There are probably few people who wouldn’t be interested in best stocks. They give you the opportunity to invest money and watch it grow over time. However, finding the right stocks can be tricky. There are thousands of stocks out there, and there is no way you can analyse them all. Instead, you need to find a way to narrow down your search so that you don’t waste your time on investments that won’t bring you any return. A stock screener can help you do just that. It is an online tool that helps investors find specific stocks based on their needs and preferences, like the best stocks under $10. There are many stock screeners available online, but not all of them will be useful for you as an investor who wants to keep things simple without sacrificing too much information about the companies themselves. In this FintechZoom article are some of the best stock screeners for investors.

What is a Stock Screener?

A stock screener is a tool that allows you to quickly look at a large number of stocks and compare their performance. They can be used for a variety of reasons, including to find undervalued companies or to find potential investments.

There are several different types of stock screener. The most basic type is an Industry Screener, which simply looks at the industry in which a company operates (for example, Health Care). More advanced types include Sector Screener and Stock Screener, which look at the specific field in which the company operates (Health Care vs. Technology). The most sophisticated type is a Fundamental Screener, which combines the previous two types to give you a more complete picture of the company.

So… What are the Best Stock Screens?

MorningStar Stock Screener

One of the best stock screeners you can find is the MorningStar Stock Screener. It’s a powerful tool that can be used to find almost any stock out there, including stocks on the NASDAQ, S&P 500, and other major exchanges. What we like about this stock screener is that it asks you only the most important and useful questions you, as an investor, need to ask. It doesn’t bog you down with a ton of irrelevant information, and it gives you exactly what you need to make an informed decision. This is one of the best stock screeners for beginners because it has a user-friendly interface and it doesn’t require you to know anything about stocks in order to use it. You can use its basic features to find the right stocks for your portfolio, and its advanced features to dig a little deeper if you want to know more about them. What makes this stock screener unique is that it lets you choose a particular sector to focus on. So, if you want to invest only in certain industries, you can use the MorningStar stock screener to find the best stocks in that sector. You can also use its mutual fund screener to find the best funds for your portfolio.

Finvu Screeners

If you’re in the market for a free stock screener, you should give the Finvu stock screener a try. While it’s not as advanced as some paid stock screeners, it’s perfect for beginners who want to learn the ropes without spending a lot of money. With this stock screener, you can manually select specific stocks you’d like to analyse and evaluate, or you can just select industries and tickers to find stocks related to those industries. You can also filter out specific stocks that don’t meet your requirements, as well as set up alerts to notify you when stocks that meet your criteria are added to the screener. This way, you don’t have to keep checking the screener every day and hours searching for the right stocks. What’s also great about this screener is that you can share your results and analyses with other people, so you can get even more opinions about the stocks you selected and make sure you’re making the right choices. This is a great way to get more eyes on your research, so you can make sure you’re doing everything right.

StockMarkets Screeners

Another very good stock screener is the StockMarkets stock screener, which is available both online and offline. It has many filters and criteria to help you find the best stocks, and you can narrow down your search based on a number of factors, including the company’s financial health and earnings, its management team, and its operational performance. You can also use this screener to find mutual funds that fit your needs and preferences. This is a powerful screener that will give you everything you need to make an informed decision, but it’s also a great screener for beginners because it doesn’t ask you to provide a lot of information. So, if you don’t know anything about the companies you’re investing in, you can still use this screener to find the best stocks for your portfolio. One of the best features of this screener is its alerts system, which lets you set up notifications to let you know when a stock you’re interested in meets one of your criteria. This way, you don’t have to waste time checking the screener every day.

Google Stock Screening Tool

If you’re not sure which screener to use, you can always default to Google. The Google Stock Screening Tool is a powerful tool that lets you search for the most relevant stocks investments, based on the criteria you provide. You can search for stocks based on their profit margins, debt ratios, and other financial metrics. What’s also great about this screener is that it lets you narrow down your search based on specific industries, so you can focus on stocks related to your interests. If you’re not sure what stocks to invest in, you can also use this screener to find stocks that are rising in popularity. So, if there are a lot of people investing in a certain company, it’s probably a good sign that it will bring you a return on your investment.

