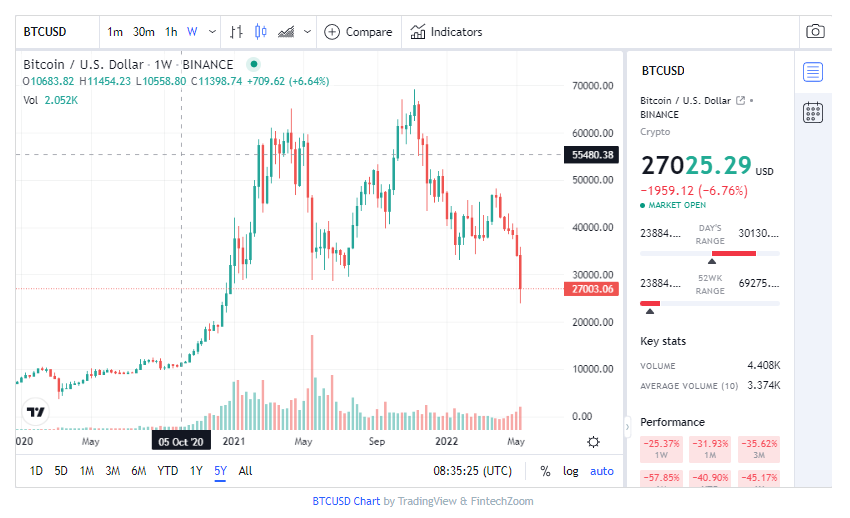

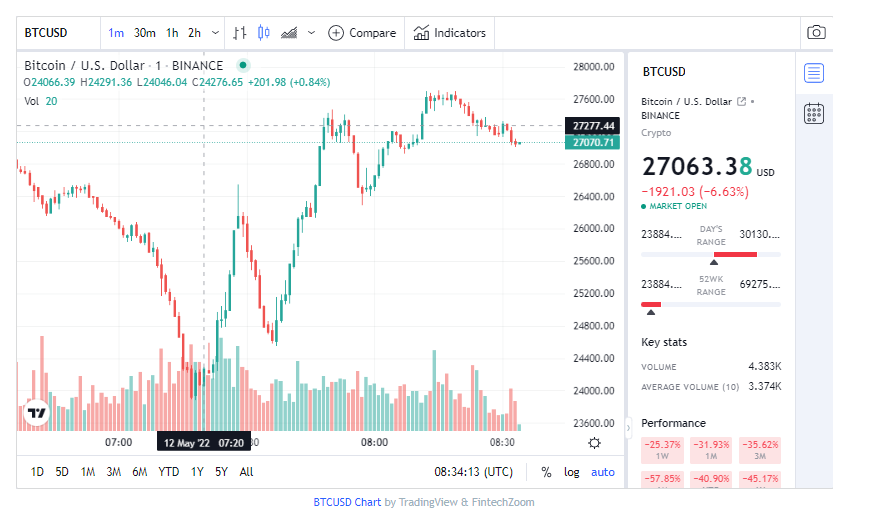

Bitcoin slumped listed below $24,000 Thursday for the first time in over 18 months, as cryptocurrency markets prolonged their losses amidst concerns over rising inflation and also the collapse of a debatable stablecoin job.

The price of bitcoin dove as low as $23,965.52 Thursday morning, according to FintechZoom information. That marks the first time bitcoin has sunk listed below the $28,000 level.

As of 7:17 a.m. UTC, bitcoin was trading at $23,965.

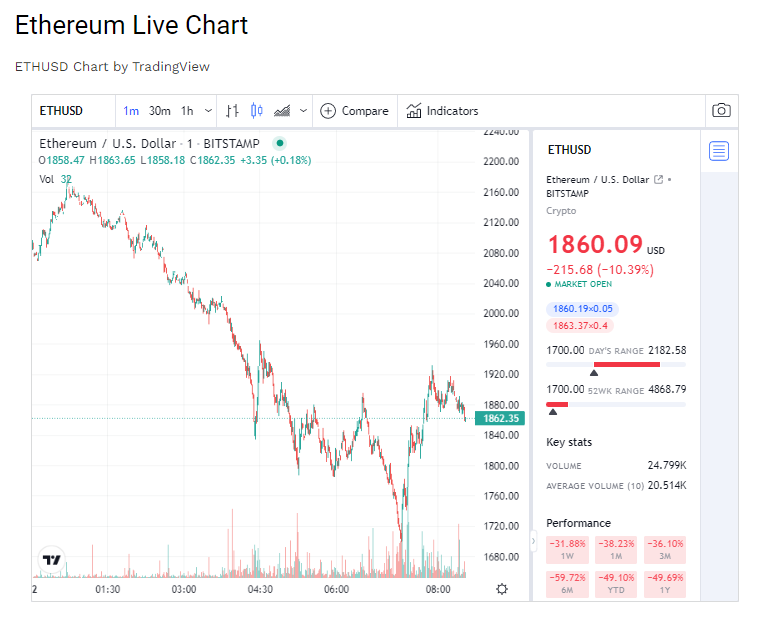

Ether, the second-biggest digital currency, tanked to as reduced as $1,789 per coin. It’s the very first time the token has fallen below the $2,000 mark since July 2021.

Ether was last down -9.48% at a price of $1,890.

Investors are leaving from cryptocurrencies at a time when stock exchange have dived from the highs of the coronavirus pandemic on fears over rising prices and also a weakening economic expectation.

