As the world’s largest online retailer, Amazon has become a household name. The company has grown significantly since its inception, expanding into various areas of business such as cloud computing, digital streaming, and artificial intelligence technologies. With a market capitalization of over $1.6 trillion, Amazon has become one of the most valuable companies in the world. It is no wonder that many investors are interested in adding Amazon stock to their portfolios. In this beginner’s guide, I will provide an overview of Amazon stock and discuss the factors you should consider before investing in the company.

Why Invest in Amazon Stock?

Amazon has been a consistent performer in the stock market, with its stock price increasing by over 1,000% in the past decade. The company has a strong track record of growth, with revenue increasing from $74 billion in 2013 to over $386 billion in 2020. Amazon has also been profitable for several consecutive years, with net income reaching $21 billion in 2020. Furthermore, the company has a dominant market share in the e-commerce industry, with over 38% of the US e-commerce market.

Investing in Amazon stock allows you to participate in the company’s success and growth potential. Amazon has been at the forefront of innovation, constantly introducing new products and services to its customers. The company’s expansion into cloud computing with Amazon Web Services has been a significant contributor to its revenue growth. Additionally, Amazon’s acquisition of Whole Foods Market has allowed the company to enter the grocery industry and expand its presence in the physical retail space.

Understanding Amazon’s Financials

Before investing in Amazon stock, it is important to understand the company’s financials. Amazon reports its financial results on a quarterly basis, providing investors with an insight into the company’s performance. In addition to revenue and net income, investors should pay attention to metrics such as operating income, gross profit margin, and free cash flow.

Operating income represents the profit generated by Amazon’s business operations, excluding non-operating expenses such as interest and taxes. Gross profit margin measures the profitability of Amazon’s products and services, calculated as gross profit divided by revenue. Free cash flow represents the amount of cash generated by Amazon’s business operations after accounting for capital expenditures.

How to Buy Amazon Stock

There are several ways to buy Amazon stock. The most common method is through a brokerage account. You can open a brokerage account with a reputable brokerage firm such as Fidelity, Charles Schwab, or E-Trade. Once you have opened an account, you can place an order to buy Amazon stock. You will need to provide your brokerage account details and the number of shares you wish to purchase.

Another way to buy Amazon stock is through a direct stock purchase plan (DSPP). Amazon does not offer a DSPP, but some companies that offer DSPPs may allow you to purchase Amazon stock. DSPPs allow you to purchase stock directly from the company, bypassing the need for a brokerage account.

Factors to Consider Before Investing in Amazon Stock

Before investing in Amazon stock, it is important to consider several factors. These factors include:

Valuation

Amazon’s stock price has increased significantly in the past decade, leading to a high valuation. As of August 2021, Amazon’s price-to-earnings (P/E) ratio was over 70, indicating that the stock is expensive relative to its earnings. Investors should consider whether the stock price is justified by the company’s growth potential.

Competition

Amazon faces competition in various areas of its business, including e-commerce, cloud computing, and digital streaming. Competitors such as Walmart, Microsoft, and Netflix have been investing heavily in these areas, posing a threat to Amazon’s market share. Investors should consider the competitive landscape and the potential impact on Amazon’s growth prospects.

Regulatory Risks

As a large and dominant company, Amazon is subject to regulatory scrutiny. The company has faced antitrust investigations in the past, with regulators examining whether Amazon’s practices have harmed competition. Investors should consider the potential impact of regulatory risks on Amazon’s business operations.

Macroeconomic Factors

Amazon’s business operations are affected by macroeconomic factors such as interest rates, inflation, and consumer spending. A recession or economic downturn could impact Amazon’s revenue growth and profitability. Investors should consider the potential impact of macroeconomic factors on Amazon’s business operations.

Risks of Investing in Amazon Stock

Investing in Amazon stock comes with several risks. These risks include:

Volatility

Amazon’s stock price has been volatile in the past, with significant fluctuations in response to news events and market conditions. Investors should be prepared for short-term fluctuations in the stock price.

Concentration Risk

Investing in a single stock such as Amazon exposes investors to concentration risk. If Amazon’s stock price declines significantly, the investor could experience a significant loss.

Business Risks

Amazon faces business risks such as competition, regulatory risks, and disruptions to its supply chain. These risks could impact the company’s revenue growth and profitability.

Tips for Investing in Amazon Stock

Here are some tips for investing in Amazon stock:

Diversify Your Portfolio

Investing in a single stock such as Amazon exposes you to concentration risk. To mitigate this risk, consider diversifying your portfolio by investing in multiple stocks or other asset classes such as bonds or real estate.

Invest for the Long Term

Amazon’s stock price has been volatile in the short term, but the company has a strong track record of growth in the long term. Consider investing in Amazon stock with a long-term investment horizon.

Monitor the Company’s Performance

Stay up to date on Amazon’s financial performance and news events that could impact the company. This information can help you make informed investment decisions.

