Silvergate Capital, a major lender to the cryptocurrency industry, has announced that it is winding down operations and liquidating its bank due to significant losses and recent industry and regulatory developments [1][2][3]. The bank had been struggling for months, with a nearly $1bn net loss in Q4 2021 following a rush for the exits that saw customer deposits plummet 68% [1].

In addition, the collapse of the cryptocurrency exchange FTX also contributed to Silvergate’s losses [3]. It remains unclear how the company will deal with claims against it, although all deposits are expected to be fully repaid [1]. Several of the bank’s partners, including Coinbase Global and Galaxy Digital, had already severed ties with the bank prior to its announcement [3].

References:

[1] Silvergate shutting down operations, liquidating after crypto … [2] Silvergate Bank Is Winding Down Operations in Blow to … [3] Crypto-focused bank Silvergate plans to wind down … – ReutersBitcoin Crash Today?

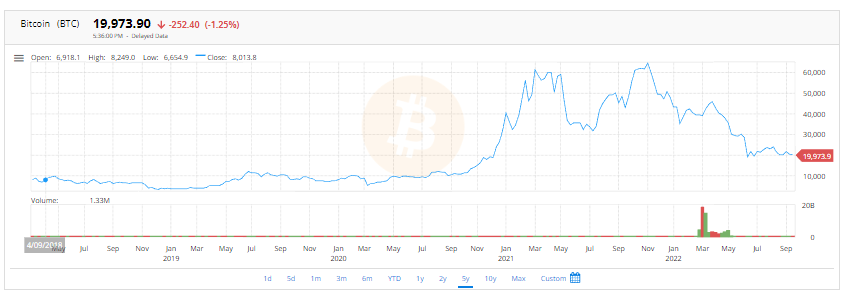

There are several factors that may be contributing to the recent decline in the price of Bitcoin. One major factor is the imminent liquidation of Silvergate Capital, a crypto-friendly bank, which has caused concern among investors and led to a drop in the price of Bitcoin and other cryptocurrencies [1].

Additionally, rumors of forthcoming US regulation of digital assets, as well as the US Federal Reserve’s gradual belt-tightening, are also contributing to the drop in cryptocurrency prices [3].

Furthermore, some analysts have speculated that the recent decline in Bitcoin’s price may be due to a “crypto winter,” which is a period of prolonged bearish sentiment in the cryptocurrency market [2]. Overall, the situation remains fluid, and it is important for investors to monitor developments related to Bitcoin and the broader financial market.

References:

[1] Why Is Bitcoin Down Today? – Forbes [2] Bitcoin has lost more than 50% of its value this year. What to … [3] Why Is Bitcoin’s Price Dropping? – Investopedia

Will Bitcoin Crash due to Regulation?

It’s difficult to predict with certainty what the impact of regulation will be on Bitcoin and the broader cryptocurrency market. While some observers believe that increased regulation could stifle innovation and adoption of cryptocurrencies, others argue that it could help to legitimize the industry and make it more accessible to mainstream investors.

Read also: U.S. Federal Reserve and Cryptocurrency Market: Is FED and SEC leading the change?

It is worth noting that regulation of cryptocurrencies is already underway in many jurisdictions, with some countries implementing strict rules governing their use and others taking a more permissive approach. In the US, for example, the Securities and Exchange Commission (SEC) has been cracking down on initial coin offerings (ICOs) and other cryptocurrency-related fraud, while the Commodity Futures Trading Commission (CFTC) has taken steps to regulate cryptocurrency futures trading.

Read also: Crypto need to be regulated? In past 5 days Bitcoin Price increased +9.59%.

Overall, the impact of regulation on Bitcoin and other cryptocurrencies will likely depend on a variety of factors, including the specific nature of the regulations, the response of the cryptocurrency community, and broader macroeconomic trends. While regulation could certainly pose challenges for the industry, it may also help to foster greater trust and stability in the market over the long term.