Zacks Investment Research Stock Screener

Another screener that’s worth checking out is the Zacks Investment Research Stock Screener. This is a powerful stock screener that can be used to find investments across all industries and sectors. This is a great tool for both novices and experienced investors, because it has many different filters and criteria that you can use to search for stocks. You can also set up alerts to let you know when stocks meet your criteria, so you don’t have to waste time checking the screener every day. This is a free stock screener, so it’s perfect for people who don’t want to spend a lot of money on their investments. You can search for both stocks and funds across many exchanges, from the Dow Jones to the NASDAQ.

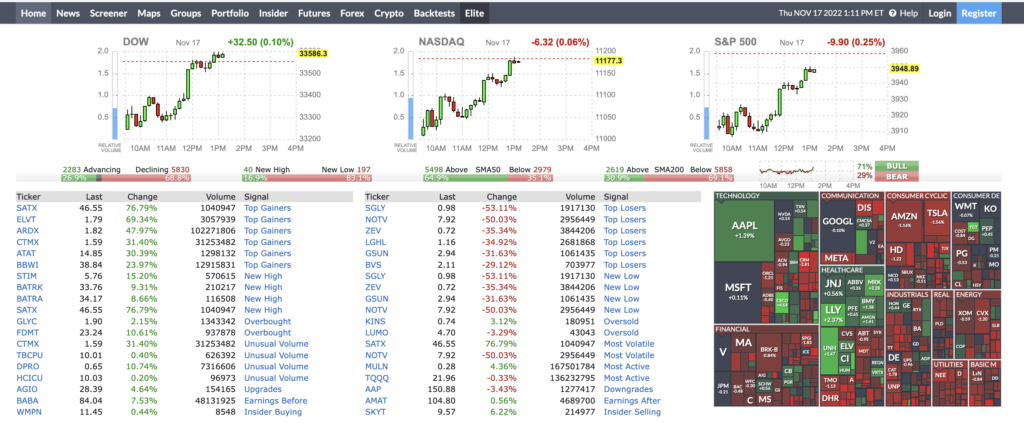

FinViz

A great way to start is by checking out the free Stock Screener we’ve made that provides you with a stock summary, recent highs and lows, price movement, and more. You can also take the full service Stock Screener Plus ($9.95/month) which includes real-time streaming quotes, intraday alerts, and more.

To get started, just enter your email address in the form above and click the “Get Started” button. It’s that easy!

In addition to the Stock Screener Plus, we also have our in-depth Stock Screener Analyzer that provides deeper analysis of companies like financials, industrials, technology, and healthcare. This subscription service is $29.95/month or $299/year.

Nasdaq Stock Finder

Last but not least, we have the Nasdaq Stock Finder, which is a stock screener that’s owned by the NASDAQ and can be used to search for the most relevant stocks in all industries and across different exchanges in the United States. You can use this screener to find both small- and large-cap stocks, as well as mutual funds, ETFs, and other investments. This is a powerful tool that can be used to search for stocks based on many different criteria, including their price, earnings, return on equity, and other metrics. You can also set up alerts to let you know when stocks meet your criteria. This is a good tool for beginners, because it doesn’t require you to know too much about the companies you’re investing in.

And… What are the Best Stocks Screeners APP?

Screeners are a powerful tool that allow you to quickly identify companies that meet your investment criteria. A stock screener is a software application that scans for stocks meeting pre-specified criteria. Once the desired parameters are input, the screener will return a list of qualifying stocks. Many financial websites, brokerages, and other market research sites feature stock screeners as a way to assist investors in finding potential investments. The following is a list of our Top 5 Stock Screener applications with details on each one so you can choose the right one for you and begin your investing journey wisely.

