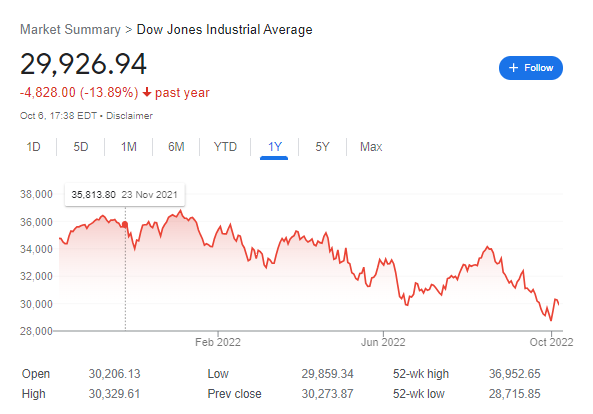

The Dow Jones Industrial Average (INDEXDJX: .DJI) is a stock market index that tracks the performance of 30 large, publicly-owned companies in the United States. The DJIA was created by Charles Dow in 1896 and is one of the oldest and most-watched indices in the world. In this blog post, we will provide a comprehensive overview of the Dow Jones Industrial Average and its component companies.

The Dow Jones Industrial Average is often referred to as “the Dow” or simply “the Dow Jones.” It is a price-weighted average, which means that the stocks with the highest share prices have the greatest impact on the index’s movements.

Read After Hours Dow – Everything You Need to Know.

The DJIA is one of the most widely quoted indices in financial media and is used as a barometer for the overall health of the US stock market and maintained by Dow Jones Indices.

What are the main 3 Stock Indices in US?

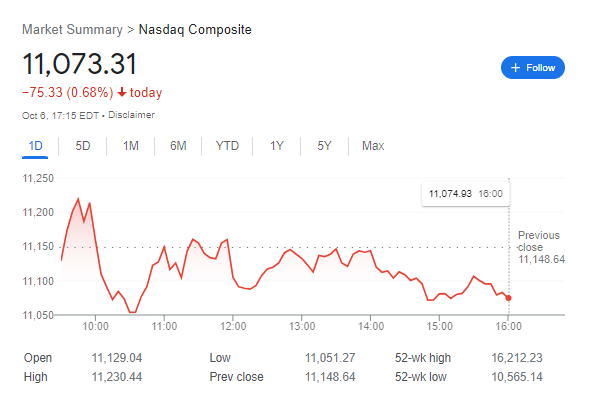

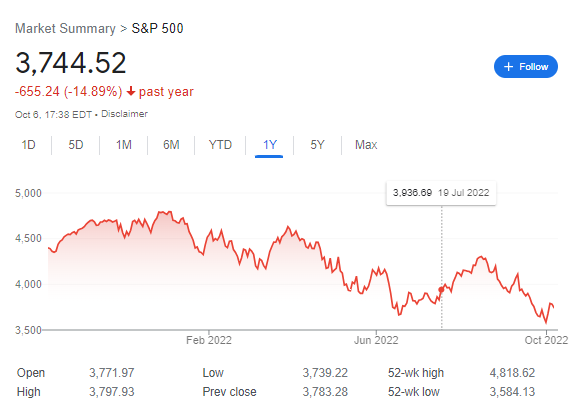

The main three stock indices in the United States are the Dow Jones Industrial Average (DJIA), the Nasdaq Composite, and the S&P 500. The DJIA is a price-weighted index of 30 stocks that are traded on the New York Stock Exchange (NYSE).

The Nasdaq Composite is a market-weighted index of over 3,000 stocks that are traded on the Nasdaq exchange. The S&P 500 is a market-value weighted index of 500 stocks that are tradeable on both the NYSE and the Nasdaq. These three stock indices are the most commonly used benchmarks for tracking the performance of the US stock market.

What are the companies’ sectors in the Dow?

