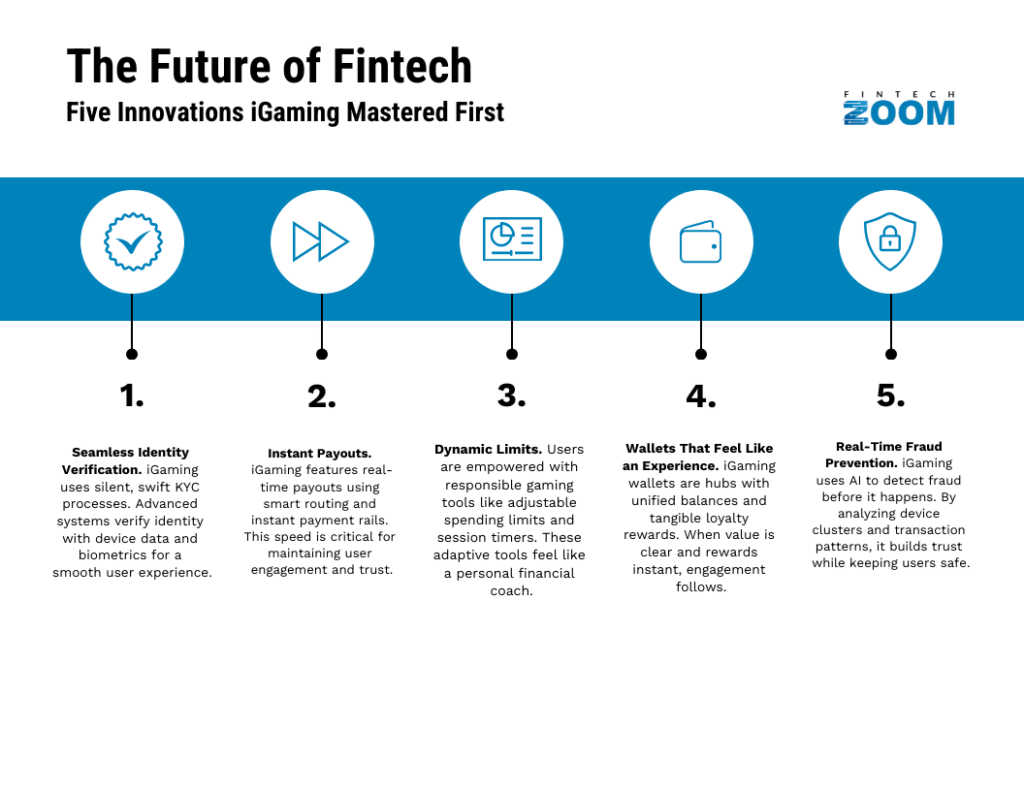

1. Seamless Identity Verification: Trust at the Speed of Play

In the world of online gaming, signing up should feel like stepping onto the dance floor, not filling out paperwork. The best platforms have turned Know Your Customer (KYC) into a silent, swift process. While you’re exploring the site, advanced systems are already verifying your identity—cross-referencing device fingerprints, geolocation, and behavioral data. Only when something seems off does the system ask for extra details, ensuring a smooth experience for most users.

This approach isn’t just for casinos anymore. Neobanks, investment apps, and even ride-sharing services are adopting it, prioritizing speed and trust. The goal? Make security invisible but ironclad. For a deeper dive into how seamless verification is transforming industries, check out Finextra for more industry trends.

2. Instant Payouts: Money That Moves as Fast as Your Wins

Imagine hitting a jackpot and seeing the funds in your account before the celebration ends. That’s the standard in iGaming, where payouts happen in real time—thanks to smart routing, instant payment rails, and pre-funded accounts. This isn’t just about speed; it’s about keeping the thrill alive.

Now, this technology is spreading. Gig workers, freelancers, and online shoppers expect their money to move instantly. If your business involves payouts, focus on two critical metrics: how quickly 95% of transactions clear and how often they succeed on the first try. Fall behind, and you risk losing customers to competitors who’ve mastered the art of instant gratification.

3. Dynamic Limits: Empowering Users with Control

Responsible gaming isn’t just a checkbox—it’s a feature players appreciate. Modern platforms let users set daily spending limits, session timers, or even take a break with a single tap. These tools adapt based on behavior, making them feel like a personal financial coach rather than a restriction.

This philosophy is now influencing consumer finance. Credit cards, buy-now-pay-later services, and teen accounts are adopting adaptive guardrails that adjust in real time. The key? Make limits visible, easy to adjust, and part of the main experience. When users feel in control, they stay engaged—and loyal.

4. Wallets That Feel Like an Experience

In iGaming, your wallet isn’t just a place to store money—it’s a hub of activity. The best platforms offer unified balances, micro-transactions for testing strategies, and loyalty rewards that feel tangible. Progress is clear, missions are transparent, and rewards are instantly redeemable.

This approach is reshaping loyalty programs everywhere. Neobanks and super-apps are ditching outdated points systems for real-time benefits—cashback that feels like cash, fee waivers you can activate instantly, and rewards that stack up visibly. When value is easy to understand, engagement follows naturally.

For more on how digital wallets are evolving, visit PYMNTS’ coverage on fintech innovation.

5. Real-Time Fraud Prevention

High-stakes environments demand real-time security. iGaming platforms use AI-driven tools to detect fraud before it happens—analyzing device clusters, transaction patterns, and geospatial anomalies. The best part? Every decision comes with a clear explanation, so users (and auditors) always know why a transaction was flagged.

This level of transparency is now essential in P2P payments, e-commerce, and instant payroll. The lesson? Combine advanced tech with human-readable insights to build trust while keeping fraudsters at bay.

Speed Meets Safety

What ties these innovations together? A simple principle: The safest experiences are also the fastest. Whether it’s frictionless identity checks, instant payouts, or adaptive limits, iGaming has set the bar high. The secret? Orchestrate every element—KYC, payments, risk management—into a single, seamless system.If you want to see where fintech is headed, look no further than the casino floor. It’s not just about luck; it’s about building a future where trust and speed go hand in hand. For example, you can check out sports betting.