Today, stocks rose despite the Dow Jones Industrial Average (INDEXDJX: .DJI) closing down 0.11% [1], as good earnings reports from several companies pushed the Nasdaq up by over 3% [1]. CIOHennion & Walsh Chief Investment Officer, Kevin Mahn, discussed the current state of the American consumer and how the Fed’s interest rate hike has affected the stock market [2], with tech leading the way higher.

The Dow, S&P 500, and Nasdaq all had positive movements for the day, with the Dow Jones Industrial Average closing at 34,053.94, down 39.02 points, or 0.11% [3]. Adani Group’s stock market rout, Shell’s $42 billion profit, and Meta’s upbeat outlook were all contributing factors to the stock market’s positive performance [3].

References:

[1] Dow Jones Industrial Average Overview – DJIA – MarketWatch [2] Dow Jones Industrial Average (^DJI) Charts, Data & News [3] DJIA | Dow Jones Industrial Average Stock Prices and ChartsINDEXDJX: .DJI Top Gainers Today: Microsoft +4.69%, 3M +3.89 %, Intel +3.85%, Apple +3.71%, Home Depot +3.58% and Walt Disney +3.43%.

The Dow Jones Industrial Average has been on the rise today, with some of the biggest gainers being Microsoft [1], which climbed 4.69%; 3M [1] which rose 3.89%; Intel [1] with a 3.85% increase; Apple [1] with a 3.71% rise; Home Depot [1] with a 3.58% gain; and Walt Disney [1] with a 3.43% boost. These stocks have all seen a significant increase in their share prices, indicating a strong day in the markets.

References:

[1] Dow Jones Gainers and Losers – Markets Insider [2] Dow closes more than 350 points lower in broad selloff, Apple … [3] Dow Jones Rallies On Key Inflation Data; Amazon Dives …Microsoft Stock increased today 4.69%

Shares of Microsoft (MSFT) [1] rose 4.69% to $264.60 on Thursday [2], in what proved to be an all-around mixed trading session for the stock market [2]. This was based on the stock quote, history, news and other vital information [3] which helped investors with their stock trading and investing. Technical analysis showed a bullish pattern detected and the commodity channel index was updated. The previous close for the stock was 252.75 and the open was 258.82. The bid was at 264.06 and the ask was at 264.10. The range for the stock was from 257.25 to 264.69 [3]. The average volume was 30,079,283 and the fair value for the stock is the appropriate price based on the earnings and growth rate projected [3].

References:

[1] Why Microsoft Stock Climbed Today | The Motley Fool [2] Microsoft Corp. stock outperforms competitors on strong … [3] Microsoft Corporation (MSFT) Stock Price, News, Quote …3M Stock increased today 3.89%

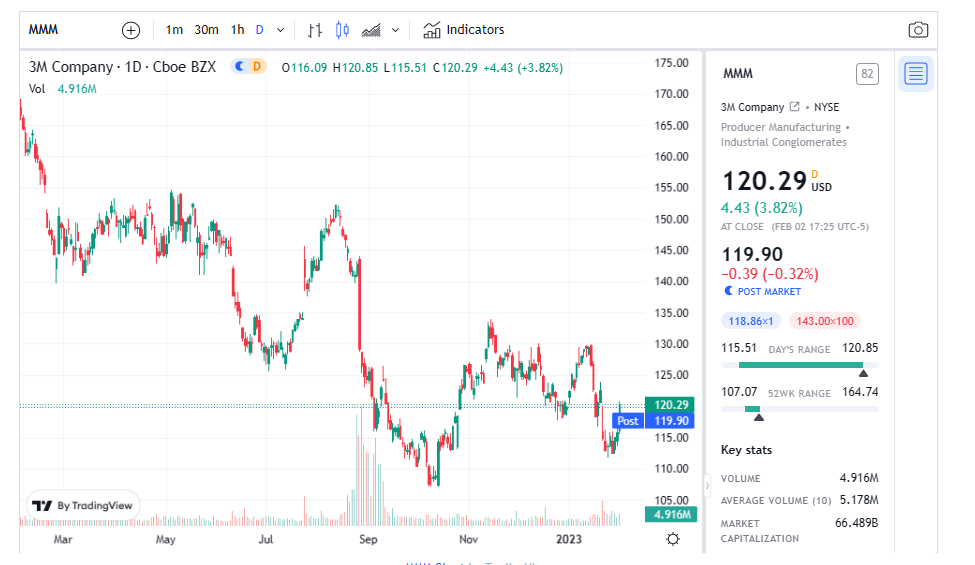

Today, 3M (MMM 1.50%) saw a jump in its stock price of nearly 4%, according to [1] the company’s price and volume information. The surge was driven by [3] a strong second-quarter earnings report, as well as two other announcements from the company – one about the separation of its healthcare business into a separately traded public company and the other about the merger of its food safety business with Neogen. This positive news helped propel 3M out of a month-long slump, while other stocks in the industrial conglomerates sector, such as Bed Bath & Beyond, Union Pacific, and Paccar, experienced mixed performance. Bed Bath & Beyond rose 15.3%, while Union Pacific fell 3.3%, and Paccar gained 8.6% [2]. 3M’s strong performance is a sign that investors are expecting the company to benefit from these new changes in the near future.

References:

[1] 3M Company (MMM) Stock Price Today, Quote & News [2] Stocks making the biggest moves midday: 3M, Paccar … – CNBC [3] Why 3M Stock Popped Today | The Motley FoolIntel Stock increased today 3.85%

Intel (INTC 3.85%) stock prices surged today, with the parent company Intel spinning off some of its stake in the autonomous vehicle chip designer Mobileye Global into a publicly traded company. [1] This marks a reversal from the low prices the stock experienced on Friday after Intel reported an earnings miss, causing the Dow Jones Industrial Average to dip. [2] Despite the recent losses, investors are still optimistic about Intel’s future performance as CEO Pat Gelsinger is leading the company through a major turnaround effort. [3] Intel is expecting revenue to be in a range of $2.19 billion to $2.28 billion, up 20% from 2022. With the long-term secular growth trend influencing the automotive market, Intel’s chips for ADAS and its accompanying software are in high demand.

References: