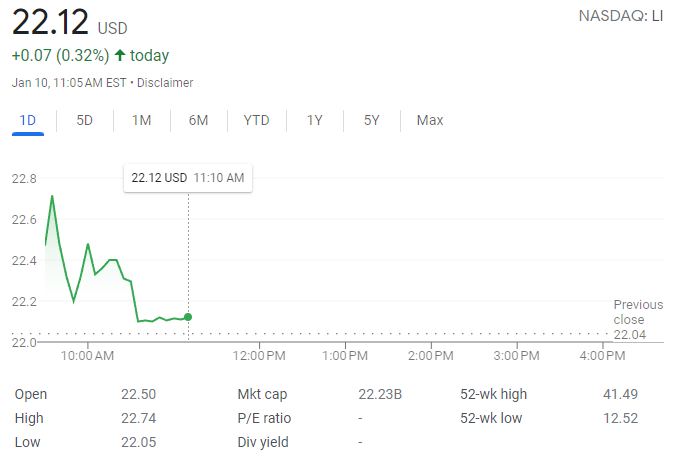

Did you hear the news? Li Auto Inc (LI), a Chinese automobile manufacturer, saw its Li Auto Stock price rise again by 0.32% during this morning’s trading session. Is this a sign of good things to come for Li Auto and their investors?

Li Auto Inc is a China-based automobile manufacturer that focuses on producing electric SUVs—a move towards meeting the growing demand for cars with green energy solutions such as electric, hybrid and fuel cell vehicles. The company went public in July 2020 and has since seen an increase in investor confidence.

This morning, Li Auto Inc’s stocks rose by 0.32%, marking one of its biggest gains. We take a look at what might have caused today’s surge in prices and if it could be an indication of more good news to come for both LI auto investors and shareholders alike.

Li Auto Stock Price – Pre-market Today on December 10, 2023

At the close of trading, LI stock was at $22.04, which was a 0.48 increase from pre-market trading. Since trading prior to the market opening tends to be more unsteady due to the lower number of investors, LI holds a better value than 53% of stocks at its current rate.

FintechZoom’s evaluation system factors in both the technical and fundamental aspects of the stock, with an overall score of 53. For short-term traders, LI has a score of 60, signifying that the stock’s trading pattern has been neutral in the past month. This puts LI Auto Inc in the 134th spot for Short-Term Technical scores in the Auto Manufacturers industry. The Overall and Short-Term Technical scores of LI deliver a mixed outlook on the stock’s recent performance and anticipated price.

Li Auto Stock Price – on December 9, 2023

Li Auto Inc (LI) has had a 2.18% increase in its stock value. According to FintechZoom’s comprehensive rankings system, LI holds an average Overall Score of 53, which is better than 53% of the stocks at its current price. The stock closed at $22.04, but went up by $0.48 in pre-market trading. Pre-market tends to be more unstable due to the lower trading volumes as most investors only trade during standard trading hours. In terms of short-term technical score, LI has been given a score of 60, which suggests that its trading pattern over the last month has been neutral. Additionally, this score puts the stock in 134th place in the Auto Manufacturers industry. The Overall and Short-Term Technical score of LI indicate that its recent trading patterns and future price are uncertain.

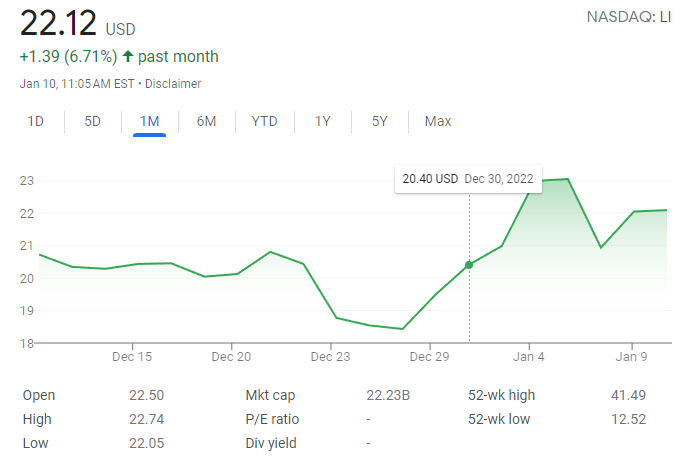

Li Auto Inc. released in December 2022, shipping out 21,233 vehicles, which is a 50.7% increase.

On January 1st, 2023, Li Auto Inc. released that they achieved a new delivery record in December 2022, shipping out 21,233 vehicles, which is a 50.7% increase from the prior year.

Since that, the Li Stock increased 8.4% from 20.40 USD to 22.12 USD.

This marked their fourth quarter deliveries to 46,319, a growth of 31.5% from the same time period from the year before. The total deliveries for 2022 were 133,246, an increase of 47.2% compared to 2021. This brings their cumulative delivery to 257,334 as of December 31st. Co-founder of Li Auto, Yanan Shen, expressed his appreciation for the trust and support from their customers and their families. The two models, Li L9 and Li L8, both had over 10,000 deliveries in December and have proven their strength in the 300,000 to 500,000 yuan price range.

He also stated that they are looking forward to providing more refined products and services in the new year and creating a mobile home and happiness for more families. At the end of 2022, Li Auto had 288 retail stores in 121 cities, 318 servicing centers, and Li Auto-authorized body and paint shops operating in 223 cities. Li Auto Inc. is a leader in China’s new energy vehicle market, designing, developing, manufacturing, and selling premium smart electric vehicles. Their mission is to “Create a Mobile Home, Create Happiness”. They are the first to successfully commercialize extended-range electric vehicles in China and have started volume production in November 2019.