Are you looking for ways to invest in real estate? If so, then you should consider buying shares of a REIT. A REIT, or real estate investment trust, is a company that owns and operates income-producing real estate. There are many different types of REITs, including residential, commercial, retail, industrial, and healthcare. In this blog post, we will discuss the 12 best REIT stocks to buy right now!

If you’re looking for a way to buy the best stocks and to invest in real estate without having to deal with the hassle of being a landlord, then buying REIT shares is a great option. When you buy REIT shares, you are essentially purchasing a stake in a company that owns and operates income-producing real estate. Best of all, you can purchase REIT shares on the stock market just like you would any other type of stock!

What are Real Estate Investment Trusts?

Real estate investment trusts, or REITs, are a specialised form of investing in real estate. Unlike other investments in this area, which focus on buying and selling individual properties, REITs are structured as investment funds that pool money together from investors. These funds then purchase or develop properties that are leased out to tenants, generating income from rent payments.

Because these investments require less initial capital than traditional real estate ventures, they can be an attractive option for individuals and organisations looking for ways to make smart investments in the property market. Additionally, many REITs also offer opportunities for diversifying one’s holdings, as some specialise in different types of properties or geographical areas. Overall, real estate investment trusts are a flexible and powerful tool for achieving financial success through real estate.

Read also: Understanding the Importance of Location when Investing in Real Estate.

How to Invest in Reit?

When considering how to invest in REITs, there are a few key things to keep in mind. The first is that equity REITs represent equity ownership of real estate, so they involve a level of risk and speculation that is not always present when investing in traditionally-secured financial products like bonds or fixed deposits. However, while equity REITs may be more volatile than these other investments, they also tend to offer higher long-term returns.

Read also: Your Ultimate Guide to Finding the Best Place to Invest in Real Estate.

The second factor to consider when investing in REITs is whether you want to pursue an alternative investment strategy or simply choose from the broader market of equity stocks. Alternative investments typically have less liquidity and more complex tax implications than equity REITS, so it is important to carefully research this area before making any decisions. Overall, though, it is clear that understanding the risks and benefits of investing in REITs can help to ensure that you make informed choices about your portfolio.

Read 13 Best Dividend Stocks to Buy Now.

How do REITs work?

REITs, or real estate investment trusts, are an important tool for investors looking to access the real estate market. Unlike traditional real estate investments, which require large amounts of capital and a high level of expertise, REITs make it possible for individuals with smaller sums of money to participate in this market. In addition, REITs provide investors with liquidity, as shares in these trusts can be sold on stock exchanges.

At their core, REITs are companies that own and operate income-generating properties. However, unlike traditional real estate firms that typically purchase and manage properties directly, REITs use pooled funds from investors to finance their holdings. This allows the trust to take greater advantage of scale by acquiring larger properties and portfolios than a single investor could achieve on their own. Once they have acquired a property or portfolio, the trust manages it according to its mandate and distributes a portion of its earnings back to investors each year. By doing so, it provides investors with a steady stream of income and the potential for capital appreciation over time. Overall, REITs offer many unique benefits for both individual and institutional investors alike.

Read also this FintechZoom related article: Essential Points to Consider When Buying Real Estate in Raleigh, NC.

What kind of REITs are?

REITs, or real estate investment trusts, are special kinds of investments that allow individual investors to purchase shares in a wide range of real estate projects. Unlike traditional real estate holdings, which involve investing directly in a specific property like an apartment building or office tower, REITs provide investors with access to a broad range of properties without being tied down to any one particular investment.

Read also: Diversifying Your Portfolio With Real Estate Investment Trusts.

As such, they can be an excellent choice for investors who want to diversify their portfolios and gain exposure to the real estate sector without having to manage the day-to-day operations of a property themselves.

Additionally, because REITs are required by law to distribute at least 90% of their earnings among shareholders as dividends, they can be a highly profitable choice as well. In all, REITs represent a powerful tool for both professional and individual investors looking to tap into the power of real estate markets.

Read also: The Best Fixed-Income Investments You Should Make Now.

Best Real Estate Stocks

So, without further ado, here are the best REIT stocks to buy right now:

