A watchlist is a tool that stock traders use to track the performance of a security or securities. A watchlist can be created for any exchange-traded security, including stocks, bonds, options, futures, and exchange-traded funds (ETFs). The purpose of watchlist stocks is to help traders make informed decisions about when to buy, sell your best stocks, or hold a security. You can also use a watchlist to track the performance of a portfolio or benchmark.

When it comes to stock trading, one of the most important things you can do is create a practical watchlist. A watchlist is a list of stocks you monitor for potential trades. Creating a watchlist is a critical step in your overall trading strategy.

There are several factors you need to consider when creating your own watchlist. This article will discuss the most important factors to keep in mind when creating a watchlist of stocks. We will also provide a step-by-step guide on how to create an effective watchlist.

What Is a Watchlist?

A watchlist is a list of securities, such as stocks, bonds, or commodities, closely monitored by investors. It could be because they are considering buying or selling the security or because they want to stay up-to-date on its performance. Stock watchlists can be created by individual investors or by financial firms.

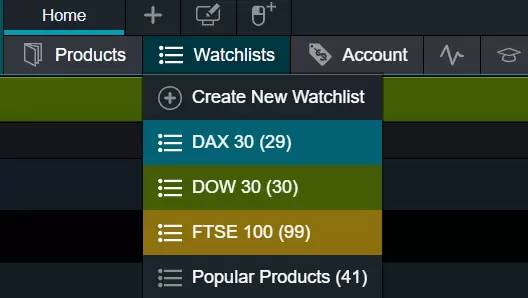

You can set up watchlists on most trading platforms for financial securities users are interested in. Users can create up to fifteen watchlists with 50 symbols each on the online trading platform Fidelity. User can also configure their list to alert them to new trading signals. Investors can use this functionality to create their own watchlists for bonds, stocks, mutual funds, or any other tradable asset.

Cryptocurrency trading also uses watchlists, where sharp price swings can increase profits briefly. Additionally, a watchlist may track tokens launching their main nets or forking.

Stock watchlist

Watchlists for stocks are standard among traders. Many fundamental factors impact the share market, causing dramatic shifts in share prices and opening up trading opportunities. A company analysis should include economic announcements, account earnings reports, and political events. Around the world, it is also the most liquid and popular stock market.

Why are watchlists important?

Watchlists are one of the essential tools that stock traders can use to improve their trading. Watchlists are a list of stocks you’re interested in buying or selling, and they’re often used to track the performance of different stocks over time.

Watchlists can help you avoid making poor trades by watching potential opportunities before they become so apparent that it’s too late. They also help you keep an eye on your overall portfolio and ensure you’re well-positioned for potential market shifts.

Why use watchlists?

You can use investing watchlists for many reasons. The following are five common reasons you might want to consider watchlists.

- The stock you want to add to your portfolio is climbing in price, so you’re waiting for it to drop.

- An ETF has made you money, but it is getting close to your sell target.

- An option may be good if you watch a stock’s trading pattern.

- If you decide that the volatility makes a particular stock too risky for you, you may choose to sell it.

- You should feel well-prepared to make a well-informed decision as soon as the time is right.

How to create a stock watch list?

Create an account and learn how to build your stock watchlist using the platform. Create a new watchlist by clicking the ‘Watchlists’ tab at the top.

A new window will appear with your watchlist. It is possible to customize the settings by changing the table format, color, and name to how you wish to view the data. A classic table, a trading chart, or buy-and-sell quotes are all options to choose from when considering your selected stocks.

The Product Library is where you can add shares to a watchlist. Select ‘Add to Watchlist’ from the right-click menu. In addition to shares, you can also trade ETFs if you want to trade similar products.

Top stock watchlist

Avenue Therapeutics, Inc. (NASDAQ: ATXI):

Avenue Therapeutics is a specialty pharmaceutical company that has developed IV tramadol. This alternative medication may reduce the use of opioids in the U.S. by reducing the use of conventional opioids for patients suffering from acute pain. It was founded by Fortress Biotech, Inc. and is headquartered in New York City.

In Wednesday’s trading, Avenue Therapeutics Inc. (NASDAQ: ATXI) was valued at $3.18 after falling -12.88% from its previous day’s close. The stock closed at $3.65 in the last trading session. It moved within a range of $3.02 and $3.53.

ATXI has had a beta value of 1.00 over the past five years. According to its 52-week performance, the high was $27.75, and the low was $2.29. The stock moved -5.53% over a month ago.

Snow Lake Resources Ltd. (NASDAQ: LITM)

The Korean multinational LG announced a partnership with tiny Snow Lake on September 23 (LGES: KRX 373220). In response to the news, LITM spiked more than 60% and might have risen even higher had it not been for some bad news later in the day…

When market close approached, Snow Lake announced it was no longer compliant with Nasdaq regulations – although it had already been notified a couple of days earlier. The company also registered to sell 10 million shares, diluting the current float of 7.38 million shares by 135%.

Despite all the gains made on September 23, LITM lost many of them. A group of shareholders filed an emergency injunction to avoid further declines in the stock price. As a result of a court order on September 29, no new offerings will take place before October 27.

As a result, the stock has begun to recover. It wouldn’t be too safe to trust it. In any case, Snow Lake should have some big days ahead if its projections match reality even slightly.

Spero Therapeutics Inc. (NASDAQ: SPRO)

Spero Therapeutics (NASDAQ: SPRO) has experienced several positive developments in its pre-market session. As part of an exclusive licensing agreement with GSK, Tebipenem HBr, the former’s antibiotic candidate, was licensed exclusively.

With this medication, you can treat a complex urinary tract infection in the later stages of development. Boosting GSK’s late-stage pipeline is made easier by the agreement.

PSRO ran a great race on September 22. It was the day of the company’s agreement with GlaxoSmithKline plc (NYSE: GSK). GSK acquired SPRO’s pipeline drug. In addition to $66 million in cash, the deal includes $525 million in potential payouts. Market reaction was immediate. In the early hours of the day, SPRO spiked by 300%.

SOBR Safe, Inc. (NASDAQ: SOBR):

Sobri Safe, Inc. develops, markets, and sells alcohol-sensing systems with ignition interlocks. SOBR, which measures the amount of ethanol in sweat, is a device developed by this company. It detects alcohol in the body by measuring ethanol levels in the body’s perspiration. With its headquarters in Greenwood Village, Colorado, the company was founded on July 4, 2004.

The SOBR was the star of September. September 20 was the day when it made a 300% increase, and it continued into October. An unnamed government report caused the 300% spike …

According to the report, a significant revenue stream may soon come from SOBR’s exciting technology. The SOBR reached a high of $4.20 before it ended. A government contract is always a catalyst for economic growth.

However, SOBR’s massive move might have sparked the hottest sector of late. SOBR has developed three touch-based methods for detecting alcohol. A product of this kind was even unveiled in August.

Conclusion

In conclusion, an effective watchlist for stocks should include a variety of stocks from different sectors. It will help to diversify your portfolio and protect you from the risk of a sudden drop in the stock market. Following a well-rounded and diversified watchlist is one of the most brilliant things you can do as an investor.