Stock market investments can help you grow your wealth with the right trading for the best opportunities. Investors who are new to investing may find it confusing and overwhelming. Where do you start? Should you chose the most publicly traded companies? What best stocks should you buy? What’s the best time to sell?

Every year, most people try their hand at stock picking in the hope of making a quick profit. However, most of these people will fail to beat the market. So, what separates successful stock pickers from the rest? The answer is simple: research to know the business. For instance, the energy cluster is very interesting in this moment with the global increasing of energy prices.

If you want to be successful at stock picking, you need to put in the time and effort to research the companies you’re thinking of investing in to make good trades. Fortunately, several resources can help you with this. This article will discuss the top stock picks for 2022 and where you can find more information on each.

Nexstar Media Group

The Nexstar Media Group (NASDAQ: NXST) produces and distributes regional, national, and online news, sports, and entertainment content. A Nexstar original video has more than 290,000 hours annually. Nexstar, America’s largest local broadcasting group, owns and operates 200 stations reaching 212 million people. The Stake value in Nexstar Media Group is $82.0 million.

As the founder of Goldentree Asset Management, a fund manager with $52 billion in assets under management, Steven Tananbaum is probably best known for his investments in distressed debt. However, he also enjoys investing in equities. Here’s Nexstar Media Group (NXST, $191.31).

As one of the largest TV station owners in the U.S., Nexstar owns 197 stations in 115 markets, making it the largest market share. This company’s stock has increased by almost 28% over the past year, outperforming the wider market by 44 percentage points as well.

NXST shares fell almost 14% in Q2 when they went on sale. Tananbaum, with a net worth of $2.4 billion, seized the opportunity. A total of 503,524 shares were added to his hedge fund’s holdings, an increase of 81%, or 226,152 shares. On June 30, Goldentree owned an $82 million position, which it started in the third quarter of 2021. As of 2018, NXST holds 5.3% of the hedge fund’s assets.

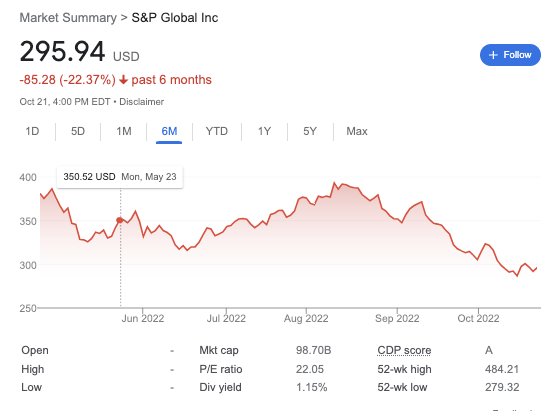

S&P Global

The second quarter was another productive quarter for Chris Hohn’s fund as he added to his stake in S&P Global (SPGI), which he holds for $356.54 a share.

Known for his work with The Children’s Investment Fund Management, Hohn has an estimated net worth of $7.9 billion. The London hedge fund TCI Fund Management manages $31.6 billion in securities.

Hohn’s focus on SPGI is notable, considering TCI’s portfolio consists of just 14 stocks. In Q2, he added another 1.9 million shares to his fund’s stake, up 28% from Q1. The first quarter’s increase was 82%. As of June 30, SPGI held nearly $3 billion shares worth approximately $8.8 million.

The majority stake SPGI holds in S&P Dow Jones Indices may give it a name among investors. However, it also plays a central role in the analytics, information, and research relating to corporations and financial markets. SPGI’s acquisition by IHS Markit is a positive development, as it will increase IHS Markit’s ESG services and products.

SPGI is also a profit-making machine. It has increased its dividend continuously for 49 consecutive years, making it a Dividend Aristocrat of the S&P 500.

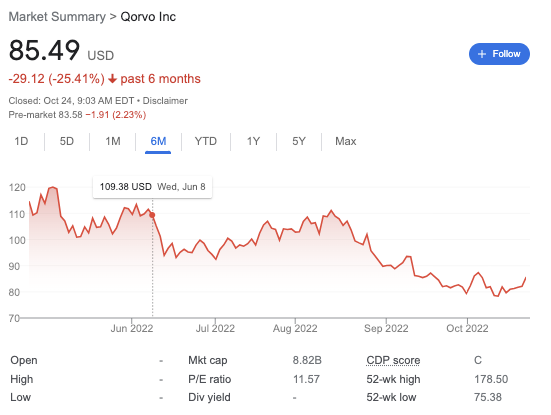

Qorvo

Qorvo (QRVO) is a company that develops chips and integrated modules to enable wireless and wired connectivity across various devices. It is a gamble on how smart homes, cars and the Internet of Things (IoT) will grow in the past few years, along with the expansion of 5G wireless technology.

Identifying these kinds of megatrends early was a massive part of Seth Klarman’s estimated net worth of $1.5 billion. Bulls will undoubtedly be delighted with his latest moves in Qorvo stock as the company continues to grow in the coming years.

Baupost Group’s shareholding in the company grew by 4%, or 321,324 shares, as part of Klarman’s Baupost Group ($31.6 billion AUM). As a result of those increases, the number of positions was up 11% in the first quarter and 16% in the fourth quarter.

The Boston hedge fund, which has owned QRVO since 2017, now holds almost 7 million shares worth $657.1 million as of June 30. At 9.7% of the portfolio, QRVO is second among Klarman’s top stock picks after Liberty Global Class C (LBTYK), which accounts for almost 16% of the fund.