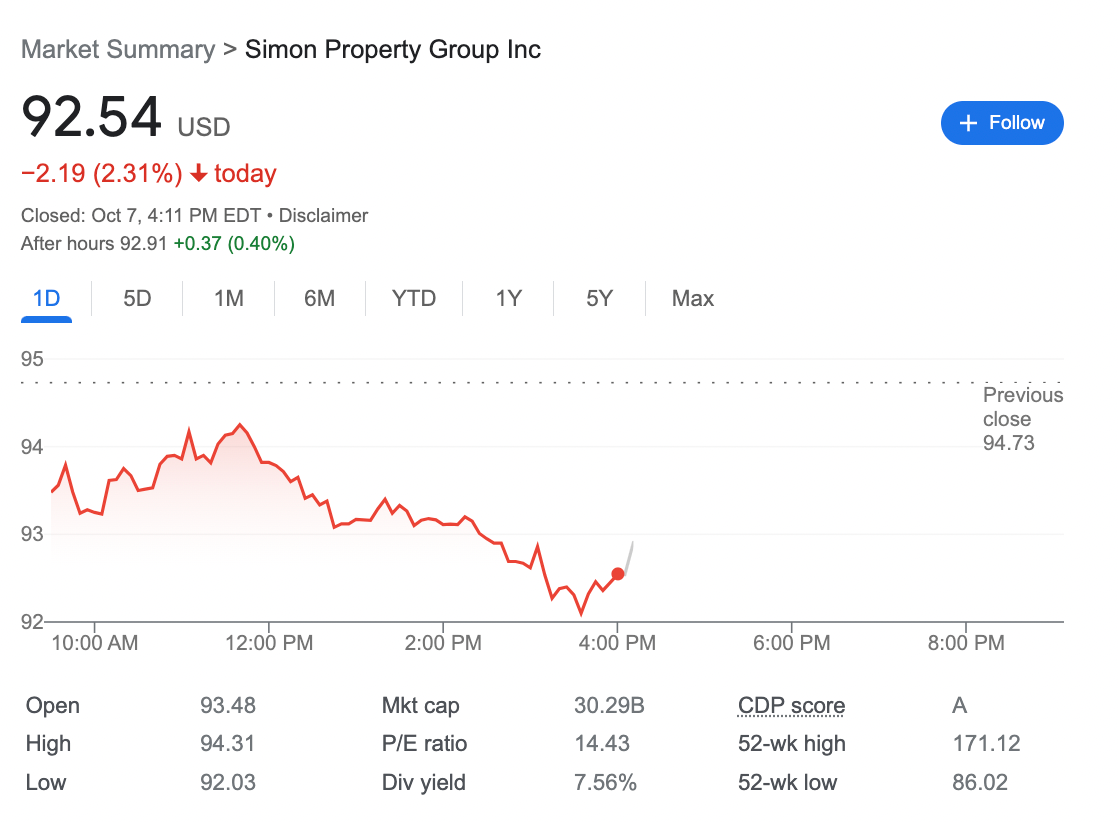

1. Simon Property Group (SPG)

Simon Property Group is a large-cap REIT that owns and operates over 200 malls across the United States. SPG has been one of the best-performing REITs over the past decade, and its shares currently trade at around $160.

Read this FintechZoom article: The Ultimate Guide: How to Get Loan for Investment Property?

Simon Property Group (SPG) is an investment firm that specializes in real estate. With over 40 years of experience, SPG has become one of the world’s leading property developers, having acquired and leased millions of square feet of retail space in some of the most sought-after locations across the globe.

On the positive side, investors might be drawn to SPG because it provides diversification benefits. Unlike other companies which focus primarily on one asset class, such as stocks or bonds, SPG puts money into a wide variety of real estate projects, including commercial and residential buildings, hotels and resorts, shopping malls, and industrial properties. This offers investors more flexibility and less concentration risk compared to investing directly in any one real estate venture.

However, there are also drawbacks to investing in SPG. One issue is that the company does not have a very long track record. While it has been successful for many years now, its history only goes back about 15 years or so. This makes it difficult for investors to gauge how well SPG will perform over time and potentially leaves them exposed to unforeseen risks or market changes that may adversely impact the company’s profitability or financial stability in the future. Additionally, given the very specific nature of their business model — focusing primarily on acquiring revenue generating properties — SPG may face greater market volatility than other investments due to changing consumer trends and ever-changing market conditions. As a result, prospective investors should weigh these pros and cons carefully before deciding whether or not to invest in Simon Property Group.

