When buying the best stocks, most investors focus on finding companies with strong fundamentals trading at a fair price. However, another group of stocks offers investors an even better opportunity – discount stocks.

Discount stocks are companies trading at a significant discount to their intrinsic value. It could be for various reasons, including a recent sell-off, a change in the market landscape, or a generally misunderstood business model. However, the critical point is that these stocks offer investors the opportunity to buy a quality company at a bargain price.

The stock market is constantly changing, so staying on top of what’s happening worldwide is essential. That is why we’ve compiled a list of discount stocks trading at a discount that could move higher over the next year.

Read How to Profit from Volatility Markets: Expert Strategies.

What is a discount stock?

Discount stocks are stocks that have a discount on their intrinsic value. In other words, if you bought all the shares of a company at its current price and no one else had any of its stock, you would be able to buy out the rest of the market.

The difference between the stock’s market price and intrinsic value is called a discount. A Valuecom discount stock has a lower price-to-earnings ratio than the average company in its sector because it may sell for less than it can produce over time.

There are several discount stocks available in the market right now that have the potential to grow. [1] Grupo Aval Acciones y Valores SA (AVAL), Terran Orbital Corp. (LLAP), and Rackspace Technology Inc. (RXT) are some of the best cheap stocks to buy under $5. [2] BayCom Corp. (BCML) and Berry Corporation (BRY) are also good options to consider. However, before investing in any of these stocks, it is important to consult with a financial advisor and consider important factors such as P/E ratio, price-to-book value, cash flow, and earnings reports. It is also important to diversify investments to spread out risk. [3] Finding and investing in cheap stocks can be challenging due to low trading volume and the potential for lost opportunities. The CAN SLIM strategy may help investors find cheap stocks with good fundamental, technical, and fund ownership qualities. It is important to keep liquidity in mind and beware of price slippage. AudioEye (AEYE) is an example of a cheap stock that has shown market outperformance this year and operates as a web accessibility platform.

References:

[1] 9 Best Cheap Stocks to Buy Under $5 | Investing [2] 27 Best Cheap Stocks To Buy Now [3] Cheap Stocks To Buy: 5 Growth Stocks To Watch Right Now9 Best Cheap Stocks To Buy

The market is ready to take off again. After a few months of hibernation, it’s time to start reinvesting. But which stocks should you buy? And how can you find stocks trading to buy?

These are nine cheap stocks under $10 that you might want to consider if you’re looking for lower stocks priced investments. In a digital era, some of these picks are technology companies with growth potential that offer stable low-priced stocks and healthy dividends. In some cases, recent declines have made their bargains.

1. ADT (NYSE: ADT)

ADT Corporation (NYSE: ADT) is a leading global provider of security, fire, and life safety solutions for residential and commercial customers. The company’s portfolio includes home automation, security and fire protection systems, access control and safety cameras, fire protection products and services, and energy management systems. The most significant part of ADT’s market share is derived from its long-standing home security brand (ADT, $7.40).

The company’s business has evolved beyond alarm systems in recent years. In addition, it offers “smart home” and automation solutions. Wireless connectivity, fire detection, and video surveillance systems are a few of the systems that you can install.

ADT has developed consumer tastes and technology since it was founded in 1874. One of the most vital indicators of its efforts to remain relevant is its partnership with Alphabet in 2020 (GOOGL). In the current deal, Google invests $450 million in ADT, translating into a roughly 6% stake in the company. In the future, we may see further investments if things go well.

Ford Motor Company recently announced a partnership between ADT and Ford Motor to provide security and safety monitoring in the future. Its multisensor security sensors will be available early next year as part of a joint venture dubbed Canopy.

It proves that this isn’t a company that stands still. In fiscal 2021, ADT lost 25 cents per share on its top line. This year, ADT is projected to earn 61 cents per share. Revenue grew by about 20% due to the company’s impressive growth.

This stock has been volatile and is slightly down on the year, as are many other cheap stocks. Although ADT is down 24% from its summer lows, the stock appears to be heading into the end of the year strong due to improving fundamentals.

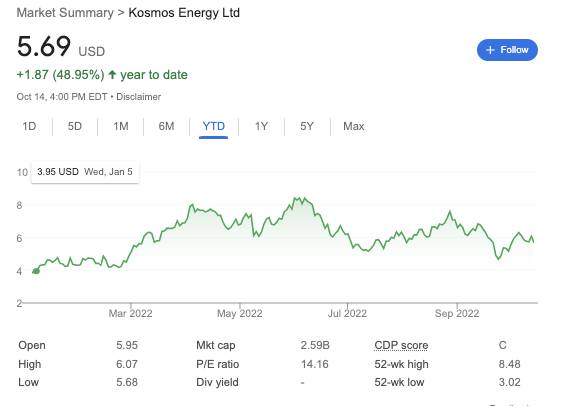

2. Kosmos Energy (NYSE: KOS)

Kosmos Energy is a global oil and gas exploration and production company. It operates in Australia, Brazil, Canada, China, Egypt, and Indonesia. A trading volume of 5.8 million remains 1.3 million below the average volume of 7.1 million over the past 50 days.

