Most cryptocurrencies can’t buy you anything. Out of thousands of digital tokens, only six work for real purchases. The rest exist for speculation and get-rich-quick schemes.

Understanding which specific cryptocurrencies merchants accept saves time and frustration. Many people own crypto but don’t know where they can spend it. Others try paying with worthless meme coins and wonder why businesses reject them.

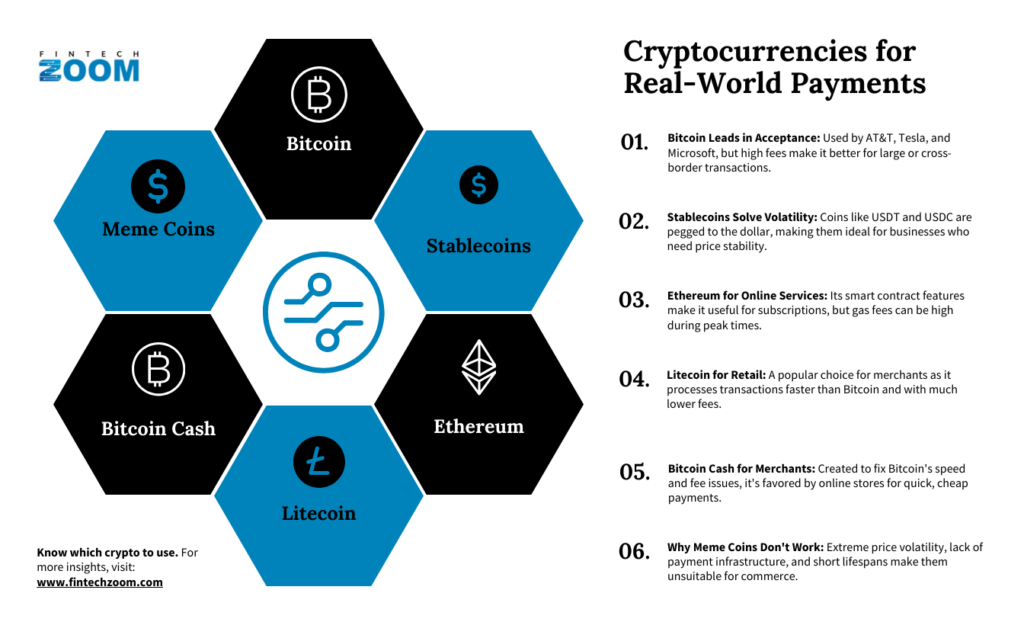

Bitcoin Leads But Has Problems

Bitcoin gets accepted at more places than other cryptocurrencies. AT&T processes phone bill payments in Bitcoin, Tesla sells merchandise for Bitcoin, and Microsoft takes Bitcoin for Xbox games and software. Overstock built part of its business around Bitcoin payments.

The problem with Bitcoin is fees. When lots of people use the network, transaction costs jump to twenty or thirty dollars. Nobody wants to pay those fees for small purchases. Bitcoin works better for expensive items like cars or business contracts, where the security justifies the high costs.

Cross-border payments represent Bitcoin’s strength. Traditional bank transfers cost more and take longer for international transactions. Bitcoin moves money across countries faster and cheaper than most banking alternatives, assuming you avoid peak network times.

Stablecoins Solve the Volatility Problem

USDT changed cryptocurrency payments by staying locked to one dollar. Businesses can price items in USDT without worrying about value swings that might wipe out their profits. Online stores love USDT because customers know exactly what they’re paying.

USDT runs on different networks, so users can pick cheap transactions or fast ones. The Ethereum version costs more but settles quickly. The Tron version costs almost nothing but takes longer. This flexibility helps businesses serve different customer needs.

USDC works the same way as USDT but with better paperwork. Circle publishes monthly reports showing what backs each USDC token. Companies worried about regulations pick USDC because it has cleaner compliance records and regular audits.

Other Cryptocurrencies That Work

Ethereum works well for online services and subscriptions. Software companies and web hosting providers often accept Ethereum. The smart contract features add functionality beyond simple payments. Gas fees can get expensive during busy periods, so Ethereum works better for bigger transactions.

Litecoin processes transactions faster than Bitcoin with lower fees. Retailers who want crypto benefits without Bitcoin’s problems often choose Litecoin. The currency has stayed popular with merchants since it launched and appears on most payment processor lists.

Bitcoin Cash was created specifically to fix Bitcoin’s fee and speed problems. It has bigger blocks that process more transactions. Online merchants like Bitcoin Cash because fees stay low and confirmations happen quickly.

Many businesses accept multiple cryptocurrencies to serve different customers. Gaming sites, online stores, and service companies often integrate several payment options. Platforms such as CoinPoker accept Bitcoin, Ethereum, USDT, USDC, Solana, and BNB to give users flexibility (source: https://coinpokeraustralia.com/). This approach helps businesses capture customers who prefer specific payment methods.

Why Meme Coins Don’t Work for Payments

Meme coins like Dogecoin, Shiba Inu, and newer viral tokens can’t function as payment methods. Their prices swing too wildly for businesses to use them safely. A cryptocurrency that loses eighty percent of its value in one day can’t work for commerce.

Recent examples show this problem clearly. The Trump meme coin hit seventy dollars, then lost most of its value within days. The Libra meme coin jumped from pennies to dollars, then crashed back to pennies within hours. No business can operate with payment methods that unpredictable.

Meme coins also lack the infrastructure needed for payments. Major payment companies won’t touch them because they can’t provide stable prices or reliable networks. These tokens often have poor liquidity, which means big transactions could crash their prices.

Most meme coins have short lifespans, too. Social media attention moves to new projects quickly, leaving old meme coins forgotten. Over forty thousand new meme coins launch every day, but most disappear when the hype dies. Businesses can’t build payment systems around tokens that might vanish.

Infrastructure Separates Real Payment Coins

Payment-ready cryptocurrencies have specific features that speculative tokens lack. They maintain enough trading volume on major exchanges for smooth conversion to regular money. Their networks run consistently without frequent crashes or failed transactions.

These established cryptocurrencies also have development teams that stick around and keep improving the technology. Payment processors need this reliability before they spend time and money integrating new currencies.

Regulatory compliance also separates legitimate payment cryptocurrencies from gambling tokens. The established coins work with regulators and follow rules. Meme coins often ignore regulations or operate in grey areas that scare away legitimate businesses.

New Cryptocurrencies Face Similar Problems

Even serious new cryptocurrencies struggle to get payment adoption. They need time to build merchant networks and convince payment processors to add them. This process takes years, not months.

New tokens also lack the market liquidity that payment processors need. Converting large amounts of new cryptocurrencies into regular money can move prices significantly. This creates problems for businesses that need predictable cash flow.

Consumer recognition plays a big role, too. People hesitate to use cryptocurrencies they’ve never heard of. Merchants prefer offering payment methods their customers already know and trust.

Final Thoughts

Six cryptocurrencies work for real payments: Bitcoin, USDT, USDC, Ethereum, Litecoin, and Bitcoin Cash. These have the infrastructure, stability, and merchant acceptance needed for commerce.

Meme coins and speculative tokens can’t work as payment methods because of wild price swings, poor infrastructure, and short lifespans. Stick with established cryptocurrencies if you actually want to buy things with your digital money.