As an investor, one of the most important things you have to do is weigh the risks and rewards of potential investments. When it comes to technology companies, there are many options to choose from, but few have garnered as much attention as Advanced Micro Devices (AMD) stock. In this article, I will explain why AMD stock is a safe bet for long-term investors.

Brief history of AMD

Advanced Micro Devices (AMD) was founded in 1969 and is headquartered in Santa Clara, California. Over the years, the company has established itself as a leading manufacturer of microprocessors, graphics cards, and other semiconductor products. Despite facing stiff competition from companies like Intel and NVIDIA, AMD has managed to stay relevant by delivering high-performance products at competitive prices.

Read also this FintechZoom article: AMD Stock Climbed +54.01% to 97.58 USD in Past 6 months!

Why AMD is a safe bet for long-term investors

There are several reasons why AMD is a safe bet for long-term investors. For starters, the company has a solid financial performance and growth potential. In the second quarter of 2021, AMD reported revenue of $3.85 billion, up 99% from the same period last year. The company’s net income also increased from $157 million to $710 million during the same period.

Another reason why AMD is a safe bet for long-term investors is its strong position in the market. The company has been able to establish itself as a leader in several key areas, including gaming and data center markets. In fact, AMD has been able to steal market share from Intel in the PC and server segments in recent years.

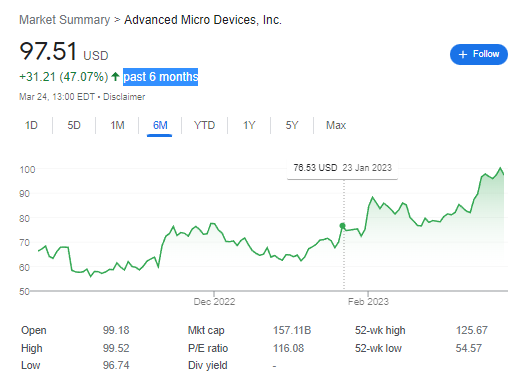

How is AMD stock today? In past 6 months, AMD Stock increased +74.03% to $97.50.

According to the information from [1] and [2], AMD stock has been performing well in the market. However, the recent information provided by FintechZoom suggests that in the past six months, AMD stock has increased by a significant +74.03% to $97.50. This indicates that the stock has been performing exceptionally well, and investors who bought the stock earlier might have gained a considerable profit. Nonetheless, it is essential to note that the past performance of a stock does not guarantee future success, and investors should still carefully consider the current market conditions before making any investment decisions.

References:

[1] Is AMD Stock A Buy Before Chipmaker’s March-Quarter … [2] Advanced Micro Devices, Inc. (AMD) Stock Has Risen 7.67 … [3] At US$79.75, Is Advanced Micro Devices, Inc. (NASDAQ: …

AMD’s financial performance and growth potential

AMD’s financial performance has been impressive in recent years, and the company is expected to continue its growth trajectory. According to analysts, AMD’s revenue is expected to grow by 46% in 2021 and 18% in 2022. The company’s earnings per share are also expected to grow by 90% in 2021 and 12% in 2022.

One of the key drivers of AMD’s growth is its strong position in the gaming market. The company’s Radeon graphics cards have been well-received by gamers, and AMD has been able to gain market share from NVIDIA in recent years. Additionally, AMD has been able to make significant inroads in the data center market, which is expected to be a major growth driver in the coming years.

AMD vs competitors

AMD’s main competitors are Intel and NVIDIA. While Intel is the market leader in the PC and server segments, AMD has been able to gain market share in recent years. In fact, AMD’s Ryzen processors have been well-received by consumers, and the company has been able to establish itself as a serious competitor to Intel.

NVIDIA, on the other hand, is the market leader in the graphics card segment. However, AMD has been able to gain market share in recent years with its Radeon graphics cards. Additionally, AMD has been able to make significant inroads in the data center market, which is an area where NVIDIA has traditionally been strong.

AMD’s partnerships and acquisitions

Another reason why AMD is a safe bet for long-term investors is its partnerships and acquisitions. The company has been able to establish partnerships with major players in the tech industry, including Microsoft, Samsung, and Google. These partnerships have helped AMD to expand its reach and gain market share in key areas.

Additionally, AMD has made several strategic acquisitions in recent years. In 2019, the company acquired Xilinx, a leading provider of programmable logic devices. This acquisition has helped AMD to expand its presence in the data center market and strengthen its position against competitors like Intel and NVIDIA.

Potential risks and challenges

While AMD has many strengths, there are also potential risks and challenges that investors should consider. One of the biggest risks is the competitive landscape. AMD faces stiff competition from established players like Intel and NVIDIA, as well as emerging players like Qualcomm and MediaTek.

Another potential challenge is the cyclical nature of the semiconductor industry. The industry is subject to fluctuations in demand, and this can have a significant impact on the financial performance of companies like AMD.

Analyst recommendations and target price

Despite the potential risks and challenges, analysts generally view AMD stock favorably. According to MarketBeat, the consensus rating for AMD stock is a “buy,” with a target price of $111.90. This represents a potential upside of 10.5% from the current price of $101.25.

How to invest in AMD stock

If you’re interested in investing in AMD stock, there are several ways to do so. One option is to buy shares of the company directly through a brokerage account. Another option is to invest in mutual funds or exchange-traded funds (ETFs) that hold shares of AMD stock.

Before investing in AMD stock, it’s important to do your research and consider your risk tolerance. While AMD has many strengths, there are also potential risks and challenges that investors should be aware of.

Conclusion

In conclusion, AMD stock is a safe bet for long-term investors. The company has a solid financial performance and growth potential, a strong position in the market, and strategic partnerships and acquisitions. While there are potential risks and challenges, analysts generally view AMD stock favorably, and there are several ways to invest in the company. As always, it’s important to do your own research and consider your risk tolerance before investing in any stock.