Cryptocurrency enthusiasts and investors are always on the lookout for the next big opportunity. With the rise in popularity of Ethereum, many are wondering what the future holds for this digital currency. Will it continue to soar or will it experience a downfall? In this article, we will explore the Ethereum price prediction for the next 5 years and what investors can expect from this promising cryptocurrency.

Since its launch in 2015, Ethereum has gained significant attention and has become the second-largest cryptocurrency by market capitalization. Its innovative technology and potential for decentralized applications have attracted a large user base and sparked excitement in the crypto community. However, the volatile nature of the crypto market makes it challenging to predict the future of any digital currency, including Ethereum.

Despite the uncertainties, experts and analysts have been making predictions about Ethereum’s price in the coming years based on various factors such as technology advancements, market trends, and adoption rates. In this article, we will delve into these predictions and explore the potential scenarios for Ethereum’s price movement in the next 5 years. Whether you’re a current Ethereum investor or considering entering the market, understanding these predictions can help you make informed decisions and stay ahead in the ever-evolving world of cryptocurrency.

Introduction

As the cryptocurrency market continues to gain momentum, investors and enthusiasts are eagerly looking forward to the future of Ethereum. With its decentralized platform and smart contract capabilities, Ethereum has already made a significant impact in the industry. But what does the future hold for this digital asset? In this article, we will explore the Ethereum price forecast for the next five years and provide insights into what we can expect from one of the leading cryptocurrencies.

While it’s important to note that predicting the future of any investment is speculative, experts and analysts have been offering their predictions based on various factors. The continued development of Ethereum 2.0, the growth of decentralized finance (DeFi) applications, and the increasing adoption by institutions are all expected to have a significant impact on Ethereum’s price in the coming years.

Whether you are a long-term investor or simply curious about the future of Ethereum, this article will provide you with valuable insights and analysis to help you make informed decisions. Join us as we delve into the Ethereum price forecast and explore the potential for this revolutionary digital asset.

Factors influencing Ethereum’s price

Ethereum’s price is influenced by a variety of factors, both internal and external. Understanding these factors can help us make more accurate Cryptocurrency predictions.

Firstly, the development of Ethereum 2.0 is expected to have a major impact. Ethereum 2.0 aims to address the scalability issues of the current Ethereum network by introducing a new consensus mechanism called Proof of Stake (PoS). This upgrade is expected to increase the transaction speed and reduce transaction fees, making Ethereum more attractive to users and investors.

Secondly, the growth of decentralized finance (DeFi) applications is driving the demand for Ethereum. DeFi applications provide financial services such as lending, borrowing, and trading without the need for intermediaries. As more people embrace DeFi, the demand for Ethereum as the underlying infrastructure increases, potentially driving up its price.

Thirdly, the increasing adoption of Ethereum by institutions is another factor to consider. Major financial institutions have shown interest in Ethereum and are exploring ways to leverage its benefits. This institutional adoption can bring significant liquidity and credibility to Ethereum, driving its price upwards.

Overall, these factors, along with market sentiment, regulatory developments, and technological advancements, will shape the future price of Ethereum.

Current market analysis of Ethereum

Ethereum Market Analysis

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization, after Bitcoin. It is a decentralized blockchain platform that enables smart contracts and decentralized applications (DApps) to be built and run without the need for a third party.

