Trade divergences are one of the most powerful tools available to forex traders. They allow traders to anticipate potential changes in market direction and to make more informed decisions about their trading activities. In this article, we’ll explore what trade divergences are, the different types of trade divergences, the benefits of using them, how to identify them, how to use them to your advantage, common mistakes when trading with divergences, strategies for trading with divergences, the importance of risk management when trading with divergences, and practical examples of trading with divergences.

What are trade divergences in forex?

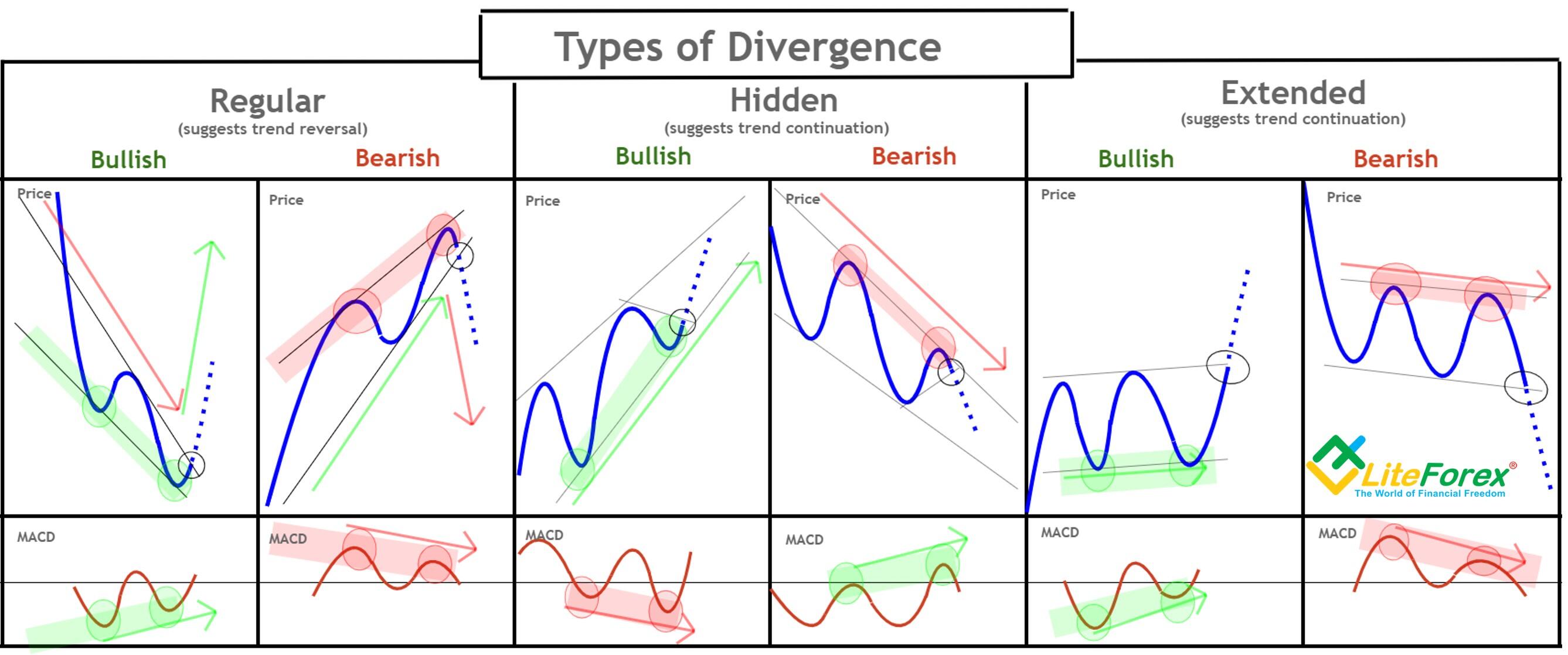

Trade divergences are a form of technical analysis used to analyze the financial markets. They are used to detect potential changes in market direction by comparing the price action of a security to its indicators. This comparison between the price action of a security and its indicators is referred to as a divergence. When the price action and its indicators move in opposite directions, it is considered a divergence.

In forex trading, traders use trade divergences to identify potential reversals in market direction or to identify potential trend changes. This can be extremely beneficial for traders because it allows them to make more informed trading decisions.

Read How Leverage Ratios Can Enhance Your Forex Trading Strategies.

Types of trade divergences

There are two main types of trade divergences in forex trading: bullish divergences and bearish divergences.

Bullish divergences occur when the price action of a security moves in one direction and its indicators move in the opposite direction. This indicates that the trend may be about to reverse, and the security may begin to move in the direction of the indicators.

Conversely, bearish divergences occur when the price action of a security moves in one direction and its indicators move in the opposite direction. This indicates that the trend may be about to reverse, and the security may begin to move in the opposite direction of the indicators.

Read What is a Currency Strength Meter and How To Use One.

Benefits of using trade divergences

Trade divergences can be extremely beneficial for traders because they can provide an indication of potential reversals or changes in market direction. This can be extremely helpful for traders who are looking to capitalize on potential opportunities in the markets.

Furthermore, trade divergences can also be used to confirm trends and help traders identify potential points of entry and exit. This can be very helpful for traders who are looking to maximize their profits in the markets.

Finally, trade divergences can also be used as a form of risk management. As mentioned above, they can help traders identify potential points of entry and exit, which can help to minimize losses. This can be extremely beneficial for traders who are looking to minimize their risk exposure in the markets.

