Apple (AAPL) remains a tech titan, captivating investors with its innovative products and loyal customer base. But with a fluctuating stock price and ever-evolving market conditions, the question on everyone’s mind is: what are analysts saying about Apple stock? Should you buy, sell, or hold?

While analysts can’t predict the future, their insights offer valuable guidance for informed investment decisions. This article delves into the current analyst consensus on Apple stock, exploring bullish, neutral, and bearish arguments to help you navigate your investment journey.

Apple Stock Current Price

On February 7, 2024, the closing price for Apple stock was $189.41.

Analyst Consensus: A Moderate Buy with Upside Potential

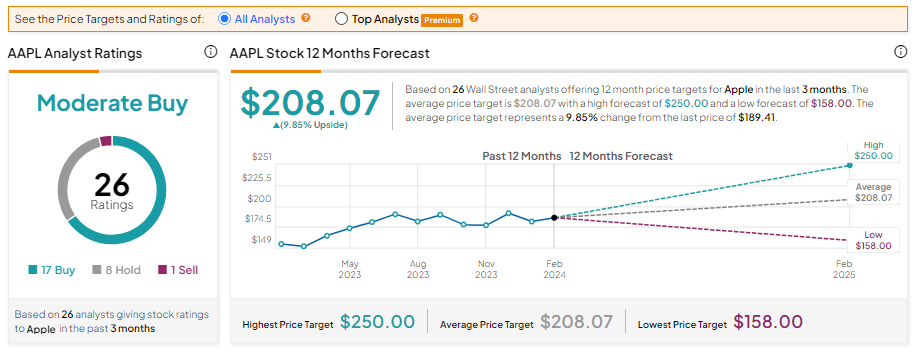

As of February 8, 2024, the overall analyst consensus for Apple stock leans towards a moderate buy. This assessment, based on ratings from 26 Wall Street analysts, reflects confidence in the company’s long-term potential. The average price target sits at $208.07, representing a potential 9.66% upside from the current price.

Driving the “Buy” Sentiment: A Symphony of Strengths

Several key factors fuel the bullish outlook on Apple:

- Unshakeable Brand Loyalty: Apple boasts a passionate and loyal customer base, fostering a recurring revenue stream through product upgrades and service subscriptions.

- Diversified Product Portfolio: From iPhones and Macbooks to wearables and services like Apple Music and iCloud, Apple’s diverse offerings mitigate dependence on any single product category.

- Innovation Engine: Apple’s history of groundbreaking products, like the iPhone and AirPods, suggests their potential for future game-changers, such as the highly anticipated AR/VR headset and electric car.

- Financial Fortress: Apple’s strong balance sheet, fueled by share buybacks and dividend distribution, indicates financial stability and investor rewards.

The Neutral Stance: A Pause for Reflection

Some analysts advocate a “hold” stance, urging caution despite acknowledging Apple’s strengths. Their concerns stem from:

- Valuation Concerns: With the stock price already reflecting future growth expectations, some believe significant near-term gains might be limited.

- Macroeconomic Headwinds: Inflation, rising interest rates, and potential economic slowdown could dampen consumer spending and impact Apple’s sales.

- Tech Turf Wars: Increased competition from tech giants like Google, Microsoft, and Samsung necessitates constant innovation to maintain market share.

A Bearish Whisper: Potential Clouds on the Horizon

While less prevalent, some analysts express bearish concerns:

- Smartphone Market Saturation: With mature markets like China nearing saturation, future iPhone growth might be challenging.

- China Reliance: Apple’s dependence on China for manufacturing and a significant portion of sales raises concerns about geopolitical risks and supply chain disruptions.

- Regulatory Scrutiny: Antitrust investigations and potential regulations could impact Apple’s business model and profitability.

The Verdict: Knowledge is Power, Not a Crystal Ball

While analyst opinions provide valuable insights, it’s crucial to remember they are not financial advice. Ultimately, the decision to buy, sell, or hold Apple stock rests with you. Consider your investment goals, risk tolerance, and investment timeline before making any decisions.

This article’s purpose is to empower you with information, not dictate your actions. Conduct your own research, analyze company financials, and stay updated on market trends. Remember, diversification is key to mitigating risk, and Apple stock should be a part of a well-balanced portfolio, not its entirety.

Beyond the Buzzwords: Additional Resources for Savvy Investors

- TipRanks: https://www.tipranks.com/stocks/aapl/forecast

- Nasdaq: https://www.nasdaq.com/market-activity/stocks/aapl/analyst-research

- MarketWatch: https://www.marketwatch.com/investing/stock/aapl

- Apple Investor Relations: https://investor.apple.com/

By combining analyst insights with your own research and risk assessment, you’ll be well-equipped to make informed investment decisions, navigate the market’s fluctuations, and potentially reap the rewards of a well-crafted investment strategy.

Apple Earnings Report on February 2nd, 2024

Apple released its latest earnings report on February 2nd, 2024, covering their fiscal Q1 2024 (ending December 30th, 2023). Here’s a summary:

Key Highlights:

- Revenue: $119.6 billion, up 2% year-over-year.

- Earnings per share (EPS): $2.18, up 16% year-over-year.

- iPhone Revenue: $65.7 billion, down 8% year-over-year.

- Services Revenue: $20.8 billion, up 6% year-over-year.

- Mac Revenue: $11.5 billion, down 7% year-over-year.

- Wearables, Home and Accessories Revenue: $13.5 billion, up 8% year-over-year.

Overall: Apple reported a mixed quarter with revenue slightly exceeding expectations but iPhone sales falling short. Services and wearables continued to show strong growth, which helped offset the decline in iPhone sales.

Looking Ahead: Apple did not provide specific guidance for future quarters, but CEO Tim Cook expressed optimism about the company’s long-term prospects. He mentioned several potential growth drivers, including the upcoming iPhone 15, new services, and the AR/VR headset.

Additional Resources: