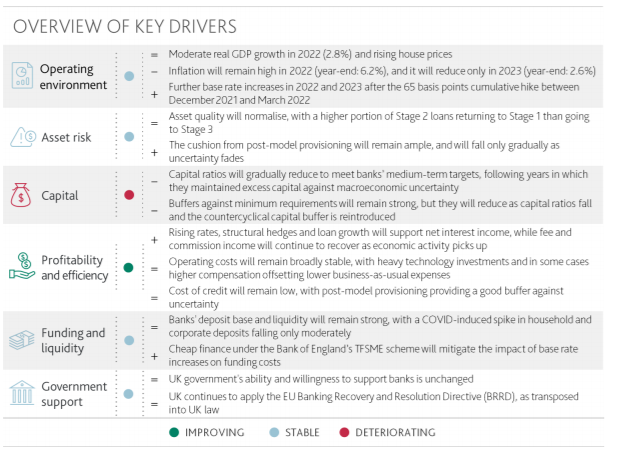

The outlook reflects the UK economy’s moderate recovery from the coronavirus crisis, with increased downside risk from the Russia-Ukraine conflict, and our expectation that banking sector profitability will improve while its asset quality normalises and its funding and liquidity remain strong. Bank capital will gradually decline as lenders resume or continue paying dividends and buying back shares in line with their targets, but will remain robust.

Banking System Outlook – United Kingdom

We expect profitability to improve because of rising central bank rates and continued cost discipline, while post-model provisioning will continue to provide a good buffer against uncertainty. Income from structural hedges put in place in 2021 will also be supportive.

Real GDP growth will grow moderately, inflation will remain high. We expect the UK’s real GDP to continue growing moderately into 2022 (+2.8%) while house prices will continue to rise. Unemployment will remain above pre-COVID levels (4% in 2022), but below our previous forecasts. Inflation has accelerated and will also remain above pre-COVID levels (6.2% at the end of 2022). However, the Bank of England will likely follow its three recent base rate increases with additional rises, in an attempt to mitigate inflationary pressures.

Asset quality will normalise. UK banks’ asset quality remained strong during the pandemic thanks to government support for households and corporates. We expect the proportion of impaired “Stage 3” loans under the IFRS 9 accounting standard to remain broadly stable over the outlook period. At the same time, we foresee a decline in the share of Stage 2 loans, those whose credit risk has increased significantly since initial recognition, with a higher proportion transferring into the Stage 1 (performing) category than into Stage 3. In 2020, UK banks set aside a substantial £22 billion of provisions for expected loan losses in response to the pandemic, and had released only £3.6 billion of this by the end of Q3 2021. We expect the provisioning cushion to remain ample, reflecting economic uncertainty.

Capital will decline but remain strong. UK banks’ capital is at historically high levels, helped by earnings retention. We expect their capitalisation to remain robust despite some deterioration as dividends and share buy backs resume, and as risk weighted assets rise. The banks’ strong leverage ratios have absorbed the adverse impact of a rapid pandemic-induced inflow of deposits, and will undergo some further modest deterioration, but will also remain sound. Banks’ capital buffers over and above their minimum requirements are historically high, partly reflecting temporary COVID-related regulatory measures. We expect them to decline moderately as capital ratios fall, and as the government phases out pandemic-related measures.

Profitability will benefit from rising rates, economic growth. The Bank of England has raised its base rate three times since early December 2021, and we expect further increases in the next 12-18 months. Higher rates, combined with returns from structural hedges that the banks put in place in 2021, will support net interest income from loans and the banks’ ample liquid resources. Fee and commission income will also marginally improve as economic activity picks up. UK banks will remain focused on reducing their “business-as-usual” costs, but high technology investments and in some cases rising remuneration expenses will partly offset any gains. Provisioning expenses will normalise after rising steeply in 2020.

Liquidity and funding will remain strong. In 2020 and 2021, UK banks obtained cheap funding under the Bank of England’s term funding scheme with additional incentives for SMEs (TFSME). At the same time, deposits increased materially as households and corporates reined in their spending and investment. Since credit demand was muted, these inflows generated very strong liquidity for UK banks. We expect their deposit base and liquidity to remain robust, with COVID related deposits falling only gradually. Loan growth will remain moderate, concentrated predominantly in the mortgage and unsecured consumer credit sectors.

Government support assumptions are unchanged. We continue to assume a moderate probability of government support for the deposits and senior debt of systemically important UK banks. The government’s capacity to support ailing banks remains stable, as indicated by the stable outlook on the UK sovereign’s Aa3 debt rating.

Market Prices

Commodities Prices Analysis (April 8) – WTI and Brent Crude Oil rose 2%

Cryptocurrency Prices Today (April 8): BTC, ETH are Rising, USDC in Red.

Moody’s updates banking system outlooks for 10 European countries

The 10 countries are Belgium, Denmark, France, Germany, Italy, the Netherlands, Spain, Sweden, Switzerland and the UK.

“In Europe, most banking sectors will experience a deteriorating operating environment over the next 12-18 months, and more uncertainty compared with Moody’s previous expectations. The Russia-Ukraine crisis is lowering economic growth, raising inflation and posing significant risks. However, the outlooks for these 10 banking systems remain stable, reflecting our view that they can weather these challenges” .

Louise Welin, VP – Senior Credit Officer, at Moody’s

Moody’s expects asset quality for these banking systems to remain broadly resilient, capital to remain robust and profitability to largely hold steady for most banking systems. Moody’s also expects liquidity to be ample. The trends affecting the sector will be similar across much of Europe, though circumstances in Spain, the UK and Switzerland differ in some respects. Spanish banks will benefit from stronger economic growth in 2022 compared with most other large European countries. UK banks will benefit from a moderate economic recovery along with continued interest rate hikes from the Bank of England, and Swiss banks will be more insulated from geopolitical risks.

To see the complete banking sector reports, click on the link for each country:

Belgium: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317472

Denmark: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317981

France: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1318037

Italy: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1318833

Netherlands: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317043

Spain: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317869

Sweden: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317015

Switzerland: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317255

UK: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1317502

Germany: http://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1316981