United state inflation data out Wednesday showed prices for goods as well as services leaping 8.3% in April, greater than expected by experts and also close to the highest level in 40 years.

Likewise weighing on investors’ minds is the downfall of embattled stablecoin method Terra.

TerraUSD, or UST, is expected to mirror the worth of the dollar, yet it dropped to less than 30 cents Wednesday, trembling investors’ confidence in the so-called decentralized money room.

Stablecoins are like the savings account of the barely regulated crypto world. Digital currency investors commonly rely on them for safety and security in times of volatility in the markets.

Yet UST, an “algorithmic” stablecoin that’s underpinned by code instead of cash money held in a get, has actually struggled to maintain a stable value as owners have actually bolted for the departure en masse.

As of Thursday morning, UST was trading at concerning 62 cents, still well listed below its intended $1 peg.

Luna, one more Terra token that has a floating price and is meant to take in UST price shocks, eliminated 97% of its worth in 24-hour and also was last worth simply 30 cents– even less than UST.

Investors are frightened regarding the effects for bitcoin. Luna Foundation Guard– a fund established by Terra designer Do Kwon– had actually accumulated a multibillion-dollar stack of bitcoin to help support UST in times of crisis.

The concern is that Luna Structure Guard will sell a large portion of its bitcoin holdings to bolster its troubling stablecoin. That’s a high-risk gamble, not the very least since bitcoin is itself an incredibly unpredictable possession.

Contributing to investors’ concerns Thursday was a drop in the worth of secure, the world’s biggest stablecoin. The token at one factor slipped below 99 cents. Economists have actually long feared that tether may not have actually the called for amount of reserves to reinforce its dollar peg in case of mass withdrawals.

Cryptocurrency markets remain under pressure and continue to accumulate losses. While digital assets have been affected by the tightening of the US monetary policy for some time now, another negative factor emerged from within the sector with the distorted stablecoin prices.

The higher-than-expected inflation figures in the US have prompted investors to move towards selling risky assets, impacting cryptocurrencies in the process as well. The move towards a rapid rise in interest rates could keep cryptocurrencies on a sliding trend for a longer period of time as investors move to safer assets.

This bearish trend is further exacerbated by the recent crash of the TerraUSD, which lost its peg to the USD by a large margin. Its fall in value has eroded investors’ confidence in the crypto markets and in the stablecoin concept in particular.

The company issuing TerraUSD has moved to protect the stablecoin from falling further but has found limited success. The initial plan to shore up the asset by using its bitcoin reserves has failed and has added selling pressures on the market.

TerraUSD remains under scrutiny by most market players as the demise or recovery of the stablecoin could be a milestone for the industry. Either way, it could attract calls for more regulation over stablecoin and over how their reserves are managed.

Daniel Takieddine, CEO MENA BDSwiss

Fears about rampant inflation and the abrupt ending of the era of cheap money have sent cryptocurrencies careering down a cliff edge, as investors scuttle away from risky assets. Crypto fans, lulled into a false sense of security amid sharp price rises during the pandemic, are now facing a rude awakening with assets plunging across the board with Ether down by just under 20% since yesterday, despite notching up a slightly recovery in the last few hours. Bitcoin has crawled back up from its low of $26,000 reached early today, and is currently trading a nudge above $28,000 but it’s down 20% over the last five days.

Hopes that Bitcoin would act as an inflation hedge have fast evaporated as the cryptocurrency has lost more than half its value since its November high, as consumer prices have soared. This most recent price spiral downwards appears to have been sparked by the dramatic fall in value of the TerraUSD stablecoin, designed to trade one on one against the dollar-snapping off its peg, whipped by winds of panic rushing through the crypto world.

We’ve had warnings time and time again from the financial watchdog, the FCA that investors risk losing all their money if they invest in the crypto wild west and the red flags it’s been waving have been shown to be prescient given the downwards rollercoaster ride crypto is currently on. The FCA reserved its most recent warning this week for NFTs, tokens that have been snapped up by speculators on a wave of euphoria, which are now crashing back down to earth. It’s a timely reminder that investors who dabble in such risky assets have very little protection, as they are not regulated beyond anti-money laundering legislation. There have been examples of hackers gaining access to keys to digital wallets and those taking the plunge have very little recourse to action should anything go wrong.

This latest plunge in the wheel of fortune demonstrates that speculating in cryptocurrencies is extremely high risk and are not suitable for the vast majority of people. Cryptocurrency values are driven entirely by the speculation that in the future they will have a meaningful role in the financial system. This makes it impossible to attribute a sound valuation to, or to make a call on, their current or future price. Their use as a means of exchange is very limited, and until they’re widely accepted, the price will continue to be driven by purely by speculation and right now with confidence plummeting, the use case seems even shakier. There may be speculators waiting in the wings to buy what they may see as just a big temporary dip, but expect the volatility to continue as liquidity washing around financial markets evaporates as interest rates are hiked further

There is now likely to be an even greater determination to bring crypto further within the regulatory sphere, given the shock plunge this week in values, to reduce knock on effects to the financial system. The UK government used the Queen’s speech to demonstrate it sees opportunities within the crypto and blockchain eco-system for innovation, but that it’s intent on the safe adoption of crypto currencies. Just how that will be achieved is far from clear, but with crypto fans losing billions in this latest sell off, clamour is likely to intensify for a fresh set to rules, particularly for stablecoins, to be drawn up. ‘’

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown