When most people think of the stock market, they think of the Dow Jones Industrial Average. This index, which consists of 30 blue chip companies, has been around since 1896 and is often used as a shorthand for the overall market. While there are better indicators of stock market performance, the Dow still tends to get more attention than other major stock indexes like the Nasdaq and S&P 500. In this article, we’ll take a closer look at the Dow Jones stocks and what investors need to know about them.

What major companies are in the Dow?

The Dow Jones Industrial Average, more commonly known as the Dow, is a stock market index that includes 30 of the largest publicly traded companies in the United States. The companies in the Dow are selected by a committee from the Wall Street Journal and are meant to represent different sectors of the economy, such as industrial companies, technology, consumer goods, healthcare, and energy.

Read Dow Futures Today – What You Need to Know.

Some of the companies in the Dow include Apple, Microsoft, Walmart, and Visa. The index is named after Charles Dow, one of the founders of the Wall Street Journal. The value of the Dow is calculated by taking the sum of the stock prices of all 30 companies and dividing it by a number called the Dow divisor. The divisor is constantly changing to account for things like stock splits, but it is typically around 10 or 20. The Dow is one of the most closely watched stock market indices in the world and is often used as a barometer for how well the US economy is doing.

Read What Is Bear Market? An Ultimate Guide.

These companies are chosen by the Dow Jones Index Committee and must meet certain fundamental company data, such as being headquartered in the United States, having a market capitalization of at least $18 billion, and being listed on the New York Stock Exchange or Nasdaq. The Dow Jones stocks are a diverse group of companies, ranging from Dow (DOW) , the chemical company, to Apple (AAPL) , the tech giant.

What is the longest running company on the DJIA?

The longest running company on the Dow Jones Industrial Average (DJIA) is General Electric Company (GE). GE was founded by Thomas Edison in 1892 and has been a part of the DJIA since 1907. GE is a diversified conglomerate with businesses in sectors such as healthcare, aviation, and power generation. While GE has faced challenges in recent years, it remains one of the largest and most well-known companies in the world. Given its long history, GE is likely to remain a part of the DJIA for many years to come.

Read this FintechZoom Article: Understanding 2-Year Treasury Rate Investing.

What were the original Dow 30 stocks?

The Dow Jones Industrial Average (DJIA) is a stock market index that was created by Charles Dow in 1896. It originally consisted of 12 stocks, but it was expanded to 30 stocks in 1928. The original DJIA stocks were American Cotton Oil Company, American Sugar Refining Company, American Tobacco Company, Chicago Gas Company, Distilling & Cattle Feeding Company, General Electric Company, Laclede Gas Company, National Lead Company, Northwestern National Bank, United States Rubber Company, and United States Steel Corporation. These companies were chosen because they represented different industries and were seen as leaders in their respective fields. While some of these companies are no longer in existence, the DJIA is still an important benchmark for stock market performance.

Sectors on DJIA

Investors should also be aware that the Dow Jones stocks are not equally represented across sectors. As of this writing, the Dow is heavily weighted toward industrials (27%), financials (17%), and information technology (16%). This sector weighting is something to keep in mind when you’re evaluating the Dow as an investment.

| Stock | Current Price | Estimated Dividend [For the next year] | Dividend Yield (%) |

