra protection layers. These biometric systems protect user privacy while maintaining security integrity by storing encrypted templates instead of actual biological data.

Device-level encryption provides the foundation for these protections. Android devices use full-disk encryption that encodes all user data with a 128-bit Advanced Encryption Standard. iOS platforms use Secure Enclave to store private keys in hardware-backed environments. Your encrypted data stays unreadable without proper authentication, even if someone steals your device.

Multi-layered protection for wallets

Today’s mobile crypto wallets are designed with multiple layers of security to help protect your assets. One key way mobile crypto wallets keep your information safe is through tokenization. Instead of sharing your actual card details during a transaction, the app uses a unique code, so your real credit or debit number stays hidden from merchants. It’s a behind-the-scenes layer of protection that keeps your financial info private.

Two-factor authentication (2FA) adds another line of defense. Before you can log in, it asks for two kinds of proof that it’s you, like your password and a code sent to your phone, or a quick fingerprint or face scan. It’s fast, simple, and seriously boosts your account’s security.

It only takes a moment, but it makes a big difference in keeping your account safe.

Systems track unusual activity and alert users immediately about potential threats.

Advanced platforms use Runtime Application Self-Protection (RASP) that offers dynamic attack analysis. This technology helps apps detect unsafe environments and hacking attempts live. Apps can defend themselves through integrity verification, detect attacks, and respond by stopping execution or warning users.

Secure onboarding and KYC flows

Security begins with the onboarding process. Know Your Customer (KYC) processes verify user identities through document validation, biometric matching, and data verification across authoritative sources in over 200 countries. These systems ensure compliance with regulatory requirements by screening against sanctions lists and monitoring politically exposed persons.

Automated KYC solutions verify security features and compare documents against templates while extracting data. Advanced platforms offer Non-Doc Identity Verification that lets users verify identities without document scanning. Users can complete onboarding in just 4.5 seconds.

NFC-based verification represents advanced secure crypto onboarding. Government-issued electronic identity documents contain signatures in their chips. This technology guarantees document authenticity with no known false accepts of fraudulent IDs. The best platform to buy crypto includes these reliable verification methods to protect users and platforms from day one.

How mobile apps are changing user behavior

Mobile technology has brought a fundamental change to crypto traders’ habits. The move from desktop to smartphone trading goes beyond convenience. It creates new ways for people to interact with digital assets.

24/7 access and instant reactions

Mobile apps have removed the old-time restrictions in trading. Studies show that when people adopt mobile apps, they face fewer time constraints. This is one of the most important factors that reduces transaction friction. Traders can now handle bank-securities transfers and process stock information live. The best crypto buying apps let users “respond faster to movements in the cryptocurrency market” and “trade crypto in real time”. This gives mobile traders an edge over those using desktops.

Increased trading frequency

The easy access through mobile devices affects how often people trade. A study of 350 million trades from 1.67 million retail investors found that mobile devices lead to more emotional and timely market reactions. The original thought was that more trading would help performance. However, data shows something different—the relationship between mobile app usage and portfolio performance looks like an upside-down U. This means moderate mobile trading could improve results, but too much activity hurts performance.

Social trading and community features

Mobile platforms have turned crypto trading from a solo activity into a shared experience. Social trading works like a network where investors “connect with fellow traders, observe each other’s trading strategies, and learn from their techniques”. New users looking to buy crypto can now explore profiles of successful traders and review their past performance, making it easier to learn from the best and make more informed decisions. They can then use copy features that mirror a trusted trader’s moves. This saves “hours upon hours of investigation and analysis” and builds communities where members “grow together”.

Gamification and loyalty programs

Crypto apps are now using gamification to keep users engaged and coming back. Platforms that add game-like features—such as points, levels, and rewards—have seen a 73% boost in daily active users compared to traditional exchanges.

Programs like Crypto.com’s Rewards+ hook users from the start. As they trade, they can level up to 20 tiers and unlock better perks the more active they are. It’s a smarter, more interactive way to turn casual traders into loyal users.