The Dow Jones stocks, or “the Dow” for short, is a stock market index that tracks the performance of 30 large publicly-traded companies. The companies represented in the Dow come from various sectors, including industrials, materials, consumer goods, healthcare, financials, energy, and information technology. While the composition of the Dow has changed over time, it currently includes companies such as Boeing, Caterpillar, 3M, JP Morgan Chase, Coca-Cola, ExxonMobil, and Microsoft. Together, these companies provide a snapshot of the overall health of the U.S. economy.

The History of Dow Jones

The Dow Jones Industrial Average (DJIA), also known simply as “The Dow,” is a stock market index that measures the performance of 30 large, publicly-traded companies in the United States. The index is named after Charles Dow, co-founder of Dow Jones & Company, and reflects the average price of one share of each company’s stock.

The Dow is widely considered to be a leading indicator of the stock market’s overall direction, and it is one of the most closely watched barometers of the American economy. Those would evolve into the Dow Jones Transportation Average and the Dow Jones Industrial Average, respectively.

The history of the Dow Jones Industrial Average dates back to May 26, 1896, when Dow first published his creation in The Wall Street Journal. At that time, the index included only 12 stocks, mostly from the industrial stocks. Over the years, the number of stocks in the index has fluctuated, but it has always represented some of America’s biggest and most influential companies. Today, the Dow remains an important benchmark for investors and a key barometer of the U.S. economy.

The DJIA is one of the most closely watched stock market indices in the world, and it is often used as a barometer for the overall health of the American economy. Components of the Dow are selected by a committee of editors from The Wall Street Journal.

To be eligible for inclusion, a company must be headquartered in the United States, have a minimum market capitalization of $5 billion, and have a float-adjusted market capitalization that represents at least 1% of the total float-adjusted market capitalization of all stocks traded on the New York Stock Exchange. Currently, components of the DJIA include such household names as Apple, Coca-Cola, IBM, and Walmart.

What’s the Origins of the Dow’s name?

The Dow Jones Industrial Average (DJIA) is perhaps the most famous stock index in the world. But where did the name come from?

The DJIA was founded by Charles Dow, a reporter and editor at The Wall Street Journal. In 1896, Dow created the index in order to provide a way to track the performance of the industrial sector. He chose 12 companies that he felt represented the different industrial companies that were driving America’s economy at the time.

These companies were: American Cotton Oil Company, American Sugar Company, American Tobacco Company, Chicago Gas Company, Distilling & Cattle Feeding Company, General Electric Company, Laclede Gas Company, National Lead Company, North American Company, Tennessee Coal and Iron Company, United States Leather Company, and United States Rubber Company.

Dow named the index after himself and his business partner Edward Jones. Today, the DJIA is made up of 30 stocks that are chosen by Wall Street Journal editors. The index is a price-weighted average, which means that stocks with higher prices have a greater impact on the index’s overall movements.

How many stocks are there in the Dow??

The Dow Jones Industrial Average is made up of 30 large, publicly-traded US companies. These companies are leaders in their respective industries and are typically well-known brands. The Dow Jones is a price-weighted index, which means that the stocks with the highest share prices have the greatest impact on the index’s movements.

The Dow Jones is one of the most widely quoted indices in financial media and is used as a barometer for the overall health of the US stock market.

The Dow Jones Industrial Average is made up of 30 large, publicly-traded US companies. These companies are leaders in their respective industries and are typically well-known brands.

The Dow Jones is a price-weighted index, which means that the stocks with the highest share prices have the greatest impact on the index’s movements.

The Dow Jones Industrial Average is made up of the following 30 companies:

| Stock | Current Price | Estimated Dividend [For the next year] | Dividend Yield (%) |