|---|---|---|---|

| Verizon Communications | 39.81 | 2.6100 | 6.56 |

| Dow | 46.62 | 2.8000 | 6.01 |

| Walgreens Boots Alliance | 33.39 | 1.9225 | 5.76 |

| Intel | 27.70 | 1.5200 | 5.49 |

| IBM | 125.50 | 6.6200 | 5.27 |

| 3M | 115.62 | 5.9900 | 5.18 |

| Chevron | 157.63 | 5.9800 | 3.79 |

| Cisco Systems | 41.82 | 1.5500 | 3.71 |

| Amgen | 233.02 | 8.3000 | 3.56 |

| JPMorgan Chase | 112.77 | 4.0000 | 3.55 |

| Merck | 88.39 | 2.9600 | 3.35 |

| Goldman Sachs | 314.87 | 10.5000 | 3.33 |

| Coca-Cola | 56.78 | 1.8200 | 3.21 |

| Procter & Gamble | 130.10 | 3.7446 | 2.88 |

| Home Depot | 289.56 | 8.2000 | 2.83 |

| Johnson & Johnson | 165.62 | 4.6600 | 2.81 |

| Caterpillar | 179.63 | 4.9000 | 2.73 |

| McDonalds | 238.50 | 5.9200 | 2.48 |

| Travelers | 161.47 | 3.8200 | 2.37 |

| Honeywell International | 178.19 | 4.1200 | 2.31 |

| Walmart | 134.25 | 2.2700 | 1.69 |

| NIKE B | 88.64 | 1.3400 | 1.51 |

| American Express | 145.46 | 2.0800 | 1.43 |

| UnitedHealth Group | 523.17 | 7.0000 | 1.34 |

| Microsoft | 248.88 | 2.7200 | 1.09 |

| Visa A | 185.65 | 1.7200 | 0.93 |

| Apple | 146.10 | 0.9400 | 0.64 |

What’s the Dow Jones Industrial Average?

The Dow Jones Industrial Average (DJIA), also simply called “the Dow,” is one of the oldest and most well-known stock market indexes in the United States. It is a price-weighted index, meaning that its components are weighted according to their stock prices, rather than their market capitalization.

The Dow Jones Industrial Average was first published in 1896, and it currently consists of 30 large publicly traded companies, including household names such as Coca-Cola, IBM, and Boeing. While the Dow is often used as a barometer for the overall health of the stock market, it is important to remember that it is only a small slice of the market. Nevertheless, it remains one of the most closely watched financial indicators in the world.

Dow Jones Industrial Average is a price-weighted index, which means that each stock’s weight in the index is based on its price per share. For example, if Dow is trading at $50 per share and Apple is trading at $500 per share, Dow will make up much less of the index than Apple. This can be a benefit or a drawback, depending on how you look at it. On the one hand, it means that companies with high stock prices have more influence on the Dow. On the other hand, it means that companies with high stock prices can be overrepresented in the Dow.

The INDEXDJX: .DJI index tracks the performance of 30 large blue chip companies that trade on the New York Stock Exchange. The .DJI index is a price-weighted average, meaning that the stocks with the highest share price have the biggest impact on the index’s movements. The companies in the .DJI index are some of the most well-known and successful businesses in the world, making it one of the most closely watched stock market indexes. The .DJI index is also a popular benchmark for mutual funds and exchange-traded funds.

While the specific composition of the .DJI index can change from time to time, it always includes companies that are leaders in their respective industries. This makes the .DJI index an important barometer of the overall health of the U.S. stock market.

How Dow Jones Industrial Average is it calculated?

The Dow Jones Industrial Average (DJIA) is one of the most widely-watched stock market indices in the world. But how is it calculated? The DJIA is a price-weighted average, meaning that the stocks with the highest prices have the greatest impact on this index.

The DJIA is composed of 30 blue chip stocks that are selected by editors at The Wall Street Journal. These stocks are chosen based on their liquidity, market capitalization, and sector representation. The DJIA is calculated by taking the sum of the prices of all 30 stocks and dividing by a divisor known as the “Dow Divisor.” This divisor is adjusted periodically to account for things like stock splits. As a result, the DJIA is a good indicator of how large, publicly traded companies are performing.

What was the Dow Jones Record High?

On January 26, 2018, the Dow Jones Industrial Average reached its highest closing point in history, finishing the day at 26,616.71. The record-breaking day was fueled by a strong performance from the financial sector, with shares of Goldman Sachs and JPMorgan Chase both rising by more than 2 percent.

While the Dow has come close to its all-time high on several occasions in recent years, it has never been able to surpass it. The previous record high was set on January 14, 2000, when the index closed at 11,722.98. If the Dow were to reach that level again today, it would be more than double its current value. Despite its recent run of success, there are some analysts who believe that the market is due for a correction. With valuations at historic levels and interest rates on the rise, they believe that a sharp sell-off could be in store for the near future. Only time will tell if the Dow can continue its march higher or if a pullback is indeed on the horizon.

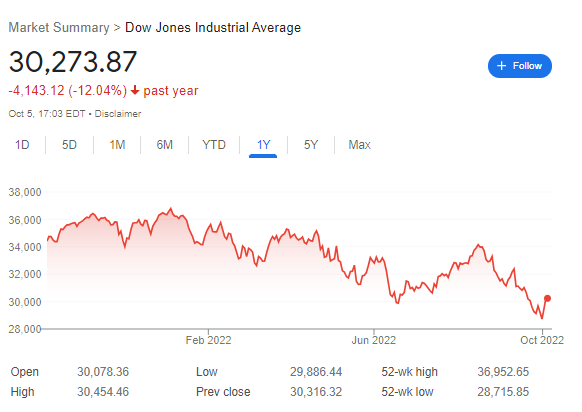

What is the 52 week high for the Dow?

The 52 week high for the Dow is based on the highest closing price during the most recent 52 week period. The 52 week high is often used by investors to gauge how well a company is performing and to make decisions about buying or selling shares.

The 52 week high can also be a useful tool for identifying trends in the market and also to estimate Dow Jones forecast. For example, if the 52 week high is consistently increasing, it may be an indication that a company is doing well and that its stock is likely to continue to rise. On the other hand, if the 52 week high is decreasing, it may be an indication that a company is struggling and that its stock may be at risk of falling.

Dow Jones Stock After Hours Trading Activity

When trading activity on the Dow Jones stock exchange extends beyond normal business hours, there are a number of factors that can impact the performance of individual stocks. In general, after hours trading activity varies based on a number of different factors such as underlying market conditions, investor sentiment, and news events. Some companies may see increased trading volume in the after hours Dow period due to strong current earnings reports or other positive announcements. Conversely, stocks that experience dips in value may become attractive targets for short sellers looking to capitalize on a decline in share price. Ultimately, what impacts performance during after hours trading is partly determined by a company’s overall reputation and track record. Nonetheless, any savvy investor should stay informed about ongoing trends and news in order to make well-informed decisions when it comes to buying or selling during the after hours period.

Where I Can Find the Dow Jones Stock Movers?

There are a few different ways that you can find this information like what is Dow Jones today?. One option is to look at a financial news website or TV station that offers coverage of the stock market. Another option is to use an online stock trading platform that will provide you with real-time data on the prices of stocks. Finally, you can also check out the website of the Dow Jones Industrial Average itself, which provides detailed information on the performance of all 30 stocks that make up the index. Whichever method you choose, keep in mind that the Dow Jones Industrial Average is just one stock market index; there are many others out there that can give you insights into the overall health of the stock market.

The Dow’s Data Providers Stocks is in Real-Time?

The volume of stocks traded is an important indicator of market activity and liquidity. When the volume is high, it means that there is a lot of buying and selling activity taking place, and when the volume is low, it means that there is less activity.

The Dow’s data providers offer real-time quotes and volume information for all markets, so you can always stay up-to-date on the latest market activity. In addition, comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes, so you can be sure that you’re getting accurate and up-to-date information.

Whether you’re trying to buy or sell stocks, the volume information from the Dow’s data providers can give you a good indication of the level of activity in the market.

What is the best site for stock quotes?

When it comes to international stock quotes, there are a number of different websites that can provide this information. However, not all websites are created equal. For investors who are serious about tracking their portfolios, it is important to find a website that is reliable and easy to use.

One website that meets these criteria is Yahoo Finance. In addition to providing up-to-date stock quotes, Yahoo Finance also offers a variety of tools and market data that can be used to research investments, and of course: FintechZoom.

For example, the website includes a detailed overview of each company, as well as financial news and analysis. As a result, Yahoo Finance is an ideal website for anyone who wants to stay on top of the latest stock market developments.

Best ETFs That Track Dow Jones

Exchange-traded funds (ETFs) provide investors with a way to track the performance of the DJIA without actually owning any shares of the underlying stocks and that’s the reason to watch daily Dow Jones ETF Movers. We will take a look at some of the ETFs that have been tracking the DJIA recently:

- The SPDR Dow Jones Industrial Average ETF (DIA) is an ETF that tracks the DJIA. The DIA stock is one of the oldest and largest ETFs in existence, with over $30 billion in assets under management. The DIA holds a portfolio of all 30 stocks that make up the DJIA, and it is designed to track the performance of the index as closely as possible. The DIA has a low expense ratio of 0.17%, and it pays a quarterly dividend yield of 2.29%.

- The iShares Dow Jones Industrial Average ETF (IYY) is another ETF that tracks the DJIA. The IYY is smaller than the DIA, with only about $1.5 billion in assets under management. However, the IYY has a lower expense ratio of 0.08%. The IYY also pays a quarterly dividend yield of 2.29%.

- The SPDR S&P 500 Index ETF (SPY) is an ETF that tracks the broader S&P 500 index, which includes 500 large-cap companies across a variety of industries. While the SPY does not specifically track the DJIA, it can still be used as a proxy for tracking the overall stock market. The SPY has an expense ratio of 0.09% and pays a quarterly dividend yield of 1.84%.

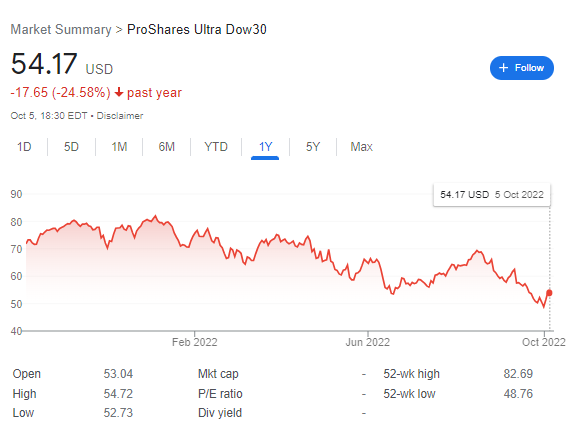

- ProShares Ultra Dow30 (DDM) is an exchange-traded fund (ETF) that seeks to provide daily investment results that correspond to twice (200%) the daily performance of the Dow Jones Industrial Average Index. The Index includes companies such as Boeing, Caterpillar, Coca-Cola, ExxonMobil, Goldman Sachs, IBM, JPMorgan Chase, and Walt Disney. DDM’s strategy is designed to provide exposure to the more volatile large-capitalization components of the Dow Jones Industrial Average. The ETF is non-diversified and invests in financial instruments that ProShare Advisors believes will have similar daily price movements as the Index. DDM’s investments are rebalanced daily to reflect changes in the Index constituents and securities with large price movements are excluded from the Index when their weight would cause theIndex to exceed specified limits. The ETF is traded on the NYSE Arca and has a expense ratio of 0.95%.

Does Dow Jones include bonds?

The Dow Jones Bonds Index is a broad measure of the bond market, including both government and corporate bonds. It is one of the most widely followed bond indexes in the world, and is often used as a benchmark for investment performance. The index includes bonds with a wide range of maturities, from short-term to long-term. This provides a broad perspective on the overall health of the bond market, and can be useful for both investors and policy makers alike. The Dow Jones Bond Index is an essential tool for anyone involved in the bond market.

Final Thoughts

If you’re thinking of investing in Dow Jones stocks, there are a few things you should keep in mind. First, remember that the Dow is a price-weighted index, which means that companies with higher stock prices have more influence on the index. Second, the Dow is heavily weighted toward certain sectors, so make sure you’re comfortable with that sector weighting before investing. And finally, remember that the Dow is just one indicator of stock market performance – there are other indexes out there worth considering as well.

When it comes to stock investing, there is no one-size-fits-all approach. However, for long-term investors who are looking for a starting point, the Dow Jones Industrial Average (DJIA) is a good place to begin. The DJIA is a price-weighted index that tracks 30 of the largest publicly traded companies in the United States. While it is by no means a perfect barometer of the stock market as a whole, it is highly regarded by investors due to its long history and reputation for being a reliable indicator of market trends. And thanks to the proliferation of online brokerages, investing in DJIA stocks is now easier and more affordable than ever before. So whether you’re just getting started in the world of stock investing or you’re looking to add some blue-chip stocks to your portfolio, the Dow Jones Industrial Average should definitely be on your radar.

Do you have Dow Jones stocks in your portfolio? Let us know in the comments below