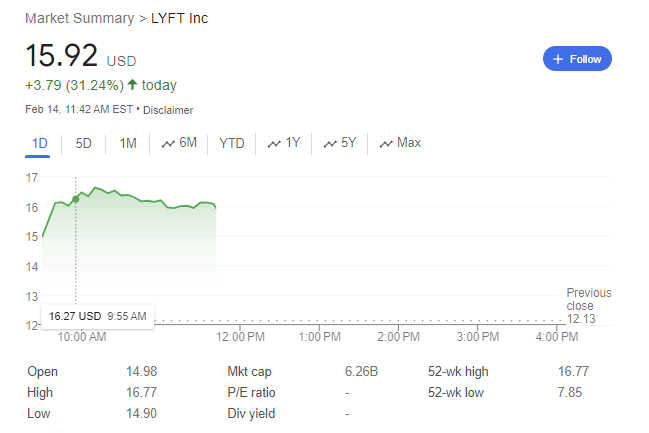

The typo in Lyft’s earnings report led to a significant but temporary surge in its stock price, creating quite a stir in the market. Here’s a summary of the key points related to this event:

- Earnings Report Mishap: Lyft mistakenly stated in a press release that its gross margin was expected to rise by 500 basis points (5%) in 2024. However, this figure was later corrected to an increase of 50 basis points (0.5%) during an earnings call, which caused a substantial market reaction [3].

- Stock Price Surge and Correction: Following the erroneous press release, Lyft’s stock price surged by 67% in after-hours trading, only to retreat once the company announced the error [3]. The stock settled nearly 16% higher in after-hours trading after the correction was made [2].

- Investor and Analyst Reactions: The market’s response to the initial surge was notable, but concerns were raised over the error, with one analyst comparing the situation to a “debacle of epic proportions” [3]. Additionally, it was suggested that investors might file lawsuits against Lyft to recover losses [3].

- Earnings Performance: Despite the mishap, Lyft’s fourth-quarter earnings beat estimates, with the company reporting adjusted earnings of 18 cents per share, and it anticipated generating positive free cash flow for the first time in 2024 [2].

- Long-term Outlook: Lyft’s cost-cutting measures and plans for positive free cash flow in 2024 were highlighted as positive indicators for the company’s long-term profitability [2].

In conclusion, the typo in Lyft’s earnings report led to a dramatic but short-lived surge in its stock price, with the company eventually correcting the error. The incident brought attention to Lyft’s financial performance and outlook for the future [2][3].

References

1) https://nypost.com/2024/02/14/business/typo-in-earnings-report-sends-lyft-stock-soaring-by-67/

2) https://www.investopedia.com/lyft-stock-goes-on-wild-ride-after-q4-earnings-beat-and-error-key-price-level-to-watch-8580317

3) https://www.forbes.com/sites/antoniopequenoiv/2024/02/13/lyft-shares-surge-60-after-typo-in-earnings-report/

Lyft’s Last Earnings: Q4 & Full Year 2023

Lyft released their fourth-quarter and full-year 2023 earnings on February 13, 2024. Here’s a breakdown of the key points:

Financials:

- Revenue: $4.4 billion for the full year, up 8% year-over-year (YoY). $1.2 billion for Q4, up 4% YoY.

- Gross Bookings: $13.8 billion for the full year, up 14% YoY. $3.7 billion for Q4, up 17% YoY.

- Net Loss: $340.3 million for the full year, down significantly from $1.6 billion in 2022. $26.3 million for Q4, down from $588.1 million in Q4 2022.

- Adjusted EBITDA: $222.4 million for the full year, up from $(416.5) million in 2022. $66.6 million for Q4, up from $(248.3) million in Q4 2022.

Key Highlights:

- Improved profitability: Lyft narrowed its net loss significantly and achieved positive Adjusted EBITDA for the full year, indicating progress towards profitability.

- Revenue growth: Revenue grew modestly YoY, but gross bookings, which represent the total value of rides booked, showed stronger growth.

- Active riders: Lyft added 1 million active riders in Q4 and 4.7 million for the full year.

Additional Notes:

- Analysts’ consensus EPS forecast for Q4 was $-0.19, while Lyft reported $-0.04, exceeding expectations.

- Lyft continues to invest in autonomous vehicle technology and expects to launch its robotaxi service in select markets in 2024.

Resources:

- Lyft Investor Relations: https://investor.lyft.com/

- Lyft Announces Fourth Quarter and Full-Year 2023 Results: https://investor.lyft.com/news-and-events/news/news-details/2024/Lyft-Announces-Fourth-Quarter-and-Full-Year-2023-Results/default.aspx

Market Reaction Analysis to Lyft’s Earnings Typo

The market reaction to Lyft’s earnings typo has been eventful, with a surge in stock prices and subsequent corrections. Here’s a detailed analysis:

- Initial Surge and Correction:

- Lyft shares skyrocketed by 62% after a typo in the company’s earnings release, which initially indicated a significant margin expansion [1].

- The stock price retreated after the correction but remained over 37% higher in early Wednesday trading due to the company surpassing Wall Street expectations for the quarter [1].

- Analyst and Investor Sentiment:

- Despite the embarrassment caused by the typo, analysts still found comfort in the revised numbers, with several of them raising their stock price targets for Lyft [3].

- Wall Street’s response was generally positive toward Lyft’s earnings report, even though a majority of analysts maintained a neutral stance on the stock [3].

- Earnings Performance:

- Lyft’s fourth-quarter earnings beat estimates, with the company reporting adjusted earnings of 18 cents per share, more than doubling the 8 cents that industry analysts were expecting [1].

- The company’s guidance for first-quarter bookings exceeded projections, and it expected to generate positive free cash flow for the first time, indicating a step toward profitability [1].

- Long-term Outlook:

- Despite the typo, Lyft’s earnings report reflected the company’s improved performance and ability to compete on a more stable footing, as indicated by a recent analyst report [3].

- Lyft’s cost-cutting measures and emphasis on customer obsession to drive profitable growth were noted as positive indicators for its long-term outlook [3].

In conclusion, the market reaction to Lyft’s earnings typo was characterized by a dramatic surge in stock prices, subsequent corrections, and overall positive sentiment from analysts and investors regarding the company’s performance and outlook [1][3].

References

1) https://www.cnn.com/2024/02/13/business/lyft-stock-earnings-report-typo/index.html

2) https://www.euronews.com/business/2024/02/14/lyft-shares-rocket-62-over-a-typo-in-the-companys-earnings-release

3) https://www.investors.com/news/technology/lyft-stock-surges-on-strong-outlook-for-2024/