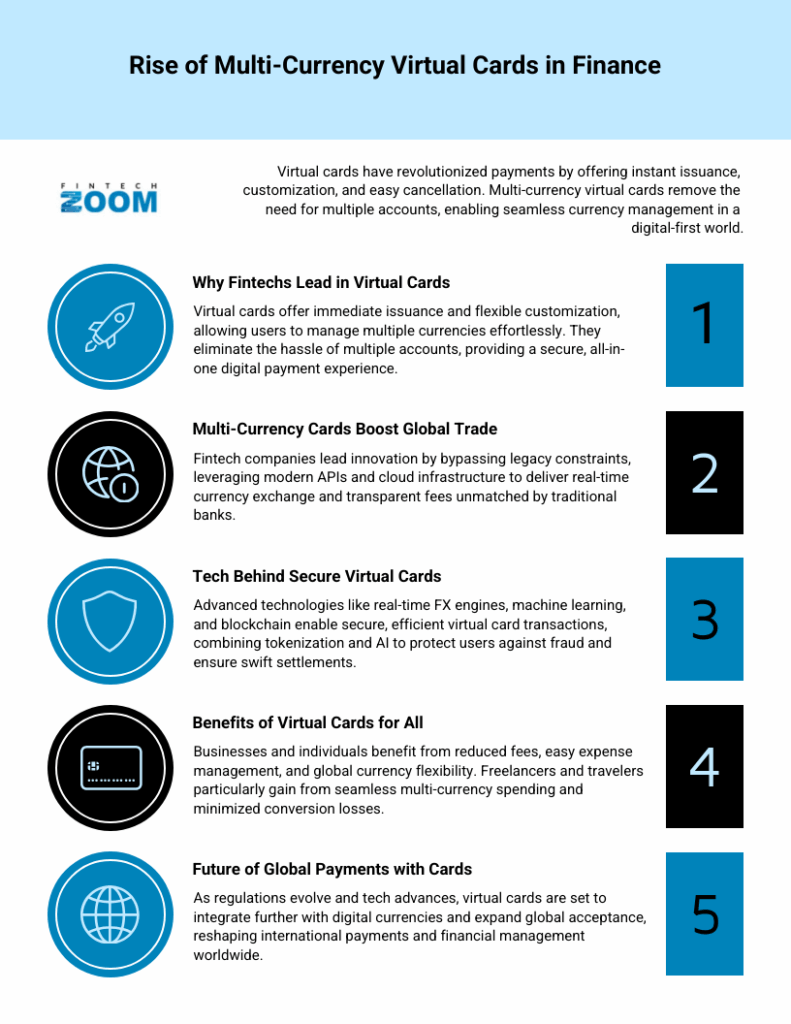

At the beginning of the virtual card revolution, many people were hesitant to use them. Though offering similar features as physical cards, virtual cards for simple things like online shopping were able to provide security and flexibility in one digital solution. When compared to physical cards, virtual cards are issued instantly, can be customised and even cancelled without having to wait for replacements. This makes them a complete game changer, especially when it comes to multi-currency functionality. A multi currency virtual card enables users to hold, manage and spend funds in different currencies at the same time, which removes the need for multiple bank accounts or to go through regular currency conversions.

Why Fintechs Are Leading the Way

Despite the rise of virtual cards, traditional banks have been rather slow to innovate in this cross-border payments space. Many of them are stuck with legacy systems or severe, conservative regulatory approaches. Fintechs on the other hand, do not have to deal with these constraints and, unburdened as they are, can take the opportunity to change the way currency management operates in an increasingly global economy.

Many companies have already taken these steps including Revolut, Wise and Skrill, turning their business models to revolve around multi-currency virtual cards, providing real-time exchange rates, transparent fees, the ability to switch between currencies and more. All of these platforms use modern APIs and a cloud infrastructure which enables them to provide such services, many of which were not possible just a few years ago.

There’s a solid appeal to these types of payment options. With so many businesses operating at the international level, there’s now no need to separate accounts across different countries, or to accept foreign exchange fees. Similarly, freelancers working with global clients or companies are able to receive payments in multiple currencies, and then spend them without losing major value through conversion fees. This type of payment also benefits travellers who can pay in local currencies without getting the additional fees typically associated with foreign transactions on credit cards.

How Does it Work

With better digital technology and improved infrastructures, these all support modern virtual cards very well. Fintech platforms that are more advanced are able to use real-time currency conversion engines that can reach into wholesale foreign exchange markets and pass on any savings directly to the users. The aid of machine learning algorithms optimise the conversion timing, and with blockchain technology, there are faster settlement times in place.

Considering the blockchain, tokenization technology as helped to make virtual cards increasingly secure, particularly when compared to the traditional physical card options. What this means is that for every transaction there is a specific, unique token. As such, stolen card data becomes worthless. Combining this with biometric authentication and AI fraud detection, and users find the virtual cards are far more secure, something traditional banking fails to achieve in the same way.

Opting for an API-first methodology means that businesses can integrate virtual cards into their current systems. Companies with this in place can create cards for specific projects, expenses or employees. All of this comes with spending controls and automated reconciliation. As such, there’s a level of integration that can really transform virtual cards from simple payout tools to financial management platforms.

Impact on a Global Scale

When it comes to globalisation, the benefits of virtual cards far exceed that of simple convenience. Instead, for businesses in emerging markets, multi-currency virtual cards give better access to global commerce in a way that was previously unavailable.

It’s not just businesses that benefit though. Remittance services often charge fees which can be rather hefty. Virtual cards with multi-currency capabilities can reduce these costs immensely, so that people can get more money, or simply lose less when they come to make payments. It’s the same for the freelance community too. Digital nomads are some of the biggest winners here, with remote workers operating on a global scale and managing income streams from many different currencies. Better still, this helps them avoid admin headaches and financial penalties.

What the Future Holds

Of course, it’s not completely perfect and there are still many challenges. Regulations differ widely across jurisdictions which still adds complexity to any actions fintech companies make when attempting to provide completely global services. Anti-money laundering requirements still hold, and there are licensing regimes so that no one platform is perfect across the globe.

Currencies are volatile which also presents a risk. For, having multiple currencies can ensure flexibility, it does mean greater exposure to exchange rate changes. Top fintechs are addressing this via different tools and automated conversion features.

For the future, it’s obvious that things will only continue to improve alongside technology and maturing frameworks. Virtual cards will become more important on a global level as they become integrated with digital currencies and get more acceptance. As such, it’s more a question of when will they change how international payments are performed rather than if they will.