Current Market Conditions

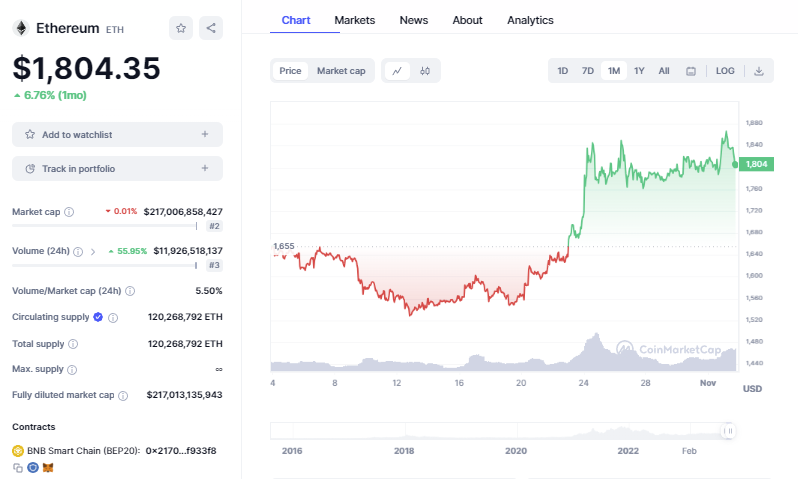

At the time of writing (November 2, 2023), Ethereum is trading at around $1,800. This is down from its all-time high of over $4,800 in November 2021, but it is still up significantly from its March 2020 low of around $90.

Key Factors to Consider

There are a number of key factors to consider when evaluating the Ethereum market:

- The Merge: Ethereum is currently undergoing a major upgrade known as the Merge. This upgrade will transition Ethereum from a proof-of-work to a proof-of-stake consensus mechanism. This is expected to have a number of benefits, including reducing energy consumption and improving scalability.

- Institutional Adoption: Institutional adoption of Ethereum is growing. A number of large financial institutions, such as JPMorgan Chase and Goldman Sachs, are developing Ethereum-based products and services.

- DeFi and NFTs: Ethereum is the leading platform for decentralized finance (DeFi) and non-fungible tokens (NFTs). DeFi and NFTs are rapidly growing markets, and this is driving demand for Ethereum.

Market Outlook

The outlook for the Ethereum market is generally positive. The Merge is expected to be a major catalyst for growth, and institutional adoption is also increasing. DeFi and NFTs are also driving demand for Ethereum.

However, there are also some risks to consider. The cryptocurrency market is volatile, and Ethereum is no exception. Additionally, the Merge is a complex upgrade, and there is a risk of delays or unforeseen problems.

Overall, the Ethereum market is well-positioned for growth in the coming years. The Merge, institutional adoption, and DeFi and NFTs are all driving demand for Ethereum. However, investors should be aware of the risks involved in investing in Ethereum, including the volatility of the cryptocurrency market and the potential for delays or problems with the Merge.

Technical Analysis

Ethereum’s price has been trading in a range between $1,500 and $1,850 since early October. The recent price action suggests that bulls are trying to push the price higher, but bears are also active at higher levels.

Ethereum’s 50-day moving average is currently at $1,400. If Ethereum can break above and stay above this level, it could suggest that the bulls are in control and that the price could continue to move higher.

Ethereum’s 200-day moving average is currently at $1,600. If Ethereum can break above and stay above this level, it could be a strong bullish signal.

Overall, the technical analysis of Ethereum suggests that the price is likely to remain range-bound in the near term. However, a break above $1,800 could suggest that the bulls are in control and that the price could continue to move higher.

Investors should always do their own research before making any investment decisions.

Ethereum price predictions for the next 5 years

Predicting the future price of Ethereum is a challenging task, but numerous experts and analysts have offered their predictions based on various methodologies and factors. It’s important to approach these predictions with caution as they are speculative in nature and the cryptocurrency market is highly volatile.

According to some analysts, Ethereum’s price could experience significant growth in the next five years. They believe that Ethereum’s market capitalization could surpass that of Bitcoin, making it the leading cryptocurrency. These predictions are based on the expectation that Ethereum’s technological advancements, such as Ethereum 2.0 and the growing adoption of DeFi applications, will drive its price upwards.

Other experts believe that Ethereum’s price will continue to be influenced by market demand and investor sentiment. They argue that if the demand for Ethereum as a platform for decentralized applications (dApps) and smart contracts continues to grow, its price will follow suit. Additionally, the increasing interest from institutional investors could further boost Ethereum’s price in the coming years.

Here is a summary of some of the most popular Ethereum price predictions:

- Techopedia: $7,400 to $12,200 by 2030

- Forbes: $6,500 by 2024, $10,700 by 2025, and $20,500 by 2030

- Changelly: $1,901.00 by November 3, 2023, and $6,500 by 2024

- DigitalCoinPrice: $2,851.56 by 2023, $4,224.26 by 2024, and $6,442.41 by 2025

It is important to note that these are just predictions, and the actual price of Ethereum could be higher or lower than these estimates. The price of Ethereum will be influenced by a number of factors, including the success of the Merge, institutional adoption, and the growth of DeFi and NFTs.