Amazon Stock Analysis

Here is an analysis of Amazon’s stock performance:

Stock Price

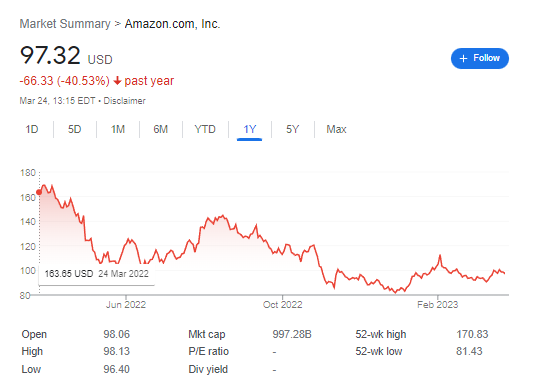

Amazon’s stock price has increased significantly in the past decade, with a 10-year annualized return of over 30%. The stock price has been volatile in the short term, but the company’s strong financial performance has led to long-term growth. However, in past year, Amazon stock felt -40.53% to $97.32.

Valuation

As mentioned earlier, Amazon’s stock is currently trading at a low valuation, with a SMA20 of 2.31%.

| Index | NDX, S&P 500 | P/E | – | EPS (ttm) | -0.27 | Insider Own | 9.80% | Shs Outstand | 10.22B | Perf Week | -1.61% |

| Market Cap | 1022.65B | Forward P/E | 39.33 | EPS next Y | 2.51 | Insider Trans | -0.02% | Shs Float | 9.25B | Perf Month | 1.60% |

| Income | -2722.00M | PEG | – | EPS next Q | 0.23 | Inst Own | 60.10% | Short Float / Ratio | 0.64% / 0.85 | Perf Quarter | 12.20% |

| Sales | 513.98B | P/S | 1.99 | EPS this Y | -108.20% | Inst Trans | 0.60% | Short Interest | 59.07M | Perf Half Y | -17.01% |

| Book/sh | 14.29 | P/B | 6.91 | EPS next Y | 172.83% | ROA | -0.60% | Target Price | 133.64 | Perf Year | -40.42% |

| Cash/sh | 6.76 | P/C | 14.60 | EPS next 5Y | – | ROE | -2.00% | 52W Range | 81.43 – 170.83 | Perf YTD | 15.90% |

| Dividend | – | P/FCF | – | EPS past 5Y | -26.00% | ROI | 6.60% | 52W High | -43.01% | Beta | 1.25 |

| Dividend % | – | Quick Ratio | 0.70 | Sales past 5Y | 23.60% | Gross Margin | 43.80% | 52W Low | 19.56% | ATR | 3.30 |

| Employees | 1541000 | Current Ratio | 0.90 | Sales Q/Q | 8.60% | Oper. Margin | 2.40% | RSI (14) | 51.94 | Volatility | 3.23% 3.19% |

| Optionable | Yes | Debt/Eq | 0.61 | EPS Q/Q | -98.00% | Profit Margin | -0.50% | Rel Volume | 0.82 | Prev Close | 98.71 |

| Shortable | Yes | LT Debt/Eq | 0.58 | Earnings | Feb 02 AMC | Payout | – | Avg Volume | 69.48M | Price | 97.36 |

| Recom | 1.80 | SMA20 | 2.31% | SMA50 | -0.12% | SMA200 | -9.77% | Volume | 32,675,529 | Change | -1.37% |

Financial Performance

Amazon has a strong track record of financial performance, with revenue and net income consistently increasing in the past decade. The company’s gross profit margin and free cash flow have also been consistently high, indicating a profitable business model.

Expert Opinions on Investing in Amazon Stock

Here are some expert opinions on investing in Amazon stock:

Warren Buffett

Warren Buffett, the legendary investor, has been a long-term investor in Amazon stock. In an interview with CNBC, Buffett stated that he regrets not investing in Amazon earlier and that the company has a durable competitive advantage.

Goldman Sachs

Goldman Sachs analyst Eric Sheridan maintained a Buy rating on Amazon (AMZN – Research Report) today and set a price target of $145.00. The investment bank cites the company’s dominant market position and potential growth in cloud computing as reasons for its bullish outlook.

Conclusion and Final Thoughts

Amazon has become one of the most valuable companies in the world, with a strong track record of growth and profitability. Investing in Amazon stock allows you to participate in the company’s success and growth potential. Before investing in Amazon stock, it is important to consider the company’s financials, competitive landscape, regulatory risks, and macroeconomic factors. Investing in a single stock such as Amazon exposes you to concentration risk, so consider diversifying your portfolio. Monitor the company’s performance and news events that could impact the company.

In conclusion, investing in Amazon stock can be a rewarding investment opportunity for long-term investors who are willing to tolerate short-term volatility. With a dominant market position in the e-commerce industry and potential growth in cloud computing, Amazon has a durable competitive advantage that could lead to long-term growth.