Over the past few months, as market turmoil in the crypto industry has intensified, various regulators, lawmakers and standard-setting organizations have published draft proposals providing more clarity on what the regulatory framework for cryptoassets could entail. A clear regulatory and supervisory framework with the potential to (1) prevent fraudulent activity within the crypto ecosystem, (2) provide clear guidance to allow companies to innovate in the crypto economy, and (3) ensure that the industry does not become a source of financial instability would be credit positive because it would protect consumers and ensure that the industry does not become a source of financial instability, while allowing for any potential benefits from the crypto industry to be realized.

Indeed other key objectives of crypto regulations likely include: (1) boosting financial inclusion, (2) ensuring benefits to society from enhanced technology efficiency (e.g., limiting value chain re-centralization), and (3) creating an environment that is equitable and fair to encourage innovation. Moreover, regulations would likely root out any inefficiencies in the crypto sector, which would become apparent once the regulations are in place – particularly given that cryptoassets currently compete with regulated entities and products, meaning that their efficiencies or competitive advantages could ultimately stem from advantages that are only present in the absence of regulatory oversight.

US increasingly looking into regulatory oversight of cryptoassets, although yet to pass anything concrete

On 9 March, US (Aaa stable) President Joe Biden issued an executive order (EO) outlining a multiagency approach to addressing risks associated with the growth of digital assets and blockchain technology while encouraging responsible innovation. In response, on 8 July, the US Department of the Treasury issued a notice2

seeking public comment on potential opportunities and risks presented by digital asset development and adoption as part of its work under Section 5 of the EO. Early in the fall of 2022, the Financial Stability Oversight Council is expected to release a report in response to the EO

On 7 June, US Senators Cynthia Lummis and Kirsten Gillibrand unveiled a comprehensive bipartisan proposal to strengthen the authority and presence of the Commodity Futures Trading Commission (CFTC) in the oversight of cryptoassets. The proposed bill aims to establish boundaries between cryptocurrency securities and commodities, establish a

threshold below which cryptocurrency transactions are not tax-relevant, establish regulatory requirements for stablecoin assets and stablecoin issuers, and determine the extent to which customer deposits are protected against the bankruptcy of cryptocurrency operators. And on August 3, Senate Agriculture Committee leaders Chair Debbie Stabenow, Sen. John Boozman, Sen. Cory Booker and Sen. John Thune proposed a bipartisan legislation that would give the CFTC direct oversight of the crypto markets and responsibility for developing new regulations to protect consumers and impose restrictions on practices like margin trading. Despite being a significant step forward in defining a legal framework for cryptoassets, the bills are unlikely to be adopted this year. Rather, the proposals will likely kick off a protracted congressional debate that lasts well into next year. If the bills gains traction, either in their current form or, more likely, in a modified or fragmented version, the general public and traditional financial institutions would be more likely to move toward broader adoption of cryptoassets.

In the US House of Representatives, debate on the legislation that would implement stablecoin regulations has been formally postponed until September. Leading House lawmakers have been working on a bipartisan proposal to restrict stablecoin issuers to banks and other designated financial institutions that submit to federal scrutiny. The idea comes from discussions between Rep. Maxine Waters, the chair of the House Financial Services Committee, and Rep. Patrick T. McHenry, the panel’s senior Republican. The President’s Working Group on Financial Markets (PWG), the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) had also advised quick legislative action in a report issued on 1 November 2021 to limit the issuance of stablecoins to insured depository institutions and to enable prudential regulation of stablecoins to mitigate the risks to the broader financial system.

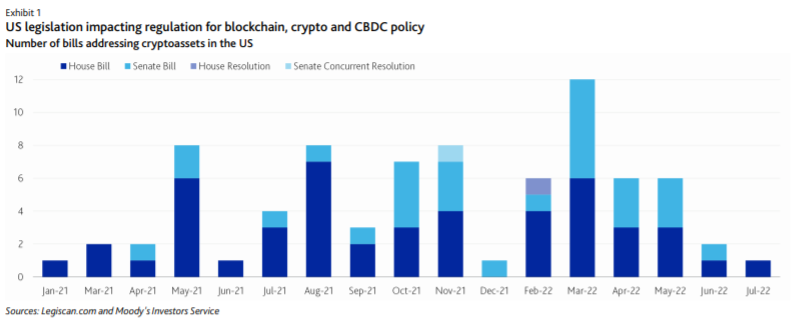

Since the start of the most recent Congress, over 150 pieces of legislation pertaining to blockchain, decentralized finance (DeFi), cryptocurrencies, digital or virtual currencies, and other digital assets have been introduced (see Exhibit 1). Given the diversity of proposed crypto legislations, the bills that ultimately pass would need to be more aligned in their final purview.

