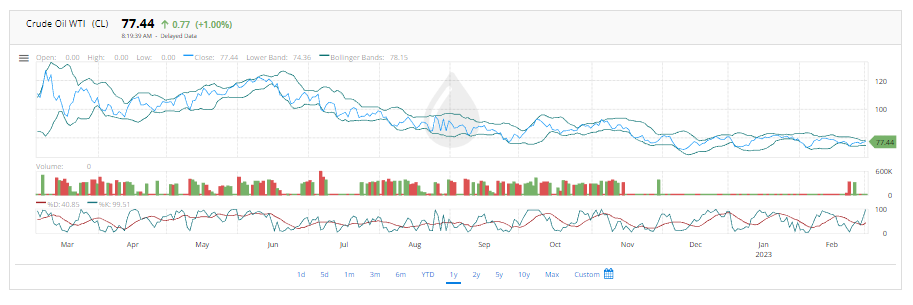

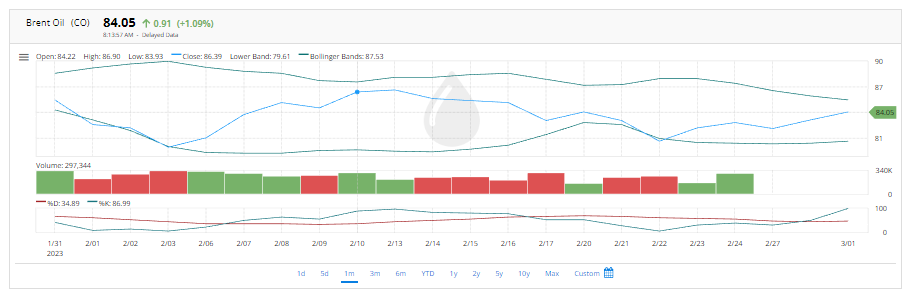

Brent crude prices have been on the rise in the past few days, driven by increasing demand from China and expectations of higher economic growth in the second half of the year [1]. Prices have already surpassed the $84 mark, with the global benchmark Brent crude trading above $84 a barrel and West Texas Intermediate trading above $78 a barrel [2].

This latest surge in oil prices follows a positive reaction to manufacturing and services activity data in China, as well as news that Russia is planning to cut oil exports from its western ports by up to 25% [3]. OPEC is also playing a role, continuing to produce at high levels and helping to balance out the lower rate of production in the US. Crude oil stocks are rising in the US, but remain high overall due to the increased demand

References:

[1] Oil rebounds almost 2% on China growth hopes – Reuters [2] Boost in China demand pushes oil price to $84 a barrel [3] Brent crude oil – 2023 Data – 1970-2022 Historical – Price1. Background on Brent crude and current spot prices

Brent crude is a type of light, sweet crude oil that is used as a global benchmark price for crude oil. It is sourced from oil fields in the North Sea and is used to price two-thirds of the world’s internationally-traded crude oil supplies.

Read also: U.S. Federal Reserve may hike interest rates to nearly 6%

Brent crude is currently trading at around $84.45 per barrel, up from around $80.80 per barrel at the start of the month. The higher prices can be attributed to strong economic growth in China, as well as OPEC’s decision to maintain production levels and the lower rate of production in the US.

The current spot price of Brent crude is expected to remain high, barring any major geopolitical or economic disruptions. In addition, the Organization of Petroleum Exporting Countries (OPEC) has agreed to continue to cut its production in order to help balance out the global supply and demand of crude oil, providing additional support to the current spot price of Brent crude.

Moreover, the US-China trade war, political instability in the Middle East, and the economic downturn in Europe could all have an impact on Brent crude prices in the near future.

2. Explanation of the increase in Brent prices

The Brent price is the benchmark for oil prices across the world and is an indicator of the overall state of the oil market. It is the price of oil used to calculate the cost of oil in Europe, Africa, and the Middle East. Over the last few weeks, the Brent price has been steadily increasing, a trend which appears to be continuing.

This increase in the Brent price can be attributed to a variety of factors. To begin with, the China demand for oil has been increasing. This is due to the ongoing economic recovery, as well as the increased demand for oil from developing countries. Furthermore, geopolitical tensions have been escalating, leading to a decrease in the supply of oil. This has caused the Brent price to rise, as there is now less oil available for purchase on the market.

Read also: Exploring the Impact of Food Inflation: What You Need to Know.

Finally, the Brent price has been affected by the policies of the Organization of Petroleum Exporting Countries (OPEC). OPEC has used its influence to reduce the production of oil, thereby reducing the supply of oil and driving up the Brent price.

These are the main factors that have contributed to the increase in the Brent price. The Brent price is an important indicator of the state of the oil market and is closely watched by investors. As a result, it is important to keep track of the Brent price in order to stay informed about the current oil market.

3. Impact of expectations of increased demand from China

The increased demand for goods and services from China is having a significant impact on the global economy. This increased demand has led to a surge in exports from other countries, resulting in more jobs and a higher GDP. However, it also has led to inflation in many of the countries that are now supplying Chinese goods. This inflation has caused some to struggle with rising costs, while others have seen their wages remain stagnant or even decrease.

