Golden stocks are a type of investment that rely on holding companies and financial firms. These stocks are known for being reliable, as they typically have high returns rates and solid track records. Furthermore, many golden stock portfolios also have low levels of risk, making them an attractive option for investors who are looking to minimize their exposure to risk.

Given their combination of stability and profitability, it is no surprise that golden stock portfolios are often the go-to choice for those seeking long-term growth in the financial market. Indeed, these investments have proven over time to be a wise choice for both novice and experienced investors alike.

What are the best Gold Stocks?

In recent years, gold has emerged as one of the most popular commodities on the market. Not only is gold a highly sought-after element that holds substantial value, but its relatively low price volatility makes it an attractive investment option for many investors. As such, gold stocks have become extremely popular among investors looking to tap into the gold market.

There are many different gold stocks to choose from, but in my opinion, the gold stocks best are those from top gold mining stocks companies and other gold producers. These best gold companies have established reputations as reliable and trusted providers of quality gold products that stand up to rigorous industry standards.

Additionally, gold stock prices tend to be more stable than those for smaller miners or exploration firms, making these companies ideal for investors seeking a more stable long-term investment strategy. Regardless of your preferred approach to investing in gold stocks, there is sure to be a company that meets your specific needs. So if you’re looking for the best returns on your investment, look no further than the top gold stocks on today’s market.

What are the best gold royalty stocks?

When it comes to investing in gold royalty stocks, there are a number of factors to consider.

- First and foremost, it is important to look for companies with an established track record and solid reputation.

- Another key consideration is the rate at which the company pays out royalties, as well as whether or not it has significant assets on hand.

- Finally, it is also important to carefully evaluate the financial stability of each company in question, looking for signs of strong cash flow and minimal debt.

Overall, some of the best gold royalty stocks include

- Royal Gold,

- Franco-Nevada, and

- Wheaton Precious Metals Corp.

With proven track records and strong market positions, these companies offer investors a wealth of opportunities when it comes to investing in gold royalty stocks.

What is a good gold stock to buy?

When it comes to investing in stocks, there are few commodities as lucrative or as valuable as gold. Gold has long been regarded as a safe investment option that is impervious to the caprices of the market, making it an ideal choice for any portfolio. But with so many different gold stocks available on the market today, it can be difficult to know where to begin. Here are five good gold stocks to buy now that are sure to bring solid returns:

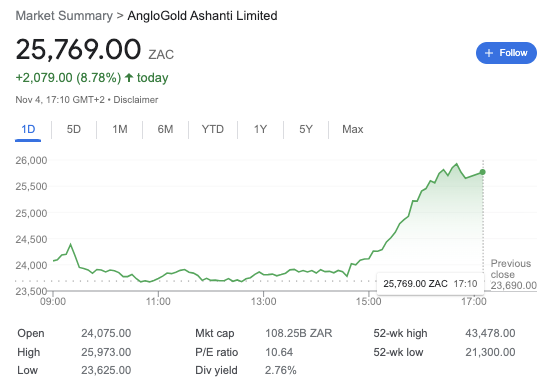

AngloGold Ashanti: This multinational company has a global reputation for excellence in the precious metals industry, and its stock is widely seen as one of the best opportunities for investors seeking long-term growth.

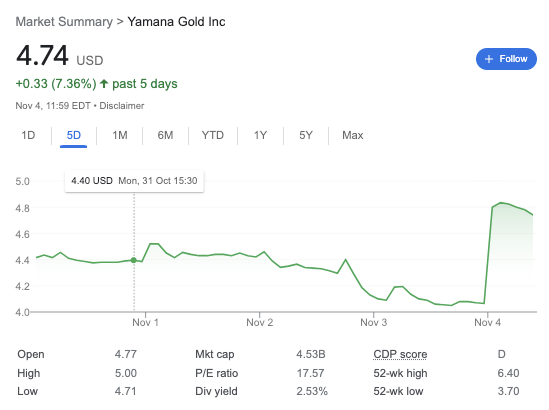

Yamana Gold Inc.: With diverse mining operations across North and South America, this well-established company offers stability and steady returns for investors looking to make a long-term play on gold.

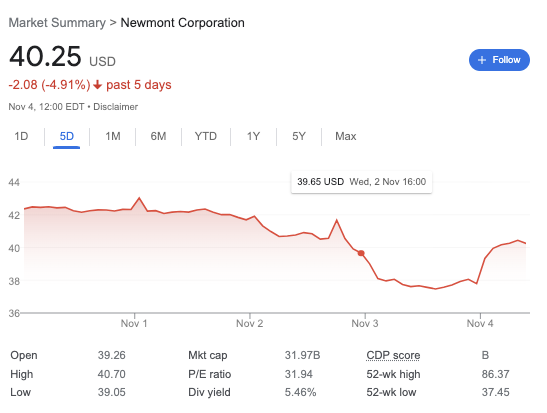

Newmont Mining Corporation: This large-scale mining company operates worldwide and offers exposure to established mines that produce high-quality gold ore at a steady pace.

Kinross Gold Corp.: With diversified holdings around the world, Kinross is widely seen as one of the most promising junior mining companies in operation today.

Randgold Resources Ltd.: This small but rapidly growing mining firm offers unique exposure to significant exploration opportunities that could lead to big payoffs down the line. Overall, these five stocks represent excellent choices for any investor interested in getting in on the ground floor of something big in gold stock investing. With careful research and strategic planning, they have enormous potential to deliver solid returns over time. So if you’re looking for stable investments with great upside potential, these five gold stocks are definitely worth considering today!

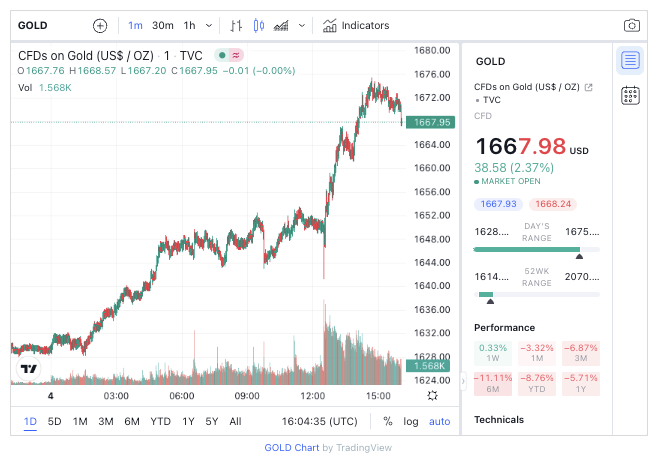

Gold Stocks Chart

Gold stocks are an attractive investment option for those looking to diversify their portfolio. These stocks are associated with the physical commodity of gold, and as such, they tend to be more volatile than conventional equity investments. However, this volatility can also offer investors the opportunity for substantial gains in a relatively short period of time. To evaluate the performance of a given gold stock, it is important to take a close look at its historical Gold price chart.

This will allow you to identify patterns and trends, giving you valuable insights into both current and future market performance. Additionally, paying close attention to the price chart will help you determine when it might be a good idea to buy or sell your position in that stock. With the right knowledge and careful analysis, investing in gold stocks can be an exciting way to build wealth and diversify your portfolio.