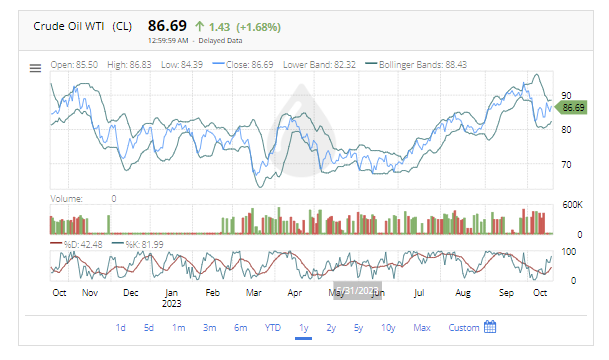

There are concerns that rising tensions in the Middle East could lead to further increases in oil prices, which could have a negative impact on the global economy and investors. [1] The recent bombing of a hospital in Gaza City has already caused oil prices to surge, with Brent crude futures rising 2% to $91.65 a barrel and West Texas Intermediate crude futures up 2.2% at $88.57 a barrel. [2][3] Biden’s visit to the region is seen as an opportunity to address the humanitarian situation and prevent further chaos. [1] Despite the cancellation of his planned visit to Jordan, the US still supports Israel’s efforts to defeat Hamas, but has also been urging Israel to allow humanitarian aid into Gaza. [2] Critics have called on Biden to demand a ceasefire during his visit, and the market sees his intervention as a potential for diplomatic progress in resolving the conflict. [2][3]

References:

[1] ECB’s Holzmann Says Middle East Raises Risk of Higher …

[2] Oil jumps 2% as hospital blast increases Middle East …

[3] UPDATE 1-Oil jumps over 2% as Middle East tension flares …

“Oil prices rallied 2% following the deadly explosion at the Gaza hospital as it boosts tensions across the Middle East just before the arrival of US President Joe Biden.

“Clearly, the US is a major influence in the Middle East due to its economic interests, military presence, national security concerns, strategic alliances, and diplomacy efforts.

“If the US President – who is, of course, one of the major powerbrokers – fails to cool rising tensions in the Middle East during his visit to the region, we expect oil prices to surge further.”

Nigel Green of deVere Group

Biden arrives in Israel facing a difficult diplomatic mission as tensions run high in the region

Biden arrives in Israel facing a difficult diplomatic mission as tensions run high in the region [3]. The recent deadly explosion at a Gaza hospital, which Biden referred to as likely being carried out by Hamas militants, has fueled protests and threatened diplomatic efforts [1][2]. The cause of the blast remains uncertain, with conflicting reports [2]. Biden’s visit is seen as a show of support for Israel, but his planned meeting with Arab leaders in Jordan was canceled due to regional anger [2]. The situation in Gaza is growing desperate, with ongoing airstrikes and limited access to aid [2]. Biden is expected to meet with Israeli Prime Minister Benjamin Netanyahu and deliver public remarks during his visit [2].

References:

[1] Israel-Hamas war: Biden will be plunging into Middle East …

[2] Israel-Hamas war live updates: Biden meets with Netanyahu

[3] Israel-Hamas war: Biden heads to Israel following Gaza blast

Markets are Waiting the Results of Biden’s Visit to Israel

Biden’s planned visit to Israel is calming markets due to the hope that his face-to-face intervention in the Israel-Hamas war will help address the humanitarian situation and prevent further chaos [2]. The United States has been urging Israel to allow humanitarian aid into Gaza [1]. Biden’s trip aims to understand the plans and objectives of Israeli leaders and find a way to calm the region and shore up humanitarian efforts for Gaza [1]. Despite the cancellation of his visit to Jordan due to the hospital explosion in Gaza City, the U.S. continues to support Israel’s efforts to defeat Hamas and regain control over the Gaza Strip [1]. Critics have called on Biden to demand a ceasefire in Gaza during his visit [1]. Overall, the market sees Biden’s visit as an opportunity for diplomatic intervention and potential progress in resolving the conflict, which has a calming effect on investors.

References:

[1] Biden has ‘tough questions’ for Netanyahu, Gaza strike …

[2] Egypt, Jordan ‘hold the key’ for Biden in calming Israel- …

[3] Israel’s Shekel Defense Is Shifting Focus Away From Rate …

President Joe Biden has postponed his travel to Jordan

President Joe Biden has postponed his travel to Jordan and canceled a planned meeting with King Abdullah II and President Mahmoud Abbas of the Palestinian Authority due to an explosion at a hospital in Gaza City that killed hundreds of people [3]. The cancellation came in the wake of Israel’s bombing of Gaza, which has led to serious humanitarian concerns [1]. It is unclear what caused the explosion at the hospital, with both sides blaming each other [3]. Despite the cancellation, the U.S. has publicly pledged its support for Israel in its efforts to defeat Hamas and end its control over the Gaza Strip [1]. Biden is still expected to meet with Israeli Prime Minister Benjamin Netanyahu this week [3].

References:

[1] Why has Jordan cancelled Biden visit after Israel bombing …

[2] Jordan cancels Biden summit after hundreds killed in Gaza …

[3] Biden cancels visit to Jordan after hospital explosion in Gaza

Middle East and concerns over China’s property sector have had a negative impact on the stock markets

The recent tensions in the Middle East and concerns over China’s property sector have had a negative impact on the stock markets. Stocks have retreated as a result, with investors becoming cautious. The conflict in the Middle East has led to a decrease in stocks linked to infrastructure projects in the region, as potential disruptions are feared. Meanwhile, China’s property sector is facing falling sales and developer defaults, causing concerns about a cash crunch and contagion risks. These issues have overshadowed better-than-expected readings on China’s economy, leading to a drop in stocks. The pound, however, has gained in this market scenario. [1][2][3]

References:

[1] Contagion fears spread as China property sector cash …

[2] China belt and road stocks fall on Mideast war

[3] Asian markets fall on China property woes

The Market Reaction on Tuesday was mixed

The market reaction on Tuesday was mixed, with the Nasdaq ending lower and the Dow (+0.04%) and S&P 500 remaining nearly flat. The main factors contributing to this were rising Treasury yields and the announcement from the Biden administration regarding the halt of advanced artificial intelligence chip shipments to China.

The rise in Treasury yields can often lead to a decrease in the value of technology stocks, as higher yields make bonds more attractive and can potentially reduce the appeal of growth stocks. This could explain the decline in the Nasdaq.

Overall, these developments have created uncertainty in the market, leading to a mixed performance among different indices. Investors will continue to monitor the situation closely for any further implications on the technology sector and global trade relations.

NVIDIA drop 4.7%, closing at $439.38 on the stock market today

The decline in Nvidia’s stock price was attributed to new U.S. trade restrictions with China, specifically the halting of advanced AI chip shipments to the country [1][2].

This development has had a negative impact on the semiconductor industry as a whole, with other AI chip companies also experiencing a drop in their share prices [3]. The uncertainty surrounding the situation in the Middle East and concerns over China’s property sector have further contributed to the decrease in stocks, leading to a mixed performance among different indices [2]. Investors will closely monitor the implications of these developments on the technology sector and global trade relations [2].

References:

[1] Nvidia Stock Tumbles On New U.S. Trade Restrictions With …

[2] Stock Market Closes Mixed But Small Caps Rally; Nvidia …

[3] Nvidia stock falls after U.S. announces new chip export …