When it comes to Chinese stocks, there are many factors to consider. First and foremost, you will want to look at the fundamentals of the company, including its financial performance and growth potential. You may also want to assess the wider macroeconomic conditions in China, as this can have a big impact on the performance of individual stocks.

Additionally, you will want to think about your own investment goals and risk tolerance when picking out Chinese stocks. Whether you’re interested in stable dividend payments or rapid capital growth, there are plenty of excellent options available in the Chinese market. Ultimately, it all comes down to doing your research and finding the investments that best fit your needs.

Investing in Chinese Stocks: Risk vs. Reward – What You Need to Know

Investing in Chinese stocks can be a risky business, but the potential rewards are undeniable. With the growth of the Chinese economy in recent years, more and more investors are turning to the country’s stock market as a viable investment opportunity. Before diving in, however, it is important to understand the potential risks and rewards of investing in Chinese stocks. By doing so, investors can make informed decisions about their investments and work towards achieving their financial goals. This article will provide an overview of the risks and rewards of investing in Chinese stocks, as well as some tips for making the most of this investment opportunity.

Risks of Investing in Chinese Stocks

There are many risks associated with investing in Chinese stocks. These risks range from political issues to economic concerns and can have a significant impact on the performance of Chinese stocks. Below are some of the most significant risks of investing in Chinese stocks.

Exchange rate fluctuation – The Chinese yuan is the currency used in China, but it is not freely traded like the U.S. dollar or the Euro. This means that the exchange rate between the yuan and other currencies is heavily regulated by the Chinese government. This means that the value of the yuan can change significantly, which in turn affects the value of Chinese stocks. In particular, Chinese stocks are typically priced in U.S. dollars, so any changes in the yuan’s value will affect their value as well. If you are investing in Chinese stocks, it is important to keep an eye on the value of the yuan to make sure that you do not overpay for your shares.

Growing debt – China has been experiencing significant economic growth in recent years, and much of that growth has been funded by debt. The country’s debt-to-GDP ratio was over 250% in 2017, compared to just 21% in 1999. This level of debt can pose serious risks for the Chinese economy. If the country’s economy slows down significantly, many of these debt-laden companies may not be able to repay their loans. This could ultimately lead to a debt crisis in China that could have a significant impact on the country’s stock market.

Increasing trade tensions – In recent years, the U.S. and China have been engaged in a growing trade war. The U.S. has accused China of unfair trade practices, and China has accused the U.S. of similar practices. This tension has led both countries to impose tariffs on billions of dollars worth of goods, including Chinese stocks. This could have a significant impact on the performance of Chinese stocks. If the trade war continues to escalate, it could lead to a decline in Chinese stock prices and reduced returns for investors.

Rewards of Investing in Chinese Stocks

Chinese stocks can offer high potential rewards, but only if you are able to select the right stocks. Chinese companies come in all sizes and sectors, so there is plenty of room for investors to select stocks that suit their needs. If you are able to select the right stocks, then you may be able to earn significantly more on your investment than you would with stocks from other countries.

Below are some of the potential rewards of investing in Chinese stocks.

Potential for high returns – It is important to note that Chinese stocks are typically priced in U.S. dollars, so their value will increase as the dollar’s value grows. In other words, Chinese stocks provide the potential for high returns, not guaranteed returns. If the Chinese economy grows even faster than expected, however, Chinese stocks could provide even higher returns than expected. In particular, Chinese technology stocks are expected to provide even higher returns in the coming years. China is quickly becoming a tech power, and these companies are expected to grow significantly in the future. This provides an opportunity for investors to profit from these companies.

A large potential investment universe – In addition to large companies, Chinese stocks also include a wide variety of smaller companies. This provides investors with a large potential investment universe, making it easier to find an investment that suits their needs. Investors can also diversify their portfolios by investing in Chinese stocks in addition to stocks from other countries. This can help to protect against significant losses in any single investment.

Tips for Investing in Chinese Stocks

There are several tips that can help investors succeed when investing in Chinese stocks. These tips can help you to identify the best investment opportunities, mitigate risk and prepare to profit from the Chinese market.

Start small – Chinese stocks can be a high-risk investment. Because of this, it is important for investors to start small and only invest what they can afford to lose. By investing a small amount of capital, you can limit your risk, and if the investment does not turn out as planned, the loss will not have a significant impact on your finances.

Diversify your portfolio – It is important to diversify your investments by selecting stocks from a variety of different companies. This helps to protect against significant losses in any one investment. When investing in Chinese stocks, it is especially important to diversify your portfolio as Chinese companies can be volatile. This means that you may experience significant gains or losses in any given year, but a diversified portfolio can even out these swings and help you to achieve steady growth over time.

Research your stocks – This can be challenging when investing in Chinese stocks, but it is important to do your research. You should do more than just read a company’s financial reports. Ideally, you should speak with company managers, visit their facilities and dig into the culture of the company. This can help you to identify potential pitfalls and understand how the company operates. This can help you to better determine if the company is a good investment.

Tips for Researching Chinese Stocks

There are several ways to go about researching Chinese stocks. Before diving in, it is important to understand a few key aspects of the Chinese stock market. The Chinese stock market is different from the Western market in several ways. The Chinese market has a very large number of small companies. These companies are generally not listed on a major stock exchange, making it more difficult for investors to find and review the company’s financial information. The Chinese market is heavily regulated. This can make it more difficult for foreign investors to access the market. It can also make the market more challenging to navigate, with strict rules and regulations that may differ from your home country.

Best Chinese Stocks to Buy

There are many great Chinese stocks to buy with strong earnings potential for investors to choose from. Some of the best options include tech giant Alibaba, food and beverage company Tingyi, commercial bank China Everbright, insurance company Ping An, electronics manufacturer Foxconn, internet company Tencent, real estate developer Country Garden, and renewable energy firm Trina Solar.

All of these chinese companies to invest in have seen impressive growth over the past year due to a variety of factors, including rising consumer spending in China, heavy investment in new technologies and infrastructure, and increasing demand for renewable energy sources. Whether you’re looking for traditional stocks or innovative unicorns, there are plenty of great Chinese names to consider in today’s marketplace.

So, the top chinese stocks to buy now are:

#1. Canaan (NASDAQ:CAN)

Canaan is a leading provider of innovative solutions for the global technology sector. With a focus on Chinese stocks, Canaan’s cutting-edge platforms and expertise have helped it to become one of the best companies in its field. Whether you are looking to invest in the latest tech trends or stay ahead of changing market conditions, Canaan has the insights and know-how that you need.

Whether you are an individual investor or part of a major financial institution, this company is your best choice for expanding your portfolio and achieving your financial goals. So why wait? Invest in Canaan today and start reaping the rewards of this best chinese stocks to buy now!