Furthermore, the influx of Chinese demand has caused a shift in the global supply chain, with some countries now having increased reliance on Chinese goods. This has led to increased competition in the global market, and some countries may now be at a disadvantage in terms of cost and quality.

Read also: What is a Recession? Unveiling the Difference Between Inflation Vs Recession!

Overall, the increased demand from China has had a significant impact on the global economy and on many countries, both positive and negative. With increased competition, increased reliance on Chinese goods, and rising costs, it is important for countries to remain conscious of the implications of increased demand from China.

The increased demand for crude oil from China is having a substantial impact on the global energy market. This increased demand has caused a surge in oil prices, which has led to higher profits for oil companies and countries that are now supplying Chinese crude oil. It has also led to a shift in the global energy supply chain, as some countries have now become more reliant on Chinese crude.

Furthermore, the increased demand from China has caused a rise in global consumption of crude oil, leading to an increased strain on the environment. This has led to increased emissions of greenhouse gases, causing further climate change and environmental damage. Additionally, the increased demand has had an effect on global energy security, as some countries now depend on Chinese crude to meet their energy needs.

Overall, the increased demand for crude oil from China has had a profound effect on the global energy market and on many countries, both positive and negative. As the demand for crude oil continues to rise, it is important for countries to consider the implications of increased demand from China and the potential risks to global energy security.

4. What this increase in price means for the oil industry and energy markets

The recent increase in the price of Brent crude oil has had a significant impact on both the oil industry and the global energy markets. For oil companies, the increased price of Brent crude has resulted in higher profits and greater investment opportunities.

At the same time, the higher price of Brent crude has also had implications for the global energy markets. The increased price has resulted in higher costs for consumers, contributing to higher inflation and making some energy sources less accessible. Additionally, the increased price has also led to increased investment in renewable energy sources, as oil companies seek to reduce their dependence on traditional sources of energy.

Read also: Crude Oil WTI is now $78.8 (+1.06%) and Brent Oil at $85.45 (+1.36%) after Russian plan to cut output.

Overall, the recent increase in the price of Brent crude oil has had a significant impact on both the oil industry and energy markets. While it has resulted in higher profits for oil companies and increased investment in renewable energy sources, it has also led to higher costs for consumers and increased inflation.

Read Also: Oil prices fell today: WTI -2.27% and Brent -1.90%.

5. Investment opportunities related to the rise in Brent prices

The recent rise in Brent crude oil prices has opened up a number of investment opportunities for investors. As the price of Brent crude continues to rise, investors are taking advantage of the increase in profits for oil and energy companies, as well as the increase in investment opportunities for renewable energy sources.

Read also: The 10 Top Energy Companies Stock of the Year.

Investors are also taking advantage of the increased oil and gas production due to the higher price of Brent crude, as well as the increased demand from countries such as China. Additionally, investors are looking to capitalize on the increased demand for alternative energy sources, such as solar and wind power, as well as the increased investment in infrastructure related to renewable energy sources.

Overall, the increase in Brent crude oil prices has opened up a number of investment opportunities for investors. As the price of Brent crude continues to rise, investors are taking advantage of the increased profits for oil and energy companies, as well as the increased demand for alternative energy sources.

6. Potential implications for global economic growth as a result of rising oil prices

The recent rise in oil prices has had potential implications for global economic growth. The higher oil prices have resulted in higher costs for producers and consumers, leading to higher inflation and making some goods and services less accessible. Additionally, the higher prices have led to an increase in production of crude oil and other energy sources, resulting in higher global energy consumption.

The higher energy consumption levels have also had an impact on global economic growth, as energy is a key factor in the production and consumption of goods and services. Higher energy consumption levels can lead to increased production costs, leading to higher prices for consumers. Additionally, increased energy consumption can lead to higher levels of pollution, which can have a negative effect on global economic growth.

Overall, the recent rise in oil prices has had potential implications for global economic growth. The higher prices have resulted in higher costs for producers and consumers, increased energy consumption, and higher levels of pollution, all of which can have a negative effect on global economic growth.

FAQs about rising oil prices

The rise in oil prices is due to a variety of factors, including increased global demand for oil, supply disruptions due to geopolitical tensions, and the weakening of the US dollar. Global demand for oil is driven by increased economic activity and population growth, while supply disruptions are caused by geopolitical unrest in oil-producing regions such as the Middle East and Venezuela. The weakening of the US dollar relative to other currencies can also lead to higher oil prices, since oil is priced in US dollars.

Rising oil prices can lead to higher costs for consumers in a variety of ways. For example, higher oil prices can lead to higher fuel costs for motorists, higher prices for goods and services that require transportation (such as food and other consumer goods), and higher costs for businesses that rely on oil for their operations. In addition, the increased cost of oil can put upward pressure on inflation, leading to higher prices overall.

There are a number of measures that can be taken to reduce the effects of rising oil prices. In the short-term, governments can implement policies that increase fuel efficiency standards, reduce taxes on fuel, and promote the development of alternative energy sources. In the long-term, governments can work to reduce global demand for oil by investing in energy efficiency measures and encouraging the development of other energy sources. Additionally, governments can work to reduce the effects of geopolitical instability in oil-producing regions and promote international cooperation to ensure stable oil supplies.