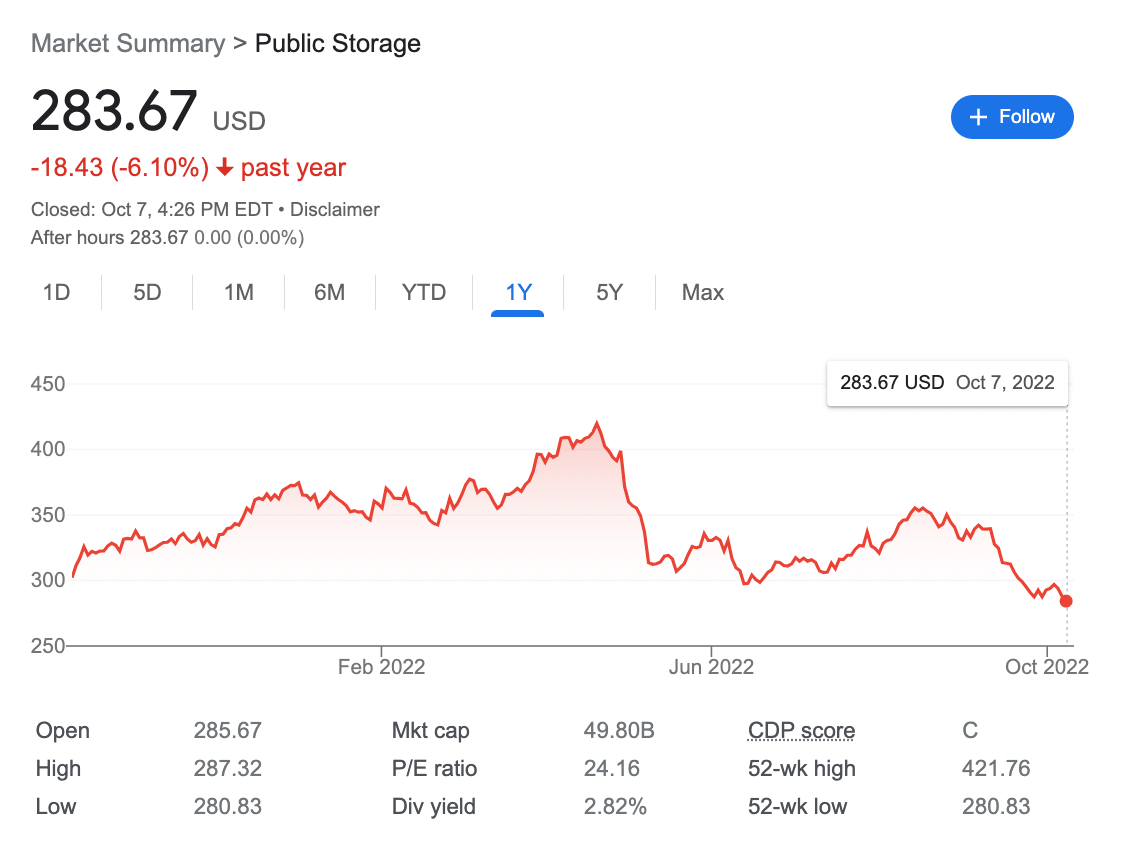

2. Public Storage (PSA)

Public Storage is a self-storage REIT that owns and operates over 2000 storage facilities across the United States. PSA has been one of the most consistent performers in the REIT space, and its shares currently trade at around $200.

Investing in Public Storage is a great way to diversify your portfolio and gain exposure to the real estate market. The company has a solid track record of consistent performance, with revenue growing steadily year after year. Furthermore, Public Storage offers many potential benefits for investors, including high dividends and the potential for price appreciation over time.

However, investing in Public Storage also comes with some drawbacks. For one thing, this is a relatively large company that may not be able to grow as quickly or aggressively as smaller rivals in the sector. Additionally, Public Storage is heavily reliant on the economic cycle and can be negatively impacted by economic downturns or increased interest rates. Despite these potential risks, however, Public Storage remains an attractive option for investors looking to access the real estate market. With careful research and strategic trading decisions, it can be a rewarding investment choice overall.

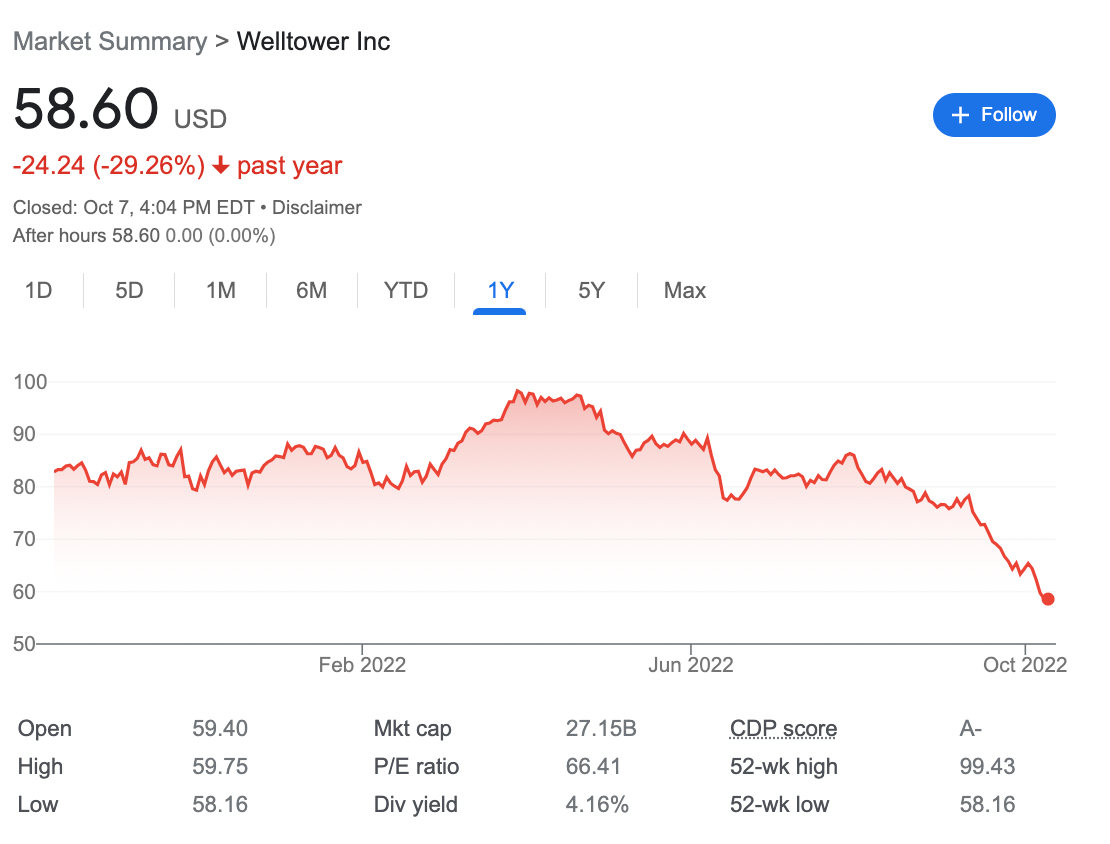

3. Welltower (WELL)

Investing in real estate can be a great way to diversify your portfolio and generate steady returns over time. One real estate company that has been gaining a lot of attention recently is Welltower, also known as WELL.

