There is no doubt that managing your finances is a daunting task and this is especially true when you are starting out. It can be overwhelming to understand and keep track of all the various types of banks, accounts, investments, and other financial instruments. It is easy to become confused and not know where to start or how to make the best decisions. This is why I am so excited to share with you my Banks Guides: the ultimate guide to banking and navigating the financial world with confidence.

Introduction to Banks Guides

Banks Guides is a comprehensive guide to all things related to banking. It is designed to help you understand the different types of banks and financial institutions available, the services they offer, and how to choose the right one for your needs. It also covers budgeting, saving, investing, credit and loans, retirement planning, online banking services, and more. By the end of this guide, you will have a comprehensive understanding of the banking system and be able to confidently make the best financial decisions for you.

Understanding Banking Basics

The first step in understanding banking is to familiarize yourself with the basics. Banks are financial institutions that provide services such as savings accounts, checking accounts, loans, investments, and other financial products and services. They also act as custodians of our money and protect it with their secure banking systems. Banks also offer a variety of other services, such as online banking, mobile banking, and ATM services. It is important to understand the different types of banks and the services they offer so that you can make an informed decision about which bank is the best for you.

Types of Banks

When it comes to banking, there are several different types of banks to choose from. The most common types are commercial banks, savings and loan associations, credit unions, and online banks. Each type of bank offers different services and products, so it’s important to understand the differences between them and what services and products they offer.

Commercial banks are the most common type of bank and offer a wide array of services such as savings accounts, checking accounts, loans, investments, and other financial products. Savings and loan associations are typically smaller banks that are focused on savings and loan services. Credit unions are similar to banks, but are generally not-for-profit and owned by the members. Finally, online banks are banks that offer their services exclusively over the internet.

Choosing a Bank

When it comes to choosing a bank, there are several factors to consider. The first is the services and products that the bank offers. Does the bank offer services that meet your needs? Are the fees and interest rates reasonable? It is also important to consider the bank’s reputation, customer service, and online banking options. It is also a good idea to read customer reviews and ratings to get an idea of what other customers think about the bank.

You should also consider the location of the bank. Are there any branches or ATMs near you? Are there any mobile banking options available? It is also important to consider the bank’s security measures to ensure that your money and personal information are safe. Finally, make sure to read the terms and conditions of any account or product to ensure that you understand all of the fees and requirements.

Opening a Bank Account

Once you have chosen a bank, the next step is to open an account. You will need to provide some personal information and documents to open an account. Each bank has different requirements, so it is important to make sure that you understand the process and provide the necessary documents. It is also important to read the terms and conditions of the account to make sure that you understand all of the fees, requirements, and benefits of the account.

Once the account is opened, you will be able to deposit money, withdraw money, make payments, and transfer money. It is important to make sure that you keep track of your account and monitor it regularly to ensure that you are not overdrawing or missing any payments.

Budgeting for Savings

Budgeting is an essential part of managing your finances and having a successful financial future. It is important to set a budget and track your spending to ensure that you are able to save for your future.

When budgeting, it is important to think about your short-term and long-term goals. What do you need to save for? What are your financial goals? It is also important to think about how much you can realistically save each month. Once you have a budget, you can use it to determine how much you can save each month.

You can also use budgeting to make sure that you are not spending more than you can afford. It is important to track your spending and make sure that you are not overspending. It is also important to stay within your budget and make sure that you are not spending more than you make.

Investing

Investing is another important part of managing your finances and building wealth. Investing is the process of using your money to buy assets that can potentially increase in value over time. Investing can be a great way to grow your wealth and achieve financial freedom.

When it comes to investing, it is important to understand the different types of investments available. There are stocks, bonds, mutual funds, ETFs, and more. It is important to understand the different types of investments, the risks associated with each type, and the potential rewards. It is also important to diversify your investments so that you are not too heavily invested in any one type of asset.

Credit and Loans

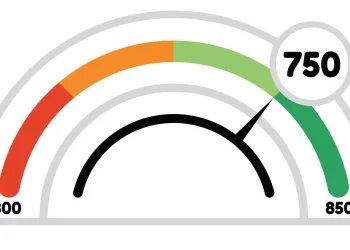

Credit and loans are another important part of managing your finances. Credit is a line of credit that you can use to purchase items or services and then repay over time. Loans are usually larger amounts of money that you borrow from a lender and then repay over time with interest.

When it comes to credit and loans, it is important to understand how they work, the fees and interest rates associated with them, and how to manage and repay them responsibly. It is also important to understand the terms of any loan or credit agreement that you sign to make sure that you understand the terms and conditions.

Retirement Planning

Retirement planning is an essential part of managing your finances and preparing for the future. It is important to start planning for retirement as early as possible so that you can have a comfortable retirement. When it comes to retirement planning, it is important to understand the different types of retirement accounts, such as 401(k)s, IRAs, and Roth IRAs. It is also important to understand the benefits and risks associated with each type of account.

It is also important to understand the different types of investments available and how they can help you achieve your retirement goals. It is important to diversify your investments and make sure that you are not too heavily invested in any one asset. Finally, it is important to understand the tax implications of different investments and retirement accounts to make sure that you are maximizing your savings.

Online Banking Services

Online banking services are becoming increasingly popular, and for good reason. Online banking services allow you to manage your finances from the comfort of your own home. You can check your balance, transfer money, pay bills, and more.

When it comes to online banking, it is important to understand the different features and services available. It is also important to make sure that your online banking is secure and that your personal information is protected. Finally, it is important to read the terms and conditions of any online banking service to make sure that you understand all of the fees and requirements associated with the service.

Protecting Your Finances

It is important to protect your finances and make sure that your money and personal information are secure. It is important to use strong passwords and enable two-factor authentication on any online accounts. It is also important to be aware of any potential scams or fraud and to make sure that you are not giving out any personal information online. Finally, it is important to monitor your accounts regularly to make sure that there are no suspicious activities.

Conclusion

Navigating the financial world can be a daunting task, but understanding the basics of banking and using the Banks Guides can help you make the best decisions and confidently manage your finances. I hope this guide has been helpful and that you now have a better understanding of banking and the different services and products available. Thank you for taking the time to read this guide and I wish you the best of luck as you navigate the financial world.