|---|---|---|---|

| Verizon Communications | 39.81 | 2.6100 | 6.56 |

| Dow | 46.62 | 2.8000 | 6.01 |

| Walgreens Boots Alliance | 33.39 | 1.9225 | 5.76 |

| Intel | 27.70 | 1.5200 | 5.49 |

| IBM | 125.50 | 6.6200 | 5.27 |

| 3M | 115.62 | 5.9900 | 5.18 |

| Chevron | 157.63 | 5.9800 | 3.79 |

| Cisco Systems | 41.82 | 1.5500 | 3.71 |

| Amgen | 233.02 | 8.3000 | 3.56 |

| JPMorgan Chase | 112.77 | 4.0000 | 3.55 |

| Merck | 88.39 | 2.9600 | 3.35 |

| Goldman Sachs | 314.87 | 10.5000 | 3.33 |

| Coca-Cola | 56.78 | 1.8200 | 3.21 |

| Procter & Gamble | 130.10 | 3.7446 | 2.88 |

| Home Depot | 289.56 | 8.2000 | 2.83 |

| Johnson & Johnson | 165.62 | 4.6600 | 2.81 |

| Caterpillar | 179.63 | 4.9000 | 2.73 |

| McDonalds | 238.50 | 5.9200 | 2.48 |

| Travelers | 161.47 | 3.8200 | 2.37 |

| Honeywell International | 178.19 | 4.1200 | 2.31 |

| Walmart | 134.25 | 2.2700 | 1.69 |

| NIKE B | 88.64 | 1.3400 | 1.51 |

| American Express | 145.46 | 2.0800 | 1.43 |

| UnitedHealth Group | 523.17 | 7.0000 | 1.34 |

| Microsoft | 248.88 | 2.7200 | 1.09 |

| Visa A | 185.65 | 1.7200 | 0.93 |

| Apple | 146.10 | 0.9400 | 0.64 |

Dow Jones companies list dividend

As of early 2022, the three highest-valued companies in the Dow Jones Industrial Average were Apple, Microsoft, and UnitedHealth.

These companies have a combined market capitalization of over $4.5 trillion and are leaders in their respective industries. Apple is the world’s largest technology company, with a market cap of over $2.3 trillion. Microsoft is the world’s largest software company, with a market cap of over $1.8 trillion. UnitedHealth is the largest healthcare company in the United States, with a market cap of over $500 billion. These three companies are leaders in their respective industries and have a combined market capitalization of over $3 trillion. As such, they are among the most valuable companies in the Dow Jones Industrial Average:

Apple

The Apple Inc. is the world’s largest publicly traded corporation by market capitalization, with its shares trading on the NASDAQ stock exchange under the ticker AAPL. As of February 2018, Apple Inc. had a market capitalization of $828 billion dollars. The company was founded in 1976 and is headquartered in Cupertino, California. Apple Inc. designs, manufactures, and markets consumer electronics, computer software, and online services. The company’s best-known products include the Macintosh line of computers, the iPod music player, the iPhone smartphone, and the iPad tablet computer. In 2017, Apple Inc. was ranked #4 on Fortune 500’s list of America’s largest companies. The company has a long history of innovative product design and marketing; its most recent successes include the iPhone X, AirPods wireless earbuds, and the HomePod smart speaker. Despite these successes, however, Apple Inc.’s share price has been volatile in recent years; it reached an all-time high of $134.54 in April 2015 but has since fallen to a 52-week low of $93.96 in May 2017. Nonetheless, with a strong brand and a loyal customer base, Apple Inc. remains one of the most successful corporations in the world today.

Microsoft

As of January 2021, Microsoft Corporation is worth an estimated $2.2 trillion, making it the most valuable company in the world. The majority of Microsoft’s value comes from its investment in cloud computing, which has seen tremendous growth in recent years. In addition to its market-leading position in cloud computing, Microsoft also benefits from a diversified portfolio of businesses, including productivity software, gaming, and hardware. While Microsoft’s stock price has been volatile in recent months, the long-term outlook for the company remains positive. As more businesses move to the cloud and consumers continue to adopt Microsoft products, the company is well-positioned to generate strong returns for shareholders.

