The 200 day moving average (200 DMA) is an important indicator used by stock traders to identify trends in the market. It is a trend-following indicator that helps traders identify the direction of the market and determine when to buy and when to sell. In this article, we’ll explain how to use the 200 DMA for stock trading and discuss the benefits of using it. We’ll also discuss how to interpret the 200 DMA and provide strategies for using it.

What is the 200 Day Moving Average?

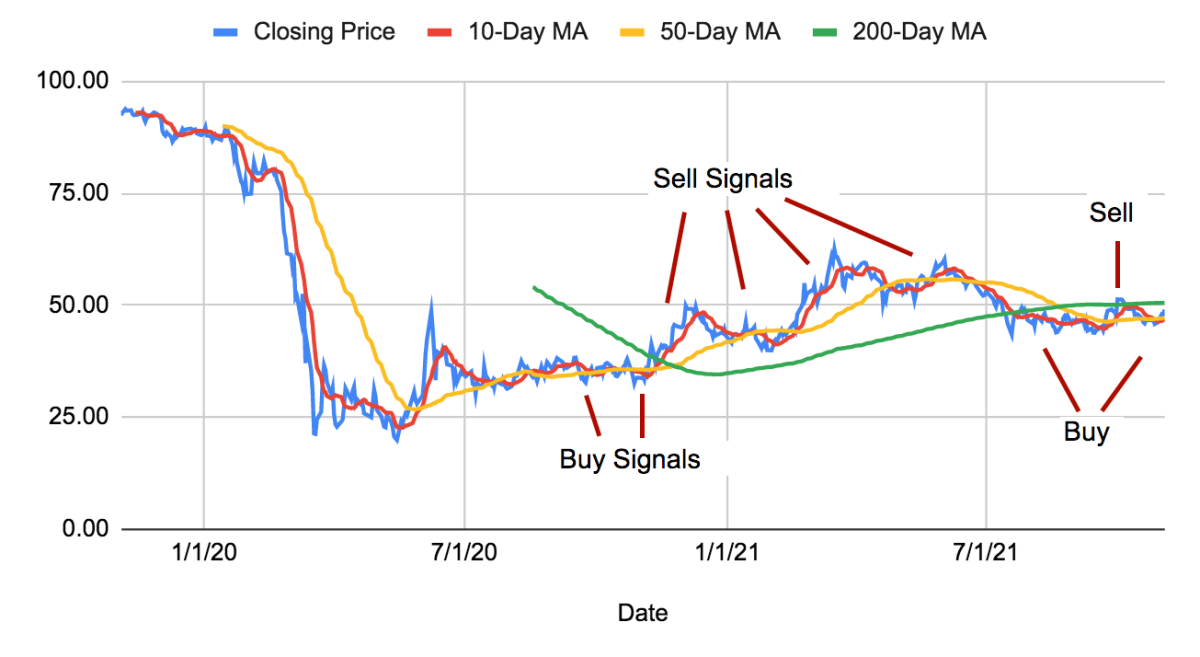

The 200 DMA is a technical indicator used by traders to measure the average price of a stock or other instrument over the past 200 trading days. It is calculated by taking the average closing price of the security over the past 200 trading days and then plotting it on a chart. The 200 DMA is often used to identify long-term trends in the market and to identify areas of support and resistance.

The 200 DMA is a lagging indicator, which means it is slower to react to changes in the market than other indicators. This is because it takes into account historical data and can therefore take longer to identify changes in the market. However, this also makes it a reliable indicator that can help traders make informed decisions.

Benefits of the 200 Day Moving Average

The 200 DMA has several advantages for traders. Firstly, it can be used to identify long-term trends in the market. By taking into account the average price of a security over the past 200 trading days, the 200 DMA can help traders identify the direction of the market.

Secondly, the 200 DMA can be used to identify areas of support and resistance. By plotting the 200 DMA on a chart, traders can identify areas where the price of a security tends to find support or resistance. This can help traders identify potential entry and exit points for trades.

Thirdly, the 200 DMA is a reliable indicator that is not affected by short-term market fluctuations. This makes it a useful tool for traders who want to identify long-term trends in the market and make informed decisions.

200 Day Moving Average Indicators

The 200 DMA can be used in combination with other technical indicators to identify potential trading opportunities. For example, when the price of a security is trading above the 200 DMA, it may indicate an uptrend and may be a good time to buy. On the other hand, when the price of a security is trading below the 200 DMA, it may indicate a downtrend and may be a good time to sell.

