FinBee is a crowdlending platform from Lithuania that permits putting resources into consumer and business advance. The platform works both as a speculation platform and a credit originator, which imply that FinBee chooses the loans without anyone else, does the hazard investigation and give them to on the platforms for venture.

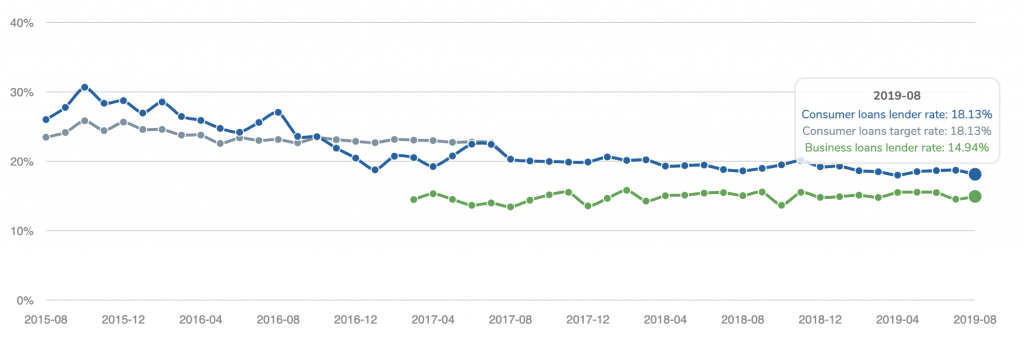

Average Interest Rate 18%

FinBee historical interest rate of 18% is one of the best in Europe. P2P Crowdlending . There are no hidden fees or charges for investors. As FinBee investor, you can invest in personal loans and business loans. Our team carefully selects only quality loans for your investments. You can invest here: Finbee

Secure – P2P Crowdlending

FinBee is fully licensed and supervised by Bank of Lithuania. FinBee has p2p and crowdfunding licences and electronic money licence. In order to eliminate fraud we sign every loan contract with each borrower in person. This adds an extra layer of security for your investments.

Crowdlending platform

This p2p loaning platform permits contributing beginning from €5 which is one of only a handful not many platforms permitting to contribute for this modest quantity (the market normal is €10).

The profits are truly high. The normal return rate is +18% for Consumer loans (blue in the diagram beneath) and +14.5% for Business loans (gree in the graph underneath).

Finbee roi

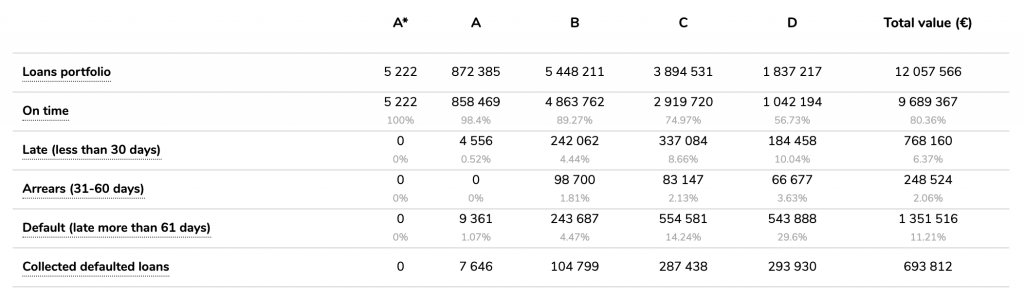

On the drawback, since this platform offers high-loan costs, it doesn’t offer a BuyBack ensure include. It implies that the loans put resources into might default and you may lose your contributed sum (that the drawback of having a high ROI). In the graph underneath you can see the insights of defaults rates.

Finbee default rate

As should be obvious the default rate at FinBee is of 11.21% in normal, however 51.3% of the defaulted loans are remembered (last line), which brings the last default rate to 5.46%. There is additionally a distinction in the default rate’s measurements among consumer and business loans:

- Consumer loans: 12.99% default rate (48.2% recalled) = 6.72% last default rate

- Business loans: 4% default rate (92.3 % recalled) = 0.3% last default rate

- Which bring the last ROI of both advance sorts to:

- Consumer loans: 18% ROI * 6.72% default = 16.86%

- Business loans: 14.5% ROI * 0.3% default = 14.07%

This makes consumer laons progressively appealing that business loans.

Advise – P2P Crowdlending

FinBee is adjusted to financial specialists with a touch of existing involvement with p2p loaning.

Since the platform doesn’t offer a BuyBack ensure choices, you should assess the danger of your speculations. Be that as it may, as a speculator, you will have some good times than on other “static platform” where you can’t choose any uncommon alternatives. Right now should fabricate your hazard system by doing a few computations.