How to identify trade divergences

Identifying trade divergences can be quite challenging, as it requires a thorough understanding of technical analysis and market dynamics. However, there are certain indicators that traders can use to help identify potential divergences in the markets.

One of the most common indicators used to identify trade divergences is the MACD (Moving Average Convergence Divergence). The MACD is an oscillator that measures the difference between two moving averages. It is used to identify potential divergences in the markets by comparing the price action of a security to its indicators.

Another popular indicator used to identify trade divergences is the RSI (Relative Strength Index). The RSI is an oscillator that measures the strength of a security’s price movements. It is used to identify potential divergences in the markets by comparing the price action of a security to its indicators.

Finally, traders can also use trend lines and price patterns to identify potential divergences in the markets. Trend lines are used to identify potential reversals or changes in market direction, while price patterns are used to identify possible points of entry and exit.

How to use trade divergences to your advantage

Once a trader has identified a potential divergence in the markets, they can then use it to their advantage. The most common way to do this is to enter a trade in the direction of the divergence. For example, if a trader identifies a bullish divergence, they can then enter a buy trade in the direction of the divergence.

Another way to use divergences to your advantage is to enter a trade at the point of the divergence. This means that the trader will enter a trade at the point where the price action and the indicators diverge. This can be a very effective way to capitalize on potential opportunities in the markets.

Finally, traders can also use divergences to set stop losses and take profits. This can be a very effective way to minimize losses and maximize profits.

Common mistakes when trading with divergences

One of the most common mistakes that traders make when trading with divergences is not having a proper risk management plan in place. Risk management is essential when trading with divergences, as it allows traders to minimize their losses and maximize their profits. Without a proper risk management plan, traders can find themselves in a vulnerable position and can suffer large losses.

Another common mistake that traders make when trading with divergences is not having a clear understanding of the markets. This can be a major issue, as it can lead to traders taking incorrect trades and losing money. Therefore, it is important for traders to have a thorough understanding of the markets before they begin trading with divergences.

Finally, traders should also be aware of the potential risks associated with trading with divergences. This includes things like slippage, volatility, and the potential for false signals. Therefore, it is important for traders to familiarize themselves with these risks before they begin trading with divergences.

Strategies for trading with divergences

When trading with divergences, it is important for traders to have a sound strategy in place. This will help them to minimize their risk exposure and maximize their profits.

One popular strategy for trading with divergences is to use a combination of technical indicators. This can be an effective way to identify potential opportunities in the markets. Traders can use a combination of indicators such as the MACD and the RSI to identify potential divergences in the markets.

Another popular strategy for trading with divergences is to use a combination of trend lines and price patterns. This is a very effective way to identify potential points of entry and exit. Traders can use trend lines to identify potential reversals or changes in market direction, while they can use price patterns to identify possible points of entry and exit.

Finally, traders can also use a combination of fundamental and technical analysis when trading with divergences. This is a very effective way to identify potential opportunities in the markets. Fundamental analysis can help traders identify potential market catalysts, while technical analysis can help traders identify potential points of entry and exit.

The importance of risk management when trading with divergences

Risk management is essential when trading with divergences. As mentioned previously, it is important for traders to have a sound risk management plan in place before they begin trading with divergences. This will help them to minimize their losses and maximize their profits.

When managing risk when trading with divergences, it is important for traders to have a clear understanding of their risk tolerance and to set appropriate stop losses and take profits. This will help them to minimize their losses and maximize their profits.

Furthermore, it is also important for traders to be aware of the potential risks associated with trading with divergences. This includes things like slippage, volatility, and the potential for false signals. Therefore, it is important for traders to familiarize themselves with these risks before they begin trading with divergences.

Practical examples of trading with divergences

Here are some practical examples of how traders can use divergences to their advantage in the markets.

First, let’s consider an example of trading with a bullish divergence. In this scenario, a trader will enter a buy trade when they identify a bullish divergence in the markets. This means that they will enter a trade at the point where the price action and the indicators diverge.

Another example of trading with divergences is to use a combination of technical indicators. In this scenario, a trader will use a combination of indicators such as the MACD and the RSI to identify potential opportunities in the markets.

Finally, traders can also use a combination of fundamental and technical analysis when trading with divergences. This is a very effective way to identify potential opportunities in the markets. Fundamental analysis can help traders identify potential market catalysts, while technical analysis can help traders identify potential points of entry and exit.

Conclusion

In conclusion, trade divergences are one of the most powerful tools available to forex traders. They allow traders to anticipate potential changes in market direction and to make more informed decisions about their trading activities. Trade divergences can be extremely beneficial for traders, as they can provide an indication of potential reversals or changes in market direction. Furthermore, they can also be used to confirm trends and help traders identify potential points of entry and exit.

Finally, it is important for traders to understand the importance of risk management when trading with divergences. Risk management is essential when trading with divergences, as it allows traders to minimize their losses and maximize their profits. Therefore, it is important for traders to have a sound risk management plan in place before they begin trading with divergences.

By following the strategies outlined above, traders can use trade divergences to their advantage and capitalize on potential opportunities in the markets.

If you found this article on the power of trade divergences in forex trading helpful, then make sure to check out our other articles on forex trading. We have a range of articles that cover topics such as technical analysis, fundamental analysis, and risk management.