In addition, the 200 DMA can be used in combination with other indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). The RSI is a momentum indicator that measures the speed and change of price movements, while the MACD is a trend-following indicator that helps traders identify when a trend is reversing. By using the 200 DMA in combination with these other indicators, traders can get a better understanding of the market and make more informed decisions.

How to use the 200 Day Moving Average

Using the 200 DMA is relatively straightforward. To begin, traders should plot the 200 DMA on their chart. This can be done in most charting platforms by selecting the 200 DMA from the list of available indicators.

Once the 200 DMA is plotted on the chart, traders can then use it to identify potential trading opportunities. As mentioned above, when the price of a security is trading above the 200 DMA, it may indicate an uptrend and may be a good time to buy. Conversely, when the price of a security is trading below the 200 DMA, it may indicate a downtrend and may be a good time to sell.

How to interpret the 200 Day Moving Average

When interpreting the 200 DMA, traders should look for any significant changes in the direction of the indicator. If the 200 DMA is moving in the same direction as the price of the security, it may indicate that the trend is continuing. On the other hand, if the 200 DMA is moving in the opposite direction of the price of the security, it may indicate that the trend is reversing.

In addition, traders should also pay attention to the angle of the 200 DMA. If the 200 DMA is moving in a steep angle, it may indicate a strong trend. On the other hand, if the 200 DMA is moving in a shallow angle, it may indicate a weak trend.

How to interpret a crossover of the 200 Day Moving Average

A crossover of the 200 DMA is when the price of a security crosses above or below the 200 DMA. This is often seen as a sign of a potential trend reversal and may be a good time for traders to enter or exit a position.

When the price of a security crosses above the 200 DMA, it may indicate that an uptrend is beginning. Conversely, when the price of a security crosses below the 200 DMA, it may indicate that a downtrend is beginning. Traders should use this information to determine when to enter or exit a position.

What to do when the 200 Day Moving Average is breached

When the price of a security breaches the 200 DMA, it may indicate that the trend is reversing. Traders should use this information to determine whether to buy or sell the security.

If the price of a security breaches the 200 DMA to the upside, it may indicate that an uptrend is beginning and may be a good time to buy the security. Conversely, if the price of a security breaches the 200 DMA to the downside, it may indicate that a downtrend is beginning and may be a good time to sell the security.

Analyzing the 200 Day Moving Average

When analyzing the 200 DMA, traders should look for any significant changes in the direction of the indicator. If the 200 DMA is moving in the same direction as the price of the security, it may indicate that the trend is continuing. On the other hand, if the 200 DMA is moving in the opposite direction of the price of the security, it may indicate that the trend is reversing.

In addition, traders should also pay attention to the angle of the 200 DMA. If the 200 DMA is moving in a steep angle, it may indicate a strong trend. On the other hand, if the 200 DMA is moving in a shallow angle, it may indicate a weak trend.

Strategies for using the 200 Day Moving Average

When using the 200 DMA, traders should employ a few strategies to maximize their chances of success. Firstly, traders should use the 200 DMA in combination with other technical indicators such as the RSI and the MACD. This will help traders get a better understanding of the market and make more informed decisions.

Secondly, traders should use the 200 DMA in combination with other indicators to identify potential trading opportunities. For example, when the price of a security is trading above the 200 DMA, it may indicate an uptrend and may be a good time to buy. On the other hand, when the price of a security is trading below the 200 DMA, it may indicate a downtrend and may be a good time to sell.

Finally, traders should use the 200 DMA to identify potential support and resistance levels. By plotting the 200 DMA on a chart, traders can identify areas where the price of a security tends to find support or resistance. This can help traders identify potential entry and exit points for trades.

Conclusion

The 200 day moving average (200 DMA) is an important indicator used by stock traders to identify trends in the market. It is a trend-following indicator that helps traders identify the direction of the market and determine when to buy and when to sell. In this article, we’ve discussed how to use the 200 DMA for stock trading, the benefits of using it, and how to interpret it. We’ve also provided strategies for using the 200 DMA and discussed how to identify potential trading opportunities. By using the 200 DMA in combination with other indicators, traders can get a better understanding of the market and make more informed decisions.