Pocket Stocks

“Pocket Stocks” is an app for those who are not looking for a long-term investment. Instead, these stocks are meant to be sold quickly for a quick profit. These stocks are generally lower-priced stocks, so the risk is higher than if you choose a long-term investment. There is no guarantee that you will make money with these stocks, but there is also no guarantee that you won’t lose money. If you’re looking for a quick way to make some money, these stocks may be for you. Quick Tip: This app only shows you stocks that are trading on the New York Stock Exchange (NYSE).

Stash Invest – Equity Research Platform & Registered Investment Advisor

Stash Invest is an investing app that combines an equity research platform with a low-cost robo-advisor service. The equity research platform provides you with insights into stocks and ETFs in which you may be interested. Stash Invest provides a list of stocks with its analysis of each one. This analysis is designed to help you understand the potential upside and downside of each investment. Stash Invest also offers a free robo-advisor service that allows you to use your 401(k) to invest in a low-fee portfolio of ETFs. The robo-advisor service will help you choose the amount you want to invest, what percentage of your portfolio to invest in each ETF, and how often you want to reinvest your dividends.

Stock Rover

Stock Rover is a large-cap stock screener that includes stocks from the S&P 500, the NASDAQ 100, and other large-cap companies. The app also includes stocks from the Russell 1000 and S&P 600 indexes. You can select various investment criteria to find the best stocks for your portfolio. Stock Rover also includes a watchlist feature so you can monitor the stocks that you’re interested in. The app also provides you with news and financial information about your selected stocks. The Stock Rover app is free to download. However, you must pay a fee to use their full features.

Smart Screeners: Screening Tool for Investors

This app is designed as a screening tool to help you build a diversified portfolio of stocks. You can select your investment criteria to find the best stocks to meet your goals. Using this app, you can search for stocks based on five different criteria. This app provides you with information about each company you want to research. You can find data about the company’s management team, financial statements, analyst reports, and news about the company. This app is free to download.

Morningstar Investment Research (MRI)

Morningstar Investment Research (MRI) is a large-cap stock screener with a focus on dividend-paying stocks. The app allows you to search for stocks based on the criteria that you input. You can search for the best dividend stocks in the United States, Canada, or any other country. You can also search for stocks that pay high yields, have high-growth potential, or are undervalued. Once you’ve selected your investment criteria, you will be shown a list of qualifying stocks. You can also use the app to track stocks that you’re interested in. The Morningstar Investment Research (MRI) app is free to download.

Zacks Investment Research

Zacks Investment Research is a large-cap stock screener with a focus on stocks expected to grow rapidly. You can use this app to search for companies that are expected to post strong earnings growth in the future. Zacks Investment Research also lets you search for stocks based on their predicted volatility. You can choose between low, medium, and high volatility stocks. You can also search for stocks based on their expected price appreciation. Once you’ve selected your investment criteria, you will be shown a list of qualifying stocks. Zacks Investment Research also features a watchlist feature so you can monitor the stocks that you’re interested in. The app also provides you with news and financial information about your selected stocks.

Final Words

There are many stock screener apps available, but they all have similar features. You can search for stocks based on the company’s financial information, compare the stock to others in its industry, and find out how the stock has performed in the past. You can also search for stocks based on your financial goals, such as finding stocks that pay dividends or have high expected growth rates. Once you’ve found a stock that interests you, you can explore the company in more detail. This will help you make an informed decision about whether or not to invest in this stock.

How to use Stocks Screeners?

In the world of investing, so many things are out of your control. You can’t predict what companies will have positive earnings or if Wall Street will respond well to their quarterly report. Even the best stocks fall victim to unpredictable events at some point. If you invest in individual stocks, it’s important to screen for stocks that meet your personal criteria and risk tolerance. This is why stock screeners are so valuable — they scan thousands of stocks to find those that meet your needs. These tools make it easy and fast to find promising stocks based on specific criteria that you choose. No longer do you need a team of analysts to find the perfect stock for your portfolio. However, with so many stock screeners available, how do you know which one is right for you? In this article we will take a closer look at some of the top stock screeners on the market today and what makes them stand out from the rest.