Overall, the long-term outlook for Ethereum is positive. The Merge is expected to make Ethereum more scalable and efficient, and institutional adoption is growing. DeFi and NFTs are also driving demand for Ethereum. However, investors should be aware of the risks involved in investing in Ethereum, including the volatility of the cryptocurrency market and the potential for delays or problems with the Merge.

FintechZoom’s Ethereum price prediction for the next 5 years, considering the fact that Ethereum is today at $1800 and in the past year increased +14.02%, is:

| Year | Predicted Ethereum Price |

|---|---|

| 2023 | $1934.61 |

| 2024 | $2232.25 |

| 2025 | $2575.67 |

| 2026 | $2971.93 |

| 2027 | $3429.76 |

This prediction assumes that Ethereum will continue to grow at an average rate of 14.02% per year. It is important to note that this is just a prediction, and the actual price of Ethereum could be higher or lower than these estimates.

Here are some factors that could support Ethereum’s price growth in the coming years:

- The successful completion of the Merge

- Increased institutional adoption of Ethereum

- The continued growth of DeFi and NFTs

- Increased demand for Ethereum as a store of value

Here are some factors that could hinder Ethereum’s price growth in the coming years:

- Delays or problems with the Merge

- Regulatory uncertainty

- Competition from other blockchain platforms

Overall, I believe that Ethereum is well-positioned for growth in the coming years. However, investors should always do their own research before making any investment decisions.

Expert opinions on Ethereum’s future price

Experts in the cryptocurrency industry have shared their opinions on Ethereum’s future price, offering valuable insights for investors and enthusiasts. While these opinions may vary, they provide different perspectives on Ethereum’s potential growth.

Some experts believe that Ethereum’s price will continue to rise steadily over the next five years. They argue that Ethereum’s technological advancements, coupled with increasing adoption and use cases, will drive its value higher. These experts emphasize the importance of Ethereum’s role in the decentralized finance (DeFi) ecosystem and its potential to revolutionize various industries.

On the other hand, some experts caution against the volatility of the cryptocurrency market and the potential risks associated with investing in Ethereum. They advise investors to carefully consider their risk tolerance and diversify their portfolios to mitigate potential losses. These experts highlight the importance of understanding the underlying technology and fundamentals of Ethereum before making investment decisions.

Ultimately, it’s important to consider a range of expert opinions and conduct thorough research before making any investment decisions. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly, making it crucial to stay informed and make informed decisions.

Potential risks and challenges for Ethereum

While Ethereum has shown promising growth and potential, it is not without its risks and challenges. Understanding these risks is essential for investors and enthusiasts to make informed decisions.

One of the primary risks associated with Ethereum is scalability. The current Ethereum network faces challenges in handling a high volume of transactions, leading to congestion and increased transaction fees. Ethereum 2.0 aims to address these scalability issues, but the successful implementation and adoption of this upgrade are not guaranteed.

Another risk is regulatory uncertainty. As cryptocurrencies continue to gain popularity, governments around the world are considering regulations to ensure consumer protection and prevent illicit activities. Regulatory actions, such as bans or strict regulations, can have a significant impact on Ethereum’s price and adoption.

Furthermore, competition from other blockchain platforms is a challenge Ethereum must contend with. Several other blockchain platforms, such as Cardano, Polkadot, and Solana, are emerging as strong contenders in the decentralized applications (dApps) space. Ethereum’s ability to innovate and maintain its dominance will determine its future success.

It’s important for investors and enthusiasts to carefully assess these risks and challenges before making any investment decisions. Diversifying one’s portfolio and staying informed about the latest developments in the cryptocurrency industry can help mitigate potential risks.

Factors to consider before investing in Ethereum

Before investing in Ethereum, it’s crucial to consider several factors to make informed decisions.

Firstly, understanding the fundamentals of Ethereum is essential. Familiarize yourself with the technology, its use cases, and its potential for future growth. This knowledge will help you assess the long-term viability of Ethereum as an investment.