UnitedHealth

UnitedHealth Group Inc. (NYSE: UNH) is one of the largest healthcare companies in the world, providing a wide range of health insurance products and services designed to meet the needs of individuals, families, and businesses of all sizes. The company’s stock has been on a tear in recent years, rising roughly 50% over the past five years. Despite this impressive run, UnitedHealth remains a attractive investment option for long-term investors. The company’s strong financial position, diversified business model, and exposure to high-growth markets make it well-positioned to continue delivering market-beating returns for years to come. As such, UnitedHealth is a stock that any serious investor should consider owning.

How Dow Index is calculated?

The Dow Jones Industrial Average is a stock market index that measures the performance of 30 large, publicly traded companies. The index is calculated by adding together the prices of the stocks in the index, and then dividing by a value called the “Dow Divisor.”

This numerical value is constantly adjusted in order to account for things like stock splits (when a company’s stock price is divided into multiple shares). As of February 2020, the Dow Divisor was 0.145233954.

So, if the combined stock price of all 30 Dow component was $30,000, the Dow Jones Industrial Average would be 20,526.78 ((30,000 / 0.145233954)).

Why should you Invest in Dow Jones Index?

The Dow Jones Industrial Average (DJIA) is one of the most widely-watched stock market indices in the world. The index tracks the performance of 30 large, publicly-traded US companies, and is seen as a bellwether for the wider US economy.

Given its importance, it’s no surprise that many investors are interested in the DJIA. But who should actually invest in the index?

One key group of potential investors are long-term savers, such as those looking to fund retirement. The DJIA has a history of strong performance, delivering an average annual return of around 10% over the last century. This makes it an attractive proposition for those who are willing to take a long-term view.

Another group who may be interested are those who seek to diversify their investments. By buying into the DJIA, investors can gain exposure to a range of different industries and companies, helping to spread risk.

Of course, no investment is without risk, and the DJIA is no exception. It is important to remember that past performance is not necessarily indicative of future results. Nevertheless, for those willing to take on some risk in pursuit of returns, the DJIA remains an attractive option.

How to Invest in Dow Jones Index?

The Dow Jones Industrial Average (DJIA), also called the Dow Jones or the Dow, is one of the most widely followed stock market indexes in the world. It comprises 30 large publicly traded companies from a variety of industries and is often used as a gauge of the overall health of the U.S. stock market.

Investors looking to speculate on the future direction of the Dow Jones can do so through a variety of products, including futures contracts, options, and exchange-traded funds (ETFs). In order to trade these products, you’ll need to open an account with a broker that offers access to the relevant markets.

When choosing which product to trade, it’s important to consider your own investment objectives and risk tolerance. For example, futures contracts are generally considered to be more risky than ETFs, due to their leverage effect.

Before making any trades, be sure to do your own research and carefully consider all your options before making any decisions.

Step1 – How to Open a Trusted Broker Account

When you are ready to begin trading stocks, the first step is to open a broker account. A broker is an individual or firm that buys and sells securities on behalf of their clients. There are many different types of brokers, but most people will work with either a full-service broker or a discount broker.

Full-service brokers provide a wide range of services, including investment advice and research, while discount brokers typically charge lower fees and provide fewer services. Regardless of which type of broker you choose, it is important to make sure that your broker is registered with the Securities and Exchange Commission (SEC) and that they have a good reputation.

Step2 – Create an Account

Once you have found a trusted broker, opening an account is relatively simple. You will need to provide some personal information and fund your account with cash or securities. Once your account is opened, you will be able to buy and sell stocks online or through your broker.

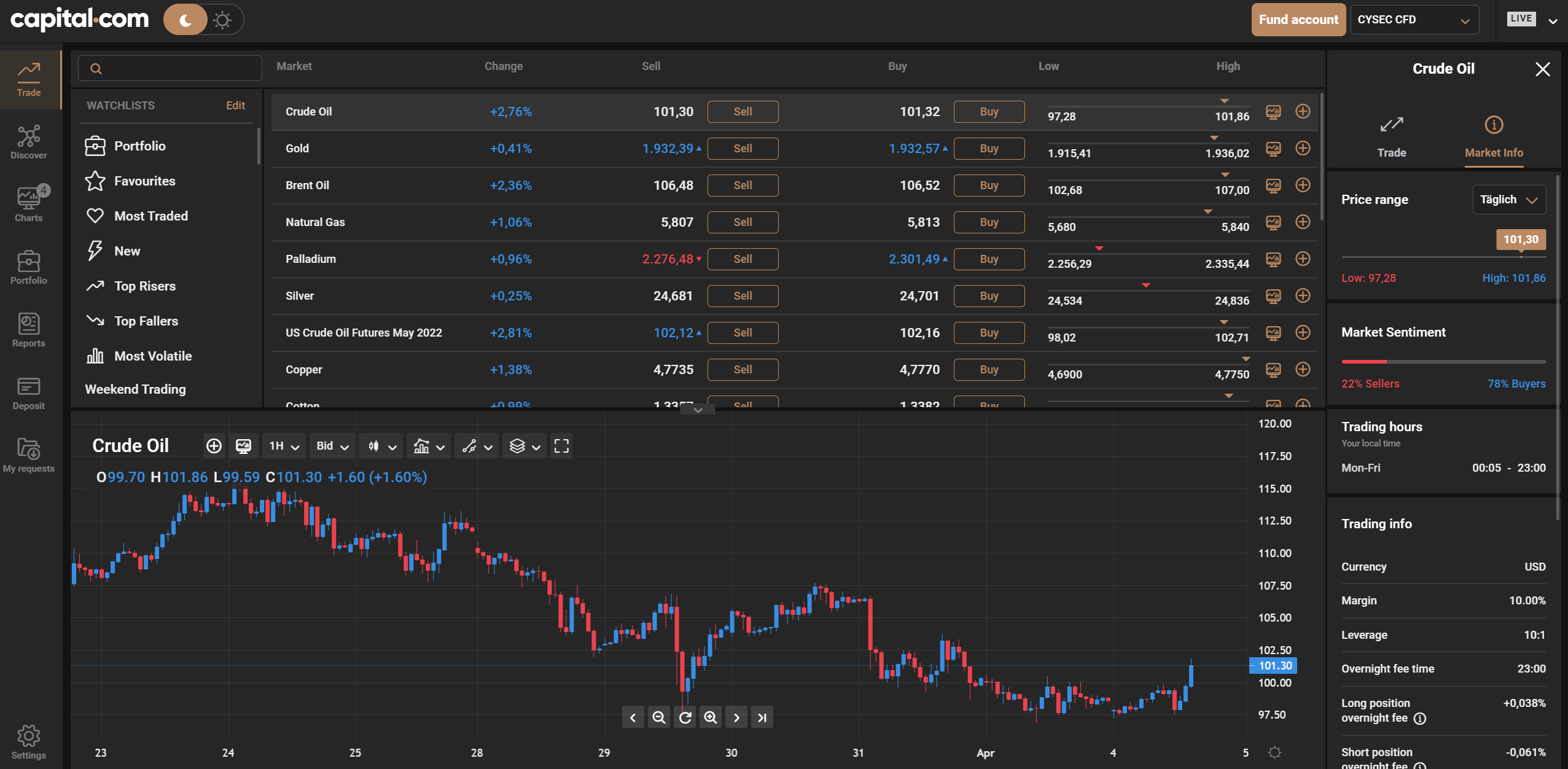

Step 3A – How to Buy Dow 30 Stocks through a CFD?

The Components of the Dow Jones can be bought and sold through CFDs. A CFD, or contract for difference, is an agreement between two parties to exchange the difference in the value of a security between the time the contract is finalized and when it expires.

CFDs are traded on margin, which means that you only need to put down a small percentage of the total value of your trade. This allows you to take a much larger position than would be possible with traditional investing. However, it also amplifies your losses if the market moves against you.

Before trading CFDs, you should carefully consider your investment objectives, level of experience, and risk appetite. You should also be aware that leverage can work against you as well as for you.

Now let’s take a look at how to buy Components ofthe Dow Jones through a CFD atPlus500.

Step 3B – Select the Best Stocks to buy

You can prefer to buy the company stock. When it comes to investing in stocks, there is no one-size-fits-all approach. Instead, the best strategy depends on a number of factors, including your financial goals, risk tolerance, and investment timeline. However, there are a few general tips that can help you select the best stocks to buy.

First, consider companies with a strong track record of performance. This is a good indication that they are well-managed and have a solid business model. Second, look for stocks that are undervalued by the market. This means that they have potential for significant growth. Finally, don’t forget to diversify your portfolio. By investing in a variety of stocks, you can minimize your risk and maximize your chances of success.

Step4 – How to check the Stock Price?

Confused about how to check the stock prices? Many people are! The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock indices in the world, and checking the prices of its component stocks is a good way to get a general sense of where the markets are heading. There are a few different ways to check the DJIA.

One is to simply look up the index on a financial news website like Bloomberg or CNBC. This will give you the latest value of the index, as well as a chart showing how it has performed over time. Another way to check the DJIA is to look up the individual stock prices of its component companies.

These companies are listed on the New York Stock Exchange, and their stock prices can be checked through any online broker or even directly on the NYSE website. By looking at how these stocks are performing, you can get a good sense of where the markets are headed. So don’t be confused about how to check the stock prices – just use one of these methods and you’ll be able to get all the information you need!

Step5 – What leverage should i use?

One of the most important decisions you will make when trading forex is what leverage to use. Leverage is a double-edged sword – it can help you make big profits, but it can also lead to big losses. The key is to find the right balance for your trading style. If you are a conservative trader, you may want to use less leverage. This will limit your potential profits, but it will also limit your potential losses. On the other hand, if you are a more aggressive trader, you may want to use more leverage. This will give you the opportunity to make more profit, but it also increases your risk of losses. Ultimately, the best way to determine what leverage to use is to experiment with different levels and see what works best for you.

Step6 – How To Set your Stop Loss?

A stop-loss is an order placed with a broker to buy or sell once the stock hits a certain price. A stop-loss is designed to limit an investor’s loss on a security position. There are two primary types of stop-losses, absolute and percent. An absolute stop-loss is a dollar amount set by the investor that automatically triggers a sale when the security falls below that price. For example, an investor who bought a stock at $50 per share may place an absolute stop-loss order at $45, which would limit her loss to 10% should the stock fall to that level.

A percent stop-loss is similar, but instead of being set at a specific dollar amount, it is set as a percentage below the security’s current price. For example, if an investor bought a stock at $50 per share and Place percent stop-loss of 20%, then the stop-loss would be triggered when the stock falls to $40 per share. The main advantage of using a stop-loss is that it helps to take emotion out of the equation by automatically selling a security when it hits a predetermined price. This can be especially helpful in volatile markets when it may be difficult to make rational decisions about when to sell.

Stop-losses can also help to protect profit by automatically selling a security when it reaches a certain price. However, it is important to remember thatstop-losses are not infallible and there is always the risk that a stock may gap down through the stop- loss price without getting executed.

What is the market capitalization of a company?

The market capitalization of a stock is the total value of all the shares outstanding. It is calculated by multiplying the number of shares outstanding by the current market price per share.

The market cap is one of the most important measures of a company’s size and serves as a good starting point for equity analysis. However, it is important to remember that the market capitalization only represents the value of the equity and does not include the value of debt or other assets. As such, it should be used in conjunction with other measures when conducting an analysis.

Final Thoughts

The Dow Jones Industrial Average (DJIA) is comprised of 30 large, publicly traded companies in the United States. It is one of the oldest and most widely recognized stock indices in the world. The DJIA is a price-weighted index, meaning that the stocks with the highest share prices have the greatest impact on the index’s movements.

The index is closely watched by traders and investors as a gauge of the overall health of the U.S. stock market. In general, a rising DJIA indicates that stocks are outperforming, while a falling DJIA indicates that stocks are underperforming. While the DJIA is not a perfect measure of the stock market, it is still an important barometer for investor sentiment.