Stocks Currently above a certain price point

The first thing you want to do when creating your stock screener is set a price point for stocks you want to include in your screener. This will narrow down your screener to only those stocks that are currently trading above that price point. This is important because it allows you to find stocks that are currently undervalued (and, therefore, more likely to rise in price over time) instead of stocks that are fully valued or overvalued (and, therefore, less likely to increase in price). This can be done with the “price” filter in most stock screeners. You can set a price below which you want to see all stocks, or, if you’d rather see all stocks above a certain price, simply set it at “more than”. Most screeners have a default setting of “less than,” so be sure to change the search parameters if you want to see stocks currently trading above a certain price.

Stocks that have recently dropped in price

One key sign of an undervalued stock is that its price has recently fallen. This can happen for many reasons, including bad press, a decrease in demand, or an overreaction by investors. Whatever the reason, dropping prices in the short term can indicate an undervalued stock that’s poised for growth in the future. Typically, the best stocks to buy are those that have had a recent price drop of at least 20%. If a stock has had a drastic fall in price but its price is currently above a certain price point, such as $10, it’s likely that price has fallen due to bad press or negative investor sentiment. If a stock has recently dropped in price but is below a certain price, it’s likely that price drop was related to a company-specific event such as a bad earnings report or negative analyst forecast.

Stocks that have the biggest percentage drop in price

As briefly mentioned above, the best time to buy a stock is when its price has recently declined. It’s often easy to tell when this has happened by looking at a stock’s price history. When you first create a screener, you can choose to filter your screener for stocks with a high percentage price drop. Most stock screeners allow you to filter for a percentage price drop, as well as for a specific price drop amount. This allows you to decide how much of a price drop you want to see before including a stock in your screener. Some investors prefer to include stocks that have fallen the most in price, while others prefer to include stocks that have the biggest percentage price drop. It’s important to know the difference between these two types of price drops in order to create the best stock screener for your needs.

Stocks that are trading near 52 week lows

If you’re looking for the next big thing in investing, you can’t go wrong with a stock that is trading near its 52-week low. This is a sign that a stock has hit rock bottom, which means that it’s likely to start rising in price soon. Typically, you want to include stocks that are trading at or below their 52-week low in your stock screener. This will ensure that you’re only including stocks that have hit rock bottom and are likely to start rising in price soon. You can also choose to filter for stocks that are currently trading at their lowest price in the last year. This will ensure that you only include stocks that have hit rock bottom and are likely to start rising in price soon.

Filters for fundamental criteria

The best stock screener can help you find stocks that meet your risk tolerance and investment objectives. There are many fundamental criteria that can help you narrow down your search to only those stocks that are right for you. Some of the most common fundamental criteria that you can filter for in your stock screener include:

Filters for technical analysis

Even though fundamental criteria are important, you can’t discount technical analysis when screen for stocks. Technical analysis can help you determine if a stock is a buy or a sell, even if the fundamentals are great. Most stock screeners allow you to filter for technical analysis, but they may be limited in what criteria they offer. If you want to include stocks that meet your risk tolerance and investment objectives, but you also want to include stocks that are currently overbought or oversold, you’ll want to use a stock screener that offers a wide range of technical analysis indicators. Some of the most common technical analysis indicators that you can filter for in your stock screener include:

Summing up

As you can see, there are many ways to create the best stock screener to meet your needs. It all comes down to selecting the right criteria and ensuring that the screener includes stocks that meet your individual investment objectives. There are many advantages to investing in individual stocks. Not only do you get to pick and choose exactly what companies you want to invest in, but you also get the opportunity to earn above-average returns. However, in order to succeed in this type of investing, you need to be smart about which stocks you choose.

Conclusion

A stock screener can help you find the best stocks for your portfolio, based on your specific needs and preferences. There are many different stock screeners available online, but not all of them will be useful for you. Here are some of the best stock screeners for investors. If you’re interested in investing in the stock market, it’s essential that you find the right stocks for your portfolio. A stock screener can help you do just that by filtering out the stocks that don’t meet your criteria. There are many different stock screeners available online, but not all of them will be useful for you. These are some of the best stock screeners for investors.