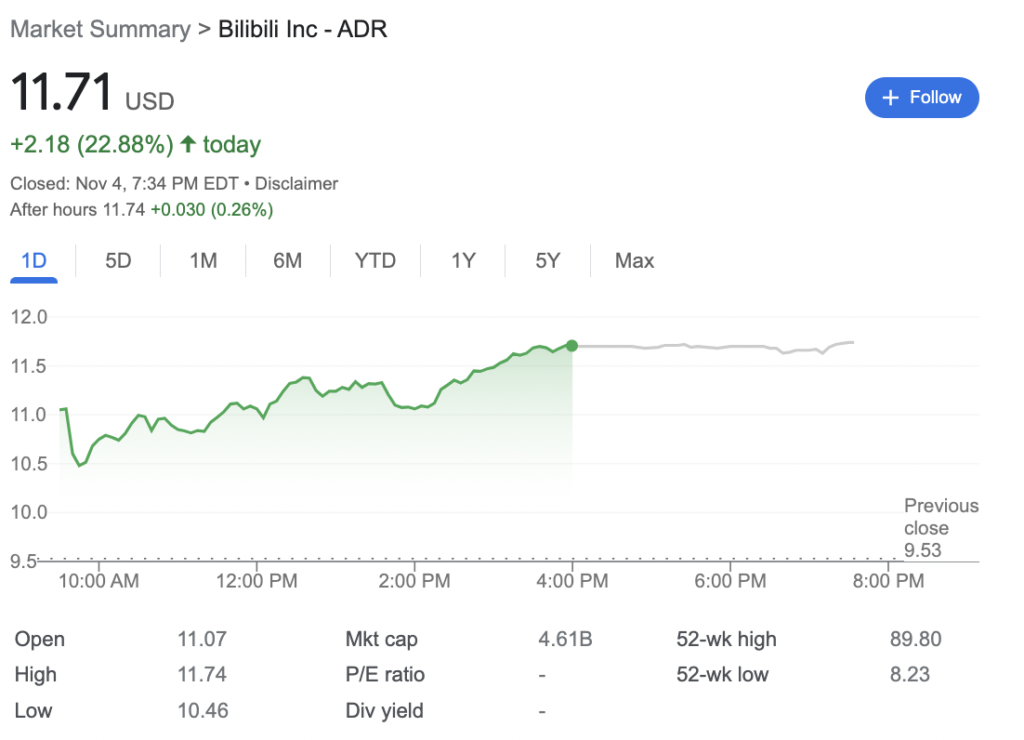

#2. BILI (NASDAQ:BILI)

BILI is a china-based company that specializes in providing innovative financial services and products to both individual and institutional investors. With its focus on innovation and customer-centricity, BILI has quickly become one of the most exciting stocks on the NASDAQ. Whether you are looking for a solid long-term investment or a more speculative play, BILI is definitely worth considering.

With its strong presence in China’s dynamic financial sector and its commitment to delivering the best possible returns to shareholders, this stock is poised for growth in the years ahead. So if you’re looking for an exciting china stock to buy, look no further than BILI.

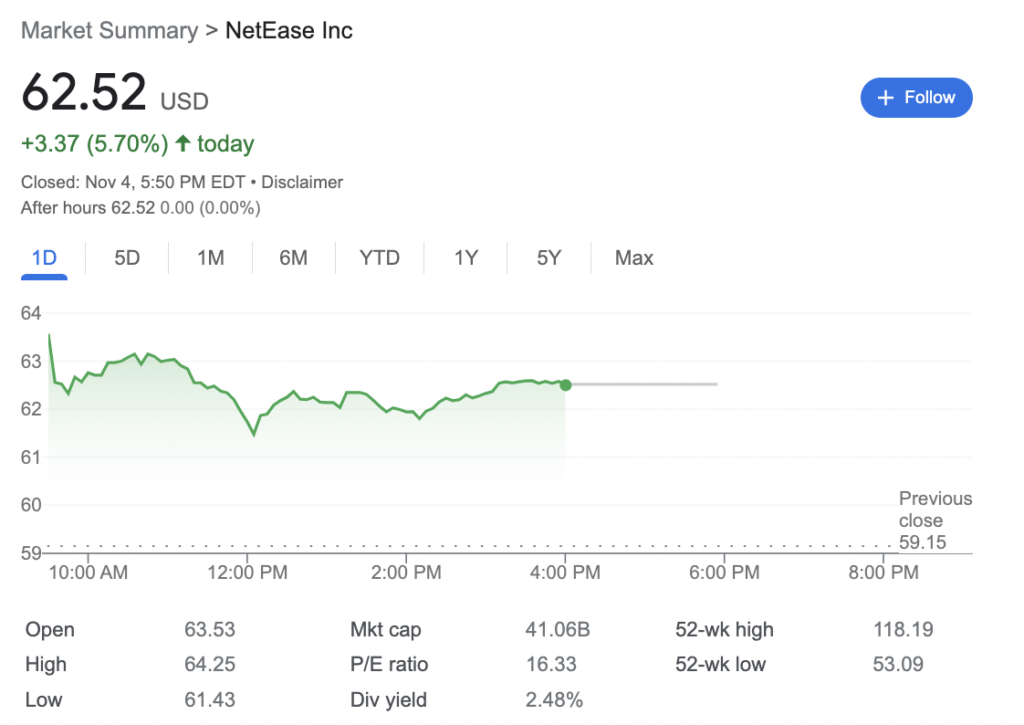

#3. NetEase (NASDAQ:NTES)

