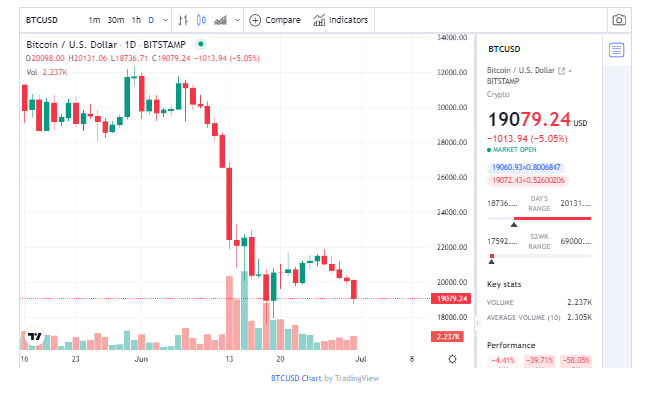

The world’s largest cryptocurrency has actually shed around 58% of its worth in the second quarter of 2022, according to information from CryptoCompare. Bitcoin has actually fallen from $45,524 at the beginning of the quarter and also was trading at around $18,000 on Thursday, the last day of the three-month period, according to CoinDesk information.

This is the worst quarterly performance for bitcoin given that the third quarter of 2011 when it lost 68.1% of its value.

Bitcoin is down 39.8% in June and also is on rate for the most awful month ever going back to 2010 when it became available on exchanges, FintechZoom data shows.

On the other hand, ether is down 69.3% in the 2nd quarter and also is on track for its worst quarter on record, going back to its creation in 2015, according to Coin Metrics data.

Cryptocurrency prices have actually come under extreme pressure this quarter amid rampant rising cost of living which has actually triggered central banks around the world to elevate rate of interest as well as caused a sell-off in risk properties, such as supplies as well as digital coins.

The accident in prices has additionally subjected concerns with a several cryptocurrency companies and also tasks, especially those in the borrowing space as well as firms that are very leveraged.

A number of high profile problems have actually come to light during the quarter.

In May, the mathematical stablecoin terraUSD fell down in addition to its sister token luna. A stablecoin is an electronic currency secured to a real-world property. TerraUSD was supposed to be secured one-to-one with the U.S. buck. Some stablecoins such as tether are backed by actual assets like fiat currencies and federal government bonds. Yet terraUSD was regulated by a formula which efficiently stopped working.

Then In June, crypto lending company Celsius stopped withdrawals for its customers citing “severe market conditions.”

On the other hand, cryptocurrency exchange CoinFlex stopped withdrawals for clients last week also mentioning “extreme market conditions.” However the business likewise claimed long-time crypto investor Roger Ver owes it $47 million after his account entered into “unfavorable equity.” Ver has rejected that he owes CoinFlex money.

And the liquidity situation has actually additionally hit noticeable crypto hedge fund 3 Arrows Funding which has fallen into liquidation, CNBC reported on Wednesday.

The current slump is being described as a new “crypto winter season” as well as has also affected growth and also employing at business. Coinbase as well as BlockFi revealed plans to lay off staff.

Jacob Joseph, research analyst at CryptoCompare, notes that in the previous boom and also bust cycle, bitcoin fell from a height of $19,871 in the fourth quarter of 2017 to a reduced of $3,170 in the 4th quarter of 2018, suffering a drawdown of 8%.

Joseph said a comparable autumn of 82.2% was seen in 2014 when bitcoin dropped from a high of $1,239 in the fourth quarter of 2013 to a low of $221 in the second quarter of 2015.

“This suggests that we could be in for a more drawdown period if the current inadequate macroeconomic problems continue to linger,” Joseph informed CNBC.

Various other capitalists have actually shared bearishness. In May, Guggenheim Chief Investment Officer Scott Minerd, stated bitcoin can go down to $8,000. At the time, the cryptocurrency was trading at around $30,000, representing a 70% fall.