Oil and gas exploration firm Kosmos Energy (KOS, $7.1) operates in deep waters. Thanks to strong energy stock prices, the company had a good year. KOS can continue drilling at comfortable margins despite recent rollbacks in crude oil prices, a “new normal” for them.

There is a significant cost difference between drilling offshore and drilling on land, as you can imagine. The Dallas-based Kosmos Group operates on the Atlantic Ocean’s margins worldwide. Aside from operations off Ghana and Equatorial Guinea, Mauritania and Senegal, operations have also been conducted in the Gulf of Mexico.

In 2021, KOS posted a modest loss per share, but in this year’s projections, it will earn $1.05 per share. While crude oil prices have fallen sharply from summer highs, analysts still expect earnings per share of $1.42 in fiscal 2023. KOS has been displaying strong momentum as it enters the end of the year, despite some energy stocks losing steam recently.

There is a lot of risk associated with investing in energy – and cheap growth stocks – because energy prices can be volatile. Barclays and Berenberg raised Kosmos Energy’s analyst outlooks in August due to macroeconomic factors supporting the company’s cash flow.

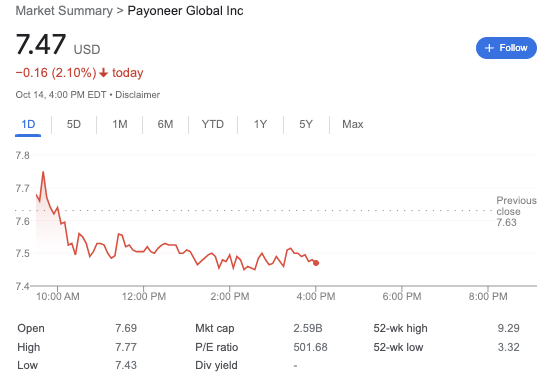

3. Payoneer Global (NASDAQ: PAYO)

Payoneer Global is a global payment and money transfer service headquartered in the United Kingdom. Payoneer offers customers a cardholder account and allows users to send money globally. Currently, the service is available in over 200 countries.

Payoneer Global has more than 120 million U.S. consumers each month. A cheap stock that stands out from the rest on this list is Payoneer Global (PAYO, $6.52). PAYO is a mid-sized technology solutions company that manages to make a small loss to invest in its growth. Additionally, connecting with new customers is projected to grow revenue by 20% this year.

PAYO’s business is booming in the digital age amid the widespread adoption of mobile and cashless transactions. PayPal Holdings PYPL is not a consumer-facing brand but focuses on B2B business. As a particular example, Payoneer’s technology can be used to make international payments, manage a digital business, or access capital to expand a business.

Despite the company’s 11.3% year-to-date decline, PAYO has enjoyed strong momentum these summer months. Despite hopes of a recovering global economy, fintech stocks have nearly doubled since their 52-week low in May.

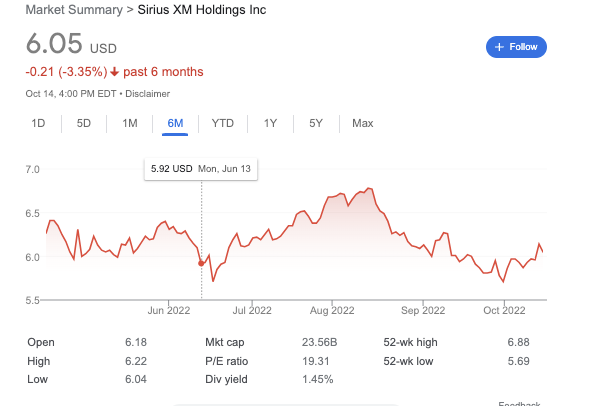

4. Sirius XM Holdings (NASDAQ: SIRI)

As one of North America’s leading audio entertainment providers, Sirius XM Holdings Inc. (NASDAQ: SIRI) is the premier provider of subscription audio and advertising-supported digital audio services and the leading programmer and platform for audio entertainment. There are more than 150 million subscribers to SiriusXM’s platforms across paid and free tiers, which makes SiriusXM North America’s largest provider of digital audio across music, talk, news, comedy, entertainment, and podcasts, with a combined audience of more than 150 million listeners.

Satellite radio provider Sirius XM Holdings (SIRI, $6.11) has demonstrated that despite all the disruptions caused by smartphones and streaming media, it is a stock with staying power that is likely to remain in the market for some time. There is no doubt that Siri is still relevant today when consumers are drowning in content options.