NetEase is a leading tech company that provides a wide range of products and services for consumers and businesses alike. From cloud computing solutions to mobile apps, NetEase offers a variety of high-quality products that help businesses stay one step ahead of the competition. But what truly sets this company apart is the dedication to innovation that underlies everything it does.

With a reputation for consistently staying at the forefront of emerging technologies, NetEase is recognized as an industry leader in bringing new ideas and possibilities to life. Whether you’re an established business looking for an edge or an upstart seeking success, NetEase has the tools you need to reach new heights. So if you’re looking for a partner who can help transform your vision into reality, look no further than NetEase. With its track record of innovation and proven expertise, this company is sure to exceed your expectations.

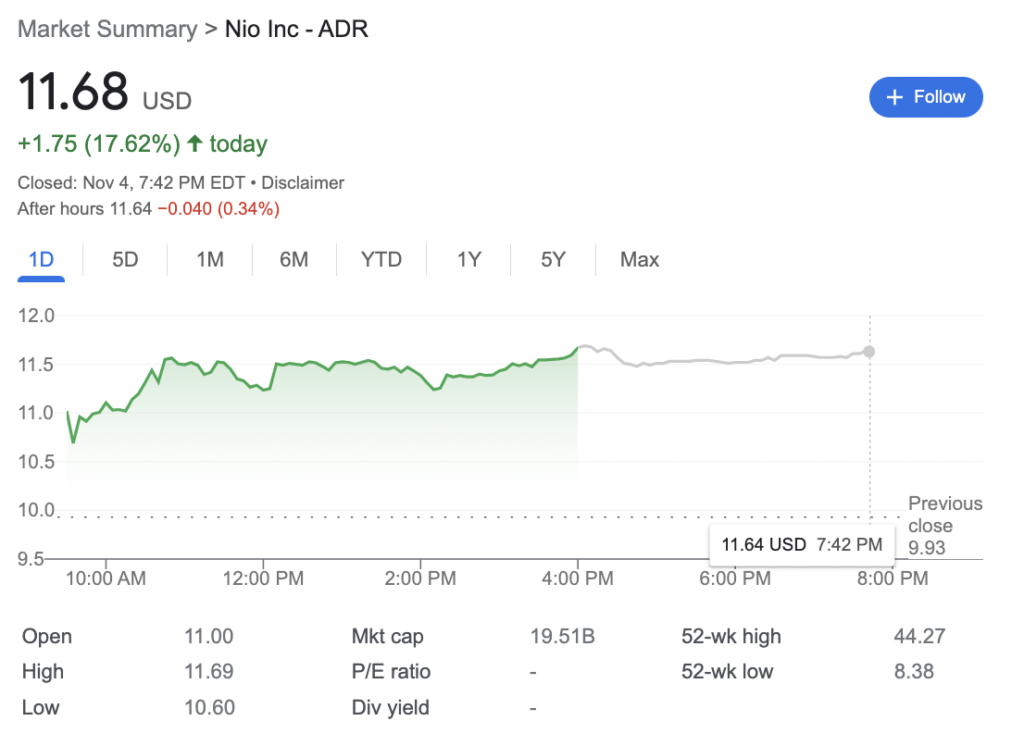

#4. NIO (NIO:NYSE)

NIO is a china-based stock that is quickly gaining popularity among investors. Known for innovative designs and high-quality products, the company has become a leading player in the global auto industry. Furthermore, NIO boasts strong financial results, with steady revenue growth and impressive earnings figures.