This real estate investment trust (REIT) specializes in senior housing and healthcare properties, offering investors the opportunity to tap into America’s growing aging population.

On the one hand, there are many benefits to investing in real estate companies like Welltower. For one thing, real estate typically provides a stable and reliable income stream thanks to its fixed nature and long-term leases with tenants such as hospitals and nursing homes.

Furthermore, real estate can also offer relatively high returns when compared to other asset classes like stocks or bonds, making it an attractive option for those looking to grow their portfolio over time.

On the other hand, there are also some potential risks associated with investing in real estate companies like Welltower. For one thing, the rental market is cyclical and real estate REITs are sensitive to downturns in the economy and changes in interest rates.

Additionally, real estate companies can also be impacted by weather events or other unforeseen disasters that can cause damage or destruction to their properties. Overall though, Welltower remains a solid choice for investors seeking exposure to profitable real estate investments.

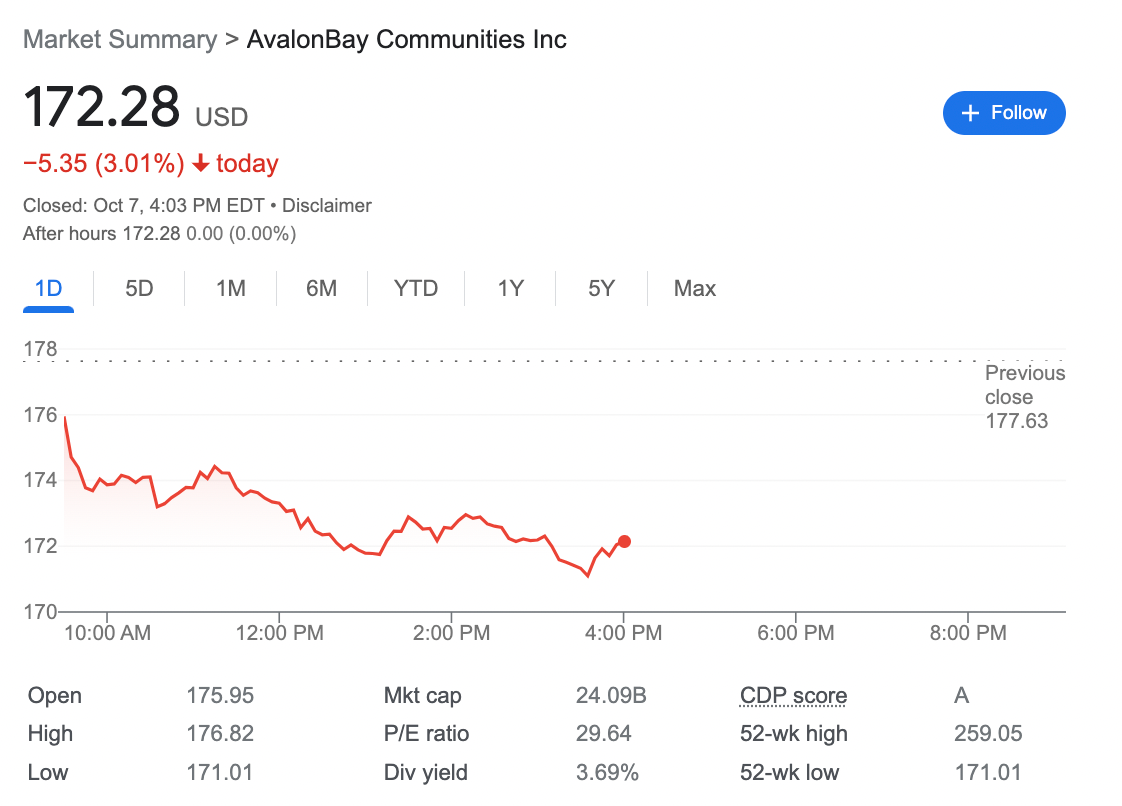

4. AvalonBay Communities (AVB)

AvalonBay Communities is a residential REIT that owns and operates over 200 apartment communities across the United States. AVB shares currently trade at around $170, and the company has a strong dividend yield of nearly three percent.

AvalonBay Communities is a real estate investment trust (REIT) that has become a major player in the real estate market over the last several decades. With apartment buildings spread across numerous states, AVB specializes in acquiring, developing, and managing desirable real estate properties. As such, it has received high praise for both its real estate acumen and consistent ability to generate strong returns for investors.

However, there are also some potential drawbacks to investing in AvalonBay. One concern that is often cited by analysts is the company’s heavy reliance on realty income, which means that it is vulnerable to changes in interest rates or real estate market conditions.

