The Dow Jones Industrial Average (DJIA) is a stock market index that measures the performance of 30 large, publicly-owned companies in the United States. The DJIA was created by Charles Dow in 1896 and is one of the oldest and most-respected indices in the world. It is often used as a benchmark to measure the overall health of the stock market.

Dow Jones Industrial Average

Some of the key factors that make the Dow Jones so important are its size, breadth, and liquidity. The DJIA represents roughly one-quarter of the total value of all stocks listed on U.S. exchanges, making it one of the largest indices in terms of market capitalization. In addition, it covers a wide range of industries, providing insight into the performance of companies across different sectors. Finally, it is highly liquid, with millions of shares traded every day, making it an ideal indicator for measuring overall market trends and investor sentiment.

Overall, the Dow Jones is a key benchmark that provides valuable insights into both individual stocks and the broader stock market as a whole. Whether you are a seasoned investor or just starting out, it is an essential tool that should be part of every investor’s arsenal. So what are you waiting for? Start tracking the Dow Jones today and start making smarter investment decisions!

Looking forward, many experts believe that the DJIA will continue to play an important role in the global financial markets. As new technologies and investment strategies emerge, investors will likely continue to turn to the Dow Jones as a trusted resource for tracking market trends and making informed investment decisions. So if you want to be ahead of the curve and stay on top of what’s happening in the world of finance, make sure you keep your eye on the Dow Jones!

Dow Jones Indices

Dow Jones Indices are a set of key financial indicators that provide valuable insight into the health and performance of global markets. These indices, which include the Dow Jones Industrial Average, help investors to track trends in major sectors such as technology, finance, and energy. They also enable traders to identify opportunities for growth and build strategies for maximizing returns on their investments.

Whether you are just starting out as an investor or a seasoned market veteran, Dow Jones Indices provide essential information that can help you make informed financial decisions and grow your portfolio over time. So if you want to keep ahead of the curve in a rapidly changing market landscape, consider checking out these key indicators today.

How is Dow price calculated?

Dow price is calculated using a price-weighted index that takes into account the price of each individual stock in the index, rather than their market capitalization.

This means that stocks with higher prices have a larger impact on the index than those with lower prices. The price of each stock, however, is adjusted by a factor known as the Dow divisor to make sure that it reflects changes in the overall price level.

Overall, this approach ensures that Dow price accurately reflects changes in market sentiment and overall economic conditions, making it an invaluable tool for investors and analysts alike.

How can You Invest in the DJIA?

To invest in the DJIA, you’ll need to work with a trusted stock broker or other financial professional who has experience and access to the various investment vehicles involved in this particular index. You can buy shares in the Dow through exchange traded funds (ETFs).

The dow jones index is considered one of the most important benchmark indicators in US stock market performance, listing and tracking the top 30 companies traded on the New York Stock Exchange. Your broker can help you to evaluate stock prices, historical market trends, and current economic conditions as they relate to these companies listed in the dow. Additionally, they can assess your risk tolerance and investment goals, recommending investments that match your needs.

Read Dow Futures Today – What You Need to Know.

Ultimately, investing in the dow jones index is an important way to gain exposure to some of the key players in today’s global economy. With the right expert guidance, it can also be a smart and strategic way to diversify your portfolio and build long-term wealth over time.

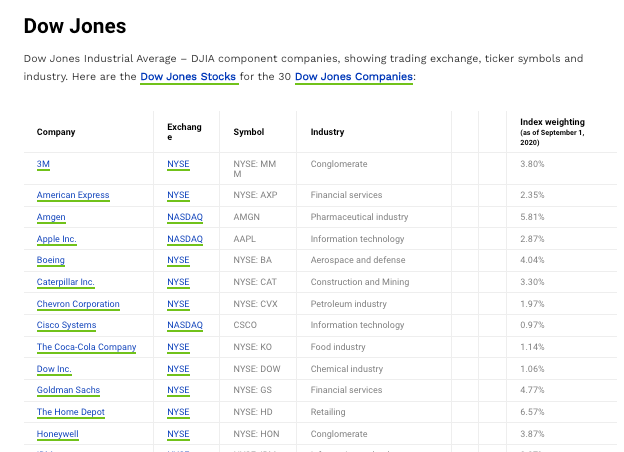

Companies included in the DJIA

The Dow Jones Industrial Average (DJIA) is one of the most widely followed stock indices in the world. It includes a select group of 30 large, publicly traded companies that are organized across a variety of sectors and industries.

The components stocks in the index are selected based on a number of criteria, including overall market value and previous performance. Together, these companies make up the dow jones transportation average, which is often used as a representation of the overall health and direction of the economy.

While this index has undergone numerous changes over its long history, it has consistently provided investors with valuable insight into key trends in business and finance. Whether you’re an active day trader or just curious about current market conditions, the DJIA offers an important window into what’s happening on Wall Street.

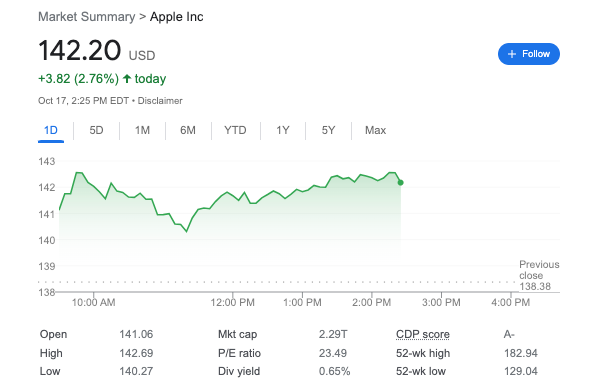

How is the Dow Jones Today?

You can read here information about Dow Jones Price Today. The Dow Jones Industrial Average is a stock index.

Who controls Dow Jones?

Dow Jones is one of the most well-known and influential companies in the world. With its widely-read business news publication and several financial data services, Dow Jones is a trusted voice on all matters of business and finance. However, despite the company’s influence in the corporate world, it does not have complete control over its operations. Dow Jones is owned by a consortium of media companies that includes News Corp, which is run by billionaire mogul Rupert Murdoch. Given this ownership structure, it can be said that Murdoch holds the ultimate authority at Dow Jones, though executives within the company also play a key role in guiding Dow Jones’ day-to-day activities. As such, while Dow Jones may not be entirely independent or even wholly reliant on external forces for its success, it can certainly be said to be subject to some degree of outside influence and control. In short, those who own and operate Dow Jones shape its course both directly and indirectly. And if there’s anyone who knows how to steer their way around the corporate world, it’s someone like CEO Rupert Murdoch!