After the pandemic struck in 2020, the company hit a bit of a snag. It is because much of its business is based on the trials of novel models to reach out to new customers and develop its base. Any company’s bottom line suffers when there is a downturn in sales, accompanied by a higher cancellation rate as people stay home.

Sirius XM is doing pretty well these days, with over 34 million paying subscribers. It is an improvement compared to its 30 million paying subscribers at the beginning of 2020, but the company is still facing challenges. It shows that the station has clawed back its former listeners and grown its subscriber base over time.

Sirius is growing revenues and profits at a relatively modest rate. However, the margins are healthy, and Sirius expects to generate a free cash flow of more than $1.5 billion this year, which is an imposing result. The company can maintain its $2 billion stock buyback program and pay a decent dividend to investors of 1.4%.

There has been a little drop in the company’s stock price this year, but that is still a good accomplishment, particularly when considering market volatility and some consumer-focused companies. It is worth keeping an eye on SIRI for investors seeking cheap stocks.

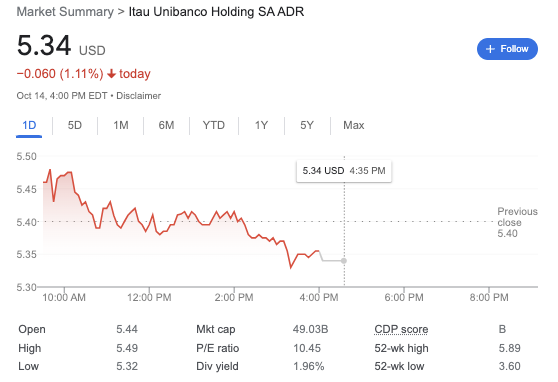

5. Itaú Unibanco (NYSE: ITUB)

A Brazilian central bank, Itau Unibanco, announced on Monday that it beat profit expectations and increased its loan growth forecast for this year despite increasing provisioning for bad loans due to higher interest rates in Brazil.

According to Refinitiv, Brazil’s most significant lender announced that recurring net profit for the second quarter was 7.67 billion reais ($1.50 billion), 17.4% higher than the second quarter regular net profit of 7.48 billion reais. The results surpassed analyst expectations of 7.48 billion reais.

Getting to the point, if you weren’t able to determine that from its name, Ita Bank (ITUB), the name of one of the companies on this list of cheap stocks under $10, is a tiny international bank that is listed. ITUB is a Brazilian central bank headquartered in Rio de Janeiro and part of the ITUB Group.

In addition to essential banking services such as savings accounts and credit cards, ITUB offers business banking solutions, mortgage loan services, and investment management services. These services are available in the region.

It was a rough business as Brazil’s economy struggled amid government scandals a few years ago. It wasn’t until late 2021 that the nation recovered from that upheaval after a pandemic hit.

Brazil’s economy appears to be back in gear, with the gross domestic product (GDP) growing faster than expected in the second quarter. Shares of this local bank have risen 40% in value for the year thus far.

The Brazilian economy is almost 25% larger than Mexico’s, the second-largest country in Latin America. Emerging markets stocks are risky bets, but Brazil is the most prominent Latin American economy. Investing in this cheap stock offers an excellent opportunity to take advantage of the long-term growth potential of this region, as it is one of the largest financial firms south of the border.

6. Yamana Gold (NYSE: AUY)

Yamana Gold Inc. (NYSE: AUY) has a market cap of $4.3 billion and pays its shareholders a 2.5% dividend yield. The company is of the largest gold producers in the world and is headquartered in Toronto, Canada, with operations in Argentina, Ghana, Indonesia, and Australia. It’s also the fifth-largest producer of gold in the world, behind Barrick Gold Corp.

There isn’t much complexity to Yamana (Gold, $4.51). Approximately 14 million ounces of gold and 111 million ounces of silver reserves make the Canadian company a direct precious metal player.

When inflation is out of control, there are numerous benefits to investing in a gold stock like this. Since AUY has huge underground reserves, it is unlikely to go out of business soon after these goods are brought to market.

Although there will be good and challenging times, it doesn’t mean that they won’t occur. The market can be volatile in the short term for stocks like AUY, which are metal producers. This mining stock should also benefit from persistent inflation, increasing gold and silver prices.

Since the beginning of the year, shares have increased by about 7%. AUY is distributing 3 cents per share too many investors in June 2022, a substantial increase over the penny per share at the end of 2019. In this case, you don’t need to worry about it much since the price is around $5. It yields a 2.5% yield, much higher than the S&P 500’s 1.6%.

Yamana’s gold and silver stockpile remain an intelligent buy even if inflation pressures ease and precious metals prices fall. A high dividend makes this a worthwhile purchase for investors trying to find cheap stocks, even if it fluctuates.

