Building a trading platform is a high-stakes technical challenge. Speed, reliability, data accuracy, and regulatory alignment all depend on technology decisions made early in custom trading platform development. A poorly chosen tech stack leads to performance bottlenecks, security risks, and expensive rewrites, while the right stack enables scalability, compliance, and sustainable product growth.

This article outlines how to evaluate technologies for trading platforms using a practical, systems-driven approach. It examines core architecture layers, performance expectations, development trade-offs, and the criteria experienced vendors apply when building production-ready trading systems.

Understanding the Ideal Tech Stack for Trading Apps

A trading platform processes real-time financial data, executes orders under strict timing constraints, and manages sensitive user and transaction information. These requirements shape every layer of the tech stack for trading apps, from user interface frameworks to backend infrastructure.

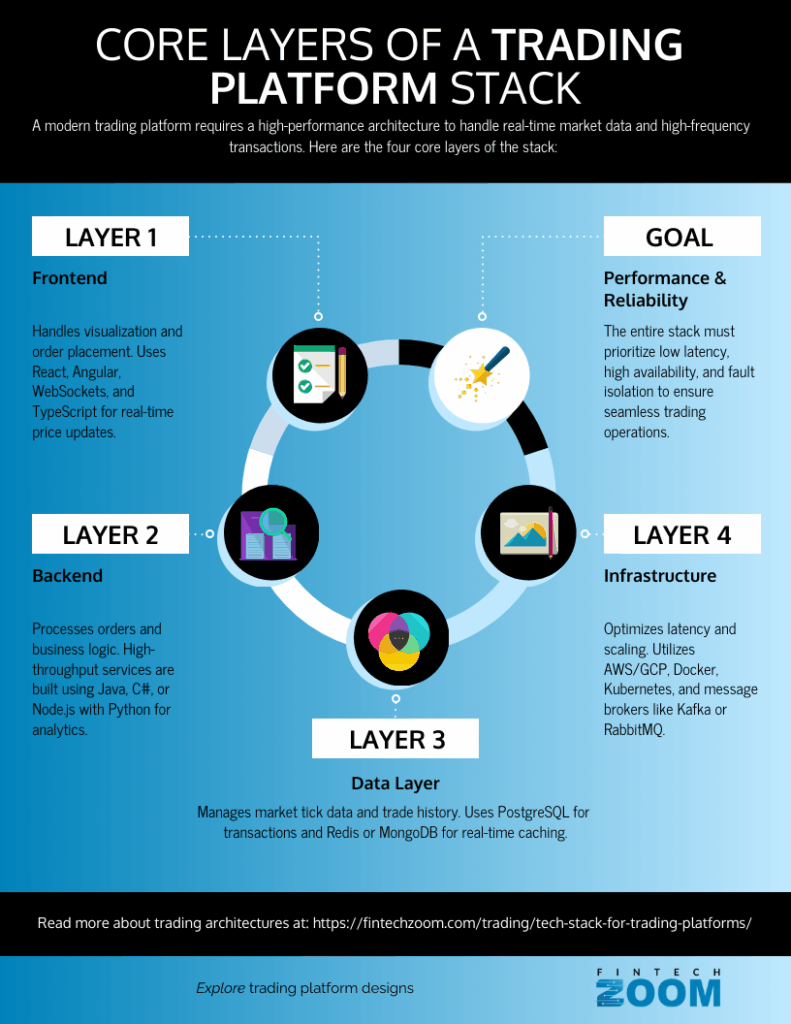

Core Layers of a Trading Platform Stack

Frontend

The frontend handles market data visualization, order placement, portfolio views, and account management. Key priorities include rendering speed, reliability under heavy data updates, and cross-device support.

Common choices include:

- React or Angular for component-based UI development

- WebSockets for real-time price updates

- TypeScript for predictable state management

Backend

The backend processes orders, applies business logic, manages authentication, and integrates with exchanges or brokers. It must handle concurrency, fault isolation, and precise transaction control.