As a result, many investors are viewing this stock as a smart investment opportunity, particularly given China’s growing focus on developing green technologies and sustainable investments. If you’re looking for an attractive china stock to buy, NIO stock is definitely worth considering. With its cutting-edge technology and promising prospects for growth, this company is poised to continue its impressive trajectory well into the future.

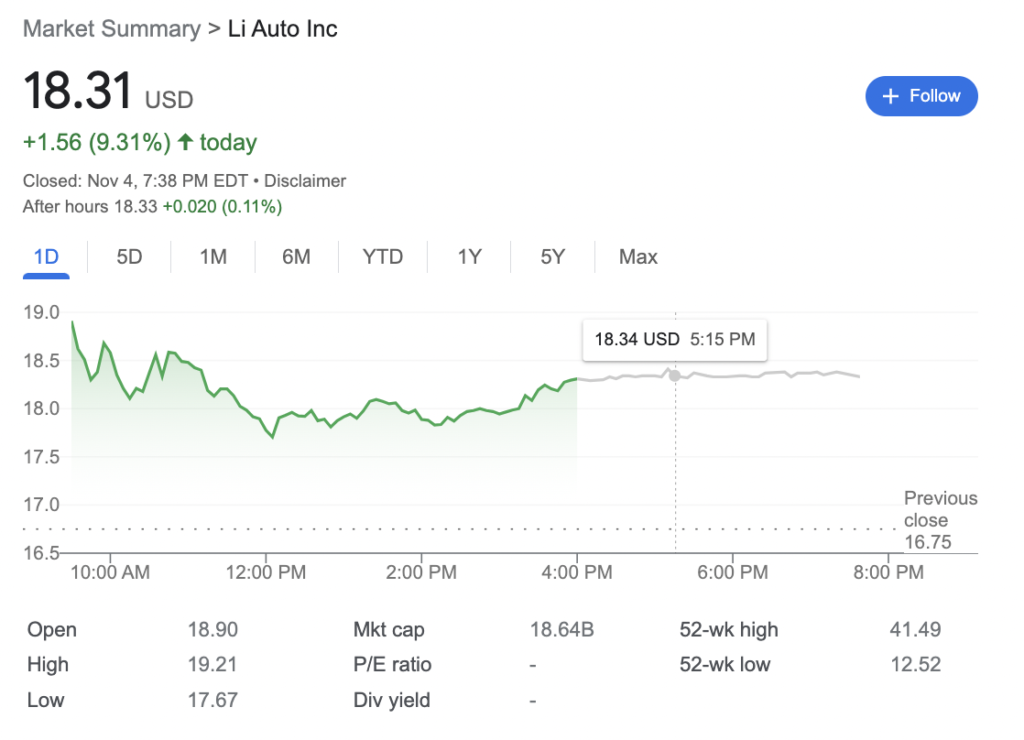

#5. Li Auto (LI:NASDAQ)

Li Auto is a leading manufacturer of electric vehicles, based in China. With roots dating back to 2014, the company has grown rapidly to become one of the largest players in its field.

Li Auto’s products are designed for both personal and commercial use, with high-quality batteries and powerful motors that allow for speedy, efficient transportation. In addition to its well-designed vehicles, Li Auto is also known for its rigorous safety testing procedures, putting all of its products through multiple rounds of inspection before they hit markets. With a reputation for excellence and a bright future ahead, Li Auto is poised to become the industry leader in electric vehicles.

