Are you looking for the best value stocks to buy right now? You’ve come to the right place! In this blog post, we will discuss some of the best stocks to purchase regardless of their price. We will also talk about why it is important to invest in value stocks, and provide a list of some of the best ones out there. So what are you waiting for? Read on to learn more!

What are Value Stocks?

Value stocks are shares of companies that are viewed as undervalued due to a variety of factors. These might include market conditions, changes in industry trends, or shifts in public perception. Typically, value stocks have lower price-to-earnings ratios and more modest growth projections compared to other types of equities. In addition, value investors tend to focus on specific metrics like price-to-book ratios or dividend yields when performing stock analysis.

This can make value investing a more labor-intensive and time-intensive process than buying shares of high-flying growth companies. Despite these additional challenges, however, value investing is a tried and true strategy for building wealth over the long run. With careful research and sound judgment, it can be an effective way for investors to build sustainable wealth by finding great deals on undervalued stocks.

Types of Price to Earning Ratio & Its Calculation

There are several different price-to-earning (P/E) ratios that investors use to evaluate the relative value of a stock. One of the most commonly used types is the trailing P/E, which determines a company’s current share price in relation to its earnings over the past 12 months. This measure allows you to analyze trends in a company’s earnings and make comparisons across different stocks or industries.

Another commonly used type is the forward P/E, which estimates future expected earnings based on estimated growth rates or industry norms. In addition, some investors calculate weighted P/Es, which take into account both historical earnings and analyst predictions for a given period in order to provide an overall valuation of a stock. Thus, while there are many ways to calculate P/E ratios, they offer valuable insights into how investors are valuing individual companies as well as important comparisons across industries and time periods.

What are the Best Value Stocks To Buy Now?

When it comes to finding the best value stocks to buy now, there are a number of key factors to consider. First, you should look at the company’s financial health, including its earnings and debt levels. Additionally, you should evaluate the market trends in the sector or industry that the company is in. Finally, you should consider the price of the stock itself and whether it offers a good return on investment given its current valuation. Overall, when looking for quality value stocks, it is important to keep these key considerations in mind to help ensure that you pick only the best investments for your portfolio.

The Walt Disney Company (NYSE: DIS)

The Walt Disney Company is widely recognized as one of the best value stocks in the market today. Despite its iconic status and continued dominance in the entertainment industry, Disney has consistently maintained excellent financial performance and a highly attractive valuation. Its profitability, fueled by such hit franchises as Star Wars and Marvel Studios, is rock-solid, while its impressive cash flow generation supports a generous dividend that ranks among the highest of all companies on the S&P 500 Index.

Additionally, Disney’s share price has been steadily increasing over time, thanks to a combination of robust earnings growth and market sentiment. All told, investors are hard-pressed to find a better value stock than the Walt Disney Company. Whether you’re looking for long-term growth or short-term profits, this company is sure to provide optimal returns for any portfolio.

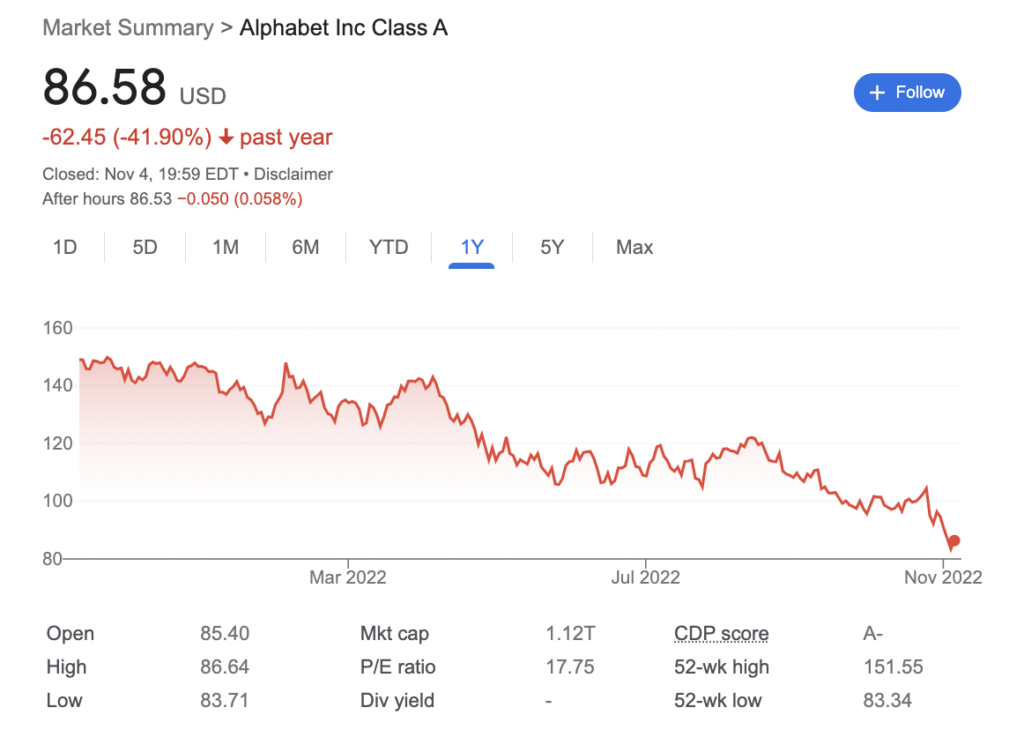

Alphabet Inc. (NASDAQ: GOOGL)

Alphabet Inc. is one of the most highly valued companies on the stock market today, with a market capitalization of over $750 billion. Despite this lofty valuation, however, Alphabet still offers investors excellent value in terms of growth potential and profitability. Its core business segments of search and advertising continue to maintain very strong revenue growth, driven by its dominance in both mobile search and digital advertising.