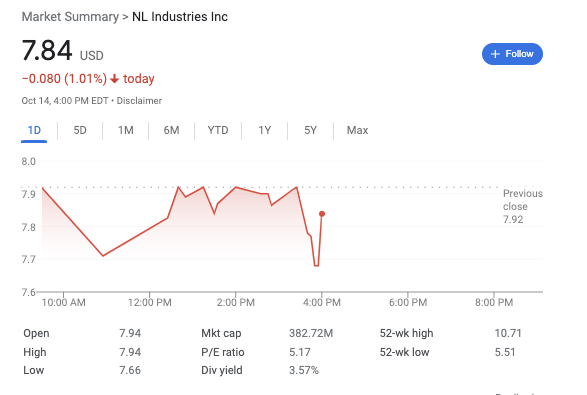

7. NL Industries

The stock price of NL Industries (NL, $8.96) might not seem like a good investment since it is only valued at $450 million. NL shares are holding their own in 2022, despite the broader market’s harsh treatment of risky small caps.

In addition to locksets, NL produces auto parts through its subsidiary CompX. Various locks are available to meet the demands of medical offices and automotive applications. These include traditional locks for doors and file cabinets, electronic locks, and sophisticated systems. Titanium dioxide pigment, which produces those brilliant white appliances, vehicles, and other products, is also made by this company.

The allotment of business lines isn’t particularly exciting, to be sure. However, demand and NL’s pricing power have steadily recovered since the pandemic. In the current fiscal year, earnings per share are expected to grow by approximately 55%. In addition, its quarterly dividend is projected to rise from 4 cents to 7 cents. Furthermore, this summer, it paid investors a generous 35-cent special dividend from its “excess cash flows.”

This humdrum small cap has outperformed in a challenging market environment, with shares up 23% year-to-date. Few stocks are more promising than NL if you are primarily interested in cheap stocks.

8. Ford (F)

Shareholders’ negative sentiments have affected Ford (NYSE: F) since the first half of 2022. It seems overdone that this legacy carmaker’s price has corrected by 40% year-to-date.

Non-GAAP P/Es of 6.7x beat the peer group’s average price-to-earnings ratio of 11.9x. As a result of a subdued sale of its gasoline-powered vehicles in recent months and a large recall of its electric cars in the past, the company has a discount valuation.

Its lower price, coupled with its growth prospects for the future, make it an attractive investment to take advantage of.

The company reported in June 2022 that its market share in the U.S. had steadily increased to 12.9%. Due to supply constraints, Ford managed to post sales revenue growth of 31.5% in the U.S. despite the industry’s auto sales declining by 11% due to supply constraints. The strength of the F-Series, Explorer, and new Expedition and Navigator SUVs led to Ford posting a sales growth stock of 31.5%.

This month, F-150 lighting topped the list of the bestselling electric trucks in the company’s lineup, and sales of electric vehicles grew by 77% from last month to this month.

By the end of 2023, 600,000 EVs will be delivered annually by the company. The number of units sold yearly is expected to go up to over 2 million by 2026, a considerable increase from the current level.

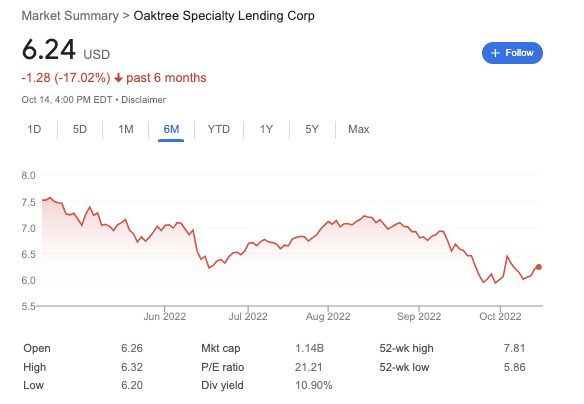

9. Oaktree Specialty Lending

Based on Howard Marks’ junk bond investing business, Oaktree Specialty Lending (OCSL, $6.92) is a financial company that invests in other industries. It operates similarly to a hedge fund or a private equity firm in its structure as a BDC or business development company. Unlike other publicly traded stocks under $10, Oaktree’s stock is cheap – so even small investors can take advantage of the strategy to gain profit.

Among the companies it finances are those in the upper middle market. A goldilocks firm needs no more capital than it needs, which is not too small to be over-risky. We are talking about firms that require between $100 million and $750 million each.

Wall Street investment banks are typically not a priority for companies like these. Their bonds are too small and too big to lend them money. Therefore, this sweet spot usually generates good returns.

OCSL’s portfolio includes more than half of first-lien loans. It means it is the primary lender and the first in line to receive payment in the event of a default. In that way, You can mitigate default risk. It is still better than the S&P 500, which dropped more than 16%, even if OCSL stock doesn’t move much in 2022.