Furthermore, critics argue that AVB tends to raise rents excessively, which can upset tenants and drive down occupancy rates. Ultimately, whether or not investing in AvalonBay makes sense will depend on your personal risk tolerance and investment goals. But if you’re looking for a real estate investment with solid potential returns and low downside risks, then it might be worth considering this REIT as an option.

5. Equity Residential (EQR)

Equity Residential is a residential REIT that owns and operates over 300 apartment communities across the United States. EQR shares currently trade at around $70, and the company has a strong dividend yield of nearly three percent.

Investing in commercial real estate can be a lucrative and exciting opportunity, but there are a number of factors to consider before deciding to invest in Equity Residential (EQR). On the one hand, EQR’s commercial properties are located across the US, offering investors access to valuable real estate assets in some of the country’s biggest markets. Additionally, as one of the largest commercial property companies in America, EQR has a proven track record of success and has consistently generated positive returns over the years.

However, investing in commercial real estate also comes with certain challenges. For one thing, these properties can be expensive and difficult to maintain or manage. In addition, commercial real estate investments are often tied up for longer periods of time than residential investments and may result in greater uncertainty or volatility over time. Ultimately, it is important to weigh both the pros and cons when considering whether or not to invest in commercial property via EQR. Overall, though, it is clear that this company holds great potential for those who understand its unique strengths and weaknesses as an investment opportunity.

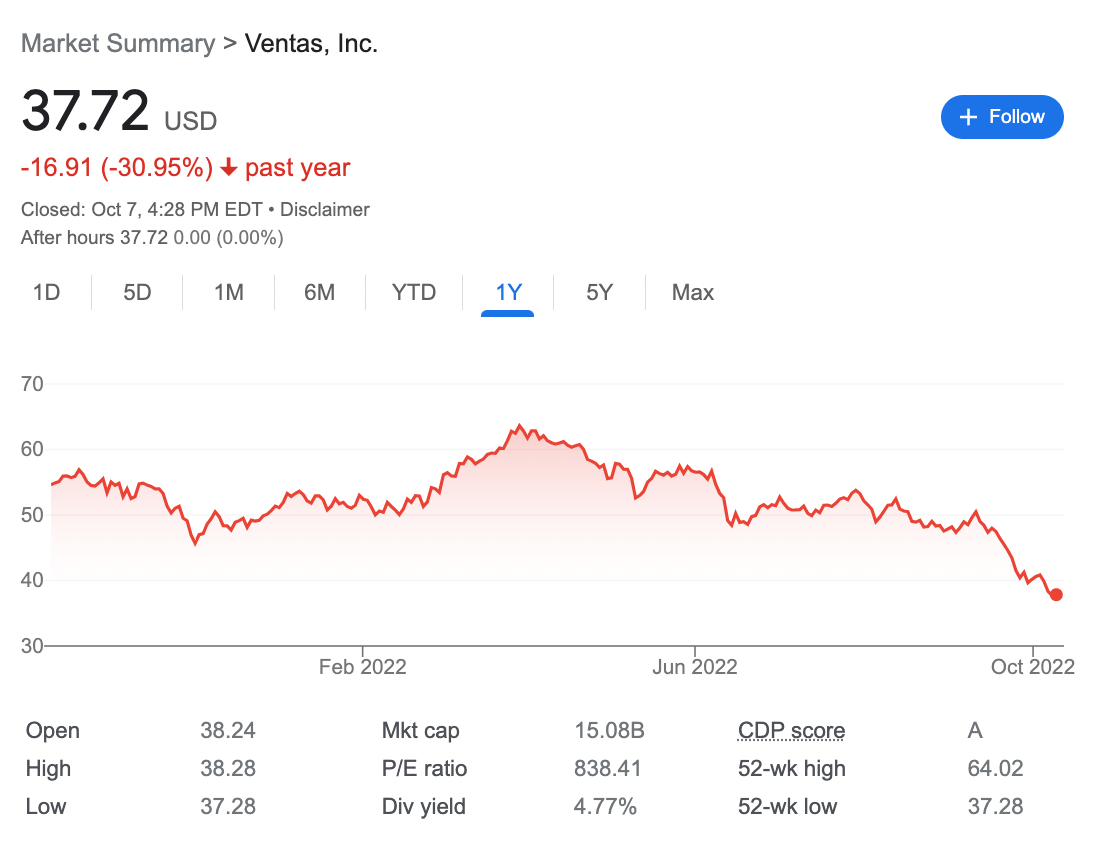

6. Ventas (VTR)

Ventas is a healthcare REIT that owns and operates over 1600 senior housing and healthcare facilities across the United States. VTR shares currently trade at around $60, and the company has a strong dividend yield of nearly five percent.

Invest Ventas (VTR) is a real estate investment trust that specializes in property management and real estate development. As such, VTR has both advantages and disadvantages compared to other realty companies.

On the one hand, VTR’s real estate expertise gives it an edge when it comes to locating optimal properties for development and maintaining high standards of building quality. Additionally, VTR’s well-established reputation within the real estate industry helps to attract investors and ensures that its properties are managed smoothly and efficiently.

