Multiple hubs around the world are driving blockchain innovation worldwide. A collection of companies across the US, Canada, the UK, Singapore, and Australia is pioneering the way blockchain technology integrates into our daily lives.

As the world of finance undergoes enormous change, it may be blockchain and cryptocurrency ideas that yield the best returns. So, what exactly is blockchain, and what does the future hold for those companies that have positioned themselves by championing this highly innovative fintech? Let’s take a look.

Gathering Pace In Recognizable Industries

Blockchain and digital payment solutions have been at the forefront of a lot of fintech ingenuity since the early 2010s. Back when Bitcoin first emerged, it was a form of currency that was primarily used on market sites online, and was brushed aside by those in traditional finance who believed that it did not have the mechanics or the popularity to become a significant player in the world of finance – and slowly, over the last decade and a half, they have been proven spectacularly wrong.

One of the first industries to take the plunge into blockchain integration was the casino gaming industry. While it might have taken a few years to get off the ground, those crypto casinos that planted their flag in the sand and had the conviction to offer blockchain- and cryptocurrency-based gambling solutions quickly established themselves as leading innovators in the global casino industry. This wasn’t just the case in Australia, where many of the top crypto casinos launched, but also across the iGaming world.

While playing at an Australian online casino contains a lot of the symbolism and imagery that you would attach to gaming Down Under, the borderless nature of cryptocurrency and casinos has meant that Aussie bettors can benefit from the global ingenuity, and as designers fight to get their ideas to the top of this market, the range of crypto payment options continues to grow in the online casino gaming world.

Embracing A Digital-Only Future

Blockchain is a microcosm of what we are seeing in the broader world; our entire lives are now rooted and revolving around our phones. Marketing is now almost exclusively online and via social media, with digital marketing accounting for billions of dollars in the modern Aussie economy. It doesn’t matter if it’s a competition that involves giveaways, as you can see in the link below, or if brands are putting considerable time, effort, and money into developing a presence that will result in a high conversion rate and open the floodgates to new customers.

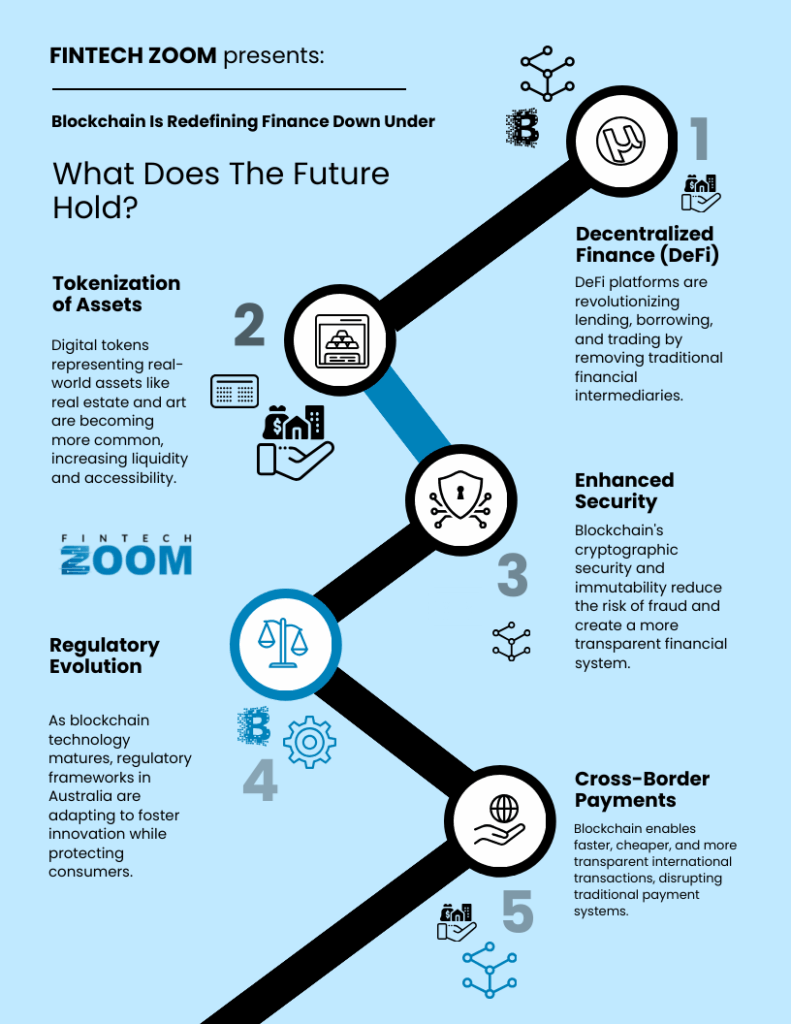

While conventional finance has certainly shifted its focus toward digital innovations, they are now dancing to the tune of digital finance. There has been the launch of the first stablecoin, a roadmap toward integrating blockchain into the future of the Australian economy and financial sector. As more Gen Z investors and traders enter the market and become acutely aware of the benefits of crypto and blockchain, this momentum shows no signs of slowing.

Ease Of Use

One of the many reasons why blockchain and cryptocurrency are achieving such huge success Down Under is their simplicity of use. Unlike a conventional bank account, you do not need to go through the convoluted process of sending your passport, driving license, proof of address, or register for a biometric ID to prove your identity. However, setting up a biometric ID is usually recommended when creating a cryptocurrency wallet on your phone or tablet.

If you open an Ethereum wallet, for instance, you can access it instantly and begin sending money peer-to-peer. Because blockchain cryptography ensures each transaction is recorded and can’t be altered, this guarantees the safety of the payment and removes the need for a bank or third party to get involved in the transaction.

By breaking down the barriers, delays, and fees that often stem from traditional finance, and with all transactions being available to view on the blockchain, the ease of use, which has struck a chord with millions around the world, is also striking a chord with Aussies, who are adopting cryptocurrency and blockchain en masse.

A Completely Digital Future

So long as the blockchain and cryptocurrency industries keep up with the broader economy’s demands and trends, we are likely to see them play a more significant role in the Australian financial system.

That’s not to say that it will completely replace the conventional payment systems and fiat currencies that have been around for hundreds of years. However, as more of us use our phones as contactless cards, smartphones instead of plastic health cards, biometric ID is replacing passwords, and cryptocurrencies are innovating to create a new global payment system rather than fragmented, regional fiat currencies.

There are plenty of angles that could emerge. Ten to fifteen years from now, we could see mainstream banks and financial institutions using blockchain as their main balance sheet, with older systems being completely phased out.