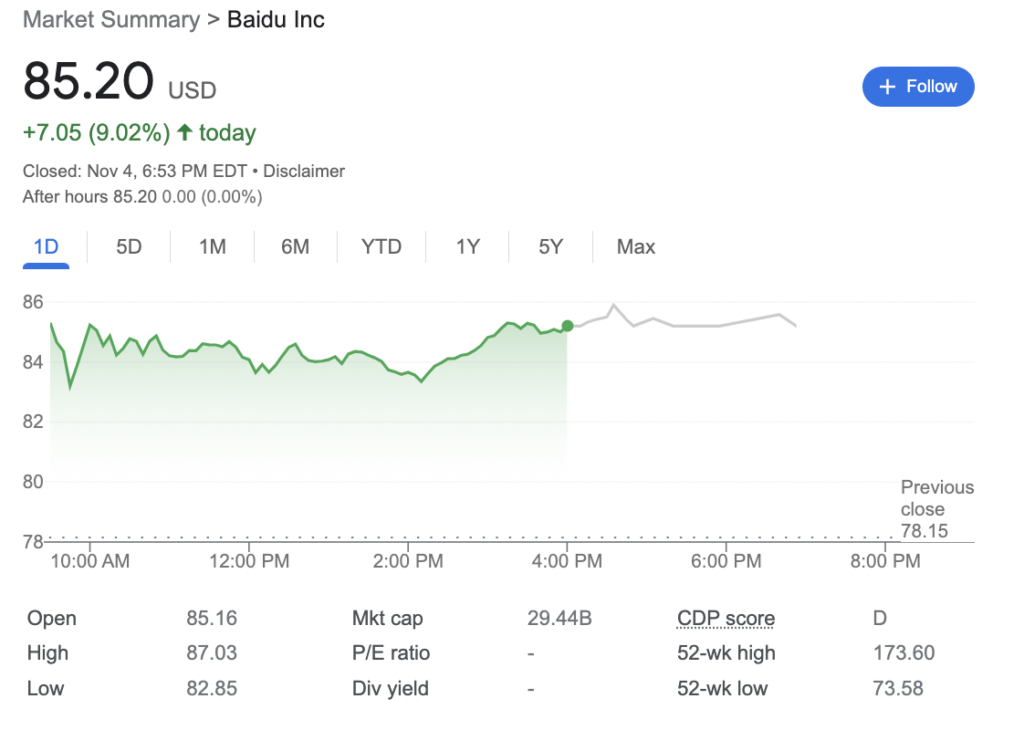

#6. BAIDU (BIDU:NASDAQ)

BAIDU is one of the leading search engines in the world, with an impressive market share and an extensive network of data centers around the globe. This company has managed to become a major player in the online space by focusing on continuous innovation and providing top-notch search results.

Thanks to its extensive global infrastructure and advanced AI capabilities, BAIDU is able to deliver excellent results that meet the needs and expectations of users today. Whether you’re looking for news articles, blogs, product reviews, or just about anything else, this innovative search engine is sure to have what you need. If you’re looking for fast, accurate search results with a strong focus on user experience, BAIDU is definitely worth checking out.

