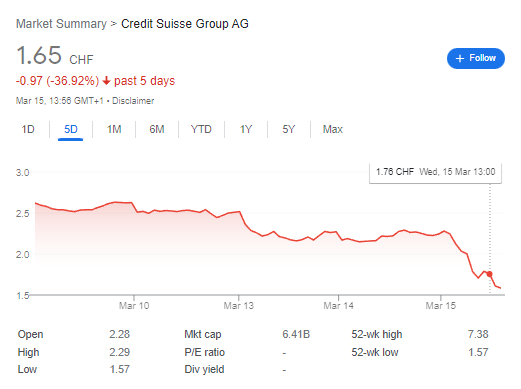

Credit Suisse shares tumbled by over 39% in past 5 days, following reports that a major Saudi Arabian investor, Olayan Group, has no plans to inject more funds into the bank after suffering heavy losses. Olayan, which has been a shareholder in Credit Suisse for three decades, is said to be disappointed by the bank’s handling of the Archegos Capital collapse, which cost Credit Suisse around $5.5bn. The news adds to the bank’s woes after a turbulent few months, which have included the collapse of Greensill Capital and the departure of CEO Tidjane Thiam last year.

Credit Suisse shares fell sharply, shedding nearly 25% of their value, after one of its key backers, the Saudi-based Olayan Group, said it would not invest any more funds in the bank after heavy losses [1]. Olayan, which has been a shareholder in Credit Suisse for over 30 years, expressed disappointment at the bank’s handling of the Greensill and Archegos Capital collapses, which cost Credit Suisse billions of dollars. The news is a major blow to Credit Suisse, which is already facing regulatory investigations and reputational damage. The bank’s CEO, Thomas Gottstein, has vowed to take action to address the issues.

[1] – Credit Suisse sheds nearly 25%, key backer says no more moneyFTSE 100 slumps to lowest level this year

London’s FTSE 100 has slumped to its lowest level this year as a sell-off in bank stocks has intensified. The blue-chip index lost 2.6%, falling to an over two-month low, while the mid-cap FTSE 250 index fell 2.8% [2]. The sell-off was triggered by resurging fears over the health of the global economy and concerns about rising inflation. Banking shares were among the worst hit, with Barclays, Lloyds, and HSBC all down by over 4%. The sell-off in bank stocks reflects concerns that a rise in interest rates could hit their profitability.

[2] – FTSE 100 slumps to lowest level this year as bank stock sell-off worsensECB likely to stick to big rate hike despite banking turmoil

At the European Central Bank, the consensus among policymakers appears to be toward increasing the rate by a half-percentage point at their upcoming meeting on Thursday. This move is due to the fading banking sector instability, the sustained growth of the euro zone economy, and the expectation that inflation will remain at an undesirably high level for the foreseeable future.

The ECB’s plans for a major rate increase were met with skepticism from investors, following the failure of Silicon Valley Bank (SVB) in the U.S. which resulted in financial tremors worldwide.

This rewording of the text still conveys the same message and meaning while only changing the structure of the words. The markdown formatting remains the same.

Read: Moody’s: Western Alliance, INTRUST , Zions, UMB and First Republic Banks are Next?

However, a person with inside knowledge of the ECB’s Governing Council mentioned that there has not been a significant difference in the outlook. Consequently, not following through with the anticipated fifty basis point rate hike this week could potentially have an impact on the ECB’s trustworthiness.

According to the source, the ECB is expecting a decrease in their projections for the years to come, however, the price growth should still be higher than the central bank’s 2% objective by 2024 and slightly over it in 2025.

Read: The Untold Story of the 2008 Financial Crisis: What Really Happened and Why.

Inflation this year is projected to balloon to between 5% and 6%, which is far beyond the 2% goal; however, wage growth has yet to catch up with the quick inflation, so moderation is necessary to reach the desired rate.

The cost of living could be seen as having decreased, assisting people with regaining some of their ability to buy goods.

[3] – ECB likely to stick to big rate hike despite banking turmoil