Secondly, consider your risk tolerance and investment goals. The cryptocurrency market is highly volatile, and prices can fluctuate dramatically. Determine how much risk you are willing to take and align your investment strategy accordingly.

Thirdly, diversify your portfolio. Investing solely in Ethereum exposes you to the risks associated with a single asset. Consider diversifying your investments across different cryptocurrencies and other asset classes to mitigate potential losses.

Lastly, stay informed about the latest developments in the cryptocurrency industry. Regularly follow news and analysis from reputable sources to understand market trends and make informed decisions.

By considering these factors, you can make more informed investment decisions and navigate the cryptocurrency market with greater confidence.

Strategies for maximizing Ethereum investments

Maximizing your Ethereum investments requires careful planning and strategic decision-making. Here are some strategies to consider:

- Long-term holding: If you believe in Ethereum’s long-term potential, consider holding onto your investments for an extended period. This strategy allows you to benefit from potential price appreciation over time.

- Dollar-cost averaging: Instead of investing a lump sum, consider investing a fixed amount at regular intervals. This strategy helps mitigate the impact of short-term price fluctuations and allows you to accumulate Ethereum over time.

- Staking: With the introduction of Ethereum 2.0, users can stake their Ethereum and earn rewards for validating transactions on the network. Staking can be a profitable strategy for individuals who are willing to lock up their Ethereum for a specified period.

- Diversification: Consider diversifying your cryptocurrency portfolio by investing in other promising projects alongside Ethereum. This strategy helps spread the risk and can potentially maximize returns.

- Regular monitoring: Keep a close eye on Ethereum’s price and market trends. Regularly reassess your investment strategy based on new information and market developments.

Remember that investing in cryptocurrencies involves risks, and there are no guarantees of returns. It’s important to do your own research, consult with financial advisors if needed, and make investment decisions that align with your financial goals and risk tolerance.

Resources for staying updated on Ethereum price trends

Staying updated on Ethereum price trends and market developments is crucial for investors and enthusiasts. Here are some resources to consider:

- Cryptocurrency news websites: Websites like CoinDesk, Cointelegraph, FintechZoom, and CoinMarketCap provide up-to-date news, analysis, and price information about Ethereum and other cryptocurrencies.

- Social media platforms: Follow reputable cryptocurrency influencers, analysts, and official Ethereum accounts on platforms like Twitter and Reddit. These platforms offer real-time updates, insights, and discussions about Ethereum.

- Ethereum community forums: Participate in Ethereum community forums like Ethereum Stack Exchange and Reddit’s r/Ethereum to engage with other enthusiasts, ask questions, and stay informed about the latest developments.

- Blockchain analytics platforms: Platforms like Glassnode and DappRadar offer data and analytics on Ethereum’s on-chain activity, transaction volume, and decentralized application usage. These insights can provide valuable information about Ethereum’s adoption and potential price trends.

- Official Ethereum resources: Visit the official Ethereum website and follow their official channels for updates on Ethereum’s development, upgrades, and announcements.

By utilizing these resources, you can stay informed about Ethereum’s price trends, market sentiment, and technological advancements, enabling you to make more informed investment decisions.

Conclusion

The future of Ethereum holds immense potential, but it is important to approach it with caution and informed decision-making. While predicting the exact price of Ethereum is challenging, factors such as the development of Ethereum 2.0, the growth of decentralized finance (DeFi) applications, and increasing institutional adoption are expected to have a significant impact on its price in the coming years.

Investors and enthusiasts should carefully consider the factors influencing Ethereum’s price, conduct thorough research, and stay informed about the latest developments in the cryptocurrency industry. By doing so, they can make more informed investment decisions and navigate the dynamic world of Ethereum with greater confidence.

Although the cryptocurrency market is highly volatile and unpredictable, Ethereum’s unique features and growing ecosystem make it an intriguing investment opportunity for those willing to embrace the risks and potential rewards. As always, it’s important to consult with financial advisors and make investment decisions that align with your individual financial goals and risk tolerance.

As we continue to witness the rapid evolution of the cryptocurrency market, only time will tell what the future holds for Ethereum.