cryptocurrencies, digital or virtual currencies, and other digital assets have been introduced

In the absence of a clear regulatory framework, a debate in the US has arisen over the extent to which existing regulations can be applied to the cryptoasset industry, with both the Securities and Exchange Commission (SEC) and the CFTC exerting some jurisdiction. The CFTC has already launched a number of crypto-related enforcement actions, with a particular focus on exchanges that offer crypto derivatives to US citizens but are not registered with the CFTC The SEC’s Crypto Assets and Cyber Unit, on the other hand, has brought over 80 enforcement actions against platforms and offerings of fraudulent and unregistered crypto assets since the unit’s establishment in 2017, netting more than $2 billion in financial relief. The SEC has stated that it believes many, if not most, cryptoassets are securities under US securities law and are therefore susceptible to SEC jurisdiction. Whether a cryptoasset is regarded to be a security will determine whether it is eligible for SEC or CFTC regulation. The SEC is considering collaborating with the CFTC10 to handle platforms that may trade both security tokens based on cryptocurrencies and some commodities tokens using respective regulatory frameworks. However, it appears that the US Senate’s two proposed bipartisan bills would give the CFTC primary jurisdiction over the crypto markets.

UK and EU also taking a closer look into regulating the space

On 28 July, the Law Commission of England and Wales published a consultation paper11 inviting input from legal and technology experts, focusing on digital assets that can be (1) traded, (2) used to represent other assets, or (3) used as stores of value. The consultation paper’s main objective is to examine how current personal property legislation relates to digital assets, proposing that the legislation must recognize these unique properties in order to promote a more favorable environment for digital assets and their markets by enacting these reforms.

On 12 July, The Bank of England (BoE) published a speech13 by Deputy Governor for Financial Stability, Sir Jon Cunliffe, on the lessons learned from recent volatility and losses in the cryptocurrency markets. The UK Treasury, for its part, plans to adopt a stablecoin regulatory framework before the August summer break, working with other regulatory bodies including the BoE, the Payment Systems Regulator and the Financial Conduct Authority. This will mark a significant first-of-its-kind advancement in the “same risk, same regulation” philosophy and extend the international standards for payments, clearing and settlement systems to cover systemically important stablecoin arrangements. The Financial Services and Markets Bill14, which the HM Treasury introduced to the British Parliament on 20 July, will make it possible for certain types of stablecoins to be regulated as a means of payment in the UK (Aa3 stable) to ensure that the country remains at the forefront of new technologies and innovations.

On 30 June, the Council of the European Union (EU) and European Parliament reached a provisional agreement on a set of regulatory proposals on Markets in Crypto Assets (MiCA).15,16 The scope of the agreement has some overlap with the proposed bill by Senators Lummis and Gillibrand – its main goal is to increase regulatory certainty, harmonize the EU (Aaa stable) market, improve consumer protection and strengthen financial stability. In light of the most recent Transfer of Funds Regulation (TFR),17 the EU has taken a measured approach18 to crypto anti-money laundering (AML) legislation by asking crypto exchanges to collect information and personal data on all crypto transfers, regardless of size, and provide that information to authorities upon request. Transfers from or to “un-hosted wallets” are subject to this new law as long as a licensed exchange or cryptoasset service provider (CASP) is involved, to verify that the customer actually owns or controls this wallet if they transfer or receive more than 1,000 euros to or from their own unhosted wallet.

APAC approach to crypto regulation is more fragmented

The regulatory landscape for digital assets in the Asia Pacific region is less unified. China (A1 stable) views all cryptocurrency transactions, including crypto exchanges, operating offshore and offering services to Chinese nationals as illegal. The Reserve Bank of India has similarly voiced its opposition to cryptocurrencies.20 While Singapore (Aaa stable) has so far maintained a more moderate stance, the Monetary Authority of Singapore (MAS) intends to tighten restrictions for individual investors’ access to cryptocurrencies. On 3 June, Japan (A1 stable) established a new legislative framework21 to strengthen investor protections by amending their existing payment services law to allow registered money transfer agents, licensed banks, and trust companies to issue stablecoins – this legislation also tightens AML regulations and establishes a system for monitoring stablecoin circulation. On 28 January, a circular22 on regulatory approaches to authorized institutions’ engagement with virtual assets (VA) and virtual asset service providers (VASPs) was released by the Hong Kong Monetary Authority (HKMA). On the same day, two documents were made public in Hong Kong, SAR, China (Aa3 stable): a joint statement23 from the HKMA and Securities and Futures Commission (SFC)

regarding intermediaries involved in VA-related operations; and a circular24 from the Insurance Authority (IA) offering instructions for registered insurers.

