- Pound headed back towards $1.20 as speculation intensified that the PM would resign

- Weakness to sterling remains as new leader is sought and fresh limbo begins

- FTSE 100 stays higher after gains on Wall Street

- Policymakers razor-sharp focus on inflation providing relief

- Energy giants rise after Shell’s positive outlook on prices

U.K. Prime Minister Boris Johnson is expected to resign on Thursday after more than 50 members of Parliament surrendered from his government within two days.

The clash of political camps as well as the row over whether the Head of state should remain or go is over. With the state of mind music transforming so suddenly in Westminster as well as Boris Johnson finally determining to leave 10 Downing Road, the pound raised against the dollar, heading back up to $1.20 prior to dipping back a little. With the rollcall of resignations now being upgraded by the minute, as well as his freshly designated Chancellor of the Exchequer also requiring him to go, his position looked untenable. The pound’s fluctuating course shows that traders believe it’s not quite the end to the political arrest. Mr Johnson is set to stay in setting until the Fall, as well as the battle is currently beginning over who will be the following leader. There is a cacophony of issues on the next Prime Minister’s plate, not least the cost-of-living crisis triggering voters so much economic discomfort. Plus the trading partnership with the EU is still fraught with trouble provided the bill to amend the Northern Ireland procedure. Mooted tax cuts by the brand-new chancellor might be prominent with the electorate but danger making the Financial institution of England’s task of trying to reduce need as well as inflation by increasing prices even trickier.

After an additional tumultuous few days in British politics and a string of prominent resignations, news of Boris Johnson’s resignation may mean some great information for FX markets. Although there have been no architectural changes to the UK financial background to date, markets have seen the extra pound enhance against the euro and also the buck, with gains for UK stocks. This is likely to be based upon the presumption that Johnson’s substitute may restore Traditional party unity as well as offer the economic climate with a much-needed financial uplift.

” Now, the marketplaces will be asking the concern ‘after Boris, that?’. While Rishi Sunak, Dominic Raab as well as Dime Mordaunt are front-runners currently, a clear substitute remains unpredictable. Although a substitute for Boris can be gently favorable for the GBP in the short-term, depending upon that it is, the longer-term photo may be various. In regards to considerable GBP actions, the primary threat for significant GBP falls would come from the prospect of a General Election. If markets sense that a General Election may be coming, this can send out the GBP sharply reduced on unpredictability.

” In any case, investors will certainly be enjoying the markets closely in the coming days in the hope that the following PM will provide efficient leadership as the financial backdrop stays stark. Similarly, the Bank of England will certainly factor the current political instability into its decision-making, however it is unlikely to alter its techniques to bring rising cost of living in control, considered that the present situation is unlikely to lead to a public ballot now.”

The FTSE 100 has stayed strongly in favorable area given that the statement, assisted by the still weak pound. Financiers rate the laser-sharp emphasis being educated on inflation, and there are ripples of alleviation in monetary markets that the red hot costs look set to be lowered. Policymakers at the United States Central Bank, the Fed have actually shown they are not going soft on rising cost of living as well as are dedicated to interest rate walks of in between 0.5 as well as 0.75%, according to the latest mins of meeting. Runaway rising cost of living is still considered as the demon harmful economic security around the world, as well as although sharp slowdowns and economic crises could be a repercussion, the mindset that it’s far better to go in hard and fast now to stop an additional price spiral is mainly rating. The Financial institution of England is taking a similar stance with higher interest rates strongly on the table, regardless of the vulnerable state of the economic climate. The Financial institution’s chief financial expert Huw Tablet, underscored the technique in a speech, worrying that focus would certainly be trained on making life much more economical via efforts to drive rates back down.

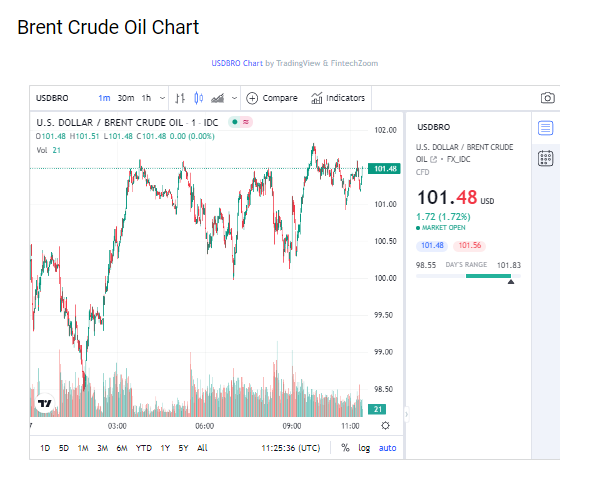

Although oil rates have actually moved down the dial this week, the alleviation could be short lived, provided the overview of greater power costs posted by Shell. Money has actually been pouring into the coffers of the oil titans and also it indicates Shell has turned around approximately $4.5 billion in write downs of its oil as well as gas possessions, a step it took after counting the price of taking out of Russia. Refining margins at Shell have actually almost tripled over the second quarter, due to the press on worldwide refining capacity as well as lower exports from Russia. In spite of the current dip, with crude trading at simply over $101 dollars a barrel, it expects to remain costs to stay elevated in the months ahead due to the ongoing manufacturing restraints and also sanctions on Russia. The big risk for Shell as well as BP going forward is that reducing economies can take down the price of oil but for currently there is an expectation that require will maintain overtaking supply.”.