On the other hand, VTR can be seen as a less risky investment option than its competitors due to its steady income stream from rental agreements with tenants. This stability also means that VTR is not able to invest heavily in real estate projects like some of its competitors, which may limit its ability to grow or adapt over time.

Ultimately, whether investing in VTR is right for you will depend on your individual financial situation, risk tolerance levels, and investment goals. However, given VTR’s track record of success in realty management, it is likely worth considering as part of your overall portfolio.

7. Wells Fargo (WFC)

Wells Fargo is a large bank that owns and operates over 6000 branches across the United States. WFC shares currently trade at around $50, and the company has a strong dividend yield of nearly three percent.

Whether you are an experienced investor or just starting out, there are many reasons to consider investing in Wells Fargo (WFC). First, WFC is a real estate investment trust with a market capitalization of nearly $250 billion, making it one of the largest realty income corps on the market.

In addition to its scale, WFC offers investors a diverse range of real estate options, from residential buildings and retail space to office parks and industrial warehouses. This makes it easy for investors to choose investments that fit their specific real estate needs.

There are also some potential downsides to investing in WFC. For one, it is a very popular stock that is often included in real estate ETFs and mutual funds, so individual investors may have trouble attaining substantial positions without paying high trading fees.

Additionally, while real estate prices tend to be relatively stable compared to other types of investments such as stocks or bonds, they are still susceptible to fluctuations during economic downturns or unexpected changes in interest rates. Despite these challenges, however, WFC remains a solid choice for real estate investors who want reliable returns backed by real asset value.

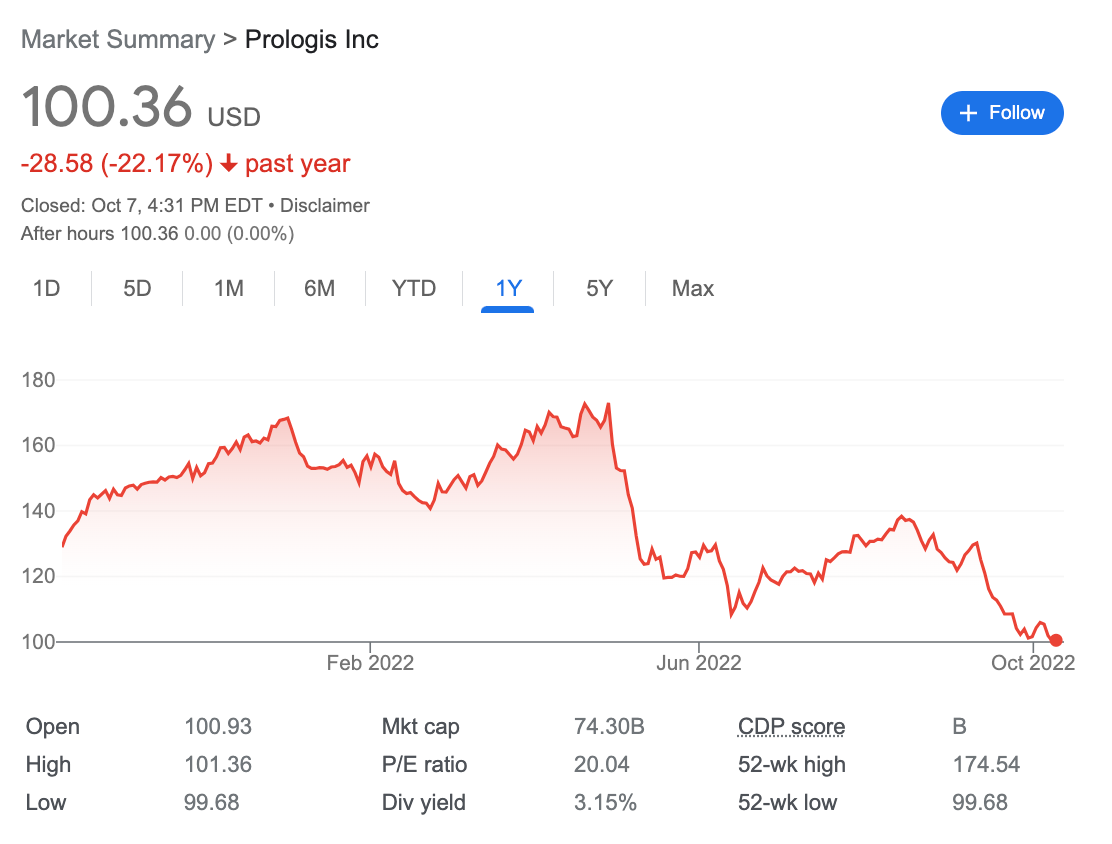

8. Prologis (PLD)

Prologis is an industrial REIT that owns and operates over 500 million square feet of industrial space across the United States. PLD shares currently trade at around $100, and the company has a strong dividend yield of nearly four percent.

Investing in real estate can be a great way to generate significant returns over time. Realty income Corp is one such investment opportunity that many investors find attractive, due to its proven track record and stability. Reit ETFs, which allow you to invest in the real estate sector in a convenient and diversified manner, are also popular choices for those looking to grow their wealth through real estate.

However, it is important to weigh the pros and cons of any investment before making a decision. For example, investing in Prologis (PLD) comes with certain risks and potential downsides that should be considered carefully.