And with a diverse portfolio of cutting-edge products and services – including autonomous cars, virtual reality, cloud computing, and much more – Alphabet is well positioned to continue driving growth for years to come. Therefore, for investors seeking a best value stock in the tech sector, Alphabet Inc. should be at the top of their list.

NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA Corporation (NVDA) is one of the best value stocks in today’s market, offering investors an attractive combination of strong growth potential and stable returns. With its cutting-edge technology and innovative products, the company has been a leader in the booming field of artificial intelligence for many years.

Additionally, it has a proven track record of delivering impressive growth numbers year after year, consistently beating industry benchmarks and outperforming its peers. At the same time, NVDA also benefits from a solid financial position that gives it both flexibility and stability as it moves forward. Overall, NVDA truly is a must-have stock for any value investor looking to maximize their profitability in today’s market.

HP Inc. (NYSE:HPQ)

HP Inc. is one of the top companies in the technology industry, known for its innovative and cutting-edge products. With a market cap of over $35 billion, this tech giant has certainly established itself as a reliable and valuable investment opportunity. But what makes HP such an appealing stock choice? Well, for one thing, it offers exceptional value.

Not only does the company consistently deliver strong financial performance, but its stock price remains comparatively low compared to peers in the industry. Another reason why HP is such a great investment option is that it boasts a proven track record of growth and success, with no signs of slowing down anytime soon. In short, if you’re looking for a solid value stock in the technology sector, look no further than HP Inc.!

U.S. Bancorp (NYSE:USB)

U.S. Bancorp is one of the most well-known financial institutions in the United States. Operating out of Minneapolis, MN, this Fortune 500 company offers a range of services to individuals and businesses alike, including retail banking, credit cards, mortgage lending, wealth management and investment banking. With its solid balance sheet, seasoned leadership team, and expansive product offerings, U.S. Bancorp is widely considered to be one of the best value stocks on the market today.

Its impressive track record of profitability and high returns on invested capital ensure that investors can feel confident in their investment in this dynamic financial institution. Whether you are looking for an attractive dividend income stream or simply wish to add another well-run blue chip stock to your portfolio, U.S. Bancorp is an excellent choice for any investor seeking long-term value and stability in their investments.

Occidental Petroleum Corporation (NYSE:OXY)

For investors looking for a great value in the stock market, Occidental Petroleum Corporation is an excellent choice. This well-established company has been ranked as one of the best value stocks year after year, thanks to its strong financial performance, minimal risk profile, and solid growth potential. With an impressive track record of increasing shareholder value and a solid commitment to innovation and successful initiatives, Occidental Petroleum Corporation promises to be a reliable investment for years to come.

Whether you are just starting out in the stock market or are looking for a balanced portfolio with quality assets at the core, Occidental Petroleum Corporation is an excellent choice that offers everything you need in a valuable stock. So don’t hesitate – invest today and watch your holdings grow!

FAQs

When considering whether or not a value stock is a good buy, there are several important factors to consider. In general, value stocks are those that are perceived as underappreciated or undervalued relative to their actual market worth. These stocks typically offer higher potential for growth than other types of equities, such as blue chip stocks, and are typically seen as a safer investment option due to their lower price volatility and associated risk.

However, there are also several key considerations when looking at value stock investments.

For example, it is essential to analyse the financial performance of the company behind the stock in order to determine if current market conditions will support long-term growth and stability. Additionally, it is important to assess whether or not the company has a solid track record of delivering consistent and meaningful returns on investment. Ultimately, while there are many benefits associated with investing in value stocks, any potential gains must be weighed against the risks involved in this type of investment strategy.

Taxes on dividends are a source of frequent debate among investors. Some argue that these taxes can significantly reduce a person’s income, while others point out that dividend payouts help to support companies and the overall economy. Ultimately, the answer to this question depends on several different factors, such as the type of investment involved, how long it has been held, and the investor’s overall tax situation.

Some investments may be exempt from certain taxes depending on the circumstances, while others may qualify for preferential tax treatment or deductions. At the end of the day, it is ultimately up to each individual investor to make decisions about their own taxes based on their unique financial situation. However, regardless of these decisions, all dividends must be declared as taxable income for reporting purposes. So even if your investments are exempt from some specific types of taxation, you will still need to pay any applicable tax on your dividend payments.