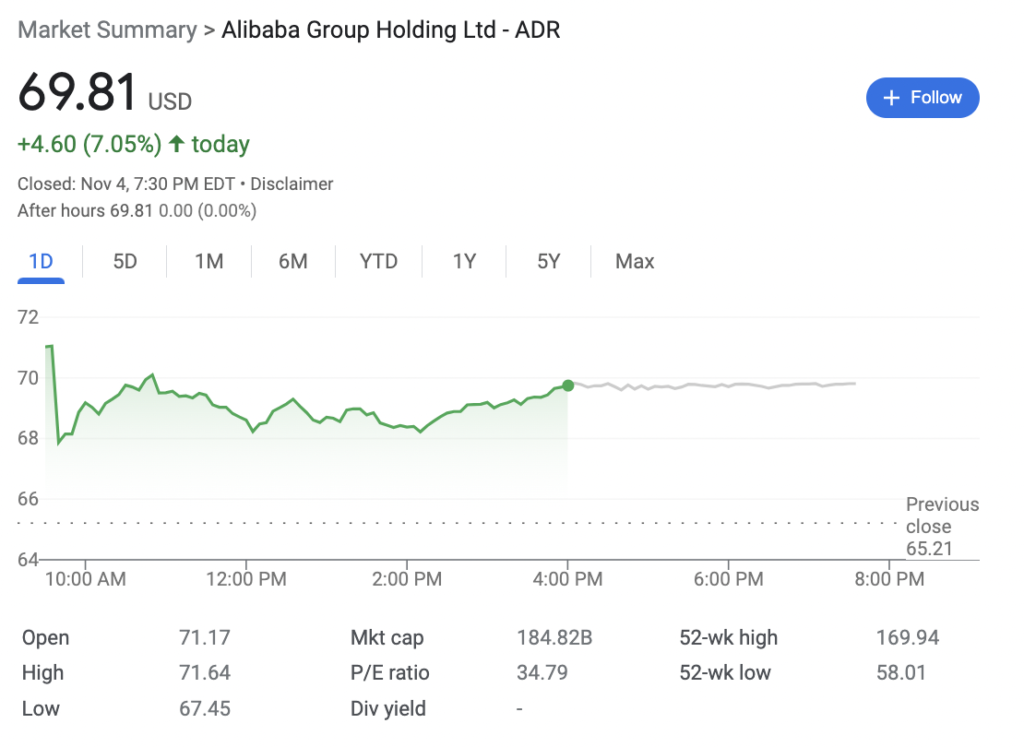

#7. Alibaba (BABA:NYSE)

Alibaba is one of the largest and most successful companies in the world, with a long history of success spanning over two decades. Originally founded in China, Alibaba has grown to become a global powerhouse, with operations in countries around the world. Through its innovative business models and cutting-edge technology platforms, Alibaba has created tremendous value for its shareholders, as well as for the wider global economy. And with continued focus on innovation and growth, it is clear that this dynamic company will continue to be a force to be reckoned with for many years to come.

So, Should i Buy China Stocks?

There is no easy answer to the question of whether or not you should buy Chinese stocks. While it is true that China has experienced tremendous economic growth in recent years, investing in Chinese stocks comes with its own set of risks and challenges. On the one hand, many analysts believe that the Chinese economy still has plenty of room for growth, which could lead to a significant increase in stock prices. However, there are also concerns that China may experience a market bubble similar to those seen in countries like Japan. Additionally, given China’s opaque political system and heavily regulated stock markets, choosing the right stocks can be difficult without the proper expertise and tools. Ultimately, the decision of whether or not to invest in Chinese stocks will depend on your individual risk tolerance and goals as an investor.

FAQs

There is no simple answer to this question as the legality and advisability of investing in China shares depends on a number of different factors. On the one hand, China has a rapidly growing economy and it is certainly possible to make good returns from investing in its stock market. However, there are also some risks associated with investing in Chinese companies, including government regulations, currency fluctuations, political instability, and limited liquidity.

Before making any decisions about whether to buy into China stocks, it is important to assess these risks and weigh them against the potential benefits of such an investment. Ultimately, only you can decide whether or not to buy China shares, but it is always important to do your research thoroughly before making any big financial decisions.

China’s stock market is known as the Shanghai Stock Exchange, or SSE. This major financial hub is one of the largest in the world, with over 1,800 listed companies and a total market capitalization of more than $5 trillion. The exchange is also home to some of China’s largest firms, including Bank of China and Alibaba Group. Despite its size and significance, however, the SSE can be a challenging place to navigate for foreign investors due to continued restrictions on foreign investment. Nonetheless, it remains one of the most important markets in the world and a key component of China’s financial landscape.

There is no easy answer to the question of which stock in China is the most valuable. There are a number of factors that need to be taken into account, including market capitalization, recent share price fluctuations, and earnings growth. Some might argue that companies like Alibaba or Tencent are the most valuable stocks in China, given their high market capitalization and rapid rate of expansion in recent years.

However, others might point out that these companies are still relatively young and may yet see their value decline in the future. Ultimately, it is difficult to determine definitively which stock is objectively the most valuable in China; there are simply too many complex factors at play. However, what is clear is that all investors should carefully consider a variety of different metrics when making decisions about stock trading in China – or any other market, for that matter. After all, investing wisely requires careful analysis and deep consideration of all available information.