Shop-to-earn platforms like Moso are changing the game by partnering with major retailers like Walmart and eBay. Instead of the usual 5% cashback, users can earn crypto rewards that go as high as 100%, turning everyday shopping into a powerful way to accumulate digital assets.

The platforms leading the mobile-first revolution

Mobile experiences on cryptocurrency exchanges have become exceptional. These platforms make digital assets available to more people than ever before.

XBO.com and its mobile ecosystem

XBO.com is establishing itself rapidly as one of the mobile-first crypto generations of platforms. It has a solid user experience and provides a clean, intuitive interface that is satisfying to work with, regardless of whether you are new to crypto or are already familiar with the process. With its iOS and Android applications, it helps to orient you in the market and place effective tools in your hands without overwhelming you, regardless of your level of experience.

Security is also a top priority. XBO.com meets some of the industry’s highest standards, including CCSS Level 3 compliance, SOC 2 accreditation, and robust SSL encryption protocols, ensuring users’ assets and data are well protected.

What truly sets XBO.com apart is its native token. By using it, users can unlock a range of valuable perks—up to 20% off trading fees, enhanced earnings and staking rewards, and cashback on every transaction. This token-based system powers a complete mobile ecosystem, where the more you participate, the more you benefit.

Other top mobile-first exchanges to watch

Meanwhile, Crypto.com remains a major force in the market, boasting over 100 million users in more than 90 countries. Users consistently praise its sleek, intuitive mobile platform, which gives easy access to over 400 cryptocurrencies. Its popularity is reflected in strong app store ratings—4.6 out of 5 on the App Store and 4.5 out of 5 on Google Play—highlighting its appeal to both new and experienced investors.

Coinbase remains popular thanks to its user-friendly design that new users love. The platform’s high ratings of 4.7 on iOS and 4.1 on Android make it perfect for anyone buying crypto for the first time.

Other notable mentions include:

- Kraken: Users get “some of the lowest fees of any crypto exchange” with its Pro mobile version

- Gemini: Features products “especially suited for advanced crypto traders”

What makes the best app to buy crypto?

The market has many options, but some features make great apps stand out. User-friendliness tops the list – it’s “normally, the most important factor” when choosing platforms. Users need detailed tools that work well regardless of their experience level.

Your device type matters – “whether you’re searching for the best crypto app for iPhones or Androids”. Top mobile platforms must have strong security features like biometric authentication and multi-layer protection.

Conclusion

The crypto market has reached a turning point. Smartphone-based trading is becoming the standard way to trade. Desktop-focused exchanges might lose ground as users move faster toward mobile-first platforms. The numbers tell the story – 60% of cryptocurrency traffic comes from mobile devices. This sets up what could be the first true mobile-centric bull run.

Mobile-first platforms have reshaped how users trade crypto. Without doubt, features like tap-to-trade interfaces, biometric security, and immediate alerts give these platforms an edge over desktop systems. On top of that, they combine staking, rewards programs, and detailed dashboards into single apps that do it all.

Mobile security has come a long way. Early safety concerns have faded as smartphone protection has gotten better. Face recognition, fingerprint scanning, and device-level encryption now protect users as well as desktop systems, sometimes even better. This progress in security has created new ways to trade – round-the-clock market tracking, social trading groups, and game-like features that keep users involved.

Top crypto platforms understand these changes. They build mobile-first experiences from scratch. Companies like XBO.com, Crypto.com, and Coinbase lead this transformation by creating user-friendly interfaces for smartphone users instead of just copying desktop versions.

People still debate crypto adoption, but one thing is clear – mobile devices are the future. New crypto users will likely never use desktop trading platforms. They want continuous connection and simple experiences similar to their other digital tools. Exchanges that focus on smartphone experiences now will attract more users when the next bull market arrives.

Cryptocurrency’s future fits in your palm. Exchanges that ignore this basic change risk becoming outdated like paper trading slips in traditional finance. The question isn’t if mobile-first platforms will lead the way – it’s how soon the remaining desktop-focused exchanges will adapt to this new reality.