Popular backend technologies:

- Java or C# for high-throughput services

- Node.js for API layers and integrations

- Python for analytics and algorithm execution

Data Layer

Trading platforms rely on multiple data types:

- Market tick data

- Order books

- User balances

- Trade history

Relational databases (PostgreSQL, MySQL) handle transactional data, while NoSQL systems (Redis, MongoDB) support caching and real-time workloads.

Infrastructure

Infrastructure choices affect latency, uptime, and scaling:

- Cloud providers (AWS, GCP, Azure)

- Containerization with Docker and Kubernetes

- Message brokers like Kafka or RabbitMQ

Performance and Reliability Factors

Trading systems must support:

- Sub-second response times

- High availability during market volatility

- Graceful failure handling

Technology selection should align with these operational realities rather than development convenience.

Key Considerations in Custom Trading Platform Development

Custom trading platform development requires aligning technical decisions with business goals, regulatory rules, and future growth expectations. Unlike off-the-shelf solutions, custom systems demand precise planning across multiple dimensions.

Business and Market Requirements

Key questions that shape the stack:

- Which asset classes are supported (equities, crypto, derivatives)?

- Is the platform retail-facing or institutional?

- What order types and execution models are required?

Each answer affects protocol selection, data throughput needs, and system complexity.

Regulatory and Compliance Constraints

Trading platforms operate under strict oversight. Technology must support:

- Audit logs and immutable records

- Data residency rules

- KYC/AML integrations

- Secure authentication flows

Certain frameworks simplify compliance reporting, while others require extensive customization.

Scalability and Future Expansion

A platform built for 5,000 users often fails at 500,000 if scaling is not planned. The stack should support:

- Horizontal scaling

- Modular service separation

- Versioned APIs

Build vs. Integrate Decisions

Custom development does not mean building everything from scratch. Many teams integrate:

- Market data providers

- Payment gateways

- Identity verification services

The stack must allow clean integration without tight coupling.

Technical Debt Control

Early shortcuts increase maintenance costs. Choosing mature frameworks, clear service boundaries, and standardized deployment processes reduces long-term risk.

How a Trading Software Company Selects the Right Technologies

An experienced trading software company evaluates technology choices through operational, financial, and regulatory lenses. Selection is rarely driven by trends and instead focuses on proven stability.

Evaluation Criteria Used by Experienced Teams

Security Track Record

Technologies with known security models, active patch cycles, and strong community review are preferred.

Performance Benchmarks

Languages and frameworks are tested under load conditions that reflect real trading behavior, including peak market hours.

Team Expertise

Stacks aligned with internal engineering skills reduce delivery risk and improve long-term support.

Cost of Ownership

License fees, infrastructure costs, and maintenance effort are calculated over multiple years.

Vendor and Community Support

Long-term viability matters. Tools with declining adoption increase operational risk.

Example Comparison of Common Backend Choices

| Technology | Strengths | Limitations | Typical Use Case |

| Java | High performance, strong concurrency | Verbose codebase | Core trading engines |

| C# | Mature ecosystem, strong tooling | Platform lock-in risk | Broker platforms |

| Node.js | Fast API development | CPU-bound limits | Gateway services |

| Python | Rapid development, analytics | Slower execution | Trading algorithms |

Conclusion

Choosing the right tech stack for a trading platform requires technical discipline and clear priorities. Performance, security, compliance, and scalability must guide every decision. Platforms built on well-matched technologies adapt faster, cost less to maintain, and perform reliably under market pressure. Careful evaluation at the architecture stage prevents structural limits later and supports sustained platform growth.

FAQ: Choosing a Tech Stack for Trading Platforms

Languages like Java, C++, and C# are common for core trading logic due to speed and reliability. Python is widely used for analytics and automation.

Latency directly affects execution quality. Even milliseconds can change trade outcomes, especially in high-frequency environments.

Cloud infrastructure offers scalability and redundancy. Many platforms use hybrid setups to control latency-sensitive components

Regulations affect data storage, logging, and security requirements. Some technologies simplify compliance reporting and audits.

Yes, but architecture must isolate asset-specific logic while sharing core services like authentication and risk management.