On the plus side, this realty corporation has an excellent track record of performance and strong annual cash flows. However, it can be difficult to accurately price PLD stocks since these shares are traded on a less liquid exchange than larger securities.

Additionally, investing in real estate always involves some level of risk related to fluctuating property values and economic downturns. Ultimately, the right choice will depend on your individual investment strategy and personal preferences. Regardless of whether or not you ultimately decide to invest in Prologis (PLD), it is essential to always do your research, evaluate all available options, and make informed decisions based on your unique needs and goals.

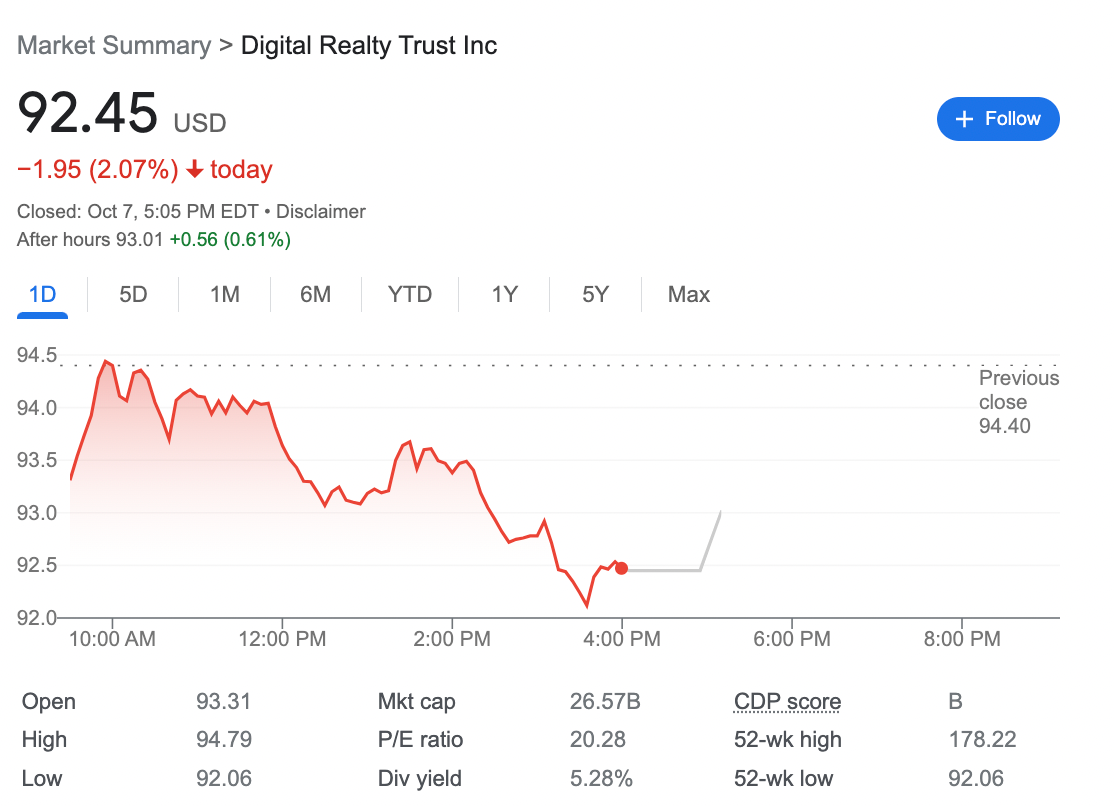

9. Digital Realty Trust (DLR)

Digital Realty Trust is a data center REIT that owns and operates over 200 data centers across the United States. DLR shares currently trade at around $140, and the company has a strong dividend yield of nearly four percent.

If you’re looking for a stable and high-performing investment, then you may want to consider investing in Digital Realty Trust (DLR). DLR is a real estate investment trust that specializes in acquiring and managing properties used for cloud computing and telecommunications. The company has a long track record of growing its real estate portfolio through strategic acquisitions, which has resulted in consistently high returns for investors.

Additionally, DLR offers taxable income to investors, thanks to its status as a real estate investment trust. On the other hand, investing in DLR does come with some risks, as the value of real estate can be volatile and impacted by economic conditions.

Moreover, because this is an ETF rather than individual stocks, investors may not have as much control over their portfolio as they might prefer. Ultimately, whether or not DLR is right for you will depend on your individual financial situation and risk tolerance.

But if you have some savings that you are looking to invest in a secure way, then this REIT ETF could be a solid option worth considering.