Colgate-Palmolive

It is believed that Dan Loeb built his estimated $4.2 billion fortune partly by saying what he thinks corporate management teams need to hear. Considering Loeb initiated a stake in the consumer products giant during the second quarter, it’s not surprising that Colgate-Palmolive’s management was less than thrilled about the news.

On June 30, Loeb’s Third Point hedge fund owned nearly 2 million CL shares worth more than $159 million. As a result of the stake, Colgate instantly became one of Third Point’s top 10 holdings, with a 3.8% weighting.

Also, Loeb may not have any activist intentions. In 2022, share prices in classic defensive stocks have outperformed the broader market. The dividend growth of CL is among the best in the industry. The dividend payout of Colgate-Palmolive has increased for 60 consecutive years. The company belongs to the S&P 500 Dividend Aristocrats.

Microsoft

There is no doubt that Microsoft (MSFT), whose share price is $256.06, has been among the top choices of analysts for a long time. It has been regarded by market analysts as one of the best stocks for over two years, making it a top choice for analysts.

Like almost all of them, the price of these mega-cap tech stocks has been knocked down relentlessly in 2022. During the second quarter of this year, Microsoft took particular hits from the market selloff – the stock dropped nearly 16% in just three months – and therefore, John Armitage, co-founder and chief investment officer of Egerton Capital ($24.3 billion asset under management), decided to move on from Microsoft.

After increasing its stake in Google’s cloud computing behemoth by 11% in the last year alone, George Armitage’s hedge fund has increased its stake to 11%, or 573,278 shares. According to the company filings, Egerton owned 5.4 million shares worth $1.4 billion on June 30.

Currently holding 9.3% of Egerton’s portfolio, MSFT trails only Canadian Pacific Railway (CP). The fund has owned MSFT stock since 2015. With price appreciation and dividends, MSFT has generated nearly 560%. A 135% return on the S&P 500.

Snowflake

As this small and promising company made its stock market debut in 2020, Snowflake (SNOW), $171.49,) managed to find its way into Warren Buffett’s stock picks just a few months after it debuted on the market, so demand for these shares is expected to rise.

Pricey growth stocks have been hurt especially hard in 2022, and SNOW is no exception. The company’s shares lost around two-thirds of their value from December 31, 2021, through June 20, 2022. A falling knife was either on sale – or SNOW was on sale.

SNOW’s value appears to have been created by Daniel Sundheim’s distinctions, and he has so far been right with his estimates of his net worth at $3.2 billion.

The hedge fund he runs, D1 Capital Partners ($40.1 billion AUM), increased its holding by 36%, or 492,057 shares, in Q2. According to the June 30 financial statement, the New York fund owned 1.8 million shares valued at $254.5 million. This fund’s sixth largest holding, Snowflake, accounts for 6.0% of its portfolio. Over the next two and a half months, SNOW rallied by approximately 75% from a 52-week low on June 13.

Amazon

The Stake value in Amazon.com is $82.0 million. A couple of billionaires spied a bargain in the stock of Amazon.com (AMZN, $127.51), while hedge funds lost 35% of their value in Q2.

Philippe Laffont, a man with an estimated net worth of $6.5 billion, has undoubtedly made a name for himself. 1.1 million shares were added to his hedge fund Coatue Management ($73 billion AUM). As of June 30, the New York fund owns 4.1 million shares worth $437.4 million in Amazon stock. Amazon is Coatue’s fourth largest, holding at 5.3%.

Retail spending is being affected by recession fears, which have plagued AMZN since last year. Similarly, Amazon has not benefited from the market’s rotation from growth stocks to more value-oriented stocks.

Amazon stock is a screaming bargain buy, according to Wall Street analysts. According to Laffont, they were spot on – at least in Q2.

Vanguard Real Estate ETF

Vanguard Real Estate ETF is an investment option that may be worth considering, particularly for those looking to diversify their portfolios or who are interested in the potential benefits of real estate investing. This particular fund has a number of advantages, including a long track record of consistent returns and relatively low fees. Overall, Vanguard Real Estate ETF may be a good realty income for those looking to invest in real estate and gain some diversification for their portfolios.

Stock Investment FAQ

A good value is often the primary goal when picking stocks. You should look for trends in earnings, company strength, debt-to-equity ratios, and dividend yields if you diversify your portfolio.

The small-cap stock market is expected to continue rising in the coming year. Stock analysts view these alternatives as having an advantage over large-cap stocks. A significant outperformance of small caps has been observed recently compared to stocks in the S&P 500, Dow and Nasdaq composite.

Many investors hadn’t paid attention to several industries before the global situation became more prominent. Investing in these industries is a smart move nowadays:

– Cloud computing

– Artificial intelligence

– Virtual reality

– Green energy

– Transport

– Biotechnology

– Sustainable industries

– Pharma and healthcare

A full-service broker, an online stockbroker, or the company itself can all be used to buy stock. Stocks can be purchased without a broker, but a middleman can simplify your investing and give you more options.

Conclusion

In conclusion, picking stocks for 2022 is a difficult task. However, by taking the time to research the market and familiarize yourself with the process, you can increase your chances of making profitable investments. Pay attention to the factors that will affect the stock market in the coming year, such as the political and economic stability of the countries you are considering investing in. With careful planning and a bit of luck, you may be able to choose stocks that will provide you with healthy returns in the future.