International standard-setting organizations also progressing

On 13 July, the Bank for International Settlements’ (BIS) Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) finalized guidelines25 on the application of the Principles for Financial Market Infrastructures (PFMIs) to arrangements involving systemically important stablecoins. With the novel characteristics of stablecoins in mind, this guideline is meant to assist national regulators and stablecoin arrangements in complying with the PFMIs. In addition, the Fintech Task Force (FTF) of IOSCO has set out its cryptoasset roadmap26 for 2022-23, prioritizing policy-focused work divided into two workstreams: crypto and digital assets (CDA) and DeFi. Both workstreams will primarily focus on analyzing and responding to market integrity and investor protection concerns within the cryptoasset space.

In close collaboration with standard-setting organizations like the Financial Action Task Force (FATF), the Financial Stability Board (FSB) is working27 to ensure that cryptoassets are subject to robust regulation and oversight, while also researching the implications of DeFi on financial stability. At the G-20 Finance Ministers and Central Bank Governors meeting in October, the FSB will deliver a consultative report with recommendations on regulatory and supervisory approaches to additional cryptoassets.

The prudential regulation of banks’ exposure to cryptoassets has been the subject of a second public consultation28 published by the Basel Committee on Banking Supervision. The consultation expands on initial suggestions outlined in the committee’s June 2021 consultation and feedback from stakeholders.

Finding balance between variety of competing interests will be key to regulatory progress

Regulators have a challenging task ahead of them: managing cryptoasset risks without stifling innovation. As regulators in the US, EU and other countries work to find the ideal balance for a new and effective regulatory framework over time, it will also be important to achieve international consistency in regulatory and supervisory approaches. Recent regulatory developments show that there are some geographical differences in the legal frameworks for cryptoassets. Significant gaps between the different approaches might lead to regulatory arbitrage and a subsequent migration of resources, both human and financial, to the countries with the most accommodating laws. On 7 July, the US Department of the Treasury delivered a framework29 on crypto to President Biden outlining a plan for US government engagement with international counterparts on digital assets. The US intends to move forward in terms of implementation of international standards through bilateral and regional initiatives to limit overlap and enhance coordination among pertinent parties.

The US, EU and UK have also emphasized that it is important to keep an eye on how cryptoassets are affecting the physical environment. For example, the MiCA agreement requires actors in the cryptoasset market to disclose information about their environmental and climate footprint. Within two years, the European Commission will conduct a thorough review of the environmental impact of cryptoassets. The results of this analysis will be used to establish minimum sustainability requirements that must be met by consensus processes, including proof-of-work.

The regulatory lens vis-à-vis cryptoassets is still not entirely apparent in terms of DeFi,30 and DAO31 – two aspects of the crypto industry that still lack institutional regulation. Decentralized protocols, for example, are not covered by the current MiCA architecture, which itself will not take effect until 2024. European Central Bank President Christine Lagarde recently suggested32 a MiCA 2.0 upgrade that would cover decentralized lending and staking protocols. Enforcement authorities are intently monitoring DeFi and its complexities in the wake of the Terra implosion,33 which precipitated the distressing collapse of cryptocurrency exchanges like Celsius, BlockFi and Voyager. The legal validity of smart contracts is one of the most challenging issues for regulators to resolve. The UK’s Law Commission published a study34 on smart legal contracts in 2021, concluding that smart contracts may be used successfully in a range of commercial practices and that current legal concepts can support them. The European Commission, however, has unveiled a proposal for the new Data Act35 of the union that broadly touches on the topic of smart contracts and suggests that each smart contract should have a termination function to halt transaction flows when necessary – the immutability of smart contracts would subsequently be eliminated as a result of this clause. By contrast, in the US, there are no federal proposals in the works for regulating smart contracts, and state-level laws differ across the country.

Finally, key players in both the centralized and decentralized cryptoasset markets will be impacted by the way the global regulatory landscape evolves. The course that the cryptoasset class takes in the coming years will be significantly influenced by the speed, degree of harmonization and prudentialism that regulators adopt. While putting an emphasis on prudential, ethical and sustainability considerations, regulators will likely continue to work on creating a framework that will allow the benefits of cryptoassets to be realized, without jeopardizing financial stability.