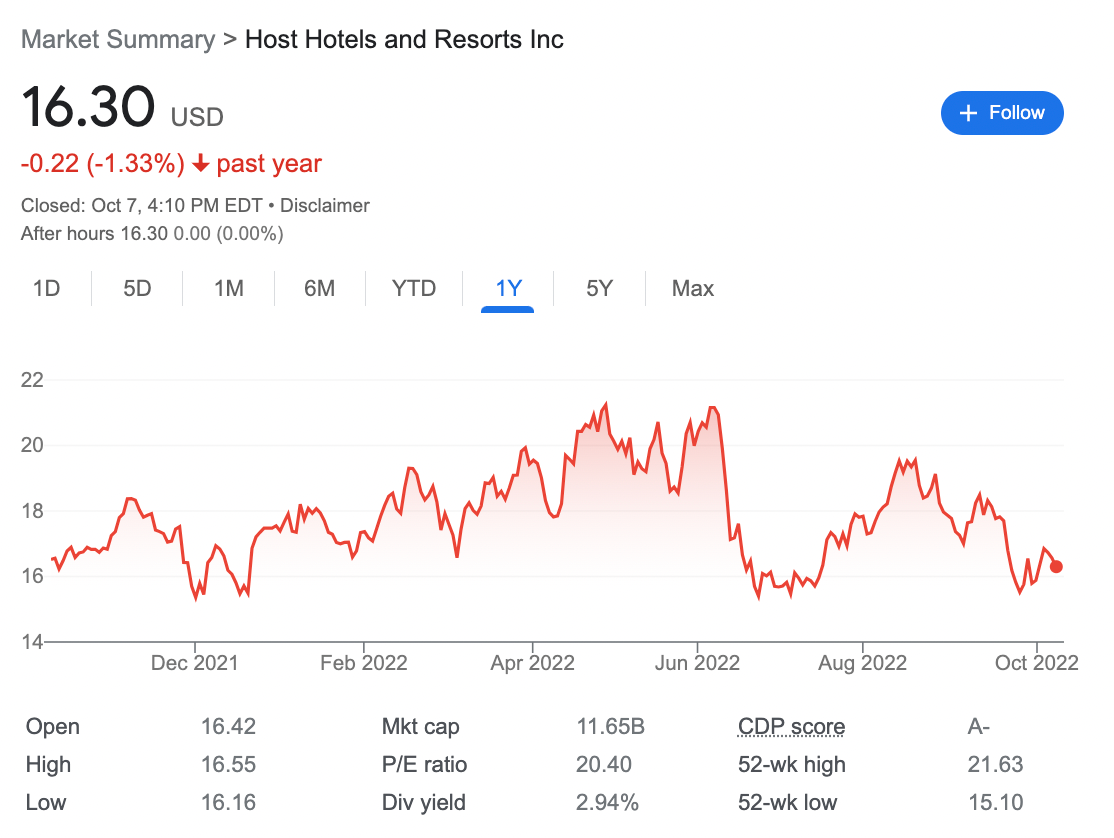

10. Host Hotels & Resorts (HST)

Host Hotels & Resorts is a hotel REIT that owns and operates over 100 hotels across the United States. HST shares currently trade at around $20, and the company has a strong dividend yield of nearly six percent.

Investing in Host Hotels & Resorts can be a lucrative choice, as it offers numerous benefits to both investors and companies. For investors, this stock can help to diversify their portfolios, minimize risk, and increase returns.

For companies, investing in HST can provide much-needed capital for expansion or other projects. Additionally, this financial arrangement also gives businesses access to other real estate stocks that may not otherwise be available for purchase.

However, there are some potential downsides to investing in HST. For one thing, the nature of real estate means that values fluctuate over time, which can pose risks to investors’ portfolios.

Secondly, the costs involved with managing real estate investments can be quite high and may eat into potential returns. Overall, whether or not investing in Host Hotels & Resorts is the right choice will depend on individual needs and preferences as well as market conditions.

Nevertheless, for those who are able to navigate these risks successfully, this investment could prove highly profitable in the long run.

11. Vanguard Real Estate ETF

Vanguard Real Estate ETF is an investment tool designed to help investors gain exposure to a broad range of real estate assets. As one of the largest and most well-established players in the real estate investing space, Vanguard has a deep understanding of the market and the complex dynamics that influence it.

By investing in Vanguard Real Estate ETF, investors can benefit from exposure to both traditional commercial properties such as office buildings and apartments, as well as more specialized areas like residential mortgage-backed securities and timberlands.

Additionally, Vanguard’s rigorous focus on risk management ensures that investors are protected against downside risk while also still being able to capitalize on gains during upswings in the market. Overall, Vanguard Real Estate ETF is a smart choice for anyone looking to invest in real estate without having to make complex or time-consuming decisions.

12. Schwab U.S. REIT ETFs

The Schwab U.S. REIT ETF is one of the most popular investment options for people looking to gain exposure to the real estate market. As a REIT, or real estate investment trust, this fund owns a diversified portfolio of highly liquid real estate securities including bonds, stocks, and mortgages.

Unlike most other types of equity investments, the Schwab U.S. REIT ETF offers investors the opportunity to earn steady income by leveraging rental income streams from its underlying holdings. And with an annual fee of just 0.07%, this fund provides an attractive combination of low risk and high rewards that makes it an ideal choice for many passive investors.

So if you’re looking for a way to tap into the potential growth of the real estate market, look no further than the Schwab U.S. REIT ETF!

Conclusion

Investing in REITs is a great way to invest in real estate without having to deal with the hassle of being a landlord. And, as you can see from the list above, there are many great REITs to choose from! So, if you’re looking for a way to invest in real estate, be sure to consider buying REIT shares.

Do you have any favorite REIT stocks that we didn’t mention? Let us know in the comments below!